Global forex markets are riding a cautiously optimistic wave this Wednesday as traders digest cooling inflation and shifting central bank outlooks. U.S. inflation data surprised on the tame side – headline CPI held at 2.7% in July while core ticked up only mildly – reinforcing bets that the Federal Reserve’s next move could be a rate cut rather than a hike. This prospect has put the U.S. dollar on the back foot, sending the Dollar Index (DXY) to two-month lows and boosting risk appetite. Meanwhile, concerns about economic stagnation linger in the background (e.g. weak UK growth and China’s slowdown), but for now markets are fixated on the prospect of policy relief. Against this backdrop, safe-haven currencies like the yen remain weak, while risk-sensitive units such as the British pound and Australian dollar are finding tailwinds from improved sentiment and upbeat data.

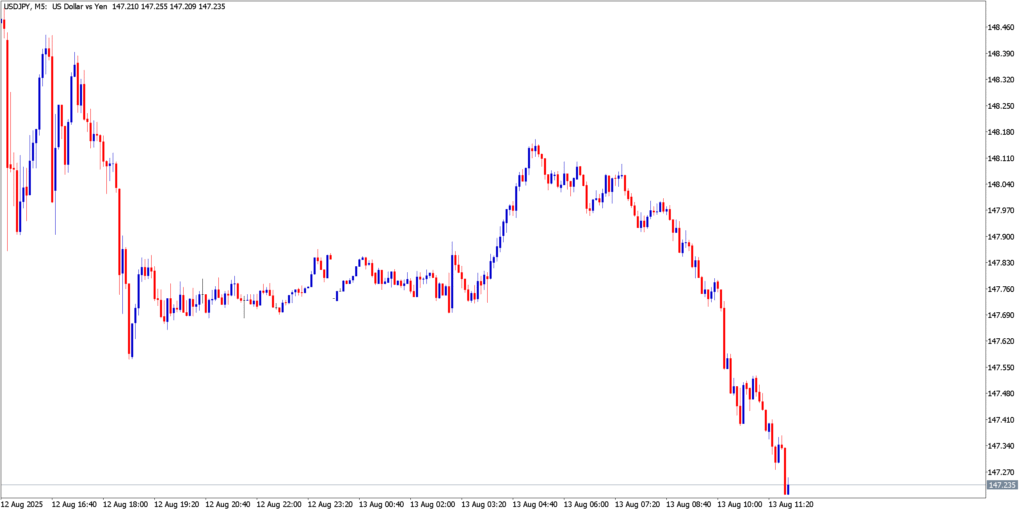

USD/JPY

Technicals in Focus

USD/JPY has eased off its recent highs but remains in an uptrend on the 5-minute chart. After peaking above ¥148.30, the pair dropped toward ¥147.20 as U.S. yields dipped on the benign inflation reading, giving the yen a slight breather. The MACD momentum indicator on M5 has flipped marginally below its signal line, reflecting the pullback, while RSI has fallen toward the mid-40s – indicative of cooling bullish momentum without oversold extremes. The Stochastic Oscillator is hovering around oversold territory, hinting at fading downside momentum. Still, the yen’s overall tone is soft; USD/JPY is only slightly off multi-month highs, with support around ¥147.00 and immediate resistance near ¥148.00/148.30.

Trading Strategy

- Bullish Setup: A sustained base above the ¥147.00 support could attract dip-buyers. Consider long positions on a bounce from ¥147.00–147.20, targeting a rally back to ¥148.50. A tight stop loss near ¥146.80 (just under the recent support) helps manage risk.

- Bearish Setup: Failure to reclaim ¥148.00 in the next upswing may invite sellers. A short position around ¥147.80–148.00, with a stop above ¥148.30, could aim for a retracement to the ¥147.00 zone (and potentially lower toward ¥146.50 if risk-off flows pick up).

