An MT5 indicator for volatility index measures market volatility on MetaTrader 5, highlighting price expansion and contraction to signal breakouts, reversals, and trend strength. Traders use it to time entries, set stops, and filter trades across forex, indices, and crypto for better risk management.

Key Takeaways

- An MT5 indicator for volatility index visualizes market volatility (expansion vs contraction) so traders can anticipate breakouts or exhaustion points without staring at raw price action.

- Volatility signals work best when combined with trend structure and confirmation tools don’t rely on volatility alone; pair with ATR, moving averages, or price action.

- Custom MT5 volatility indicators often add alerts, signal arrows, and multi-timeframe views always backtest any indicator on historical data and demo accounts before using it live.

- Installing and running a volatility indicator on MT5 is straightforward: place the .ex5/.mq5 file in the Indicators folder, restart MT5, and attach the indicator to your chart; common display issues are usually folder or compilation related.

What Is an MT5 Indicator for the Volatility Index?

An MetaTrader 5 (MT5) indicator for the volatility index is a technical tool designed to measure how aggressively price is moving within a market. Instead of tracking direction, it focuses on the intensity of price fluctuations, helping traders understand when the market is stable, heating up, or preparing for a breakout. These indicators are not the same as the traditional VIX but serve a similar purpose within the MT5 environment, offering volatility readings for forex, indices, commodities, and synthetic markets.

Volatility indicators on MT5 work by analyzing standard deviation, price ranges, momentum pressure, or volatility-based mathematical models. This allows traders to identify expansion phases (strong trends or breakouts) and contraction phases (sideways consolidation likely to precede major moves).

Many traders use these tools because MT5 does not come with a built-in “VIX-style” indicator. Instead, custom volatility index indicators replicate market volatility behavior using advanced calculations. Whether you trade forex, synthetic indices, or global indices, these tools offer precise readings that help avoid false entries and improve timing in fast-moving conditions.

How Volatility Index Indicators Work on MT5

Volatility index indicators on MT5 measure how much and how quickly price moves over a given period. Instead of predicting market direction, they quantify market energy whether price is calm, gradually building pressure, or experiencing rapid expansion. MT5 reads this through mathematical models such as standard deviation, average true range (ATR), range expansion, or smoothed volatility algorithms. These calculations reveal when markets are silent, unstable, or primed for explosive moves.

The Core Logic Behind Volatility Calculation

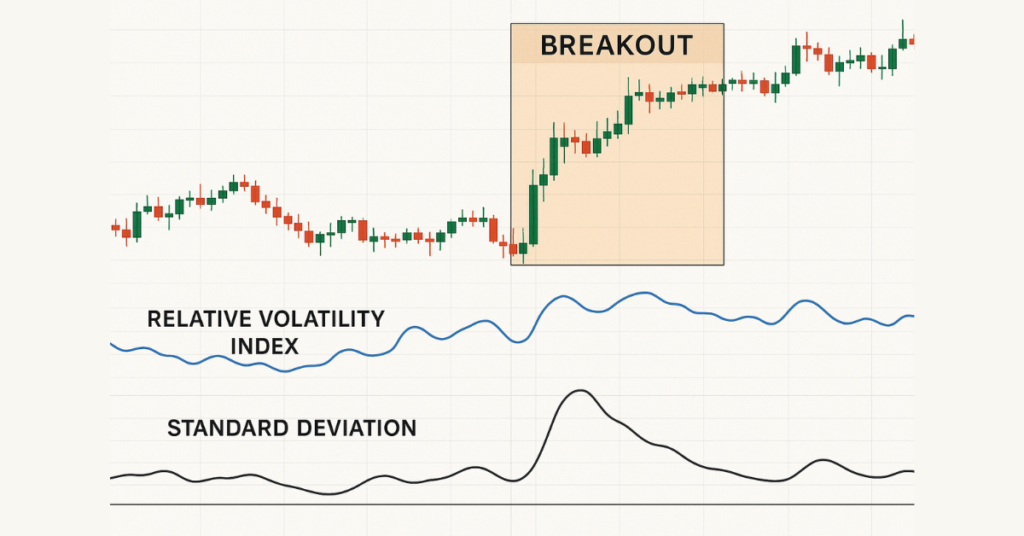

Most MT5 volatility index tools rely on price range analysis. When candles widen and highs/lows expand rapidly, volatility rises. When price compresses into tight ranges, volatility drops. This behavior often signals upcoming breakouts because markets alternate between contraction and expansion. MT5 indicators translate these changes into lines, histograms, or bands, making volatility visible at a glance.

