A good profit factor in trading typically ranges from 1.5 to 2.0 or higher, indicating a profitable strategy where gross profits significantly exceed losses. Traders use it to measure trading system efficiency, evaluate risk-adjusted performance, and compare strategies across forex, crypto, and intraday markets.

Key Takeaways

- A good profit factor typically ranges from 1.5 to 2.0 or higher, signaling a profitable trading strategy.

- Profit factor measures the ratio of gross profits to gross losses, helping evaluate trading system efficiency.

- It varies across markets and trading styles, including forex, crypto, and intraday trading.

- A higher profit factor does not guarantee zero risk; proper risk management is essential.

- Traders can improve profit factor through better trade management, optimizing entries, and controlling losses.

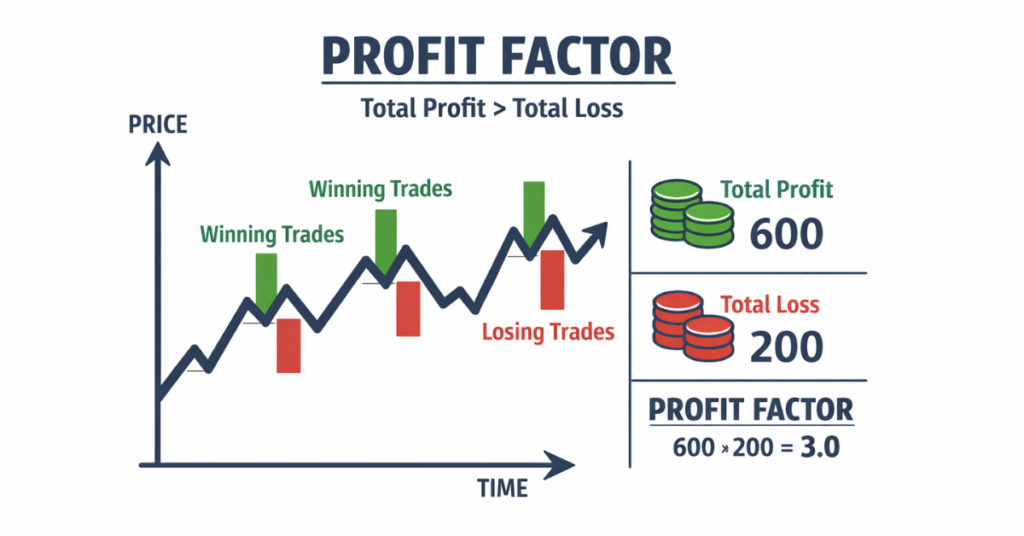

What is Profit Factor in Trading?

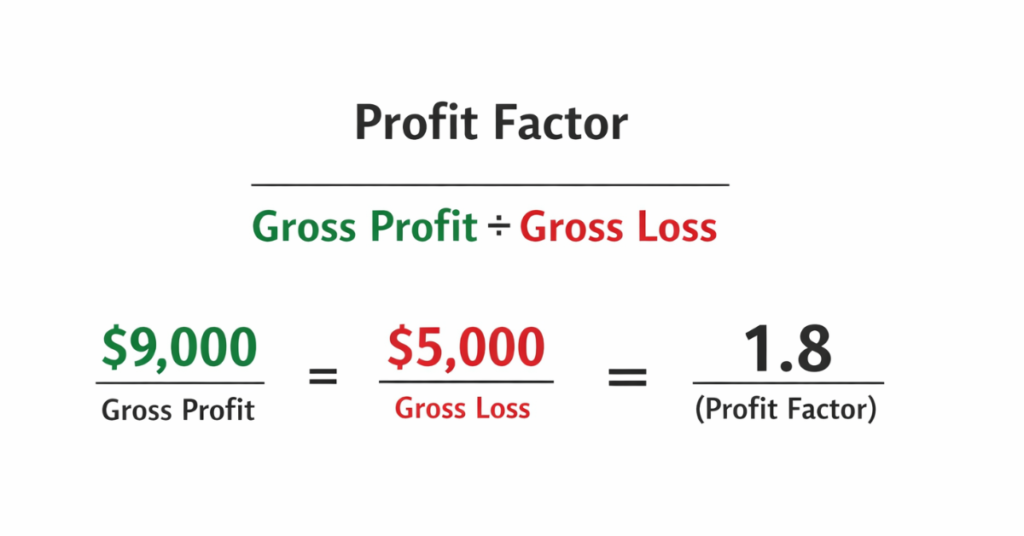

Profit factor (PF) is an important metric used by traders to evaluate the performance of a trading strategy. It’s calculated as the ratio of gross profits to gross losses, showing how much profit is generated for every unit of loss. A higher PF indicates a more efficient and potentially more profitable trading system.

Profit Factor Formula:

Profit Factor = Gross Profit ÷ Gross Loss

What is a Good Profit Factor?

A good profit factor indicates that a trading strategy generates more profits than losses and is generally considered a reliable measure of trading efficiency. While the exact benchmark varies depending on trading style, market, and risk tolerance, most professional traders consider a PF of 1.5 or higher as a solid indicator of profitability.

