A spread-only account in forex is a trading account where all trading costs are built into the bid-ask spread, with no separate commissions charged per trade. Traders pay only the spread when entering and exiting positions, making costs simpler, more transparent, and easier to calculate for each trade.

Key Takeaways

- A spread-only account in forex charges traders only through the bid-ask spread, with no separate commission fees.

- Trading costs are simpler and more transparent, making it easier to estimate profitability before entering a trade.

- These accounts are popular among beginners and frequent traders who prefer predictable pricing.

- Spread-only accounts can be cost-effective, but wider spreads during volatility may impact certain strategies.

What Is a Spread-Only Account in Forex?

A spread-only account in forex is a trading account where the broker doesn’t charge any fixed or per-lot commission. Instead, the broker’s earnings are included directly in the spread of the difference between the buy (ask) and sell (bid) price of a currency pair.

When you open a trade, the position starts slightly negative because you enter at the ask price and exit at the bid price. That initial difference is the only trading cost you pay in a spread-only account. There are no additional deductions, making this account type straightforward and easy to understand.

Because pricing is built into the spread, traders can quickly evaluate whether a trade makes sense without calculating extra fees. This simplicity is why spread-only forex accounts are commonly chosen by beginners, intraday traders, and anyone who prefers clear, all-inclusive trading costs.

What Does “Spread” Mean in Forex Trading?

In forex trading, the spread is the difference between the bid price (the price at which you can sell a currency pair) and the ask price (the price at which you can buy it).

- Bid Price: The price you receive when selling a currency.

- Ask Price: The price you pay when buying a currency.

- Spread: The broker’s cost built into the market price.

How a Spread Only Forex Account Works

A spread-only forex account operates on a simple principle: all trading costs are included in the spread, and there are no separate commissions or swap fees. When you open a trade, the difference between the buy (ask) and sell (bid) price is the only cost you pay. This ensures transparency and predictability, allowing traders to focus on strategy rather than calculating extra fees.

How it works in practice:

- You choose a currency pair or other tradable asset.

- You enter a trade at the ask price and plan to exit at the bid price.

- The spread difference is automatically deducted as the trading cost.

For example, if the EUR/USD pair has a bid of 1.1050 and an ask of 1.1052, the spread is 2 pips, which is your only trading cost for entering the position.

Why it matters:

- Cost clarity: Traders know exactly what they’re paying.

- Predictability: Easier to calculate potential profits or losses.

- Simplicity: No confusing commissions or hidden charges.

Defcofx combines spread-only accounts with low spreads starting from 0.3 pips, high leverage up to 1:2000, and no swap fees, offering both cost-efficiency and flexibility for traders of all levels.

Open a Live Trading AccountSpread-Only Account vs Commission-Based Forex Account

Understanding the difference between a spread-only account and a commission-based account is crucial for selecting the right trading style.

Spread-Only Account:

- All trading costs are included in the spread.

- No additional commissions per trade.

- Simplifies cost calculation and is easier for beginners to understand.

- Costs are predictable for standard market conditions but may widen during high volatility.

Commission-Based Account:

- Brokers charge a fixed commission per trade or per lot in addition to the spread.

- Often used by advanced traders or scalpers because the spreads can be extremely tight.

- More precise cost tracking is required since trading costs come from both spread and commission.

- Can be more cost-efficient for high-volume traders if spreads are very low.

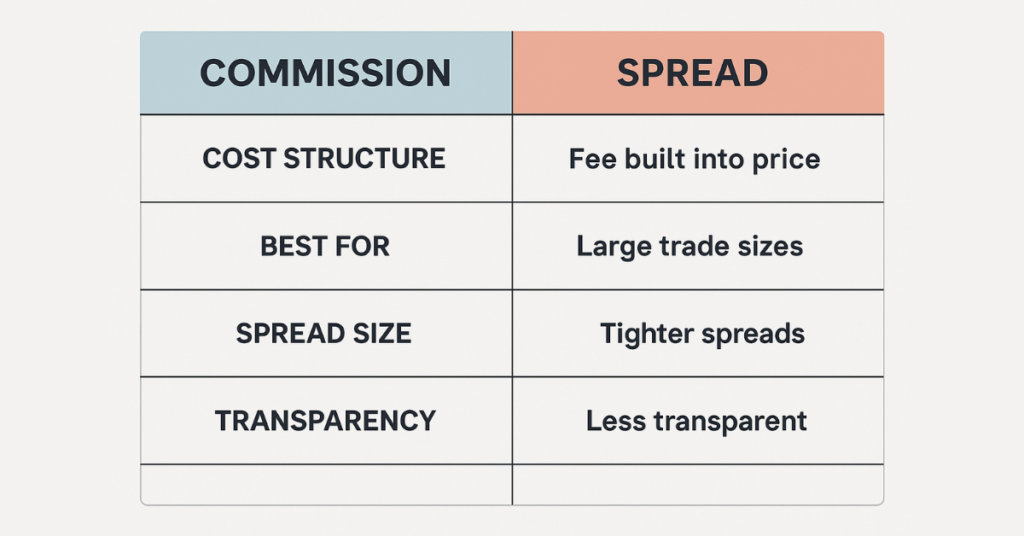

Table Example:

