Markets are on edge as a flood of global data collides with Fed policy uncertainty. Strong U.S. figures (second-quarter GDP +3.8% annualized) and Fed Chair Powell’s warning that future rate cuts are “not guaranteed” have kept the dollar bid. At the same time, looming U.S. government funding talks have injected risk aversion – the dollar slid Monday, lifting EUR/USD to about 1.1734 and GBP/USD near 1.3450. In Asia, the Reserve Bank of Australia held rates at 3.60% as expected, helping AUD/USD power up toward its recent range highs. Chinese data also supported risk assets – a private PMI jumped to 51.2 in September. Overall, volatility is elevated and the tone mixed: commodity-linked AUD is firm, but the euro and pound remain under pressure against a resilient greenback. In this context, AUD/USD has rallied off support, EUR/USD is pinning around key levels, and GBP/USD is pressured by the firmer USD.

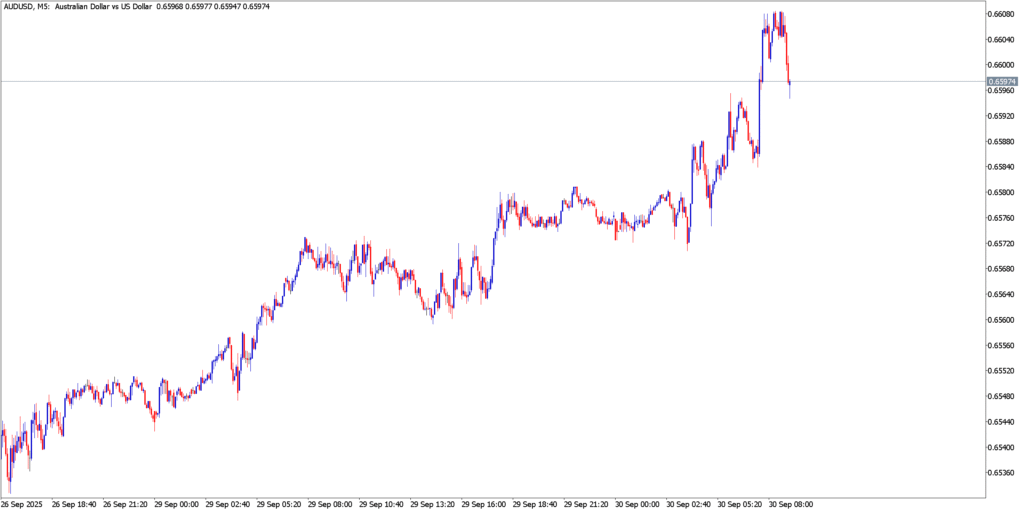

AUD/USD

Technical

AUD/USD has been carving out higher intraday lows. After gapping higher on the RBA outcome, price is now near 0.6610 and approaching resistance. Last week’s range was roughly 0.6520–0.6629, and the pair is now testing its upper band. Near-term support lies around 0.6540 (last week’s midpoint), while upside resistance is near 0.6700 (as flagged by analysts). Momentum on the 5-min chart turned positive after the RBA news, with bullish continuation above recent swing lows.

Fundamental

Australian data were mixed. The RBA held the cash rate at 3.60% (the lowest since 2023), as expected, signaling a pause in tightening. Policymakers noted “signs that private demand is recovering” alongside sticky inflation in pockets. Earlier data showed private sector credit growth eased slightly to +0.6% MoM in August (from 0.7% previously), suggesting steady lending activity. By contrast, housing consents plunged 6% in August, underlining weakness in residential construction. CNY strength and sentiment lifted commodities overnight, helping AUD, but longer-term Australian demand headwinds keep traders cautious. Overall, the RBA’s pause is neutral for AUD – it removes immediate hawkish bias, but the dovish pause and mixed data cap any rally.

