The US Dollar charged higher on Tuesday, Oct 21, as upbeat geopolitical news fueled broad dollar strength. Signs of progress in U.S.-China trade talks and optimism that Washington’s government shutdown may soon end lifted the Greenback to a six-day high. This dollar surge sent the Euro and British Pound tumbling toward weekly lows. Meanwhile, the Canadian Dollar outperformed after Canada’s inflation came in much hotter than expected, boosting bets against further Bank of Canada easing. We break down the fast-paced moves in EUR/USD, GBP/USD, and USD/CAD, with a look at Tuesday’s technical setups and the fundamental forces driving the action.

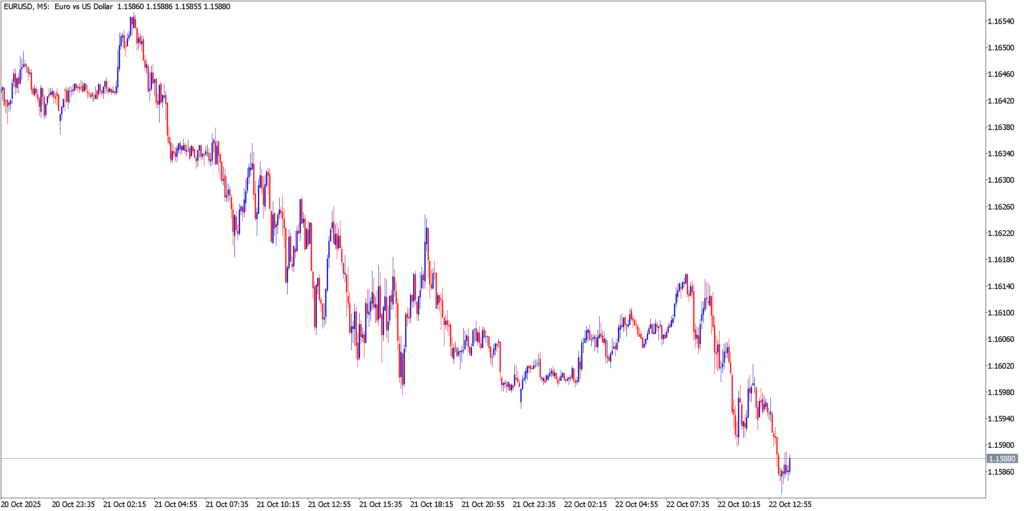

EUR/USD

Technical Analysis

EUR/USD extended its pullback, dipping below the 1.1600 handle and testing the lower bounds of a critical support zone. The pair has plunged from its yearly high near 1.19 to trade “just above key support for a third consecutive week”. Notably, buyers defended the 1.1540 area for a second time, establishing a potential double-bottom pattern (1.1543 being the trough on both occasions). This bullish reversal formation spans roughly 90 pips from the base to the neckline – a break above ~1.1640 could unleash a measured move toward 1.1720. That target aligns with the mid-1.17 zone, just below the prior significant high at 1.1748 (a Fibonacci resistance), suggesting the broader downtrend would remain intact even on a rebound to those levels. On the downside, 1.1540 is reinforced as key support (with 1.1500 as a psychological backstop), and a decisive drop beneath this floor would signal fresh bearish momentum. Initial resistance emerges around 1.1650 (this week’s highs and double-bottom neckline), followed by the 1.1700/1.1720 region – a hurdle where sellers may reassert pressure.

Fundamental Analysis

With no major Eurozone data on tap Tuesday, EUR/USD traded at the mercy of U.S.-driven sentiment. The dollar’s strength was the dominant theme, fueled by upbeat developments in Washington and Beijing. News that President Trump plans to meet China’s President Xi next week, aiming to revive trade negotiations before tariffs resume, boosted risk sentiment and the dollar. Hopes also grew for a compromise to end the protracted U.S. government shutdown, after White House officials hinted a resolution could come “sometime this week”. This backdrop sent the U.S. Dollar Index up about 0.3%, pressuring EUR/USD. The Euro slid roughly 0.3% against the stronger dollar and hit one-week lows around 1.1585. Notably, this decline came despite easing political tensions in France, a positive European development that was overshadowed by U.S. factors. Looking ahead, traders remained focused on ECB speak. With the Eurozone data calendar subdued, speeches by ECB Vice President Luis de Guindos and President Christine Lagarde were a focal point, though neither was expected to signal a shift in near-term policy. In the U.S., no top-tier data early in the week meant Fed policy expectations (a rate cut is widely anticipated at the October 28–29 FOMC meeting) and fiscal headlines drove dollar moves. Overall, the fundamental bias Tuesday favored the USD, leaving EUR/USD hovering just above critical support awaiting fresh catalysts.

