Forex markets roiled as NZD plunged on a dovish RBNZ cut, GBP climbed after hotter UK inflation, while traders eyed Fed minutes for USD direction.

Global FX sentiment is on edge as central bank surprises and sticky inflation dominate. New Zealand’s dollar skidded to fresh lows after the RBNZ cut its official cash rate to 3.00% and signalled more easing ahead. In Europe, British CPI unexpectedly rose to 3.8% YoY (above June’s 3.6%), keeping the pound firm. Meanwhile, traders await tonight’s FOMC minutes and upcoming data amid rising U.S. core inflation and growth concerns. The overall risk tone is cautious, balancing growth fears with inflation worries.

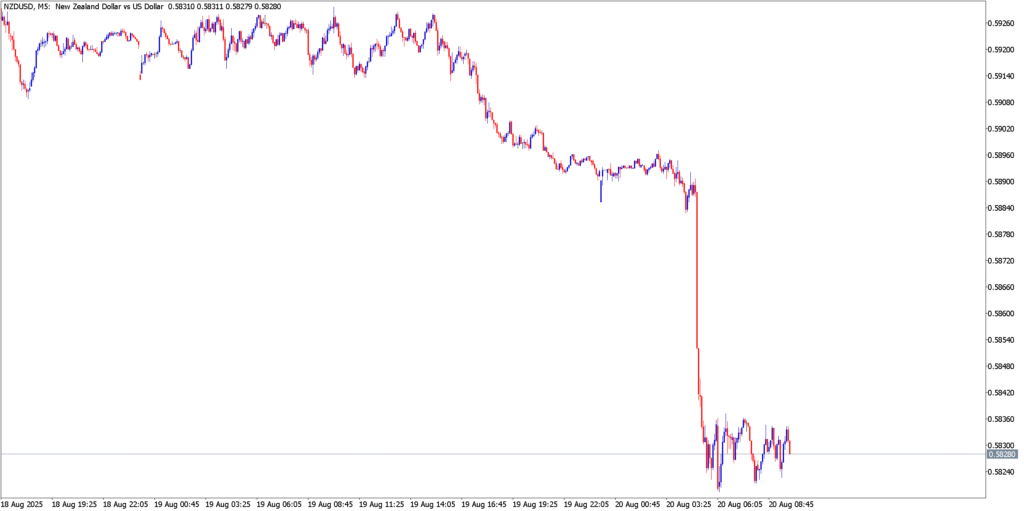

NZD/USD

Technicals in Focus

NZD/USD gapped sharply lower today, erasing recent gains and testing new lows around 0.5820. The M5 chart shows a clear bearish trend: NZD rallied to ~0.5910 earlier, but dovish RBNZ messaging drove it down to 0.5819 (a 4-month low). Key support stands at today’s low near 0.5810; resistance lies at the pivot zone 0.5845–0.5870. Momentum is firmly bearish: MACD is deeply negative, and Stochastic/RSI readings are in oversold territory, hinting at only shallow bounces ahead.

Trading Strategy

- Bullish: A bounce from the 0.5810–0.5830 area (today’s low) could be bought on early signs of recovery. Entry around 0.5840–0.5850 could target 0.5880 then 0.5900, with a stop loss below 0.5790.

- Bearish: If NZD/USD breaks decisively below 0.5810, consider shorting with targets at 0.5780 and 0.5750. Place a stop just above 0.5840 (or the high of the setup bar).

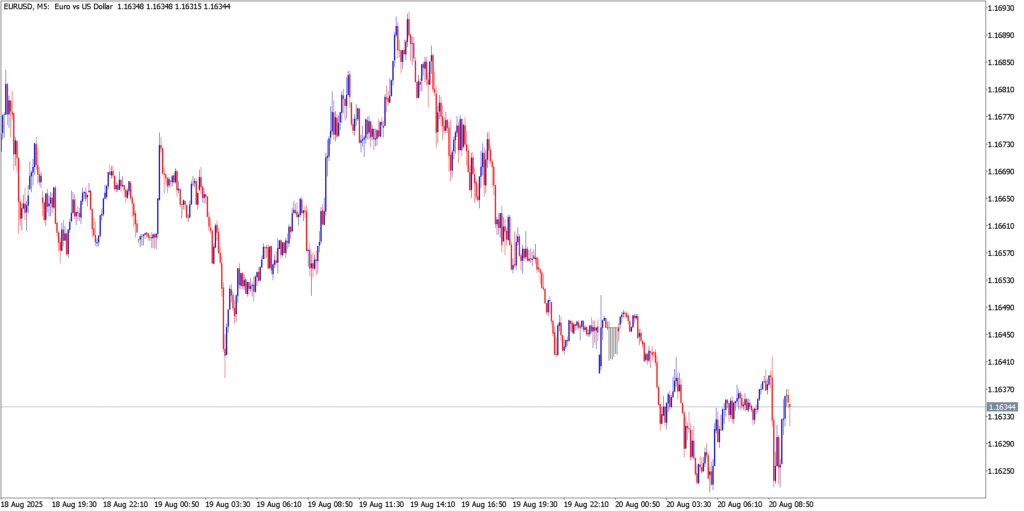

EUR/USD

Technicals in Focus

EUR/USD has drifted lower over the past day, now probing support near 1.1620. The M5 chart shows a gradual decline from ~1.1670, with only modest pullbacks. Immediate support is at the recent low ~1.1625, with resistance at 1.1650–1.1660 (today’s pivot and prior congestion) and then 1.1680. The indicators are bearish but showing some fatigue: MACD is below zero, and the Stochastic is oversold and beginning to turn higher, with RSI near 30. These signals suggest sellers may be exhausted and a short-term bounce could emerge.