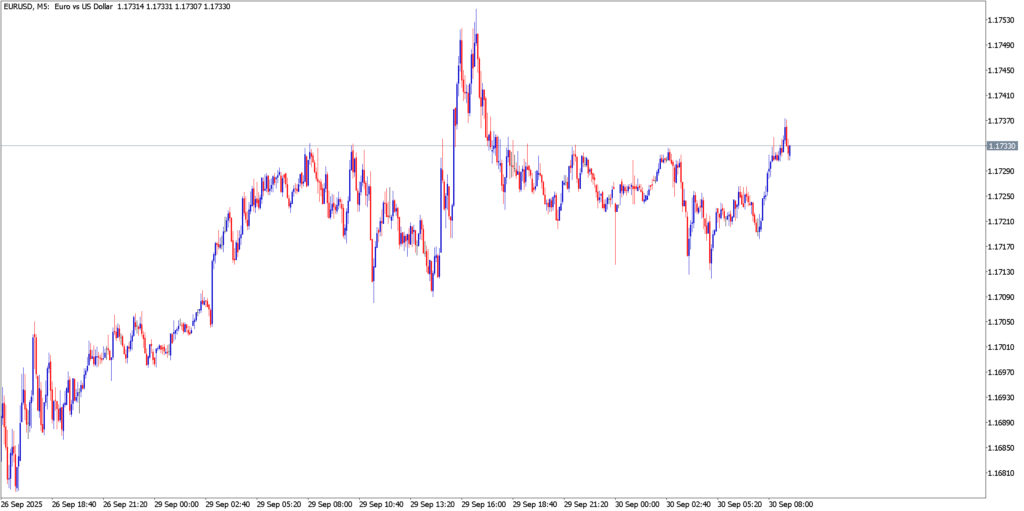

EUR/USD

Technical

EUR/USD has held in a sideways range after dipping to last week’s lows. The pair bounced off the 1.1640–1.1700 support zone (the trough of last week’s 1.1646–1.1820 range) and is now testing resistance around 1.1780–1.1820 (the previous week’s high). Intra-day, the 5-min chart shows a mild uptrend from ~1.1700, but momentum is slowing near resistance. Immediate support is at 1.1720 (Monday’s lows) and then 1.1650 (last Friday’s low). A sustained break above 1.1820 would open 1.1880, while a failure would target the 1.1640 area.

Fundamental

The euro is caught between mixed signals. Germany’s data calendar is busy today – retail sales are expected to rebound (+0.6% MoM) and unemployment should hold steady at 6.3%. Eurozone inflation is due later in the session: forecasts have core CPI ticking up (flash estimate ~2.3% YoY). If inflation surprises higher, ECB rate cut expectations will be delayed and EUR could strengthen. However, wider euro-area spending has been weak (July retail sales -1.5% MoM prior). On the U.S. side, tomorrow’s Chicago PMI and Consumer Confidence are on tap – strong U.S. numbers would bolster the greenback. In sum, EUR/USD is likely to grind in range until we get clear US/EMU signals.

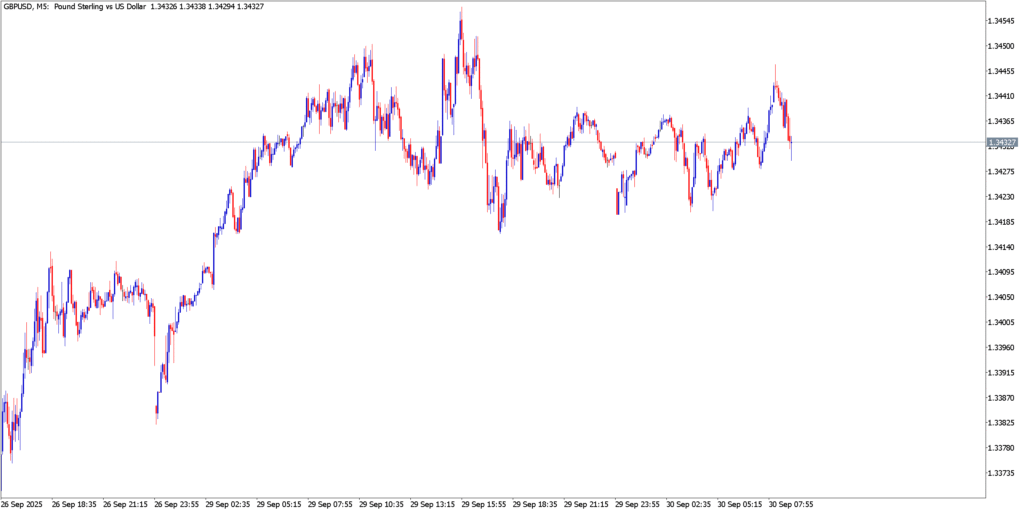

GBP/USD

Technical

GBP/USD remains under downside pressure. The pair pulled back from last week’s ~1.3540 peak down to ~1.3400 and held just above support. Monday’s trading saw GBP test 1.3449 before reversing. Key technical levels are roughly 1.3500 on the upside (near recent highs) and about 1.3320 on the downside (last week’s low at 1.3323). The intraday 5-min action shows lower highs and fading bullish momentum, suggesting bears have the edge. Unless the dollar softens significantly, GBP/USD may slip toward 1.33.

Fundamental

UK fundamentals offer little tailwind. Q2 GDP was unrevised at +0.3%, reflecting a stagnating economy. Flash PMI data have shown waning growth, and concerns over fiscal policy have weighed on the pound. By contrast, U.S. data have remained surprisingly strong, keeping Fed cuts at bay. As a result, sterling has underperformed: last week GBP/USD fell ~0.5% on a resurgent dollar. This week, traders will watch UK jobs and business surveys, but the immediate driver is the dollar. Unless U.S. sentiment sours or UK data boom, GBP/USD looks capped around 1.3500 and vulnerable toward the low-1.33 zone.

Market Outlook

All eyes are on the interplay between data-driven flows and policy rhetoric. The dollar’s recent strength reflects resilient U.S. growth and Fed caution; any further upside in USD will keep EUR and GBP in check. For the Aussie, the RBA pause has been a bullish trigger, so watch if commodity prices and Chinese demand remain supportive. Looking ahead, traders should watch tomorrow’s US service PMI and Conference Board confidence (Fri’s US payrolls loom large later), the Eurozone flash CPI at 8:00 AM ET, and any new Fed or RBA comments. If US shutdown risks fade, USD could rebound; if US data disappoint, we could see a broader retracement of last week’s dollar rally. In this volatile environment, key technical levels (AUD/USD ~0.6540/0.6700, EUR/USD ~1.1650/1.1820, GBP/USD ~1.3300/1.3500) will guide short-term trades, while global growth signals will steer medium-term sentiment. Traders should remain nimble around these zones and track incoming data for the next directional clue.