The FX arena opens under extreme tension Thursday. A US government shutdown and blockbuster data have sent shockwaves through global markets, and traders are bracing for sudden reversals and volatility spikes. Looming events from Fed speeches and factory orders to Eurozone inflation prints and China’s Golden Week. The mood is charged: with a Fed readying rate cuts and the ECB & RBA holding fire, currency traders are on edge and often stunned by each surprise twist in this drama.

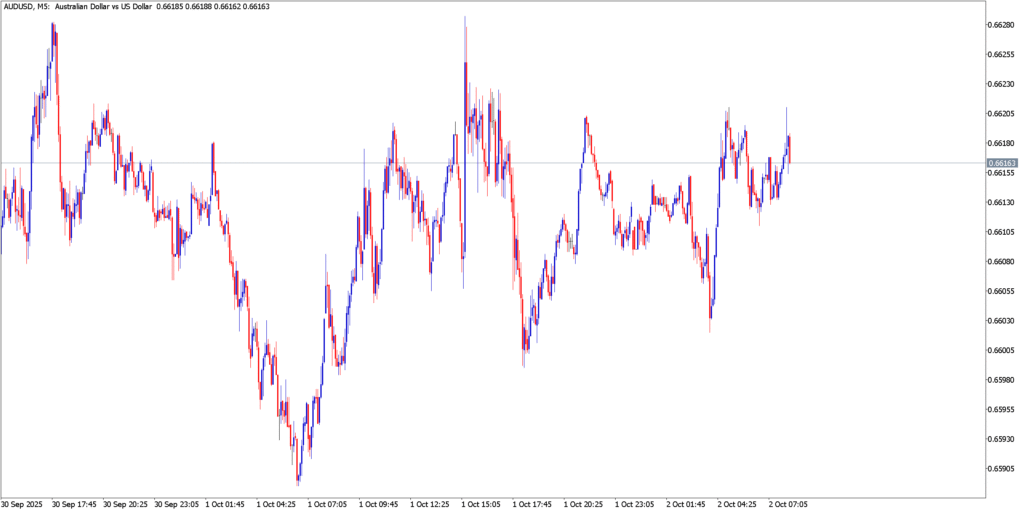

AUD/USD

Fundamental Analysis

The Australian dollar (AUD) is swinging wildly on mixed fundamentals. Chinese September PMIs showed a rebound in orders but exposed margin squeeze fears as companies cut jobs amid rising costs. That haunted AUD bears: gains from new orders were pared by fears of weaker demand. Domestically, the Reserve Bank of Australia shocked markets by holding its cash rate at 3.60%, warning that inflation was stickier than expected. This hawkish pivot (at odds with a Fed tilt) has traders buzzing. Aussie bonds sold off and AUD jumped to the mid-$0.66s after the decision. Meanwhile, renewed US-China trade tensions and Beijing’s stimulus plans add to the drama, making the AUD a high-beta play. Commodity prices (gold, oil) and upcoming Aussie data (like trade balances) will add fuel. In short, risk-on/risk-off flows are snarling with China’s outlook and RBA caution, leaving fundamental traders breathless.

Technical Analysis

On the charts, AUD/USD just broke out above its recent congestion. It has held above 0.6600 (a key floor) for two days, carving a bullish pennant on the daily timeframe. A close above the near-term ceiling around 0.6640 could open the door toward 0.6700 next. Conversely, failure back below 0.6580 would threaten a slide toward 0.6520–0.6500 support. The RSI is ramping up out of the 50–60 range (bullish), and recent candlesticks hint at a fresh uptrend. Traders will watch 0.6650 as resistance and 0.6540 as a line in the sand – a decisive move either way could trigger sudden reversals.

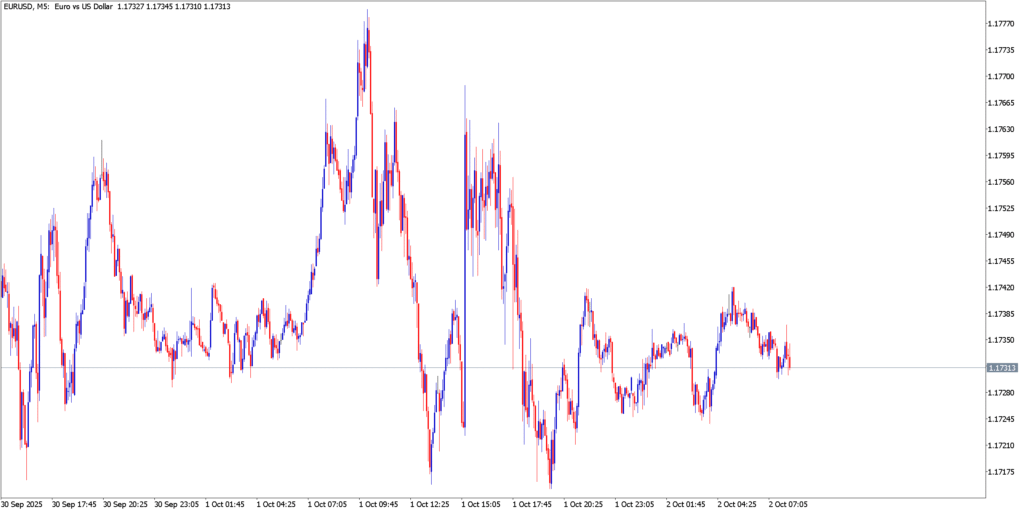

EUR/USD

Fundamental Analysis

The euro is on a charge as ECB and Fed policies diverge sharply. Euro-zone inflation surprised modestly to the upside – Sept CPI rose to 2.2% from 2.0% in August, with core steady at 2.3%. Christine Lagarde played down the uptick as transitory, implying no near-term easing. Markets now see ECB cuts as all but dead (only ~10% chance further cuts this year) while Fed cuts are fully priced in. Put simply, a dovish Fed vs. steady ECB scenario is buoying EUR. Euro bulls also got a lift from slightly better Euro-zone data (PMI revised up, robust employment). In sum, a flash of euro strength amid relative USD weakness — traders cite a “central bank showdown” narrative that has the greenback reeling.