Trading Strategy

- Bullish: Look for a recovery above 1.1645–1.1650. A sustained move above this zone could allow buys toward 1.1680 (near last swing highs) and 1.1700, with stops below 1.1620.

- Bearish: If EUR/USD fails again at 1.1650–1.1660 and breaks below 1.1620, that would open the path to 1.1590 and 1.1550. Set initial targets near those levels and use a stop above 1.1665 to control risk.

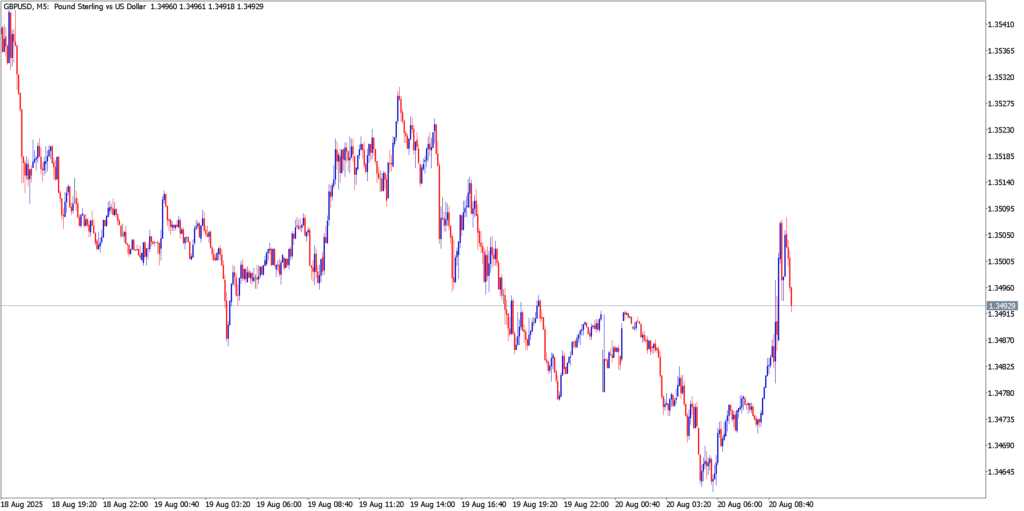

GBP/USD

Technicals in Focus

GBP/USD ticked higher early on Wednesday after surprisingly hot UK inflation, offsetting earlier weakness down to 1.3450. The pair rallied to 1.3510 and currently sits near 1.3495. Key support is around 1.3460–1.3470; resistance is at today’s high of 1.3515–1.3520 and then near last week’s peak around 1.3550. Technicals show a short-term bullish tilt: MACD just turned positive, RSI has risen from oversold, and the Stochastic has popped up from the oversold zone, signaling rising bullish momentum.

Trading Strategy

- Bullish: If GBP/USD climbs above 1.3520 and holds, look for further upside. Entry around 1.3525 targets 1.3550 and 1.3580. Use a stop near 1.3490 to limit downside.

- Bearish: Should the CPI-driven jump fade and price drop below 1.3470, shorts targeting 1.3440 and 1.3400 become attractive. Stop-loss can be placed just above 1.3490–1.3500.

Market Outlook

- USD: Investors are focused on tonight’s FOMC minutes (July 29–30 meeting) for clues on the Fed’s next moves. U.S. data (e.g. core inflation and retail sales) have been stronger than expected, fueling stagflation fears. A “higher-for-longer” Fed would buoy the dollar. Later in the week, Atlanta Fed’s GDPNow (Aug 20), weekly jobless claims and PPI could sway USD sentiment.

- GBP: July CPI came in hot at 3.8% (higher than June’s 3.6%), so markets now expect the BoE to tread carefully on cuts. GBP/USD closed largely unchanged after the data. Look ahead to Thursday’s BoE minutes and Friday’s flash PMIs; sticky inflation and tight labor data (services inflation at 5.0%) should keep the pound supported unless global risk appetite falters.

- NZD: New Zealand’s monetary policy event is done – the RBNZ cut 25bp to 3.00% today but signalled a dovish outlook. The NZD tumbled in response, and further losses could follow if global growth worries deepen. The next big data point is Q2 GDP (released Mon 25 Aug). On balance, weak Chinese data (PBOC held LPR at 3.00%) and a risk-averse market mood may keep NZD under pressure unless commodity prices rebound.

- EUR: Eurozone flash CPI figures (Germany, France, etc.) are due Wed; July HICP is expected around 2.0%. If inflation stays on target, the ECB will likely hold rates steady, leaving EUR/USD rangebound. The upcoming Jackson Hole symposium (Fri 22 Aug) and Thursday’s flash PMIs (EUR, UK, US) are the next big catalysts. Absent surprises, EUR/USD may trade in the 1.1600–1.1700 range until new data shifts sentiment.

In summary, USD moves will hinge on Fed communications and U.S. inflation/labor data, GBP on persistent inflation and UK PMIs, NZD on global risk sentiment and domestic growth figures, and EUR on ECB guidance and Eurozone inflation. Traders should watch for any shifts in central bank tone or surprise data releases to signal the next trend changes.