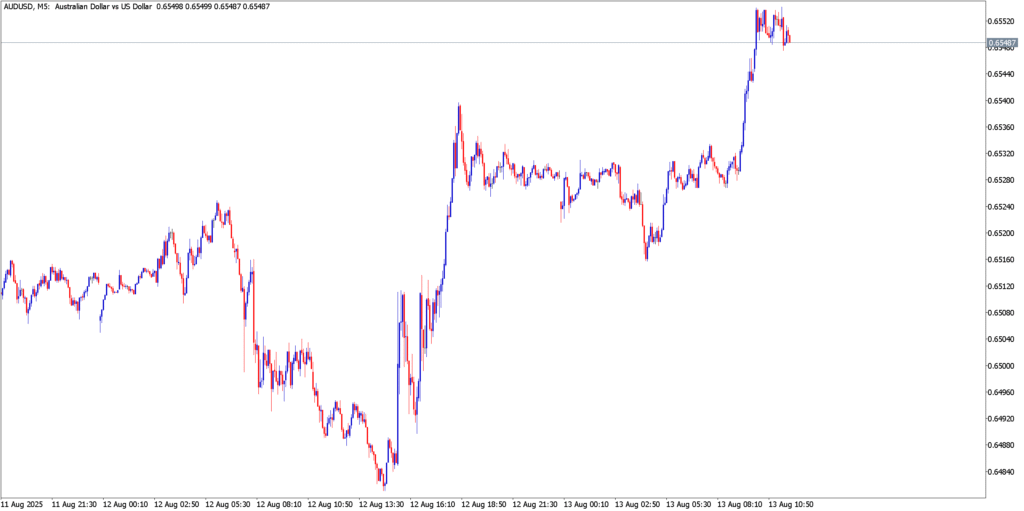

AUD/USD

Technicals in Focus

AUD/USD has reversed higher in a brisk rebound, with the pair climbing from lows near $0.6480 to about $0.6550 today. The 5-minute chart shows a series of higher lows as buyers stepped in following upbeat domestic cues and the broadly weaker USD. MACD on the intraday chart is rising in positive territory, reflecting building bullish momentum. The RSI recently pushed above 60 before moderating, indicating improving sentiment without yet being overbought. Meanwhile, the Stochastic oscillator reached into overbought levels after the sharp bounce, suggesting the rally may consolidate before any further extension. Key support is visible around $0.6500–0.6520 (prior resistance turned support), and initial resistance lies at $0.6555, with a break above that exposing the $0.6600 region.

Trading Strategy

- Bullish Setup: With momentum favoring the upside, bulls might look to buy on dips. A pullback into the $0.6520 area (near the 20-period moving average on M5) could be an entry zone, aiming for $0.6580 then $0.6600 as upside targets. A stop loss placed under $0.6490 would be prudent, as a drop below this invalidates the near-term uptrend.

- Bearish Setup: If the Aussie falters near $0.6550–0.6560 resistance without a clear breakout, a short trade could be considered. Selling in that zone with a target back toward $0.6500 (and $0.6470 on an extended decline) may yield a good risk/reward. A stop above $0.6580 will cap risk in case bullish momentum resumes.

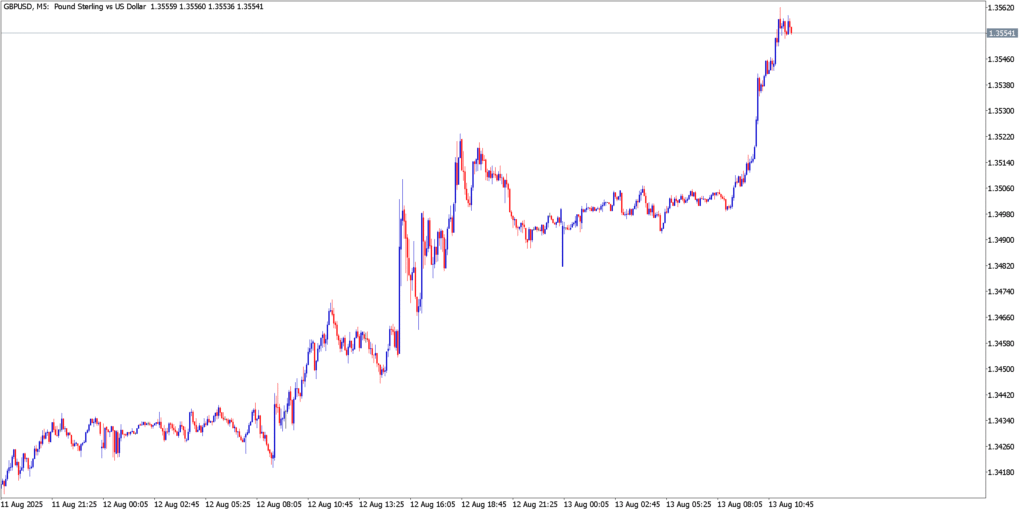

GBP/USD

Technicals in Focus

GBP/USD exploded higher in the past 24 hours, breaking out of its recent range. The pair jumped to a high around $1.3525–1.3550 intraday, a notable move up from last week’s lows near $1.3140. On the 5-minute timeframe, the trend is decisively bullish with a sequence of higher highs and higher lows. The surge pushed the RSI well into the 70s earlier, flagging short-term overbought conditions before it eased slightly. Similarly, the Stochastic oscillator pegged into overbought territory, suggesting the pound may consolidate or correct mildly after its sharp run. The MACD is firmly above zero, though its histogram has started to tick down, hinting the bullish momentum is pausing. Immediate support is seen at $1.3500 (recent breakout level), with stronger support around $1.3450. Overhead, minor resistance from today’s high near $1.3550 is in play, and beyond that the psychological $1.3600 level is the next bullish target.

