Global forex markets were whipsawed on Wednesday as a potent mix of political upheaval and central bank surprises unleashed rapid moves. The Euro plunged toward one-month lows under the weight of France’s government crisis, even as traders braced for a barrage of Fed and ECB speeches. Commodity currencies fared no better – the Australian Dollar buckled under risk-off flows and dour domestic data, while the New Zealand Dollar was shattered by a surprise jumbo rate cut, sending the Kiwi to multi-month lows. Safe-haven demand thrust the US Dollar higher across the board, setting the tone for a volatile session driven by fear and uncertainty.

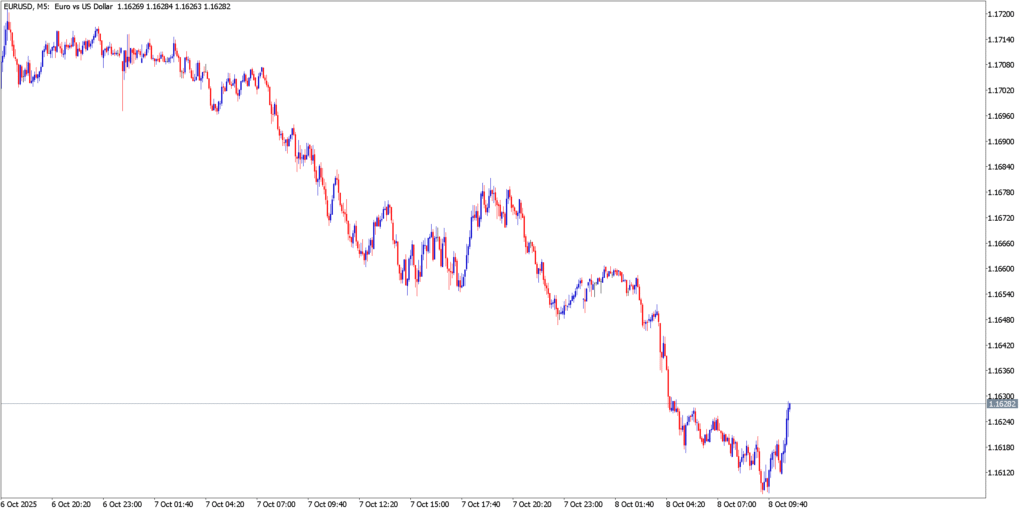

EUR/USD

Fundamental Analysis

The Euro slumped to its weakest level in a month against the surging US Dollar, falling under $1.17 and tagging lows near $1.1645. A deepening political and fiscal crisis in France has put the Euro on the defensive – the shock resignation of France’s new prime minister after just 27 days in office triggered calls for snap elections and rattled confidence in President Macron’s government. Traders fear France’s budget deficit (hovering around double the EU’s 3% limit) and a political vacuum in Europe’s second-largest economy could spur credit downgrades, lifting yields and undermining the euro further. This turmoil arrives just as the European Central Bank signals a crossroads: ECB President Christine Lagarde declared the “disinflationary process is over,” while other officials stressed weak growth and even floated the possibility of rate cuts ahead. In the US, the narrative of looming Fed rate cuts (with markets pricing a 94% chance of an October cut) has been drowned out by safe-haven flows into the dollar amid global political strain. With the U.S. government shutdown grinding into a second week and multiple Fed officials (Bowman, Bostic, Kashkari, Miran) speaking later in the day, traders remain glued to any policy clues. So far, hawkish remarks – such as Fed’s Schmid insisting inflation “remains too high” – have only reinforced the dollar’s momentum. Bottom line: Euro sentiment is bleak, battered by Europe’s internal stresses and an unforgiving market mood that favors the dollar’s safety.

