Tuesday’s forex session was an adrenaline-fueled thriller for traders. A one-two punch of major economic news – Eurozone CPI inflation, U.S. Manufacturing PMI, and U.S. Construction Spending – sent shockwaves through the currency markets. Early in the day, a Eurozone inflation surprise rattled sentiment, turbocharging the U.S. dollar and knocking EUR/USD and GBP/USD sharply lower. By mid-session, weak U.S. manufacturing data flipped the script, sparking a dramatic dollar pullback and whipsawing prices in all three pairs. Throughout the day, volatile candlestick swings on the charts reflected traders’ frantic reactions to each new headline. Below, we break down how GBP/USD, EUR/USD, and AUD/USD each navigated this wild ride.

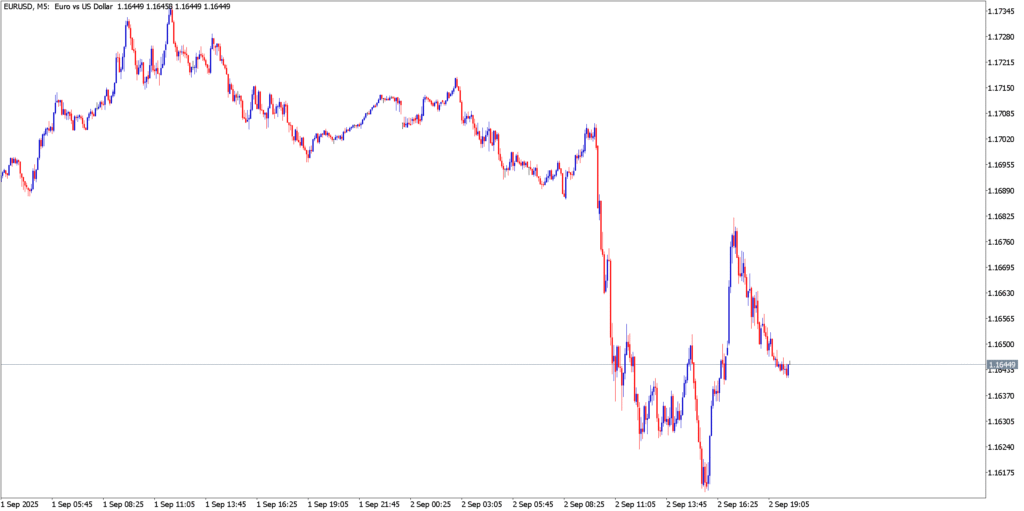

EUR/USD

EUR/USD plunged early Tuesday as Eurozone inflation data delivered an upside surprise. Headline CPI ticked up to 2.1% year-over-year in August (slightly above the 2.0% forecast), while core CPI held at 2.3%. Initially, traders interpreted the mixed inflation report as a sign the European Central Bank might hold off on more tightening, sending the euro tumbling. EUR/USD fell roughly 0.8% intraday, slicing down through the mid-1.16s as the U.S. dollar surged to multi-week highs. However, the trend reversed dramatically in the New York session. Soft U.S. manufacturing numbers hit – the ISM Manufacturing PMI came in at 48.7 vs 49.0 expected, marking a sixth straight month of factory contraction. The disappointment sent the Greenback into a swift corrective slide, and EUR/USD bounced off its lows. The pair clawed back from a $1.1613 low to around the $1.1670 zone by afternoon as the dollar lost momentum. By day’s end, EUR/USD had recovered most of its earlier loss, showcasing a stunning rebound from the inflation-fueled selloff. Traders were left stunned by the euro’s round-trip – a textbook whipsaw as Eurozone CPI jitters gave way to U.S. data-driven relief.

