The forex market is in whipsaw mode this Wednesday after a dovish bombshell from the Federal Reserve sent the U.S. Dollar tumbling. Fed Chair Jerome Powell signaled that interest rate cuts are on the table, citing a sharp hiring slowdown as a growing economic risk. This ignited a relief rally in major currencies – with the euro, pound, and Aussie dollar all rebounding fiercely off multi-month lows. Global risk sentiment has improved on hopes of easier Fed policy, even as traders remain on edge over weak economic data and geopolitical flare-ups. Below we break down the fundamental drivers and technical turning points for EUR/USD, GBP/USD, and AUD/USD, before concluding with an outlook on what’s next.

EUR/USD

Fundamentals

The euro is surging against a retreating Dollar, buoyed by Powell’s hint that the Fed will likely cut rates at its October 28–29 meeting. Money markets now peg the odds of an October Fed rate cut above 90%, a dramatic shift that has clipped U.S. Treasury yields and the Dollar’s momentum. This dovish U.S. tilt comes as Eurozone jitters ease slightly – French Prime Minister Sébastien Lecornu stunned markets by suspending a contentious pension reform until after 2027, aiming to quell months of political turmoil. While euro-area data is mixed (German investor sentiment deteriorated in October), European Central Bank officials struck a balanced tone – President Lagarde said policy is “in a good place,” and France’s Villeroy de Galhau suggested the ECB’s next move is more likely a rate cut than a hike. Taken together, these developments have improved sentiment for the euro, helping EUR/USD climb back above the 1.1600 handle.

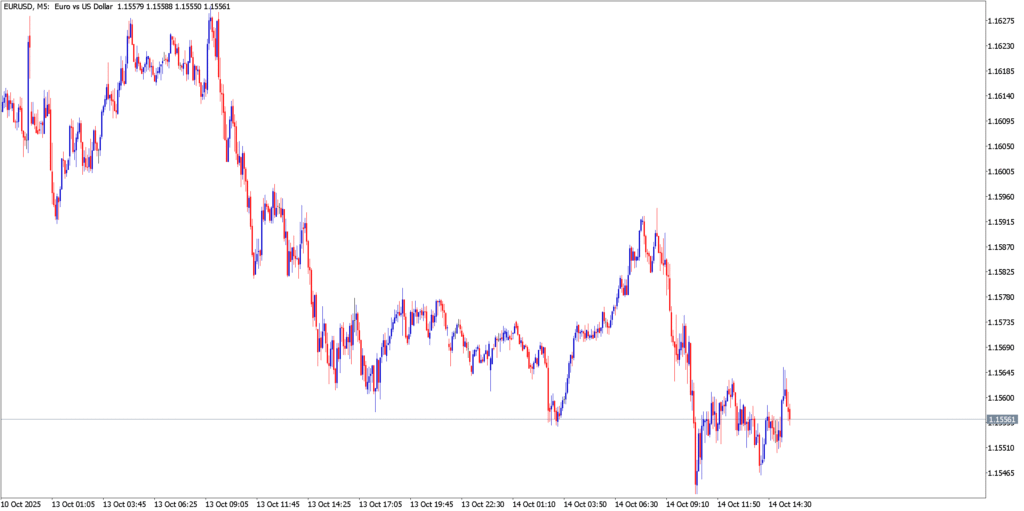

Technical Analysis

The EUR/USD bounce is testing a crucial ceiling, but the broader trend remains subdued. After sinking to 1.1550 support, the pair has rallied into the mid-1.16s, approaching an immediate resistance around 1.1650. This level coincides with the 100-day moving average (near 1.1640) and marks the upper bound of the euro’s corrective rebound. Momentum gauges reflect only a tentative recovery – on the 5-minute chart, price is trading along a supportive intraday trendline but remains below the 50-period EMA, keeping bearish pressure intact. If buyers force a break above 1.1650, it could open the door to 1.1700+ and signal a trend shift, with 1.1800 as the next upside target. Failure to clear resistance, however, may reassert the downtrend. A turn back below 1.1600 support would expose 1.1550 and possibly the 1.1500 level, and a decisive break under 1.1500 could send EUR/USD toward the August low near 1.1390. For now, the euro’s rebound has injected bullish momentum, but traders are keenly watching if this move has the fuel to sustain beyond the current inflection point.