Technical Analysis

EUR/USD’s 5-minute chart underscores a sharp bearish bias. The pair has been carving out lower highs and lower lows, accelerating into a downtrend that gained steam in late September. A steep sell-off drove the euro from the mid-$1.17s down to around $1.1650, where it tentatively found support at a one-month low. This 1.1645 area now forms a key intraday floor – the bears tested it as selling peaked, and a failure to crack it led to a brief consolidation. Any relief rallies have been shallow; attempts to recover above $1.1700 were swiftly faded, marked by long upper wicks on M5 candles as sellers pounce on upticks. Immediate resistance lies around $1.1700–1.1730 (the prior support zone and descending trendline region), and as long as the euro stays capped below that, the downside bias remains intact. A break under $1.1645 would be a bearish breakout, opening the door to the next support at $1.1610 and possibly $1.1575 (early September lows). Momentum indicators on these lower timeframes show persistent weakness – bearish momentum is dominant, with no sign of a reversal yet. Unless euro bulls decisively reclaim the high-$1.17s, the path of least resistance points lower, with any intraday bounces likely to be sold into.

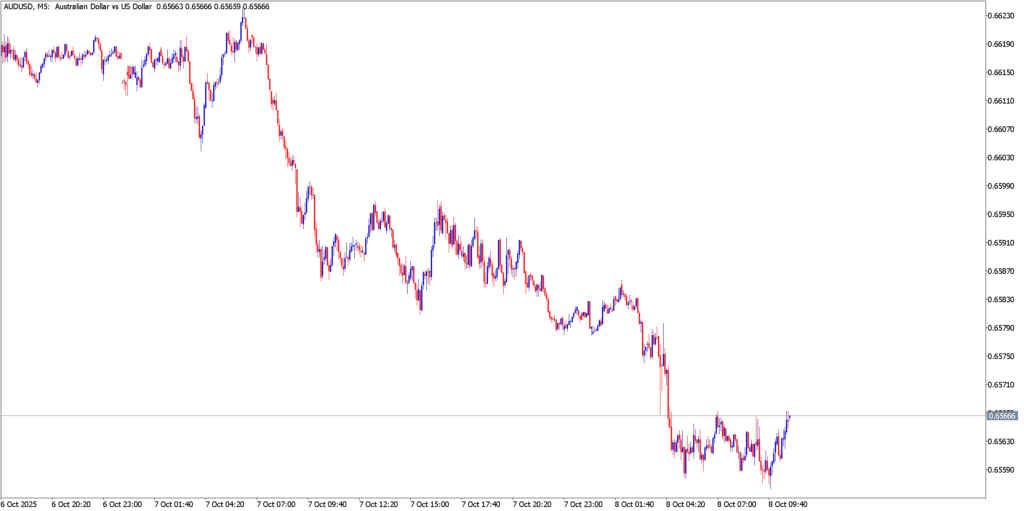

AUD/USD

Fundamental Analysis

The Aussie Dollar extended its slide for a second straight session, pressured by a cocktail of weak domestic news and global risk aversion. Early Wednesday, fresh data revealed Australia’s housing sector stumbling – private house approvals sank 2.6% in the latest month, and overall building permits plunged 6%, marking a second consecutive monthly drop. This added to the gloom from earlier in the week, when consumer confidence slumped and job ads contracted, underscoring a cooling Australian economy. The soft data reinforce the Reserve Bank of Australia’s cautious stance; the RBA kept rates on hold at 3.6% and warned inflation is lingering stubbornly. While the RBA’s vigilance on inflation suggests no imminent easing (providing some yield support to AUD), it hasn’t stopped investors from pulling back. The S&P/ASX 200 equity index dipped and capital is trickling out of Aussie assets amid the risk-off climate. Meanwhile, the US Dollar’s strength is unrelenting – safe-haven flows into the greenback are trumping dovish Fed expectations. Despite nearly everyone expecting Fed rate cuts by year-end, the USD is charging higher for a third day as traders seek shelter from global uncertainties. U.S. political drama is a big part of that story: the ongoing government shutdown (with President Trump stoking fears by threatening mass federal layoffs) has paradoxically lifted the dollar, as investors prefer the devil they know. In short, risk appetite has dried up, and high-beta currencies like AUD are bearing the brunt. Until sentiment reverses or the data flow brightens, AUD/USD remains on its back foot.