| Feature | Spread-Only Account | Commission-Based Account |

| Cost Structure | Only spread | Spread + commission |

| Transparency | Simple & predictable | Slightly complex |

| Best For | Beginners, casual traders | Scalpers, high-volume traders |

| Spread Size | Usually slightly higher | Usually lower |

| Extra Fees | None | Commission per trade |

Choosing between the two depends on trading style, frequency, and cost preferences. Beginners and traders who prefer simplicity often favor spread-only accounts, while active scalpers may benefit from commission-based accounts with very tight spreads.

4 Key Advantages of a Spread-Only Trading Account

Spread-only forex accounts offer several advantages that make them appealing to both beginners and experienced traders who value simplicity and transparency.

- Transparent Trading Costs: All fees are included in the spread, so traders know exactly what they are paying for every trade. There are no hidden commissions or swap charges, making cost management straightforward.

- Predictable Expenses: Because trading costs are embedded in the spread, it is easier to calculate potential profits and losses before entering a trade. This predictability helps with planning and risk management.

- Simplified Trading for Beginners: New traders often find commission-based accounts confusing due to additional charges. A spread-only account removes this complexity, allowing beginners to focus on learning strategies rather than calculating costs.

- Flexibility for All Traders: Spread-only accounts work well for various trading styles, from intraday trading to longer-term positions.

Potential Limitations of Spread-Only Accounts

While spread-only accounts offer simplicity and transparency, they also come with some limitations that traders should be aware of:

- Wider Spreads During Volatility: During major news releases or high market volatility, spreads can widen temporarily. This means the cost of entering and exiting trades may increase, impacting short-term or scalping strategies.

- Not Always Ideal for Scalpers: Traders who execute many small trades in quick succession may find that wider spreads reduce profitability compared to tight-spread, commission-based accounts.

- Limited Advanced Features: Some brokers may restrict certain account features or tools for spread-only accounts, so active traders might have fewer options than commission-based accounts.

Who Should Use a Spread-Only Forex Account

A spread-only forex account is suitable for a wide range of traders, particularly those who prioritize simplicity, transparency, and predictable trading costs. Beginners often find this account type is ideal because it removes the complexity of managing commissions, allowing them to focus entirely on learning trading strategies and understanding market behavior.

Day traders and intraday traders who prefer fewer, larger trades rather than hundreds of small scalping trades can also benefit. Since all costs are included in the spread, it becomes much easier to calculate potential profits or losses before executing a trade, helping traders manage risk more effectively.

Cost-conscious traders, including those with smaller trading capital, may prefer spread-only accounts because there are no additional fees or hidden charges beyond the spread itself. This clarity ensures that every pip paid contributes directly to the broker’s revenue, with no surprises impacting the trader’s bottom line.

However, traders with strategies that rely on very tight spreads, such as high-frequency scalping, might need to carefully consider market conditions, as spread-only accounts can experience temporary widening during high volatility or major news events.

Overall, spread-only accounts are best suited for beginners, casual traders, intraday traders, and anyone who values transparent costs, while traders seeking extreme precision or very low spreads for scalping might consider commission-based alternatives.

Is a Spread-Only Account Better for Beginners?

Yes, a spread-only forex account is generally better for beginners because it simplifies trading costs and makes the learning process easier. New traders often struggle with understanding commissions, swap fees, and other hidden charges in traditional accounts. Spread-only accounts remove this complexity by including all trading costs directly in the spread, allowing beginners to focus on mastering market analysis, strategy, and risk management.

By knowing exactly how much each trade costs upfront, beginners can plan trades more effectively, avoid unexpected losses due to hidden fees, and build confidence in their trading decisions. Additionally, spread-only accounts reduce the risk of overtrading for small balances, since traders are more aware of the costs involved in every position.

How to Tell If a Broker Truly Offers a Spread-Only Account

Not all brokers who advertise “spread-only” accounts are fully transparent, so it’s important to verify certain factors before opening an account. A true spread-only account should include all trading costs within the spread, with no hidden commissions, swap fees, or additional charges.