Volatility Index vs VIX on MT5

The traditional VIX tracks expected volatility in the S&P 500 using options pricing, something MT5 cannot replicate natively. Instead, MT5 volatility index indicators use price-derived volatility measurements, offering a “VIX-style” reading for forex, indices, commodities, and synthetic assets. While not identical to the real VIX, these indicators effectively show rising fear, momentum surges, and risk shifts within any market you trade.

Types of MT5 Volatility Index Indicators

Volatility index indicators on MT5 come in several forms, each designed to highlight different aspects of market volatility. Understanding the type of indicator helps traders choose the best tool for their strategy, whether for scalping, intraday trading, or swing setups.

1. Relative Volatility Index (RVI)

The Relative Volatility Index measures the directionally adjusted volatility of an asset. Unlike the traditional RSI, which measures momentum, RVI focuses on whether volatility is increasing during upward or downward moves. Traders use it to spot trend strength, overextended moves, and potential reversals in fast-moving volatility indices.

2. Standard Deviation-Based Indicators

These indicators track the deviation of price from its average over a specific period. A high standard deviation signals strong volatility (often a breakout), while a low deviation indicates consolidation. MT5 indicators that use standard deviation are excellent for spotting price compression before explosive moves.

3. Custom MT5 Volatility Indicators

Custom indicators combine multiple calculations like ATR, momentum oscillators, and trend filters to provide precise signals for trading volatility indices. Popular options include Smart Volatility Index, Volatility Pro, and other community-developed MT5 scripts. Features often include signal arrows, alert systems, and multi-timeframe analysis to give traders a complete view of volatility dynamics.

4. Trend + Volatility Hybrids

Some MT5 indicators combine trend detection with volatility measurement. These hybrid tools help traders confirm whether a trend is supported by strong volatility or if a move is likely to fail due to low momentum. This approach reduces false signals and increases the reliability of breakout entries.

Choosing the Right Indicator

The best choice depends on your trading style:

- Scalpers: prefer RVI or fast ATR-based indicators on M1–M5 charts.

- Day Traders: benefit from standard deviation or hybrid indicators on M15–H1 charts.

- Swing/Position Traders: custom multi-timeframe indicators for H4–D1 charts provide broader market context.

Best MT5 Indicators for Volatility Index

Selecting the right MT5 volatility index indicator is crucial for accurate trading signals. The best indicators combine volatility measurement, trend confirmation, and alert features to help traders respond quickly to rapid market movements.

1. Relative Volatility Index (RVI)

RVI remains one of the most reliable indicators for measuring volatility relative to price direction. It identifies whether volatility is stronger during upward or downward moves, helping traders spot overbought or oversold conditions in fast-moving markets.

2. Standard Deviation Indicators

Indicators that calculate price deviation from the mean are highly effective for detecting periods of consolidation and breakout potential. They allow traders to anticipate sudden price expansions, which are common in volatility indices like VIX 75 or synthetic indices.

3. Custom Volatility Indicators

Custom MT5 indicators such as Volatility Pro or Smart Volatility Index integrate multiple volatility and momentum measurements. Features often include:

- Multi-timeframe analysis

- Signal arrows and alerts

- Trend confirmation

- Easy visualization of market pressure

These indicators are especially useful for traders focusing on scalping, intraday, or swing strategies.

4. Hybrid Trend + Volatility Indicators

Hybrid indicators combine trend detection (MA, MACD) with volatility calculations (ATR, range expansion). They help confirm if a breakout is supported by volatility or if the trend may fail due to low momentum.

- Asset type (forex, indices, crypto)

- Your preferred timeframe

- Indicator customization and alert features

- Backtesting results on historical data

Download, Install, and Activate MT5 Volatility Index Indicators

Downloading and setting up an MT5 indicator for the volatility index is a simple process when done correctly. Most volatility indicators are provided as compiled .ex5 files or editable .mq5 scripts and are compatible with all modern MetaTrader 5 platforms.

Downloading the Indicator

Volatility index indicators for MT5 are commonly available through trusted trading communities, professional developers, or broker-supported resource pages. These indicators are typically offered as free downloads for basic volatility tracking or premium versions with advanced features such as alerts, signal arrows, and multi-timeframe analysis.

When downloading, ensure the indicator is designed specifically for MT5, not MT4, and supports the asset class you trade, whether forex, indices, synthetic indices, or crypto.

