The trading week kicked off with high drama in FX markets as political and central bank surprises jolted traders. A looming U.S. government shutdown continued to weigh on confidence and the dollar, but hawkish Fed rhetoric threw a curveball – top officials Goolsbee and Logan cautioned against assuming multiple rate cuts, defying dovish market bets. This one-two punch of uncertainty saw risk sentiment ricochet: safe-haven gold spiked while equities in Asia got a boost from a historic rally in Japan’s Nikkei after a surprise leadership vote. Amid the turmoil, the Australian, Euro, and New Zealand dollars are each navigating a unique gauntlet of fundamentals and technical levels, keeping day traders on their toes.

AUD/USD

Fundamental Analysis

The Australian Dollar started Monday on the front foot, buoyed by a burst of risk appetite out of Asia. Japan’s Nikkei 225 index surged 5% after a weekend leadership shakeup, weakening the yen and sparking broader risk-on flows that lifted pro-cyclical currencies like the Aussie. Closer to home, traders are laser-focused on the Reserve Bank of Australia’s policy stance. With an RBA meeting hours away, Governor Michele Bullock has struck a cautious tone – inflation is “not running away” and policy is only “a little bit restrictive”, leaving open the possibility of no immediate rate cuts. In her own words, “Could be couple more rate cuts, could be not,” Bullock said last week, prompting markets to pare back dovish bets. This hawkish surprise has injected new life into AUD/USD, offsetting U.S. dollar softness from the Washington gridlock. Meanwhile, Australia’s data calendar is light, but a higher-than-expected China services PMI and steady commodity prices would add fuel to Aussie momentum. Overall, shifting risk sentiment and RBA restraint have given AUD/USD an energetic bid into the new week.

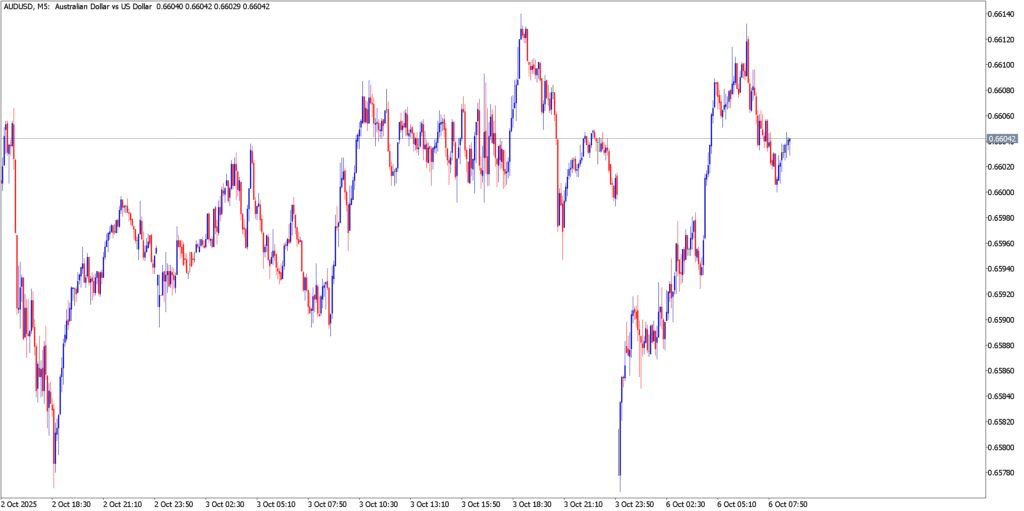

Technical Analysis

AUD/USD’s charts show a market regaining its footing after a correction. The pair is rebounding within a broader downtrend channel, riding a short-term bullish wave that has it trading back above its 50-period moving average. After finding support near the mid-0.65s, prices are now testing the first resistance around the 0.6660 region – roughly the top of the recent range. A decisive break above 0.6665 could unlock further upside, with bulls eyeing the key 0.6815 level that would nullify the prevailing downside scenario. On the downside, initial support lies at 0.6500, and a slide back below 0.6315 would confirm a bearish resurgence and expose fresh lows. Momentum indicators are turning up, but traders are wary of overbought signals creeping in. All told, the Aussie’s technical bias is tilting bullish in the near term, but it will take a high-voltage breakout (and steady risk appetite) to fully reverse the longer-term downtrend.

