Stocks and bond yields are setting the stage for a volatile start to the week. On Monday (Sep 29, 2025), traders will parse key central-bank commentary alongside housing data and industrial updates. In Washington, Fed officials John Williams and Raphael Bostic headline a packed speaking schedule, offering fresh clues on the timing of further rate cuts. Across the Atlantic, ECB speakers Isabel Schnabel and Perry Lane take the podium amid forecasts that the eurozone’s inflation has settled near the 2% target. Meanwhile, the U.S. Pending Home Sales report (Aug) is due at 10:00 am ET. Australia reports Building Approvals (Aug), where analysts expect a sharp recovery, and Asia provides an industrial-production update. Together, these events are injecting a cautious yet alert tone into forex markets.

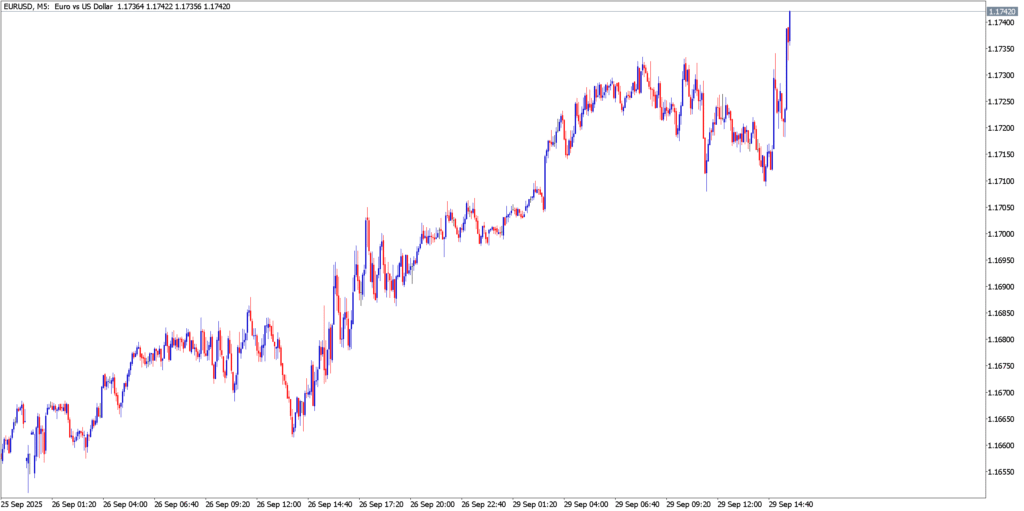

EUR/USD

Fundamental Analysis

The euro’s outlook is underpinned by a steady economy and inflation hovering near the ECB’s 2% goal. A Reuters poll suggests the ECB has likely finished easing, so the central bank may remain on hold for now. ECB speakers today (Schnabel, Lane) are unlikely to signal new easing, instead stressing patience. By contrast, the U.S. dollar faces mixed signals. Fed officials continue to preach caution despite a recent rate cut – markets remain split on further easing, and Fed commentary (Williams at 1:30 pm ET, Bostic at 6:00 pm ET) will be watched for clues. U.S. housing data arrives on Monday: pending home sales unexpectedly rose +0.2% in August, a surprise after the July decline. If confirmed, this softness in housing might dent some of the USD’s haven appeal, but the Fed’s narrative will dominate. In summary, EUR/USD may trade sensitively to any hint of stronger U.S. data or dovish Fed talk, while the ECB side is broadly steady.

Technical Analysis

The euro-dollar pair has been range-bound around the 1.1660–1.1700 zone. The 1.1700 level caps recent rallies, while support holds near 1.1650. Short-term charts (M5 timeframe) show quiet consolidation – the pair has not broken out after last week’s UK-related volatility, hugging its 1.1670 pivot. A break above 1.1700 (last Monday’s high) could quickly test the mid-1.17s, but failure there would keep bearish traders in play. Key oscillators are neutral, suggesting EUR/USD is poised to react to fundamental drivers. In effect, upside momentum needs fresh catalysts (e.g. softer U.S. rhetoric), whereas a firm dollar bid (from hawkish Fed clues or stronger U.S. data) could drag EUR/USD below 1.1650 support.