Here are verified download links and references you (or your users) can include in the article for MT5 volatility index–related indicators that traders can download and install:

Recommended MT5 Volatility Indicator Downloads

1. VIX Index Indicator (Free on MQL5.com)

A volatility index tool for MetaTrader 5 that visualizes a normalized volatility oscillator.

🔗 Download here: VIX Index on MQL5 Marketplace

Note: Visit this official MetaTrader Market page to download the indicator.

2. Smart Volatility Index MT5 on MQL5

A highly rated volatility indicator for MT5 users, useful across asset classes.

🔗 Download here: Smart Volatility Index MT5 on MQL5

This tool provides volatility readings similar to VIX behavior for stocks and other markets.

3. Volatility Indicator MT5 – Free Download Article

A downloadable volatility indicator package with real-time assessment of price movement intensity.

🔗 Reference/download link: Volatility Indicator MT5 Free Download (The Forex Geek)

This page includes a free download and installation guidance.

4. Synthetic Volatility Index Indicator (Community Source)

MT5 volatility oscillator for assessing market compression and breakout conditions.

🔗 Download link (from community resource): https://cdn.tradingfinder.com/file/2…tflab-v1-2.zip (from ForexFactory forum)

5. Relative Volatility Index MT5

A different style of volatility-based indicator available for download (may include alerts).

🔗 Download here: Relative Volatility Index Indicator MT5

This indicator visualizes volatility signals on your chart.

Download Safety Tips (for readers)

- Always only download indicators from trusted sources like official MetaQuotes/MQL5 pages, reputable indicator sites, or well-known trading forums.

- Avoid unknown or suspicious .zip files without clear author and version info.

- Scan files with antivirus software before installation.

Installing the Indicator on MT5

Once downloaded, open MetaTrader 5 and navigate to File → Open Data Folder → MQL5 → Indicators. Copy the downloaded volatility index indicator file into this folder. After placing the file correctly, restart MT5 so the platform can recognize the new indicator.

After restarting, locate the indicator in the Navigator panel under “Indicators.” Drag and drop it onto your preferred chart to activate it.

Activating and Configuring the Indicator

When the indicator is applied to a chart, a settings window will appear. Here, you can customize key parameters such as calculation period, alert triggers, color schemes, and display style. Adjusting these settings allows the volatility indicator to align with your trading strategy, whether you are scalping, day trading, or swing trading.

For best results, always test newly installed indicators on a demo account before using them in live trading. This helps confirm accuracy, responsiveness, and compatibility with your broker’s MT5 environment.

How to Use Volatility Index Indicators in Trading

Volatility index indicators on MT5 help traders understand market intensity, enabling better timing for entries, exits, and risk management. By analyzing expansions and contractions, traders can anticipate breakouts, reversals, or periods of low momentum.

Identifying Trend Strength Through Volatility

- When volatility increases during a trend, it confirms strong momentum.

- Low volatility in a trending market may indicate weakening momentum and potential reversal.

- Traders use these signals to adjust stop-loss levels or add to positions.

Detecting Reversals with Extreme Volatility Levels

- Extreme spikes in volatility often precede exhaustion points.

- Divergences between price and volatility readings can signal impending reversals.

- MT5 indicators provide visual cues like histograms, bands, or signal arrows for easier interpretation.

Using Volatility Indicators Across Markets

- Forex: Detects periods of high price swings for scalping or intraday trades.

- Indices: Spot breakout opportunities or trend exhaustion on VIX-style indices.

- Synthetic Indices & Crypto: MT5 volatility indicators help manage risk in 24/7 fast-moving markets.

Comparing MT5 Volatility Indicators vs Other Tools

Understanding how MT5 volatility indicators differ from other volatility tools can help traders choose the right method for their strategy. While MT5 indicators are tailored for real-time price analysis, tools like ATR or Bollinger Bands offer complementary insights.

MT5 Volatility Indicators vs ATR

- MT5 Volatility Indicators: Measure real-time market intensity, highlight breakouts, reversals, and trend strength.

- ATR (Average True Range): Measures average price movement over a period but does not indicate direction or breakout probability.

- Integration Tip: Many traders use both together for confirmation ATR for context, MT5 volatility indicator for actionable signals.

MT5 Volatility Indicators vs Bollinger Bands

- Bollinger Bands: Show price deviation from a moving average, giving a visual range but often lagging during fast volatility spikes.

- MT5 Indicators: Detects volatility changes instantly and can provide alert signals before price breaches typical bands.

- Trading Benefit: Combining Bollinger Bands with MT5 volatility indicators improves the timing of entries and exits, especially on synthetic indices or forex.