EUR/USD

Fundamental Analysis

The Euro is riding a policy divergence tailwind even as mixed data tempers its ascent. With the Federal Reserve all but locked into an October rate cut (futures imply a 97% chance of a 25 bp cut) and openly debating the need for further easing, the dollar’s yield appeal has eroded. In contrast, European Central Bank officials are sounding steadfast. On Friday, the ECB’s Pierre Wunsch declared policy “perfectly calibrated” to tame inflation, a hawkish signal that boosted the euro. The ECB is broadly seen as done cutting rates for now, underscored by swaps putting only a 1% chance on an October cut. This central bank gap – Fed easing vs. ECB on hold – has helped EUR/USD stay bid on dips. However, Eurozone fundamentals present a mixed picture. Euro area producer prices plunged more than expected (−0.6% YoY), highlighting disinflation that could eventually revive dovish voices in Frankfurt. And sentiment remains fragile: a surprise drop in the Sentix index last week showed investor morale sagging. For now, though, U.S. political drama is overshadowing Europe’s soft patches. Ongoing U.S. shutdown angst and Fed Chair Powell’s upcoming remarks could whipsaw the pair, but the euro’s relative macro resilience – helped by easing energy costs and steady PMI figures – gives it a fighting chance to extend gains if risk sentiment cooperates.

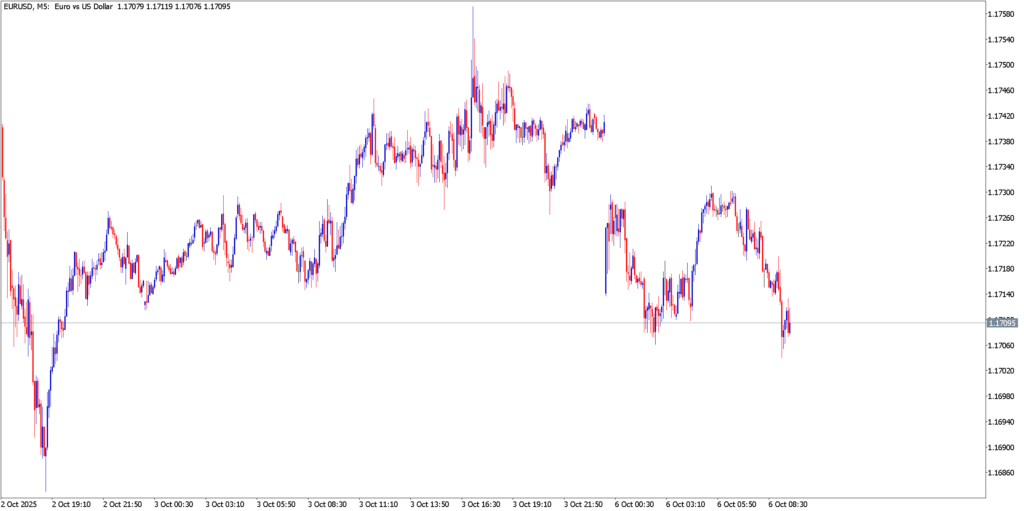

Technical Analysis

EUR/USD enters the week hesitating at major chart hurdles even as its medium-term uptrend remains intact. After a steady climb in late September, the pair stalled just below 1.1750, with intraday charts showing a pullback amid overbought signals. In fact, momentum indicators like RSI have flashed bearish divergence, hinting that euro bulls might be running out of steam in the short term. The pair has slipped under its 50-period moving average on the hourly timeframe, putting immediate downward pressure on prices. Key support is seen around 1.1680–1.1700 – a region of prior lows and a rising trendline – and euro buyers need to defend this zone to avoid a deeper correction. If that floor holds, sentiment could quickly flip back to bullish. A push above last week’s peak near 1.1755 would refocus attention on 1.1800, a psychological level and the upper bound of recent forecasts. Notably, analysts see a softer dollar possibly dragging EUR/USD up to 1.1800–1.1820 in the near term. Clearing 1.1800 decisively would mark a fresh 9-month high and expose the next target in the mid-1.18s. For now, trend fatigue warrants caution – the euro’s tone is bullish but not euphoric, and traders may wait for either a breakout above 1.18 or a dip to buy on weakness. Keep an eye on U.S. news flow, as any risk-off wave or surprisingly strong dollar data could quickly send EUR/USD back on the defensive.