Check the broker’s pricing structure carefully. Look for low, consistent spreads and review trading conditions for different market times. Brokers that provide real-time spread monitoring and transparent trade execution are typically more reliable. Reading user reviews and third-party evaluations can also help confirm whether the broker genuinely offers a spread-only account.

Other important checks include withdrawal and deposit policies, available platforms, and customer support responsiveness. A broker offering fast support and withdrawals, along with global accessibility, shows commitment to user satisfaction and reliability.

Trading Costs Breakdown in a Spread-Only Forex Account

In a spread-only forex account, the primary trading cost is the spread, which is the difference between the bid and ask prices of a currency pair or other tradable asset. Unlike commission-based accounts, there are no extra fees per trade, making it easier to calculate costs and potential profits.

For example, if you trade EUR/USD with a bid of 1.1050 and an ask of 1.1052, the spread is 2 pips, which is the only cost for entering and exiting the trade. Traders don’t pay commissions or swap fees, so all costs are transparent and predictable.

How spreads affect profitability:

- Tighter spreads: Lower trading costs, better for frequent trading.

- Wider spreads during volatility: Can temporarily increase costs, affecting short-term or scalping strategies.

Common Misunderstandings About Spread-Only Accounts

Many traders, especially beginners, have misconceptions about spread-only forex accounts. One common myth is that these accounts are completely “free” or that there are no costs at all. In reality, the cost is embedded in the spread, so every trade still carries a small fee; it’s just included in the market price rather than charged separately.

Another misunderstanding is that spread-only accounts are only suitable for advanced traders. In fact, they are often better for beginners, as the simplicity of having all costs included in the spread makes it easier to understand trading expenses and manage risk.

Some traders also assume that spread-only accounts always have the lowest possible costs. While spreads are often competitive, they can widen during periods of high volatility or major economic events, temporarily increasing trading costs. Traders must monitor market conditions to avoid surprises.

How to Open a Spread-Only Forex Account

Opening a spread-only forex account is a straightforward process, but it’s important to follow the correct steps to ensure transparency and cost efficiency.

First, research brokers that genuinely offer spread-only accounts and confirm their trading conditions, spreads, and fees. Look for features like low spreads, no commissions or swap fees, and fast withdrawals, which indicate a reliable platform.

Once you’ve selected a broker, the next step is to complete the registration process. This usually involves providing basic personal information, verifying your identity, and setting up secure login credentials.

After verification, you can fund your account using a preferred payment method. Many brokers, including Defcofx, support clients globally and offer fast deposits and withdrawals, even on weekends.

Finally, download the trading platform; most brokers provide MetaTrader 5 (MT5) for desktop, web, and mobile use, and then start trading. With spread-only accounts, you’ll immediately notice that all trading costs are embedded in the spread, simplifying your trading experience.

Start TradingFinal Thoughts on What Is a Spread-Only Account in Forex?

Spread-only forex accounts are an excellent choice for traders who value transparency, simplicity, and predictable trading costs. By including all fees directly in the spread, these accounts eliminate confusing commissions and hidden charges, making it easier to calculate profits, manage risk, and focus on strategy.

They are particularly suitable for beginners, intraday traders, and cost-conscious traders who prefer a clear understanding of trading expenses. While spreads may widen during volatile market conditions, the overall simplicity and clarity make spread-only accounts an effective tool for disciplined trading.

Brokers like Defcofx enhance this experience by offering low spreads starting from 0.3 pips, no commissions or swap fees, high leverage up to 1:2000, fast withdrawals within 4 business hours, and global accessibility, providing both flexibility and reliability for traders at all levels.

Open a Live Trading AccountFAQs

A spread-only account includes all trading costs in the spread, with no separate commissions or swap fees. An ECN account typically charges a commission per trade but offers tighter spreads. ECN accounts are often preferred by scalpers or high-frequency traders.

Yes, spread-only accounts do not charge additional commissions per trade. The broker earns through the spread itself, making costs transparent and predictable. However, spreads may widen during volatile market conditions, which can temporarily increase costs.

They can work, but traders should be cautious. Spread-only accounts may have slightly wider spreads compared to commission-based accounts, so scalpers executing very short-term trades should monitor market conditions closely to avoid higher costs.

Brokers earn their revenue entirely through the bid-ask spread. The difference between the buy and sell prices of an asset is the broker’s profit. This model eliminates commissions and makes trading costs straightforward for traders.

Spread-only accounts are ideal for beginners, intraday traders, and cost-conscious traders who value transparency and simplicity. Traders seeking ultra-tight spreads for scalping may consider commission-based accounts instead.