Technical Analysis

AUD/USD’s 5-minute chart shows a market caught in limbo, with a slight bearish tilt. After a gentle relief rally in late September that lifted the pair toward the key $0.6600 level, bullish momentum stalled out. The chart reveals clear resistance just above 0.6600, where the Aussie’s advance repeatedly fizzled out in a cluster of M5 candles with short bodies and upper wicks – a sign of buyers lacking follow-through. Since peaking near 0.6610, the pair has drifted into a sideways consolidation between roughly 0.6580 and 0.6620, marked by choppy back-and-forth price action. The 0.6600 handle has essentially become a magnet, with price oscillating around this pivot as neither bulls nor bears show strong conviction intraday. Crucially, the short-term bias is turning downward: successive minor lower highs point to building selling pressure, and a slip below $0.6575 (the bottom of the recent range) would signal a bearish break from this consolidation. That could accelerate declines toward the mid-0.6500s – the September 26 swing low around 0.6520 is an initial downside target. On the upside, any rebound faces an immediate test at 0.6630 (range top), with a stronger ceiling at the late-September high near 0.6700. Momentum on the M5 timeframe has been flat, with the RSI flitting around neutral 50 as price coils. But if risk aversion intensifies, watch for the Aussie to break decisively lower out of this range. A downside resolution would confirm that bears are seizing control, whereas a punch through 0.6630 would be needed to give Aussie bulls a spark of hope.