Trading Strategy

- Bullish Setup: The pound’s break higher puts bulls in control. A dip toward $1.3480–1.3500 could offer a better risk/reward entry to join the uptrend. Long positions in that zone can target $1.3600 next, with a stop loss below $1.3440 (just under the old resistance now turned support). Continuation of the risk-on mood or any upside surprise in UK data could propel such a move.

- Bearish Setup: Despite the strong upmove, GBP/USD is stretched in the short term. Bears may watch for a false break above $1.3550 or loss of momentum. A short position around $1.3540 with a tight stop above $1.3600 could play a pullback toward $1.3450. Initial profit targets would be $1.3450, with an extended goal at $1.3400 if a deeper correction unfolds.

Market Outlook

Looking ahead, traders are focused on a slate of key economic events and what they could mean for policy trajectories in coming days:

- United States: With inflation appearing contained (core CPI +3.1% YoY, headline steady at 2.7%), attention shifts to upcoming U.S. data. Producer Price Index (PPI) figures on Thursday and Retail Sales on Friday (Aug 15) will be pivotal. Any downside surprise in PPI or consumption could further bolster the case for Fed easing. In fact, Fed fund futures now imply over a 90% probability of a 25 bp rate cut at the Fed’s September meeting. Such expectations are keeping the dollar under pressure. However, strong retail numbers could complicate the narrative, so volatility around USD is likely into week’s end. Fed officials (including Goolsbee and Bostic speaking later today) will also be parsed for confirmation of the dovish tilt.

- Japan: Early indicators from Japan show inflation easing – for instance, producer prices rose just 2.6% YoY in July, the slowest pace since August 2024. Japan’s preliminary Q2 GDP (due overnight) is expected to reveal only meager growth (~0.1–0.2% QoQ). Such tepid economic performance, combined with still-subdued inflation, means the Bank of Japan is likely to maintain its ultra-loose stance. Any upside surprise in GDP or hint of policy tweak is a wild card for the JPY, but barring that, yield differentials should continue to leave the yen on the weaker side.

- United Kingdom: The British pound’s strength will be tested by data in the immediate term. Just-released UK labor figures showed cooling momentum – wage growth slowed and jobless claims inched up, signaling a gradually softening job market. Next up is the UK’s Q2 GDP report on Thursday. Forecasts center around roughly 0.1% QoQ growth (essentially stagnation). If the GDP data disappoint even that low bar, it could temper the GBP’s rally and revive talk of the Bank of England nearing an end to its hiking cycle. Conversely, any upside surprise in growth or revisions could give the pound a further boost. With UK inflation still running above 4%, the BoE is in a bind – weak growth argues for caution, but high prices keep pressure on. Expect the pound to react sharply to the GDP outcome as traders recalibrate BoE expectations.

- Australia: The Australian dollar enters the spotlight with Australia’s July employment report due. The market is bracing for a moderation after June’s robust gains – any significant divergence will move the AUD. Notably, Australia’s jobless rate recently ticked up to 4.3% from 4.1%, raising concerns about a weakening labor trend. The RBA, which has already enacted three rate cuts this year (most recently to 3.60% on Aug 12), has signaled a data-dependent and cautious approach. A strong jobs number could delay further RBA easing and give AUD/USD more fuel for its rebound. On the other hand, a soft employment read would reinforce bets that the RBA may cut again by year-end, likely capping Aussie upside. Beyond jobs, keep an eye on Australia’s consumer sentiment and China’s economic news for additional cues, as they will also sway the AUD’s outlook.

In summary, the forex market tone for mid-week is cautiously optimistic with the dollar on its heels. But with critical data on the docket and central bank signals evolving, traders should stay nimble. Volatility may creep back in if any of these upcoming releases defy expectations. For now, the bias favors strategies aligned with a softer USD – yet prudent risk management is key, as the late-week data deluge could quickly reprice the narrative across USD/JPY, AUD/USD, and GBP/USD.