Global markets are on edge this Tuesday as a cascade of macroeconomic dramas whipsaws currencies. Renewed U.S.-China trade war tensions and a protracted U.S. government shutdown have soured risk sentiment, boosting the safe-haven dollar. High-profile central bank showdowns add to the frenzy – traders await Federal Reserve Chair Jerome Powell’s remarks later today under intense pressure from politicians and markets. Meanwhile, recession fears and geopolitical flare-ups have driven safe havens like gold to record highs and slammed commodities, underscoring the urgency in forex markets. Against this backdrop, the euro, pound, and Aussie are reeling: the euro is pinned near multi-month lows, sterling struggles with stagflation anxieties, and the Aussie dollar is licking its wounds after a China-induced tumble. It’s a fast-paced, news-driven trading day, with sentiment fickle and every headline poised to jolt the major pairs.

EUR/USD

Fundamental Analysis

The euro’s week began on the back foot as the EUR/USD slid to its lowest in over two months. A resurgent U.S. dollar – buoyed by safe-haven flows and a surprisingly resilient U.S. economy – has overpowered the euro amid Europe’s own economic soft patch. Fresh data out of Germany revealed weakening momentum, with exports falling 0.5% in August and imports down 1.3%, highlighting fundamental challenges in the Eurozone’s engine economy. This comes as the European Central Bank holds rates steady, in stark contrast to the Fed’s shifting stance – markets anticipate the Fed will start cutting rates by year-end while the ECB stays put. Political drama is adding fuel to the fire: U.S. President Donald Trump rattled markets with a threat of 100% tariffs on Chinese goods effective next month, a move that briefly lifted the euro on Friday as traders bet on U.S. growth fallout. However, hopes of behind-the-scenes U.S.-China dialogue emerged over the weekend, tempering those gains and refocusing attention on Europe’s woes. All eyes today are on Fed Chair Powell’s evening address, which traders hope will clarify policy direction amid the U.S. government shutdown and Trump’s pressure to cut rates. Also on tap is Germany’s ZEW survey of economic sentiment, due midday, which could sway the euro if it underscores the gloom in the Eurozone. Overall, with transatlantic policy divergence and global trade tensions in play, the fundamental bias remains tilted against the euro in the near term.

Technical Analysis

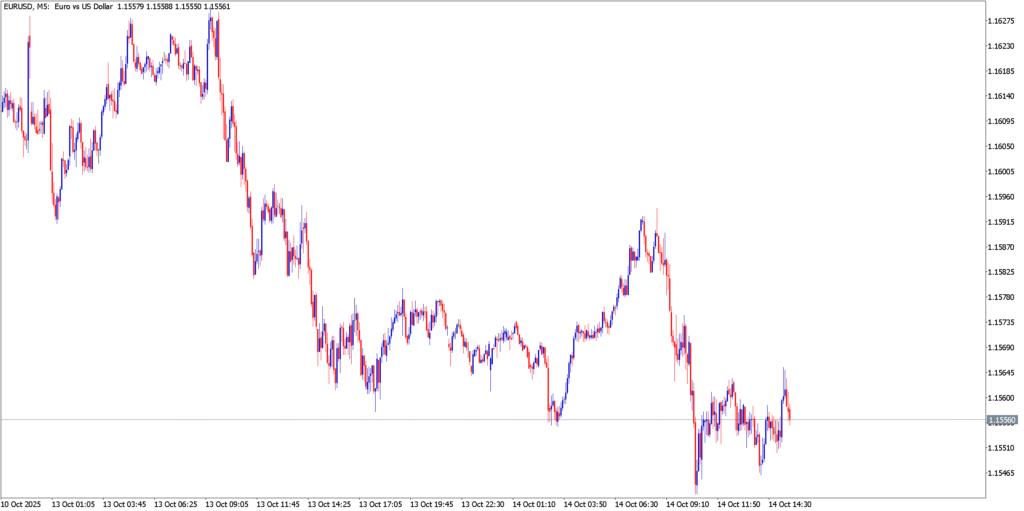

M5 chart of EUR/USD with a persistent short-term downtrend (lower highs and lower lows). After a brief bounce, the pair remains pressured below the 1.1600 handle. EUR/USD is consolidating near the mid-1.1500s – territory not seen in months – with intraday rallies capped by resistance around 1.1620 and 1.1700. Sellers have consistently faded any upticks, keeping momentum bearish. Immediate support emerges at 1.1540, with stronger floors eyed near 1.1500. A decisive break below these support levels could open the door to further downside (toward the 1.1460 area), whereas a rebound above 1.1620 would be needed to ease the current selling pressure. For now, the path of least resistance points lower, as the euro struggles to gain traction amid the prevailing risk-off tone.