Why Traders Prefer MT5 Indicators

- High flexibility with multiple timeframes

- Real-time alerts for breakouts and reversals

- Customizable settings for scalping, intraday, or swing trades

- Seamless integration with MT5 platforms offered by brokers that support high leverage (up to 1:2000), low spreads (from 0.3 pips), and fast withdrawals

4 Common Mistakes Traders Make Using Volatility Indicators

Even the most advanced MT5 volatility indicators can lead to losses if misused. Understanding common errors helps traders avoid unnecessary risk and improve consistency.

1. Over-Reliance on Volatility Alone

- Volatility indicators show market intensity but not direction.

- Mistake: Entering trades solely based on high or low volatility without confirming trend or support/resistance.

2. Ignoring Market Structure

- Volatility spikes may coincide with false breakouts if overall trend context is ignored.

- Always analyze price patterns alongside volatility readings.

3. Using Low-Quality or Unverified Indicators

- Many custom MT5 scripts exist online; some are unreliable or lagging.

- Always backtest on demo accounts before live trading.

4. Not Adjusting for Timeframe

- Indicators behave differently on M1, M5, H1, or H4 charts.

- Mistake: Using a scalping indicator on a daily chart or vice versa.

Advanced Volatility-Based Trading Techniques

Advanced traders use MT5 volatility indicators to refine entries, manage risk, and optimize trade timing. These techniques go beyond simple readings of market expansion or contraction.

1. Multi-Timeframe Volatility Analysis

- Confirm volatility trends across two or more timeframes to avoid false breakouts.

- Example: M5 for entry timing, H1 for trend confirmation.

2. Stacking Volatility Indicators

- Combine multiple indicators (e.g., RVI + standard deviation + ATR) to improve signal reliability.

- Helps filter out noise and focus on high-probability setups.

3. Volatility Filters for Scalping and Intraday Trading

- Use real-time volatility spikes to enter or exit trades quickly.

- Example: Enter long trades when volatility rises above a defined threshold and the trend is confirmed.

4. Pairing with Risk Management

- Set stop-loss levels based on volatility readings rather than fixed pips.

- Position sizing should consider the indicator’s volatility signal, especially when trading with high leverage (up to 1:2000).

When to Consider a Broker for Volatility Trading Setup

Choosing the right broker like Defcofx is crucial for effective volatility index trading. High-speed execution, low spreads, and reliable MetaTrader 5 (MT5) support can make a significant difference when trading fast-moving instruments like VIX 75, Boom, or Crash indices.

Traders should prioritize brokers that offer high leverage options, such as up to 1:2000, which allows flexible position sizing and better capital efficiency. Low-cost trading conditions, including no commissions or swap fees and spreads starting from 0.3 pips, help preserve profits and reduce friction from frequent trades.

Global accessibility is another key factor. A broker with multi-country account support and multiple language options ensures you can trade from anywhere without limitations. Fast and reliable withdrawals are also essential; brokers like Defcofx process withdrawals within 4 business hours, including weekends, allowing traders to manage funds efficiently.

Final Thoughts on MT5 Indicator For Volatility Index

MT5 volatility index indicators are essential tools for traders seeking to measure market intensity, anticipate breakouts, and identify trend strength. By combining multiple types of indicators such as Relative Volatility Index, standard deviation, or custom scripts traders can enhance timing, reduce false signals, and adapt strategies across forex, indices, and synthetic markets.

Successful volatility trading also depends on the right trading environment. Brokers offering high leverage (up to 1:2000), low spreads from 0.3 pips, no commissions or swap fees, and fast withdrawals within 4 hours, like Defcofx, provide a cost-effective and efficient platform for implementing both basic and advanced volatility strategies.

Open a Live Trading AccountFAQs

The best indicator depends on your trading style. For scalping, the Relative Volatility Index (RVI) works well, while custom indicators like Volatility Pro or Smart Volatility Index are suitable for intraday and swing strategies.

No, MT5 does not include a native volatility index indicator. Traders must use custom indicators that replicate VIX-style behavior or calculate volatility using price-based algorithms.

Yes. MT5 volatility indicators work across multiple asset classes, including forex pairs, global indices, synthetic indices like VIX 75/100, and crypto, providing consistent volatility readings.

They are reliable when combined with proper trend analysis and risk management. Using multiple timeframes and confirming signals reduces false entries, making them highly effective for intraday strategies.

Download the .ex5 or .mq5 file from a trusted source, place it in the MT5 Indicators folder, restart MT5, and attach it to your chart. Always test on a demo account before trading live.