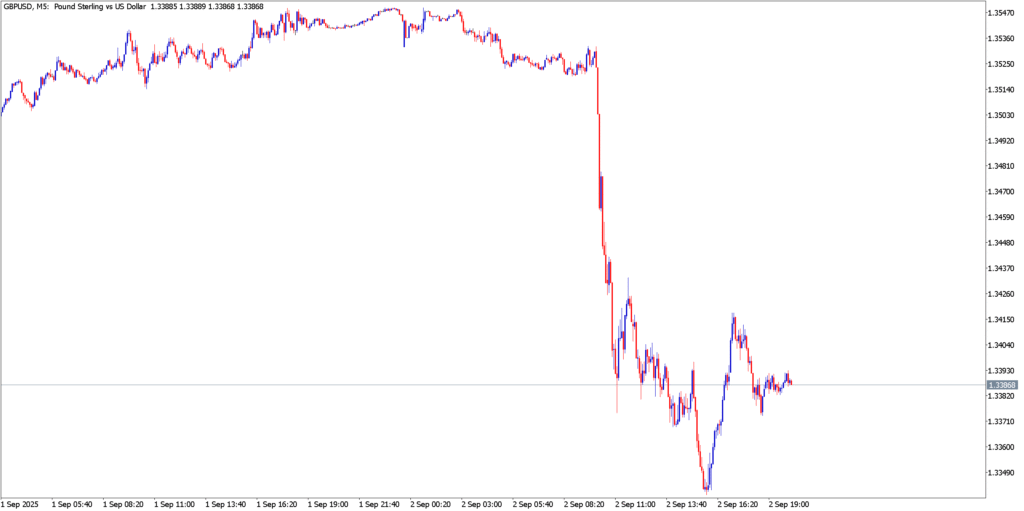

GBP/USD

GBP/USD experienced a stomach-churning drop before staging a late-day comeback. With no major UK data of its own, the British pound took its cues from the broader turmoil. In early European trading, as the dollar surged on the euro inflation shock, Cable crumbled from the mid-1.3500s down into the 1.3400 range. The pound was hit especially hard – by late European morning GBP was down over 1% against the rampaging USD. Traders saw stop-losses triggered as GBP/USD cascaded to multi-week lows. Come U.S. session, a dose of American economic news flipped the narrative. The S&P Global Manufacturing PMI (final) echoed the weak ISM figure, affirming that U.S. factory activity remained in contraction. At the same time, the July U.S. Construction Spending report showed a 0.1% decline, matching forecasts and underscoring how high rates were weighing on the housing sector. This combination of soft U.S. data triggered a knee-jerk dollar selloff, allowing GBP/USD to vault back above 1.3400 as the Greenback’s rally lost steam. The pound’s relief rally was tempered, however. Concerns over the UK’s fiscal outlook lingered in the background, which kept sterling’s rebound in check compared to its peers. By the close, GBP/USD had trimmed its losses, but the pair’s wild swing – a steep plunge followed by a partial recovery – highlighted the day’s high-voltage volatility.

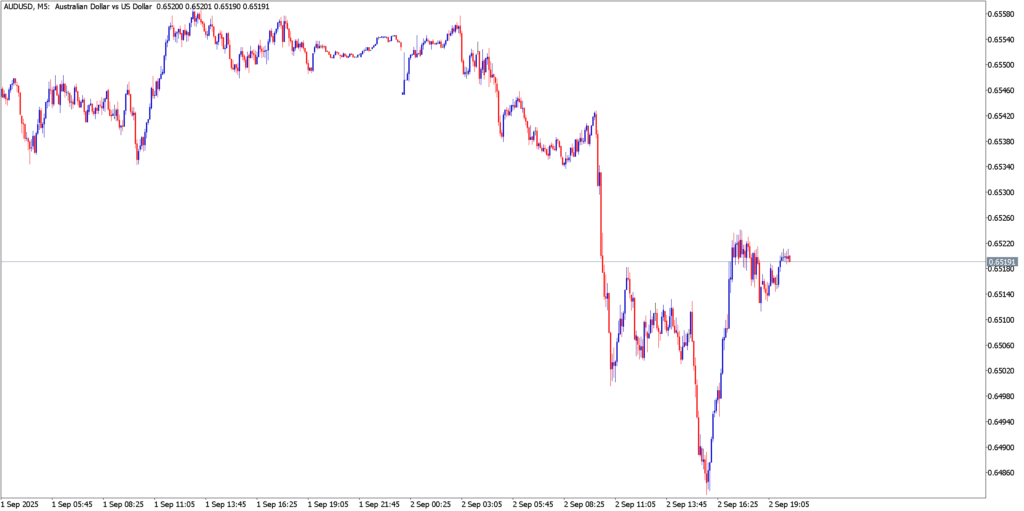

AUD/USD

AUD/USD lived up to its reputation as a risk-sensitive pair, with price action turning on a dime as market sentiment shifted. In the wake of the Eurozone CPI shock, risk aversion swept through markets – and the Aussie was no exception. AUD/USD tanked, falling roughly 0.7–0.9% to test the 0.6500 psychological support during the late European session. A resurgent U.S. dollar, which snapped a five-day losing streak and spiked on the data barrage, sent the Aussie to an intraday low near 0.6480. Traders braced as the pair hovered at the brink of a major breakdown (“Can Aussie bulls hold the line at 0.6480?” became the burning question). Then came the plot twist: as word spread of weaker U.S. PMI figures, the dollar’s safe-haven charge stalled out. Sensing a green light, Aussie dollar bulls swooped in. AUD/USD roared back to life, rebounding off the lows to climb back above 0.6520 by the U.S. afternoon. The softer U.S. outlook eased Fed rate hike fears, sparking a relief rally in equities and risk currencies. The 5-minute chart shows a V-shaped surge – a dramatic turnaround that erased a large portion of the early losses. By the end of the day, the Australian dollar had gone from being pummeled to leading a comeback, leaving traders amazed at the pair’s resilience. Volatility was on full display, as the Aussie’s fate flipped with each sentiment swing.

Market Reaction & Key Takeaways

Tuesday’s wild moves reinforced some key lessons for active forex traders. Economic surprises packed a punch: the slightly higher Eurozone CPI initially hit euro and pound hard, while the downbeat U.S. manufacturing readings later knocked the wind out of the dollar’s sails. Even a normally second-tier report like construction spending mattered by adding to the growth narrative. The result was a day of whipsaw volatility – trends reversed in a flash, and only those nimble enough to react quickly capitalized on the round-trip moves. GBP/USD, EUR/USD, and AUD/USD each saw dramatic intraday swings that tested support and resistance levels in rapid succession. Traders flocked to safe-haven USD in the morning, then rushed out just as fast in the afternoon. It was a vivid reminder of how fast sentiment can shift in the current environment. With the U.S. dollar index briefly spiking then sliding within hours, and these major pairs ultimately closing not far from where they started, market participants were left breathless. The day’s drama – from the inflation shockwave to the PMI-induced reversal – will be remembered as a showcase of 2025’s heightened forex volatility. Active traders reveling in the excitement know that staying alert and adaptable was the only way to ride this rollercoaster safely. The stage is set for more fireworks ahead as all eyes turn to the next big data releases, and traders will be on high alert for the next jolt to rock the FX world.