Global forex markets are on edge as a cascade of events converges. A slide in crude oil to multi-month lows has hit commodity-linked currencies like CAD hard, while dovish Fed signals have lifted the U.S. dollar across the board. Traders are also digesting weaker PMI data in Europe and the UK that underscore slowing growth. With Fed Chair Powell’s big speech looming and key technical levels being tested, the early buzz is electric – breakouts in either direction could spark fireworks in USD/CAD, GBP/USD and EUR/USD.

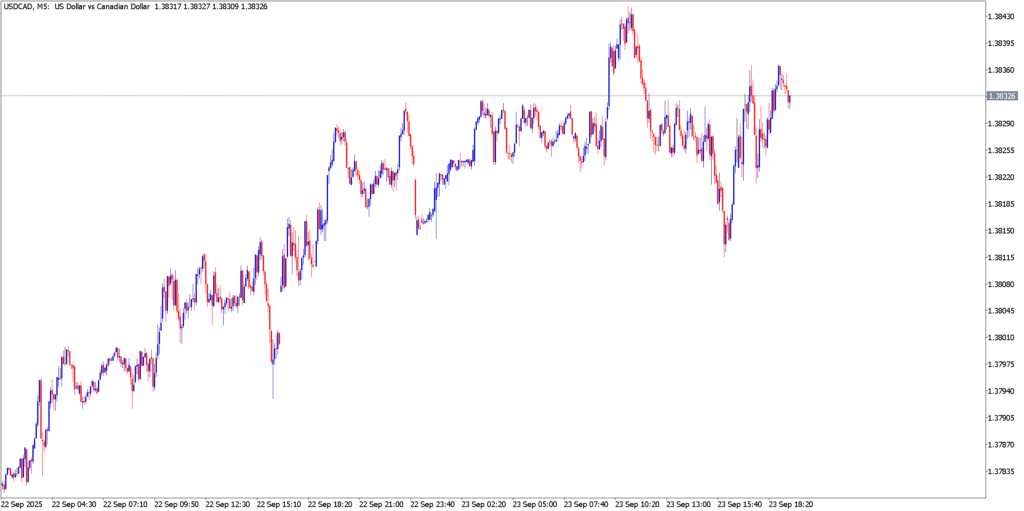

USD/CAD

USD/CAD stormed higher on Monday-Tuesday, touching the mid-1.38s as oil’s collapse and a dovish Bank of Canada fed into USD strength. The pair has broken above a short-term rising trendline and sits above its 50-period moving average, signaling a powerful uptrend. Momentum oscillators (RSI/MACD) are overbought, however, hinting that gains may need a breather soon. In other words, while the USD bulls remain in control, traders should watch for negative RSI divergence or candlestick reversal patterns as warnings. Overall sentiment is bullish – bearish PMI/cuts and weak crude keep fueling USD demand – but fresh resistance looms near 1.3840 and the 1.3900 level, cautioning against complacency.

- Support: ~1.3720–1.3780 (recent intraday lows and trendline support)

- Resistance: ~1.3840 (today’s high) and ~1.3900 (monthly swing high)