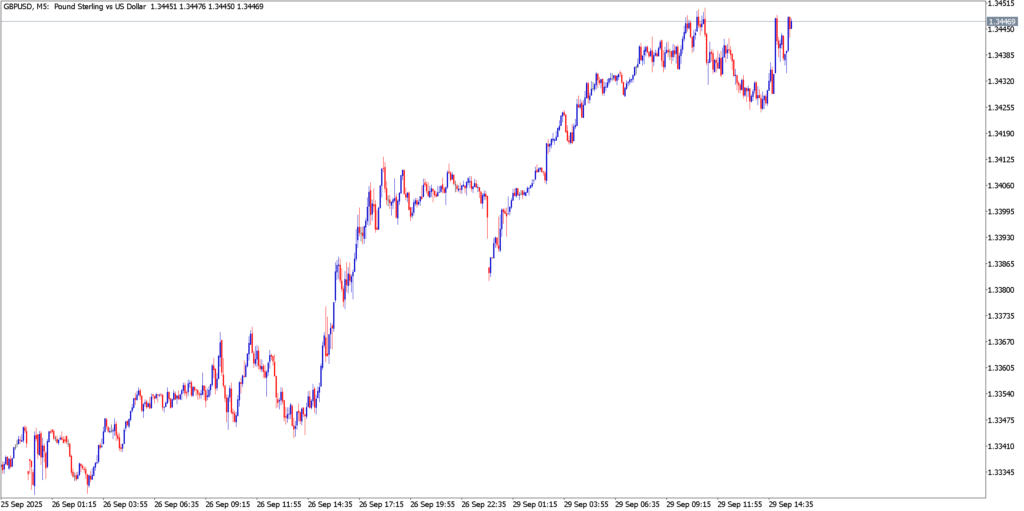

GBP/USD

Fundamental Analysis

Sterling has been relatively steady after UK inflation data came in on target. August CPI was 3.8% YoY (as expected), cementing market bets that the Bank of England will hold rates at 4.0% this week. With inflation cooling, the BoE is unlikely to ease policy immediately, but it remains behind the Fed – UK policymakers have signaled “weighing up” if cuts are needed as growth slows. On Monday, BoE MPC member Ramsden speaks (8:00 am ET) and markets will note any comments on wage pressures or growth. Still, the bigger focus for GBP/USD may come from across the pond. If U.S. data is firmer than expected (e.g. a bigger jobs miss or higher PCE), the Fed may sound less dovish, which tends to boost USD and pressure the pound. Conversely, any dovish tilt from Williams or Bostic could relieve some USD strength. Overall, sterling’s fate looks tied to U.S. cues this week, given the BoE’s steady path.

Technical Analysis

GBP/USD recently rallied sharply into resistance but has since trimmed gains. On the 5-minute chart, the pair showed a strong spike up to about 1.3580 (last week’s intraday high) before pulling back to ~1.3520. This suggests a short-term bull breakout attempt that stalled. Currently, immediate resistance is near 1.3580–1.3600, and support stands around 1.3500–1.3520 (last week’s lows). If bids return, upward momentum may pick up from oversold short-term indicators. A sustained break below 1.3500 could open 1.3450. For now, price action has left GBP/USD in a mild uptrend, but traders should watch the convergence of the 20- and 50-period moving averages (roughly at 1.3500). A clear break of last week’s range (1.3450–1.3580) is needed to confirm the next leg; until then, the pair may oscillate in response to risk sentiment shifts.