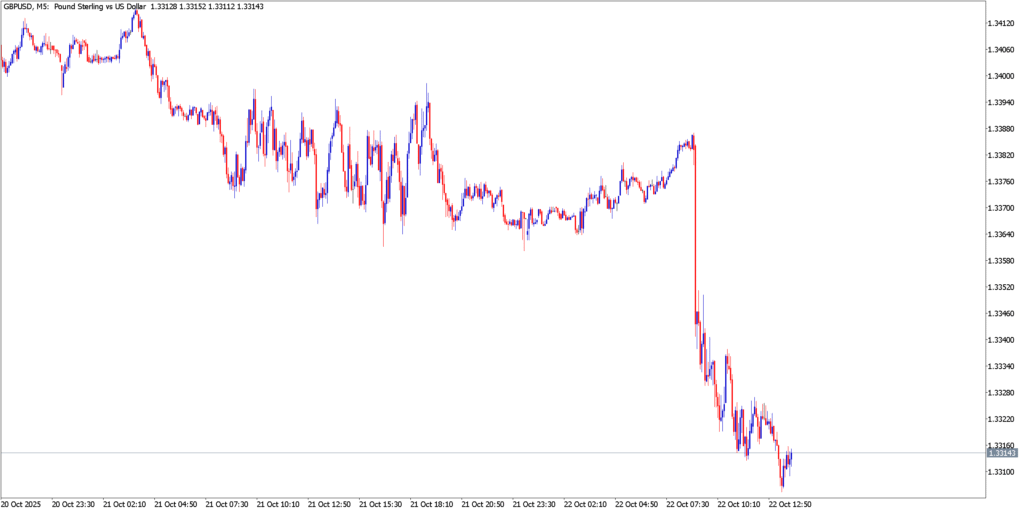

GBP/USD

Technical Analysis

Sterling continued to struggle, with GBP/USD sliding into the mid-1.33s and marking its third straight daily decline. The pair remains locked in a short-term falling wedge formation – a descending consolidation pattern often preceding bullish reversals. Within this wedge, downward momentum has been moderating, as evidenced by higher lows on the 4-hour chart even as price made marginal new lows. On Tuesday, GBP/USD’s bounce attempts were capped near 1.3415, roughly where a key Fibonacci retracement level lies. In fact, the market “re-tested a big Fibonacci level” in that area but failed to break through, and 1.3414 now stands out as an overhead resistance marker for any recovery rallies. The inability to clear 1.3414 keeps the near-term bias bearish, with sellers fading rebounds. Immediate support comes in around 1.3370 (Tuesday’s lows), followed by last week’s trough at 1.3320–1.3330. Analysts note that a firm break below 1.3325 would be a bearish signal, “canceling out” the recent corrective uptick and opening the door toward 1.3155 (the next major support based on the wedge’s lower channel and summer lows). On the flip side, if the wedge pattern plays out, a topside break above 1.3420 (and the 1.3485 region beyond it) would indicate a bullish reversal. For now, moving averages trend lower and the pound’s inability to hold gains suggests that rallies into the mid-1.34s will meet selling interest.

Fundamental Analysis

The British Pound faced an uphill battle as domestic fiscal jitters and looming data kept sentiment cautious. Sterling shed about 0.4% versus the dollar on Tuesday, continuing its retreat even as much of the bad news was arguably priced in. The UK reported that public sector net borrowing in the first half of the fiscal year ballooned to the highest level since the pandemic – underscoring Britain’s growing fiscal deficit. While alarming on the surface, investors largely took this in stride, expecting a tough Autumn budget ahead to plug what analysts estimate is a ~£25 billion fiscal hole. In fact, markets have been bracing for austerity measures, so the borrowing spike “was already factored into the price” of the pound. The bigger focus for GBP traders was Wednesday’s inflation report. U.K. CPI for September was due the next morning, and anticipation of that figure kept GBP/USD volatility somewhat subdued late Tuesday. Consensus expected inflation to tick up to around 4.0% y/y from 3.8%, but there was a sense of uncertainty given recent surprises. Many traders were unwilling to take big positions before the data, knowing it could swing Bank of England rate expectations. (In the event, an upside CPI surprise could rekindle bets of another BoE hike, whereas a downside miss would bolster the case that inflation has peaked, encouraging rate-cut bets.) Indeed, investors have already been positioning for the BoE’s next move to be a cut in 2024, and Tuesday’s soft pound reflected those dovish leanings. However, until the CPI and upcoming BoE meeting (Nov 6) clarify the outlook, the pound remains vulnerable. External factors also offered little support: the broad USD upswing tied to U.S. trade and fiscal optimism hit all majors, and GBP was no exception, drifting lower alongside the Euro. All told, fundamental drivers left GBP/USD lacking upward momentum on Tuesday – with traders looking to the next day’s inflation verdict for direction.