Technical Analysis

The daily EUR/USD chart shows the pair stuck in a tight range. It’s coiling just above the 1.1700 support zone (four sessions running) and fighting the 1.1750 resistance. The 50-day SMA sits near 1.1650, acting as firm support. RSI sits flat around 50 (neutral), signaling indecision. If EUR can break 1.1740 decisively, chartists say the next targets are 1.1800 and last year’s peak near 1.1920. On the flip side, slipping below 1.1700 would quickly put 1.1650 – and even the 100-day SMA (~1.161) – in play. In other words, EUR/USD is poised for a big move: bulls need a breakout above 1.1750 to spark a leg up, while bears eye a drop back through the low-1.16s if support fails.

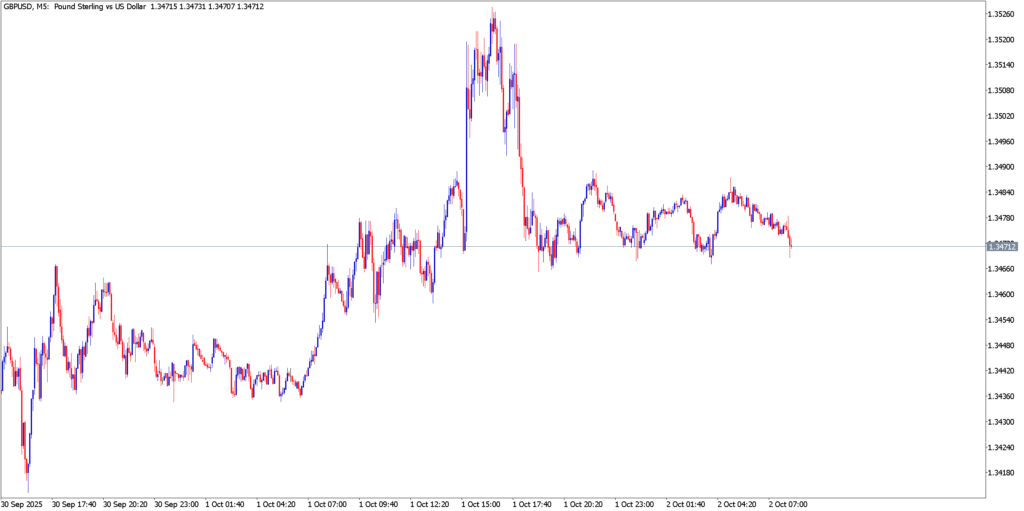

GBP/USD

Fundamental Analysis

Cable is riding a wave of twin shocks. In the UK, GDP outperformed – Q2 expanded 0.3% (fastest in G7 H1), though growth is slowing ahead and inflation is stuck near 4%. The BoE’s tone has been cautiously hawkish: policymakers warned of “higher-for-longer” inflation, and even dovish voters held rates at 4% last meeting. BoE officials (Mann, Lombardelli) stressed patience, which ironically has buoyed GBP by dashing near-term rate cut hopes. Across the Atlantic, chaos reigns: a US shutdown went into effect, core job data (ADP: -32K) was unexpectedly dire, and the official jobs report was pulled. That has smashed the dollar and sent Fed cut odds to 100% for October. The result: GBP/USD gained sharply. The pound is riding BoE hawkishness against a tormented USD – traders say this “central bank tug-of-war” has left both traders and analysts stunned by Sterling’s resilience.

Technical Analysis

GBP/USD is trading near its highest levels in over a week, around 1.3480. The pair has rallied five days straight, forming a bullish channel. Immediate resistance looms near 1.3500 (a psychological barrier). If cable blasts through 1.3500, it could sprint toward 1.3600. On the downside, the first support is around 1.3420 (200-hour MA), then 1.3350. Current momentum indicators (RSI in upper-60s) suggest short-term overbought, but the trend is sharply up. A candle close below 1.3420 would hint at profit-taking, but until then the chart screams “buy-on-dips”. In short, GBP/USD has opened the door for more upside and remains in an uptrend channel – any pullback will likely find support around mid-1.34 levels.

Market Outlook

Global currency markets are in shock, and extreme caution is warranted. A Fed pivot toward rate cuts is fueling broad USD weakness, while regional central banks (ECB, BoE, RBA) coolly hold fire, giving the euro, pound and aussie extra oomph. Traders should watch for catalysts that could trigger another panic swing: US factory and durable goods orders (Oct 2), US nonfarm payrolls later this week (when resumed), and looming speeches by Fed and ECB officials. The overnight session also brings Japan’s unemployment, and Europe has Eurozone unemployment data on tap. Any surprise – a hotter US report, a dovish Fed hint, a further China policy shock – could spark a sudden reversal or yen-driven safety surge. In this fevered climate, support and resistance levels identified above are crucial pivots. Strap in: currencies may remain volatile as crosscurrents of economic data, central bank dramas, and political turbulence collide, and traders around the globe prepare for the next explosive move