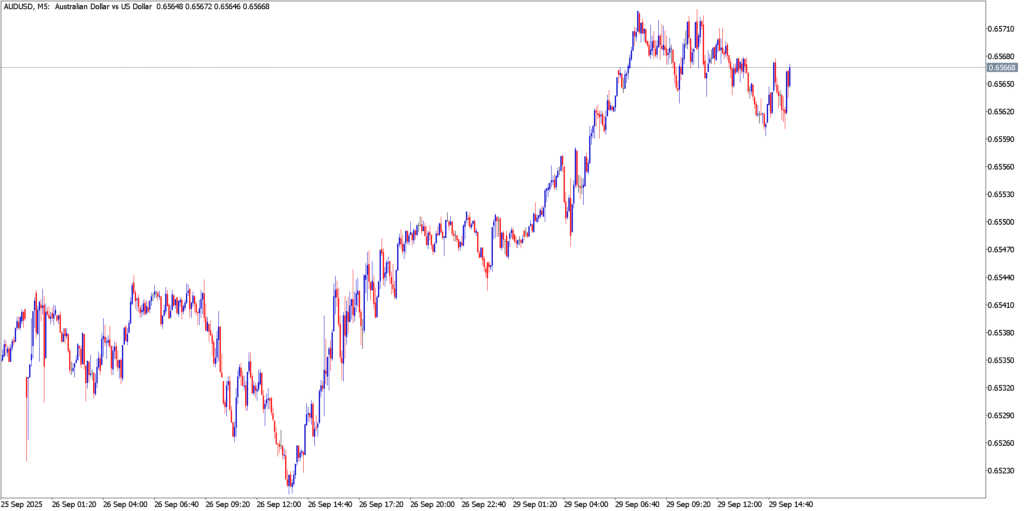

AUD/USD

Fundamental Analysis

The Australian dollar is in focus after Building Approvals jumped unexpectedly in August. Australia’s construction permits rose +2.5% MoM (much better than the -8.2% prior), indicating a surprise uplift in residential development. This adds to a mixed backdrop in Australia: inflation remains stubborn (above RBA’s 2–3% target), so economists foresee the RBA likely holding rates at 3.6% again on Tuesday. Governor Lowe and RBA speakers may reiterate caution as consumer prices have been hotter than expected recently. On Monday, besides approvals, traders will note Asia’s manufacturing data: for example, India’s industrial output unexpectedly surged (2.8% YoY in Aug), suggesting some regional strength, while Japan’s output fell again (-0.7% MoM). These mixed Asian signals could keep risk appetite lukewarm. In sum, Aussie fundamentals have a dovish tinge (inflation & global concerns) but are tempered by the building approvals upside. The net effect is cautious: any risk-off in U.S. or China, or hints of Fed dovishness, could still push AUD/USD lower, whereas strong domestic or China demand indicators (via commodities) might support it.

Technical Analysis

AUD/USD has been grinding in a narrow band below recent resistance. The 5-minute chart shows price oscillating around the 0.6520–0.6540 area after last month’s rally off the 0.6470 low. Short-term support lies near 0.6490 (recent swing low) and overhead resistance near 0.6550–0.6560 (where sellers have appeared). Momentum indicators are relatively flat, suggesting a consolidation pattern. If the pair dips toward 0.6490 again, buyers could step in – a break below 0.6470 would be bearish. On the upside, clearing 0.6560 would aim for 0.6600. In summary, AUD/USD is in a corrective range and needs an outside catalyst (e.g. surprise RBA commentary or USD moves) to make a decisive move. Traders will likely watch the pair’s reaction to any risk-flow changes as clues for technical direction.

Market Outlook

Monday’s session is set up as a classic “news drivers” trading day. Major central bank voices (Fed and ECB) will steer sentiment; any dovish slant from Fed speakers could reignite risk flows, while hawkish undertones would bolster the greenback and test emerging-market/carry currencies. The U.S. housing data is the wildcard: stronger pending sales might signal underlying demand (potentially reinforcing Fed caution), whereas weaker-than-expected figures would support the dollar. On the European side, we expect the ECB to reiterate that current policy is appropriate given inflation at target, which likely limits euro strength.

Key technical levels to watch: EUR/USD 1.1650 (support) and 1.1700 (resistance); GBP/USD 1.3500 (support) and 1.3580 (resistance); AUD/USD 0.6490 (support) and 0.6560 (resistance). A break of these ranges, especially on strong news, could trigger follow-through moves.

Traders should monitor any signals of policy divergence: for example, commentary about Fed cut timing (possibly pushing USD lower) versus reminders that inflation is still a concern (potentially USD-positive). Watch also market “flow” as Asia opens: rising yields or stock declines might underpin the dollar, whereas a calmer or risk-on mood (if U.S. data disappoints) could lift EUR, GBP and AUD. In short, stay nimble and let the data and speeches guide your bias. Currency pairs could swing quickly; prepare to respond to whichever central bank sets the tone or home-builder data confirms trend.