Investors are on edge as a cascade of global events looms. The U.S. dollar faces heavy pressure even as risk aversion catapults gold to fresh records (up ~47% YTD). A potential U.S. government shutdown and delayed economic data add to the uncertainty, ahead of a crucial mid-October CPI release and Fed meeting. Meanwhile, central banks from Europe to Down Under are setting the stage: markets expect the Fed to cut rates in October, while the ECB, RBA and RBNZ convene with divergent mandates. Weak global growth, simmering trade tensions and swings in energy prices amplify the drama. In this febrile backdrop, EUR/USD, NZD/USD and AUD/USD are poised for big moves.

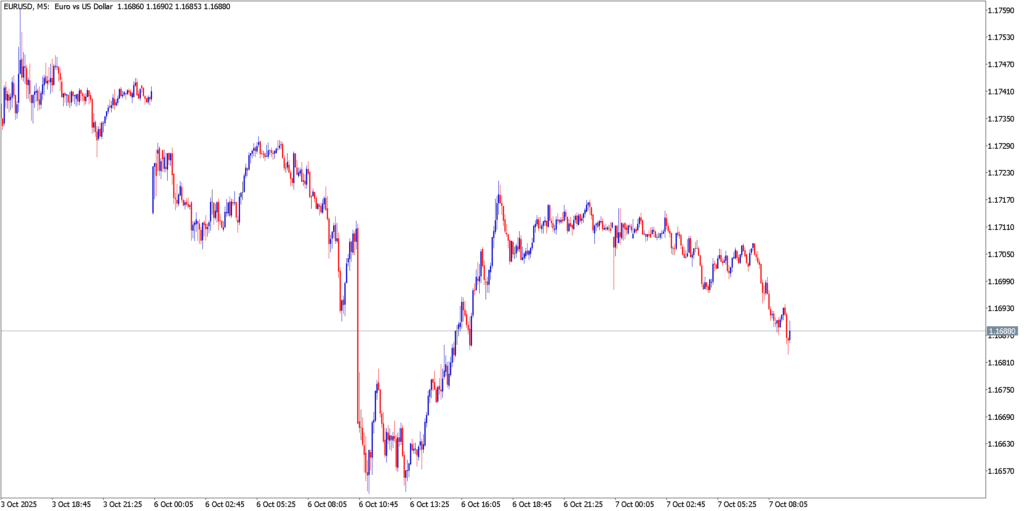

EUR/USD

Fundamental Analysis

The euro’s fortunes are tied to the diverging Fed–ECB paths. Eurozone inflation picked up slightly to 2.2% in September (from 2.0% in August) on stubborn services prices, yet core inflation held at ~2.3%. This suggests the ECB will hold rates steady at its Oct 30 meeting, especially as policymakers now regard the 2% policy rate as only “mildly” accommodative. In contrast, the Fed is widely expected to cut rates by 25bps at its October meeting (with markets pricing a ~95% chance). In practice this means U.S. rate differentials will shift in the euro’s favor. Indeed, polls see EUR/USD strengthening into year-end (targets ~$1.19–1.21 as Fed eases and the ECB holds). Geopolitical risks (tariffs, conflicts) and a fragile U.S. labor market also counsel caution – any significant global risk-off could momentarily revive the dollar, though for now the consensus is dollar weakness.

Technical Outlook

EUR/USD has broken into fresh highs. Price recently reached the ~1.18 area (the highest since 2021) and is finding resistance around ~1.185–1.190. On the upside, a push above 1.185–1.190 could clear the way toward the next psychological level near 1.20. On the downside, key support lies at roughly 1.170–1.175 (recent pivot zone); a decisive break below ~1.17 would threaten the bullish trend.

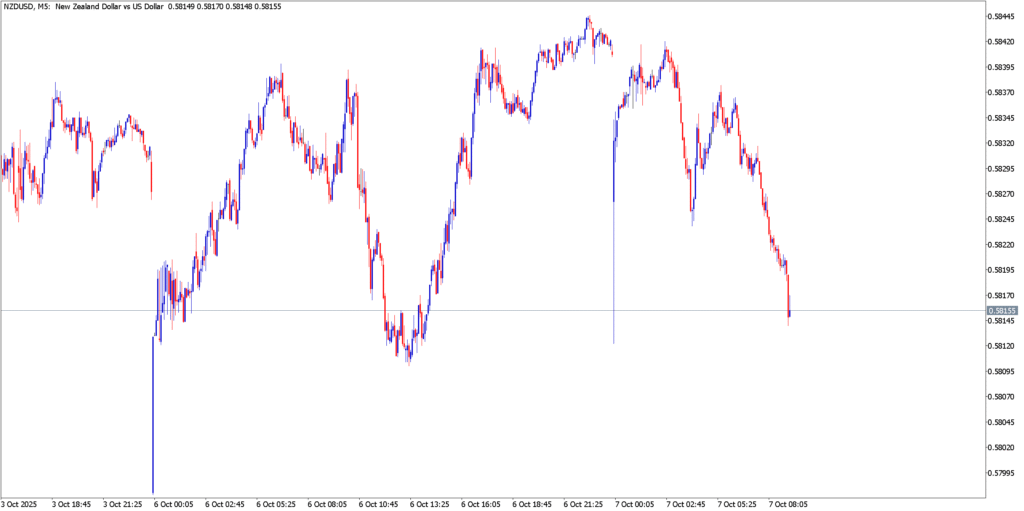

NZD/USD

Fundamental Analysis

The Kiwi is under intense downward pressure as New Zealand’s economy falters. A private survey shows confidence has slumped and Q2 GDP fell ~0.9%. With inflation tame and growth stalled, the RBNZ is virtually certain to cut the OCR – most forecasters see a 25bps cut on Oct 8, with a significant chance of a 50bps surprise. This aggressive easing contrasts with the RBA’s pause, and that policy divergence has already driven NZD/AUD to multi-year lows. In short, more rate cuts on the horizon and weak export demand (China’s slowdown hurts dairy prices) mean NZD/USD looks set to weaken further. Over the near term, U.S. Fed easing may restrain USD strength somewhat, but any sign of global slowdown would keep the Kiwi on the defensive.