- 1.5 – 2.0: Indicates a good, balanced strategy where profits consistently exceed losses.

- Above 2.0: Suggests a highly efficient strategy with strong risk-adjusted performance.

- Below 1.5: May indicate underperforming or risky trading systems that require improvement.

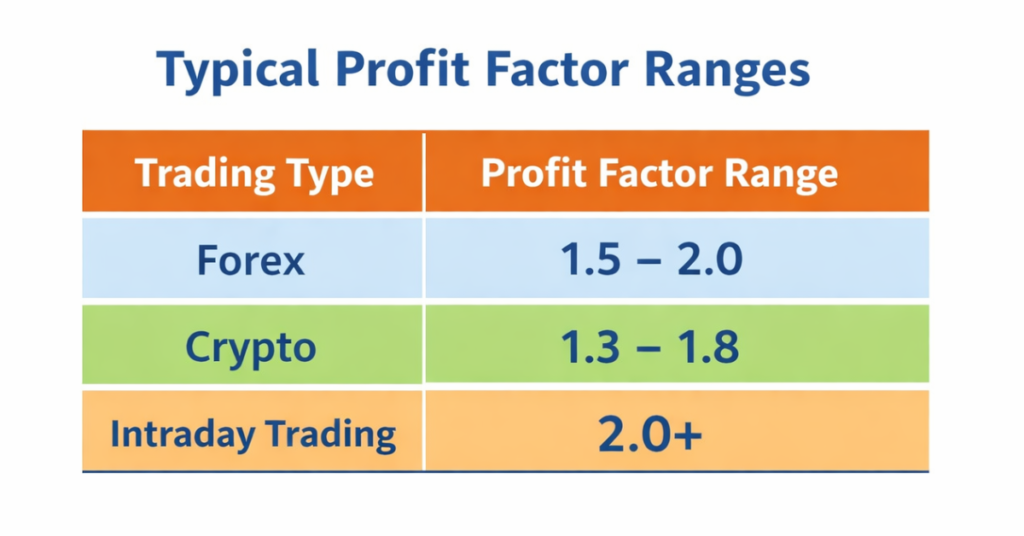

Profit factor can vary based on the type of market:

- Forex Trading: A PF of 1.5–2.0 is generally acceptable for medium-risk strategies.

- Crypto Trading: Volatility can affect PF, so slightly lower values may still be considered good.

- Intraday Trading: Higher PF values above 2.0 are preferable due to frequent small trades.

A good profit factor is also context-dependent. For instance, a strategy with a PF of 1.8 but extreme drawdowns may be less attractive than a 1.6 PF strategy with lower risk exposure. Hence, PF should always be analyzed in conjunction with other performance metrics like risk-reward ratio, win rate, and volatility.

5 Factors That Affect Profit Factor

Profit factor is influenced by multiple aspects of a trading strategy and market conditions. Understanding these 5 factors helps traders interpret PF correctly and identify areas for improvement:

Trade Size and Frequency

Larger or more frequent trades can increase gross profits but may also raise gross losses if not managed properly.

High-frequency strategies require careful risk management to maintain a strong PF.

Risk Management

Using proper stop-loss levels, position sizing, and diversification directly impacts PF. Poor risk control can drastically lower profit factor even for strategies with high win rates.

Market Volatility

Highly volatile markets, like crypto, can cause large swings in profits and losses. This can either inflate PF temporarily or reduce its reliability if volatility is not managed.

Trading Strategy Type

Trend-following strategies often produce stable PF over time, while scalping or high-risk strategies may show fluctuating PF.

Intraday vs long-term strategies also affect PF benchmarks.

Execution and Costs

Spreads, commissions, swap fees, and trade slippage reduce gross profits. Platforms offering low spreads and no commissions, like Defcofx, can help improve PF by minimizing costs.

Profit Factor Across Different Markets

Profit factor benchmarks vary depending on the market and trading style. Understanding these differences helps traders set realistic expectations and evaluate strategies more accurately.

1. Forex Trading

In forex markets, a good profit factor typically ranges from 1.5 to 2.0 for medium-risk strategies. Stable currency pairs often allow consistent gains, making PF a reliable metric for evaluating strategy efficiency.

2. Cryptocurrency Trading

Crypto markets are highly volatile, which can affect PF values. Here, a PF of 1.3–1.8 may still be considered good due to frequent price swings and higher risk exposure. Traders must factor in volatility when interpreting PF in crypto.

3. Intraday / Day Trading

For intraday strategies, which involve numerous small trades per day, a PF of 2.0 or higher is generally preferable. This ensures that frequent trades cumulatively generate more profits than losses despite transaction costs.

Comparison Table: Typical Profit Factor Benchmarks Across Markets

| Market Type | Good PF Range | Notes |

| Forex | 1.5 – 2.0 | Stable medium-risk strategies perform well |

| Cryptocurrency | 1.3 – 1.8 | Adjust for volatility and risk exposure |

| Intraday Trading | 2.0+ | High PF needed due to frequent trades |

Platforms with low spreads and fast execution, such as Defcofx, can help maintain or improve PF by reducing costs and optimizing trade efficiency.