GBP/USD

Fundamentals

The British pound is catching a bid in the wake of USD weakness, even as UK fundamentals flash warning signs. Early this week, sterling slid on downbeat labor market figures – Britain’s unemployment rate ticked up to 4.8% and job growth nearly stalled (only +91k vs 123k expected). Wage growth also cooled, bolstering the case for the Bank of England to consider rate cuts sooner rather than later. However, markets don’t see the BoE rushing; traders are skeptical of any easing before next spring, with the first cut not priced in until March 2026. This cautious BoE outlook initially dragged GBP/USD to two-week lows. But Powell’s dovish turn flipped the script – as U.S. yields fell, the Dollar lost ground and GBP/USD snapped a two-day slide, rebounding from the mid-1.32s to the 1.3350 area. Further supporting risk appetite, the U.S. government averted releasing new economic data (due to a funding shutdown), and simmering U.S.–China trade tensions pressured the Dollar. Overall, the pound finds itself supported by the global shift toward looser monetary expectations, even as domestic UK news remains a headwind.

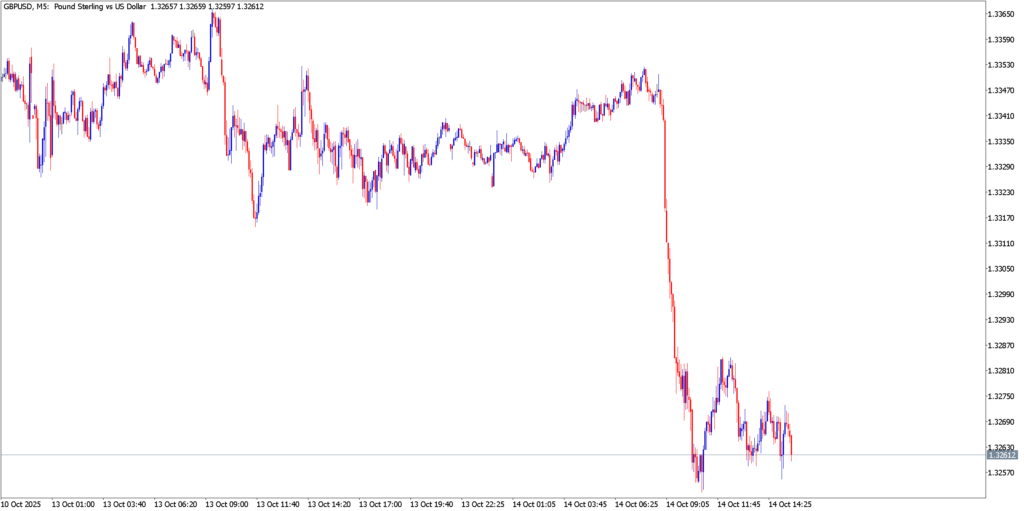

Technical Analysis

On the charts, GBP/USD is trying to carve out a floor after an extended slide. The pair plunged to 1.3300 before buyers stepped in, and it now trades near 1.3350 as the relief rally unfolds. This area around 1.3340/50 is a formidable intraday resistance that capped the bounce overnight, aligning roughly with last week’s highs. Short-term momentum is improving – the 5-minute RSI has swung out of oversold territory – but the larger trend remains bearish. The price is still well below its 50-day and 100-day averages (near 1.3470-1.3490) and continues to trade under a descending trendline from late September. To signal a real trend reversal, bulls need to push GBP/USD back above 1.3400–1.3430 (clearing the 20-day SMA at 1.3434). In the meantime, support levels are nearby. Immediate support lies at 1.3300, and a drop under that could bring the 1.3200 zone into play. Notably, the 200-day SMA around 1.3178 looms just below, making 1.3170–1.3200 a critical support shelf for Cable. A decisive break beneath the 1.32 figure would exacerbate downside momentum, whereas a climb above 1.3350 would target the 1.3400s. For now, sterling traders are balancing the short-term rebound against a still-risky technical backdrop, with dollar moves and BoE signals likely to dictate the next break.

AUD/USD

Fundamentals

The Australian dollar is on the offensive, rallying off recent lows thanks to a mix of hawkish-sounding RBA commentary and the softer greenback. In a speech today, RBA Assistant Governor Sarah Hunter noted that Australia’s recent data has been “a little stronger than expected” and warned Q3 inflation may come in hotter than forecast, hinting that price pressures could stay elevated. She also suggested the labor market might be tighter than assumed, underscoring that the RBA Board will adjust policy as needed with caution. These comments poured cold water on the idea of near-term RBA rate cuts, giving the Aussie a bullish nudge. Meanwhile, Australia’s biggest trading partner, China, revealed ongoing deflation – September’s CPI fell 0.3% YoY – but this had limited impact on AUD as traders focused on bigger drivers. The U.S.–China trade skirmish escalated, however, with President Donald Trump threatening new tariffs and port fees in response to China’s export curbs on critical minerals. This tit-for-tat rattled markets late yesterday but ultimately contributed to a weaker U.S. Dollar, as investors worry about growth fallout. With the Fed now firmly expected to cut rates (94% odds for October, and another in December), the backdrop favors risk-sensitive currencies. All told, the Aussie has found a sweet spot – rising Fed dovishness and an RBA biased toward containing inflation – helping AUD/USD rebound despite global growth concerns.