Technical Outlook

The NZD/USD chart is deeply bearish. The pair has tumbled to multi-month lows in the mid-0.59 area. Immediate resistance is near 0.59–0.60 (former support); a failure to reclaim 0.60 suggests the downtrend will resume. On the downside, support now sits around 0.585–0.580; a break below 0.580 would open the path toward the mid-0.57s. (In practice, price action looks rangebound for now between ~0.58–0.60, but bias is clearly lower.)

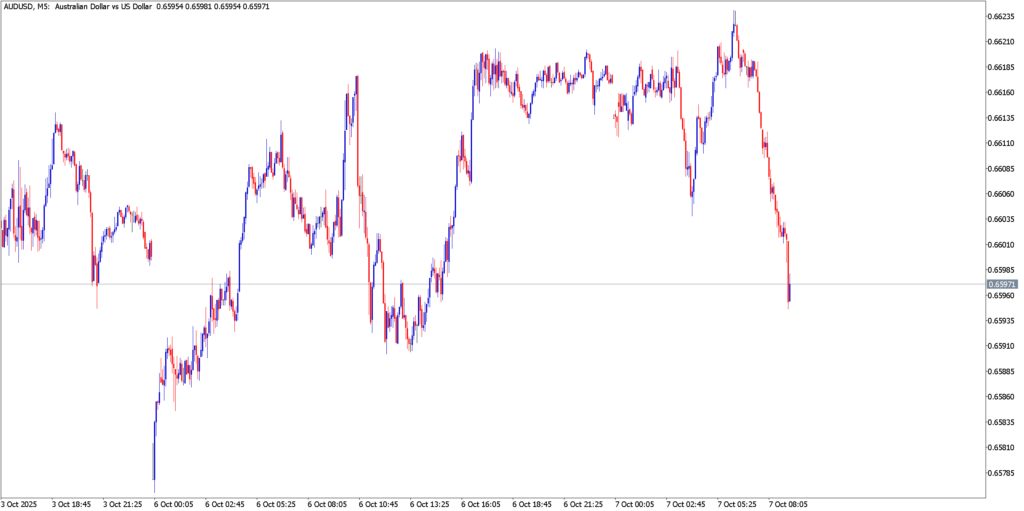

AUD/USD

Fundamental Analysis

The Australian dollar is trading in a wide band as well. In late September the RBA held rates at 3.60%, noting that recent data (sticky services inflation and surprisingly strong GDP) mean that policymakers will stay “data-dependent” before any further cuts. The meeting’s cautious tone caught markets off-guard, trimming the odds of an immediate cut and causing AUD to briefly strengthen (to ≈0.66). Still, RBA forecasts allow for a couple more cuts this cycle if inflation disappoints, so the fundamental bias remains marginally dovish. Australia’s fortunes tie back to China: sluggish Chinese growth and soft commodity prices will cap AUD upside. In short, AUD/USD is stuck in its 0.64–0.69 range; any sustained break will likely come only with a clearer signal from China or a decisive Fed move.

Technical Outlook

AUD/USD has oscillated in roughly the 0.658–0.683 range. Key support lies near 0.66 (last month’s lows) and then ~0.655; a breach below ~0.655 would threaten a slide toward 0.65. Resistance stands around 0.68–0.69; a firm break above 0.69 could quickly push the pair toward 0.70. For now, the trend lacks a clear breakout – each test of the top of the range has been met by selling.

Market Outlook

In sum, currency markets are braced for a volatile October. The big theme is Fed vs the rest: if the Fed follows through on its expected cuts (and U.S. growth lags), the dollar should weaken further, offering EUR/USD a clear runway toward the 1.20 level. However, any shock (e.g. a prolonged U.S. shutdown or surprise hawkish U.S. data) could reignite safe-haven flows into the dollar, halting the slide. Meanwhile, the commodity bloc is split: NZD is likely to keep underperforming on domestic weakness and looming RBNZ easing, while AUD’s fate hinges on China’s recovery and RBA guidance.

In the coming days and weeks we expect turbulent trading. EUR/USD will be watching the 1.18–1.20 zone – a break above could spark a quick climb, but a retreat toward 1.17 or below would reflect profit-taking. NZD/USD is vulnerable to further falls; look for it to probe the low 0.58’s as RBNZ delivers cuts. AUD/USD should continue churning within its 0.65–0.69 band, firming only if Chinese PMI surprises positively or the Fed rolls over sooner than expected. Overall, central bank cues (US CPI Oct 15, Fed Oct 28–29, ECB Oct 30, etc.) will be the catalysts. Strap in: markets have a packed calendar and a charged narrative, making short-term swings very likely.