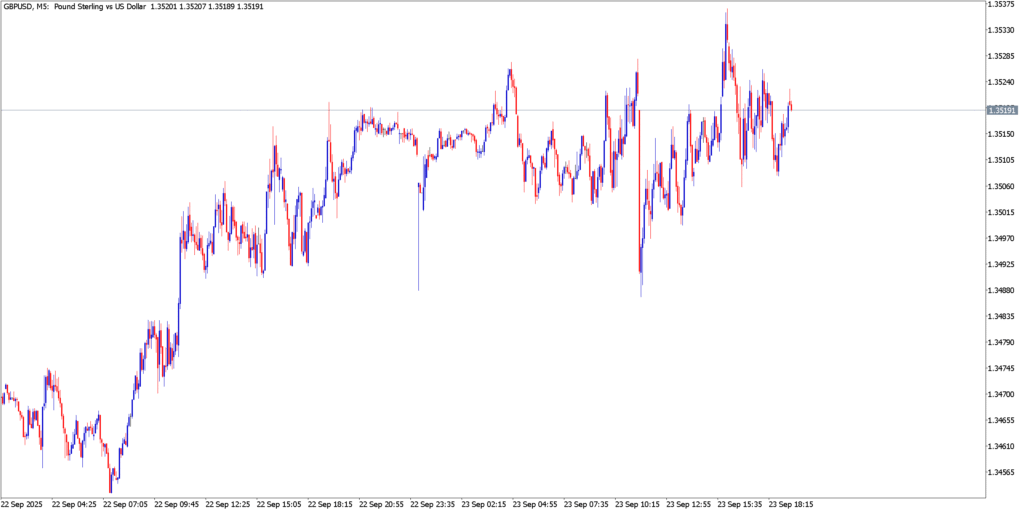

GBP/USD

GBP/USD has been bumping into stiff resistance after rallying off its short-term uptrend line. The pair climbed back above 1.3500 but stalled just below the 1.3530 area. Price action shows a series of rejected highs and a compact trading range, consistent with a “topping” pattern. Technically, momentum is waning – RSI recently hit overbought and is showing early negative divergence against price – suggesting bulls are tiring. Fundamental news adds to the caution: Tuesday’s flash UK Composite PMI plunged to 51.0 (vs 53.5 prior), fueling sterling weakness. Sentiment is mixed: GBP’s short-term trend is up, but with U.S. dollar strength still entrenched, GBP/USD looks vulnerable. A clear break above 1.3530 is needed to change that; otherwise the pair may roll back toward its trend support.

- Support: ~1.3470 (trendline pivot) and ~1.3440 (Monday’s low)

- Resistance: ~1.3530 (recent peaks) and ~1.3550 (psychological ceiling)

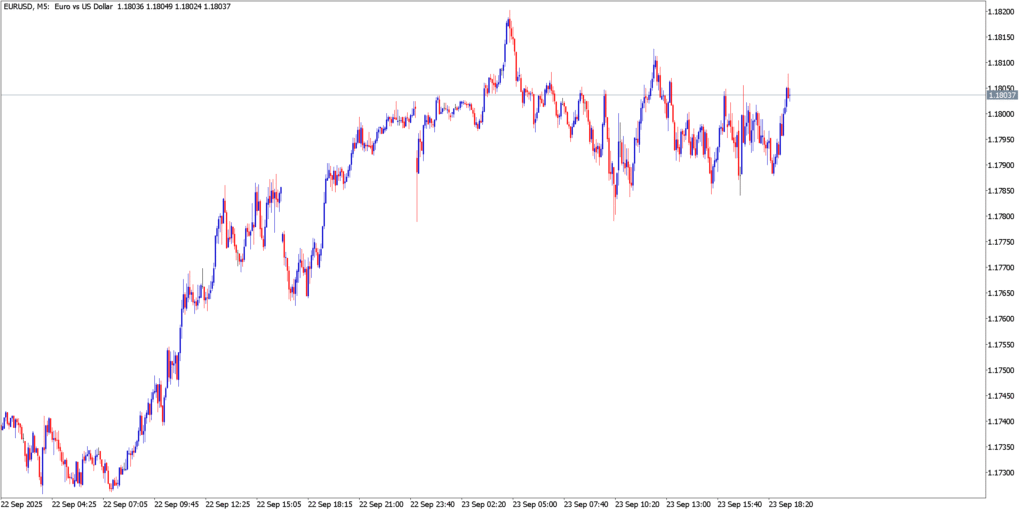

EUR/USD

EUR/USD rose to two-week highs on Monday but has paused just above 1.1800. The euro’s advance was underpinned by strength above its 50-period MA and a rising short-term trendline, which now act as support. However, the run-up hit resistance near 1.1820–1.1830 and price has pulled back slightly. Technically, the rally cleared some prior highs (a bullish sign), yet RSI readings are now overbought and hint at a pullback or consolidation. In short, the trend remains up, but momentum is stalling. Market sentiment is cautiously optimistic – the Euro still benefits from a firm technical backdrop – but traders are watching Fed rhetoric closely. A bearish shift in USD tone (e.g. Powell comments or stronger US data) could cap EUR/USD. For now the pair must hold ~1.1760–1.1780 (trendline support) to keep the bullish case intact.

- Support: ~1.1760 (short-term trendline/EMA50) and ~1.1730 (prior low)

- Resistance: ~1.1820–1.1830 (Monday’s high region)

Summary

In summary, the common thread is a resurgent U.S. dollar riding on dovish Fed signals and crashing oil prices, creating diverging technical pictures across pairs. USD/CAD is on a tear as commodity cues turn sour, eyeing its next barrier above 1.38, while EUR/USD and GBP/USD have paused near resistance after strong rallies. Mixed indicators – overbought RSI’s and trendline tests – suggest bulls have momentum but will need fresh catalysts to run. With Powell’s speech and PMI/news releases ahead, traders should brace for volatility. In effect, these pairs are at critical decision points: breakouts or breakdowns loom, and the next move could be sharp whichever way the market chooses.