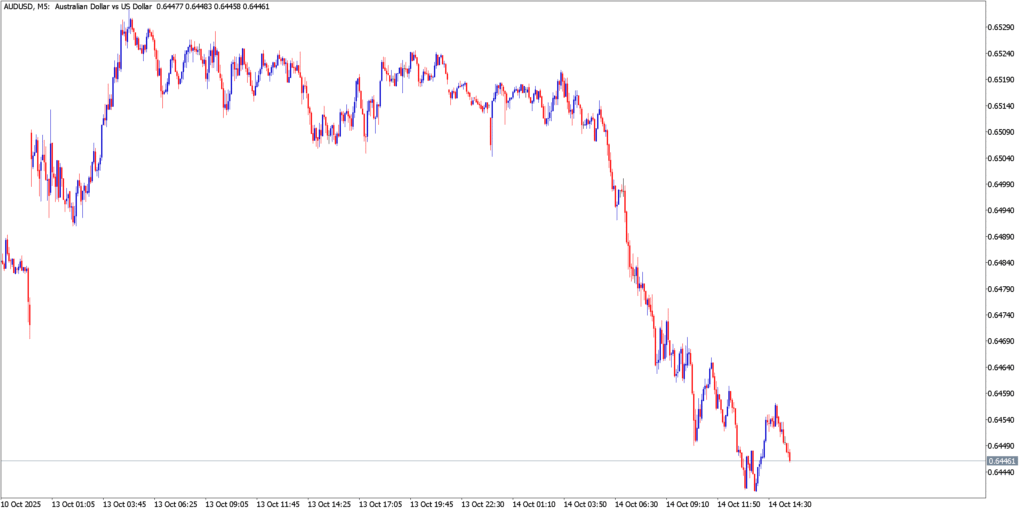

Technical Analysis

Grinding Higher Within a Downtrend: AUD/USD has bounced from deep oversold levels, but it remains in a well-defined downtrend channel. After plunging to a four-month low near 0.6415 last week, the pair is now hovering around 0.6500, attempting a gradual climb. On the intraday (M5) chart, higher lows are emerging, and price is probing the upper bounds of its descending channel. Key support is evident at the channel’s base around 0.6450, guarding the recent low at 0.6414. As long as that floor holds, the Aussie may continue to grind upward. The first hurdle for bulls is the 0.6530 region, defined by the 9-day EMA resistance. A push above 0.6550 (the 50-day EMA) would strengthen the short-term bias and could trigger a run toward the channel’s top near 0.6590. A decisive upside breakout – with a break of 0.6600 – would signal a potential trend change, exposing the 0.6700 area (12-month high) as the next target. Conversely, if the rebound falters and 0.6450 gives way, expect an acceleration lower with 0.6400 and 0.6370 (the five-month low) as downside markers. The Aussie’s short-term momentum has improved thanks to the fundamental tailwinds, but traders need to see a clear technical breakout from the bearish channel to fully trust the rally.

Market Outlook

The swift moves across EUR/USD, GBP/USD, and AUD/USD underscore a high-stakes tug-of-war between waning U.S. Dollar strength and still-fragile domestic fundamentals elsewhere. The Fed’s newly dovish stance has been the catalyst for this week’s drama – easing U.S. rate expectations have flipped market momentum in favor of previously beaten-down currencies. However, questions linger about the durability of these rallies. Major resistance levels are now being tested, and it remains to be seen if follow-through buying can overcome the entrenched downtrends on higher timeframes. Looking ahead, traders should brace for more volatility as attention shifts to upcoming event risks. Key focal points include U.S. economic releases delayed by the government shutdown (with CPI now scheduled for Oct. 24) and a slew of Fed speakers who could either confirm or walk back the ultra-dovish signal. In Europe and the UK, any signs of economic slippage or inflation surprises will feed into ECB and BoE policy bets, potentially capping euro and pound strength. Meanwhile, the commodity-tied Aussie remains sensitive to China’s economic pulse and trade headlines, which can turn sentiment on a dime. In summary, the market tone has shifted to cautious optimism on the back of central bank pivots – but with cross-currents from data and geopolitics, expect the unexpected. Savvy traders will be watching if the euro, pound, and Aussie can sustain this week’s momentum or if the Dollar stages a comeback, keeping risk management tight in these fast-paced conditions.