NZD/USD

Fundamental Analysis

The New Zealand Dollar is attempting a comeback, fueled by upbeat domestic signals and a broadly softer greenback. Early Monday, NZD/USD turned early losses into gains as a short-term bullish wave took hold. Underpinning the kiwi is a dose of business optimism at home – the NZIER’s closely watched Quarterly Survey of Business Opinion showed net confidence holding at +22% in Q3, unchanged from the previous quarter’s improvement. This sustained optimism (the highest in years) suggests firms see glimmers of recovery ahead, even as the global outlook wobbles. That said, the Kiwi’s upside is crimped by its central bank’s dovish trajectory. The Reserve Bank of New Zealand has slashed rates by a whopping 225 bps since late 2024 to revive growth, and it has signaled at least one more cut is likely in 2025. Traders are thus wary that any NZD rally could invite jawboning or easing from the RBNZ if financial conditions tighten undesirably. Elsewhere, China’s Golden Week holidays are wrapping up – any rebound in Chinese market sentiment or dairy prices (a key NZ export) would bolster the kiwi’s fundamental case. In the U.S., the same Fed-versus-shutdown narrative applies: lingering U.S. fiscal risks and the prospect of Fed rate cuts have taken some wind out of the USD’s sails, indirectly supporting NZD/USD. However, if Fed officials double down on hawkish messaging or global stocks sag, risk-sensitive NZD could quickly retreat. For now, though, the kiwi is showing some spark, balancing local resilience against external uncertainty.

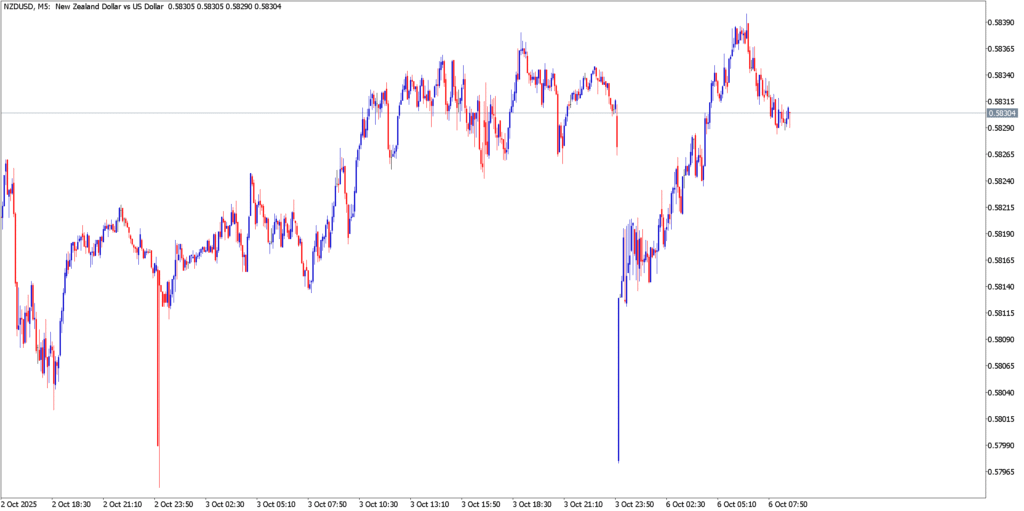

Technical Analysis

NZD/USD’s chart posture reflects a tentative rebound within a larger downtrend. After ending last week on a soft note near 0.5825, the pair is attempting a bullish correction. Initial upside momentum is targeting the 0.5895 resistance area – a level corresponding to recent swing highs. This zone is the neckline of a minor double-bottom on short-term charts, and bulls need to clear 0.5895 to extend the recovery. A breakout above 0.5900 would likely encounter additional supply around 0.6035, which technicians view as the barrier that separates this rebound from a true trend reversal. Notably, a strong rally beyond 0.6035 would cancel the current downtrend and signal a larger bullish shift, with scope toward 0.6200+ in the coming weeks. On the flip side, support is firming up at 0.5725 – a level that if breached could reignite bearish momentum. Below 0.5725, the September lows and the lower bound of the descending channel come into play, and sellers could aim for the 0.55 handle (the forecasted downside target) on an extended slide. Trend indicators still show NZD/USD under downward pressure (the pair remains below long-term moving averages, and the dominant trend channel points lower), so bulls must tread carefully. In summary, the kiwi’s short-term bounce has legs, but it will take a decisive push above resistance to break the shackles of its broader downtrend. Traders should watch for any momentum faltering near 0.5900 as a cue that the bears are regrouping, while a daily close above 0.6000 would suggest the tables have turned in favor of kiwi strength.