Open a Live Trading AccountProfit Factor vs Other Trading Metrics

While profit factor is a critical measure of trading performance, it should not be viewed in isolation. Comparing PF with other metrics provides a fuller picture of a strategy’s effectiveness.

Profit Factor vs Risk-Reward Ratio

PF measures overall profitability, while the risk-reward ratio focuses on the expected gain per trade relative to loss.

A high PF combined with a favorable risk-reward ratio indicates both consistent profits and efficient trade management.

Profit Factor vs Win Rate

Win rate shows the percentage of profitable trades, but a high win rate does not guarantee a high PF.

PF accounts for the size of wins versus losses, providing a more accurate measure of strategy performance.

Profit Factor vs Sharpe Ratio

The Sharpe ratio evaluates risk-adjusted returns, while PF highlights the profit-to-loss efficiency.

Combining PF with Sharpe ratio helps traders identify strategies that are both profitable and stable under market volatility.

How to Improve Your Profit Factor

Improving profit factor requires a combination of strategy refinement, risk management, and trade execution optimization. Here are key steps traders can take:

1. Optimize Trade Entries and Exits: Enter trades with high-probability setups and exit at logical points to maximize profits and minimize losses.

2. Manage Risk Effectively: Use proper stop-loss levels, position sizing, and diversification to reduce losses that negatively impact PF.

3. Reduce Trading Costs: High spreads, commissions, or swap fees can lower PF. Platforms like Defcofx, with low spreads starting at 0.3 pips and no commission, help maintain a higher profit factor.

4. Analyze and Adjust Strategy: Regularly review trading performance and adjust strategies based on historical PF trends. Focus on strategies with consistent positive PF over time rather than occasional high gains.

5. Minimize Emotional Trading: Avoid impulsive trades that can result in larger losses, which negatively affect PF. Consistency and discipline are key.

5 Common Mistakes Traders Make with Profit Factor

Even experienced traders often misinterpret or misuse the profit factor (PF), which can lead to poor trading decisions and unexpected losses.

1. Relying Solely on Profit Factor

One of the most frequent mistakes is using profit factor as the only measure of a strategy’s performance. While PF shows the ratio of gross profits to gross losses, it does not account for drawdowns, market volatility, trade frequency, or overall risk exposure. A strategy can display a high PF yet still suffer large losses if these factors are ignored, creating a false sense of security.

2. Ignoring Proper Risk Management

Another common error is neglecting risk management. Even strategies with strong profit factors can become dangerous without proper position sizing, stop-loss placement, and diversification. Traders who focus only on PF may overlook these critical elements, increasing their vulnerability during unfavorable market conditions.

3. Over-Optimizing Past Performance

Over-optimization—also known as curve-fitting—is a major issue. Some traders fine-tune strategies to maximize PF using historical data. While this may produce impressive backtest results, such strategies often fail in live markets because they are too closely adapted to past conditions and lack flexibility.

4. Neglecting Trading Costs

Trading costs are often underestimated. Spreads, commissions, swap fees, and slippage can significantly reduce the effective profit factor. A strategy that looks highly profitable on paper may perform far worse in real trading once these costs are included. Platforms like Defcofx, which offer low spreads starting from 0.3 pips and no commission, can help traders preserve a higher PF by minimizing these hidden expenses.

Final Thoughts on What is a Good Profit Factor in Trading

Profit factor is one of the most important metrics for evaluating the efficiency and profitability of a trading strategy. A good profit factor, typically 1.5 or higher, indicates that a strategy generates significantly more profits than losses and can serve as a reliable benchmark across forex, crypto, and intraday trading.

However, it should never be considered in isolation. Combining PF with other metrics like risk-reward ratio, win rate, and drawdown analysis provides a complete picture of a strategy’s effectiveness.

Traders should also consider factors that influence PF, such as trade size, frequency, market volatility, execution costs, and risk management practices. Misinterpreting PF or over-relying on it without these considerations can lead to poor trading outcomes.

Platforms with low spreads, no commission, and fast execution, like Defcofx, can support traders in maintaining a higher profit factor while minimizing costs.

Open a Live Trading AccountFAQs

Profit factor is a ratio that measures a trading strategy’s efficiency by comparing gross profits to gross losses. A higher PF indicates a more profitable and well-balanced strategy.

Yes, a PF of 1.5 or higher is generally considered good. It shows that the strategy generates 1.5 times more profits than losses, indicating reliable performance across various markets.

Improving PF involves optimizing trade entries and exits, implementing strong risk management, reducing trading costs, and reviewing strategy performance regularly. Using platforms with low spreads and no commission, like Defcofx, can also help maintain higher PF.

Yes. PF alone does not account for drawdowns, market volatility, or trade frequency. Relying solely on PF can lead to overconfidence and poor trading decisions. Always combine PF with other metrics like risk-reward ratio and win rate.

Yes. PF benchmarks differ across markets. For example, forex strategies often target 1.5–2.0, crypto strategies may accept slightly lower PF due to volatility, and intraday strategies generally require a PF above 2.0 due to frequent trades.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.