USD/CAD

Technical Analysis

USD/CAD traded choppily after hitting a fresh six-month high earlier in the session. The pair briefly poked above 1.4060, extending an impressive rally that has added nearly 4% from the yearly lows. However, it couldn’t sustain those highs and pulled back toward the 1.4000 handle by day’s end. From a technical perspective, the medium-term outlook remains bullish – USD/CAD recently broke out of a two-month ascending channel and cleared the psychological 1.4000 barrier plus its 200-day moving average (around 1.3980) for the first time since April. This breakout signaled a regime change to the upside. Yet near-term indicators flash caution that the pair may be overextended. On the 4-hour chart, a bearish engulfing candlestick formed off the highs, and momentum oscillators like RSI had approached overbought territory during the surge. The pullback toward 1.4000 is thus a healthy correction that could attract fresh buyers if support levels hold. Initial support is eyed at 1.4000, which is now pegged as a key support-turned-resistance line after last week’s breakout. Just below, the 1.3980 zone (a recent swing low) is significant – it roughly coincides with the 200-day MA and was identified as a “clean spot of support” that sparked the latest leg higher. A dip into 1.3980–1.4000 that holds could produce a higher low and keep bulls in charge. Conversely, a decisive break under 1.3980 would hint that a deeper correction is underway (next supports would be around 1.3900). On the upside, Tuesday’s high near 1.4065 is immediate resistance. Above that, the 1.4100 level comes into view, and beyond lies a pocket of price history from late Q1 (around 1.4200) if bullish momentum reignites. Overall, USD/CAD’s trend bias is positive above 1.3980, but some consolidation is unsurprising after the sharp multi-week climb.

Fundamental Analysis

The Canadian Dollar found a catalyst in domestic data, interrupting what had been a one-way USD/CAD rally. Canada’s inflation surprised to the upside – headline CPI surged to 2.4% y/y in September, a big jump from 1.9% in August and slightly above forecasts (2.3%). All three of the BoC’s core inflation measures also came in hotter than expected, signaling that price pressures remain uncomfortably strong. This inflation “surprise” immediately bolstered the Loonie. A firm CPI read narrowed the odds of back-to-back BoC rate cuts, as traders reassessed the likelihood of the Bank of Canada easing again at its October 29 meeting. In fact, market bets on an October cut fell after the CPI release, with some analysts now expecting the BoC to stand pat and wait for more disinflation before easing. The prospect of a less dovish (or at least not more dovish) BoC gave CAD a lift. This was evident in USD/CAD’s intraday reversal: the pair was climbing early in the global session, but after the CPI came out at 12:30 GMT, USD/CAD quickly retreated from 1.406+ highs down toward 1.401. By Tuesday’s close, USD/CAD was down about 0.1–0.2% on the day, a modest but notable turnaround considering the broader U.S. dollar strength. Aside from the CPI, oil prices – a typical driver for the petro-linked Canadian Dollar – were relatively steady near multi-week lows, so energy did not play a major role in CAD’s moves. South of the border, the USD had its own supports: the general risk-on tone (equities were mixed but off lows) and rising U.S. yields earlier in the week kept the dollar broadly firm. However, Canada’s data managed to trump those factors for USD/CAD, resulting in a net CAD-positive session. Going forward, the fundamental focus for this pair will be the BoC’s upcoming decision. If inflation’s resurgence makes the Bank more cautious about cutting rates, USD/CAD’s upside could be limited. In the meantime, traders will also watch any shifts in Fed expectations – the Fed is widely expected to cut rates next week, which, if confirmed, could cap the USD side of USD/CAD as well. For now, Tuesday’s CPI win gave the Loonie a needed boost, interrupting the dollar’s dominance in this pair.

Market Outlook

Tuesday’s forex action underscored the dollar’s ability to outperform on improving sentiment, even as specific local factors shaped individual pairs. The surge in USD – thanks to potential breakthroughs on U.S. fiscal and trade issues – pushed EUR/USD and GBP/USD down to technical support zones, while USD/CAD bucked the trend by slipping as Canadian fundamentals turned bullish for the CAD. Looking ahead to Wednesday (Oct 22) and beyond, traders will be watching whether these support and resistance levels hold and what fresh triggers lie ahead. The mid-week calendar is eventful: in Europe, the spotlight is on the UK CPI release, along with UK PPI, which together will test the Pound’s resilience. The European session also brings comments from ECB’s Luis de Guindos and Christine Lagarde, though no policy bombshells are expected. Across the Atlantic, the U.S. schedule remains relatively light, but a few Fed officials are due to speak, which could provide hints on the Fed’s easing stance. Any surprise rhetoric ahead of the Fed’s meeting next week (where a 25 bp rate cut is anticipated by many) could jostle USD pairs. Additionally, currency markets will stay tuned to geopolitical news – any concrete progress on ending the U.S. government shutdown or on U.S.-China trade negotiations could further boost risk appetite and influence the safe-haven dollar’s appeal. For EUR/USD and GBP/USD, a key question is whether they can rebound off support if U.S. political clouds clear (which might actually weaken the USD) or if soft European/UK data undercuts any relief rally. For USD/CAD, Canada’s stronger inflation has set the stage for a more data-dependent BoC; traders will monitor any commentary from BoC officials and oil price movements as additional inputs. In summary, after Tuesday’s dollar-driven moves, Wednesday’s trade will hinge on follow-through from these drivers and the incoming data – with the potential for volatility in the Euro (on ECB speak), the Pound (on inflation outcomes), and the Loonie (as traders position into the BoC meeting). All eyes are on whether the dollar can sustain its latest gains or if an inflection point is near as we progress through the week. The market mood heading into Wednesday is one of cautious optimism, with traders alert to inflection points that could redefine the trends established in this brisk trading day.