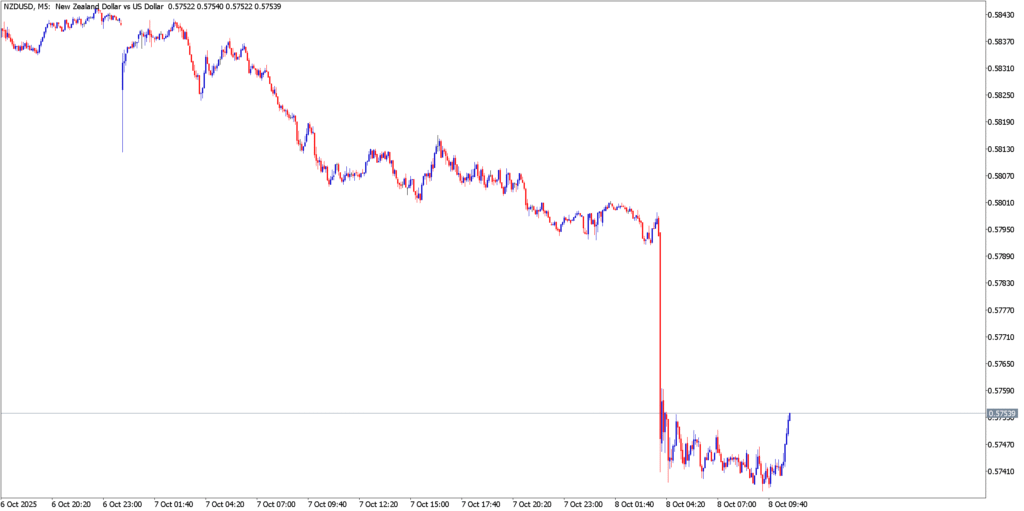

NZD/USD

Fundamental Analysis

The New Zealand Dollar was blindsided by a shock from its central bank, triggering one of the steepest drops in the FX world this session. The Reserve Bank of New Zealand stunned markets by slashing its Official Cash Rate by 50 basis points, double the expected move, citing a frail economy and easing inflation pressures. This aggressive cut – bringing the OCR to 2.50%, a three-year low – sent the Kiwi Dollar spiraling to six-month lows as traders scrambled to reprice the path of New Zealand’s rates. NZD/USD plummeted nearly 1% on the day, crashing to around $0.5745. The RBNZ’s dovish surprise came with a clear signal that more easing may be on the table if needed, further undercutting the currency. This move followed months of weakening economic data for New Zealand – growth stalled, business confidence slumped, and the government (led by PM Christopher Luxon) openly welcomed lower rates to revive a sputtering economy. By pre-emptively front-loading a cut, the RBNZ has capitulated to those pressures. The immediate aftermath saw New Zealand bond yields and swap rates tumble alongside the Kiwi. Notably, NZD’s pain was exacerbated by the broader market mood: with risk sentiment already jittery, the Kiwi’s high-beta nature made it a prime casualty. Even relative to a similarly commodity-tied Aussie, the Kiwi is weaker – partly due to the now stark policy divergence (RBNZ easing vs. RBA on hold). In summary, NZD/USD got hit from all sides: a dovish central bank shock, a risk-off dollar rush, and scant signs of relief on the horizon. Only a marked improvement in global sentiment or a stabilization in NZ’s outlook could stem the bleeding, but neither appears imminent as the Kiwi languishes at lows.

Technical Analysis

NZD/USD’s 5-minute chart encapsulates a dramatic momentum shift and heightened volatility. In the lead-up to the RBNZ decision, the pair was already trending lower, posting a series of lower highs that reflected building selling interest. The rate cut announcement then unleashed a violent downward thrust on the M5 chart – a massive bearish candlestick knifed through support levels, as NZD/USD collapsed by dozens of pips in minutes. This whipsaw price action is evident on the chart: a sharp spike (volatility on news) followed by a free-fall that broke the Kiwi to fresh lows. In the aftermath, the pair has struggled to find its footing. Brief attempts to bounce have been tepid and short-lived, capped by resistance now forming around the $0.5800 mark (a level that formerly provided support before the breakdown). The M5 candlesticks show large wicks and erratic swings, underscoring a jittery market – but importantly, each recovery attempt is met with new sellers, keeping NZD/USD heavy. The near-term support is elusive until the day’s low around $0.5740, and below that the focus turns to psychological support at $0.5700. On such a short timeframe, momentum oscillators remain oversold, but that alone hasn’t induced a turnaround; instead, it highlights the intense downward momentum that persists. Unless the Kiwi can reclaim levels above $0.5850 and form a base, the technical picture favors the bears. Traders should be prepared for continued volatility – the rate cut-fueled sell-off may evolve into a lower consolidation, but any negative news or further dovish hints could spark another leg down. Only a clear stabilization above initial resistance (and a calming of broader market fears) would signal that NZD/USD is ready to bottom out from this slide.

Market Outlook

This whirlwind trading day leaves no doubt: the US Dollar is in the driver’s seat as fear and uncertainty grip the markets. EUR/USD’s slide, AUD/USD’s stagnation, and NZD/USD’s plunge all tie back to a common theme – investors flocking to safety while punishment is dealt to currencies with weak narratives. Looking ahead, traders will watch whether these trends have more room to run or if a relief rebound is on the cards. The immediate focus turns to upcoming catalysts: Fed communications and data could either reinforce or undermine the dollar’s run. The Fed’s meeting minutes and a delayed US jobs report (once the government reopens) may clarify how soon rate cuts truly loom – any sign of a less dovish Fed than assumed could extend the Greenback’s gains. Conversely, if cooler heads prevail and political risks (like France’s turmoil or the U.S. shutdown) start to ease, we could see risk appetite cautiously creep back, giving the euro, aussie, and kiwi some breathing room. For now, the momentum favors dollar bulls, and the technicals confirm it. Barring a sudden shift in sentiment, sellers remain in control of EUR/USD, AUD/USD, and NZD/USD. However, fast-paced markets can turn on a dime – a surprise breakthrough in fiscal negotiations or a reassuring central bank comment could spark a snap reversal. Traders should stay nimble and alert as this high-voltage week in forex continues. The stage is set for more fireworks ahead, with any hint of optimism potentially tempering the dollar’s charge, while sustained anxiety could see fresh lows for the beleaguered euro and South Pacific currencies. The only certainty is volatility, and it’s not over yet.