GBP/USD

Fundamental Analysis

Sterling’s resilience is being put to the test as GBP/USD grinds lower under the weight of domestic and global headwinds. The British pound – which had held up better than many peers against the dollar – is now wilting as the dollar’s broad strength forces a correction. U.K. economic conditions offer little support: the economy is slipping into a stagflation mire of stubborn inflation and stagnant growth. Headline U.K. inflation unexpectedly ticked back up to 3.6% in September, roughly double the Bank of England’s target. At the same time, growth remains anaemic, and the government is set to tighten the fiscal screws with higher taxes in the upcoming November budget. Bank of England Governor Andrew Bailey is due to speak today, and he’s likely to acknowledge this uncomfortable mix of high prices and weak expansion. Markets are listening closely for any hint of policy shifts – however, the BoE is largely expected to stand pat for now, with rate cuts not anticipated until spring 2026. On the U.S. side, anticipation of Powell’s statement (his first since a U.S. government shutdown began three weeks ago) has traders cautious. Powell previously warned that easing isn’t guaranteed given persistent inflation, but several Fed officials (notably Trump-appointed governors Waller and Bowman) are openly advocating for rate cuts. This divergence – a dovish Fed tilt versus a static BoE – has so far played out in favor of the dollar. Also in focus are the U.K.’s latest jobs figures due out, with forecasts of unemployment holding at 4.7% and payrolls shrinking, which would reinforce the bleak outlook. In short, fundamental risks for the pound are skewed to the downside: a cautious BoE amid economic malaise versus a dollar buoyed by global uncertainty.

Technical Analysis

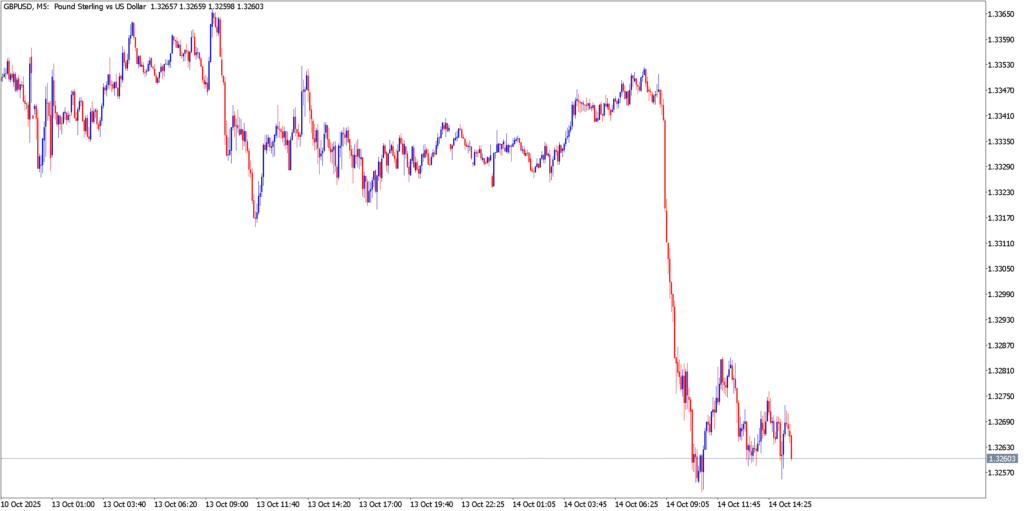

M5 chart of GBP/USD shows a market that has shifted from range-bound resilience to a bearish bias in recent sessions. Short-term price action is dominated by “lower highs and lower lows,” a pattern that set in after sterling’s late-September peak near $1.3725 gave way to a steady slide. The pair is currently oscillating in the mid-1.33s, having broken below its 23.6% Fibonacci retracement (around 1.3390) of the September rally. Notably, the 1.3340 level – which aligns with a head-and-shoulders neckline on the daily chart – is acting as immediate support. A sustained break under 1.3340/1.3300 would confirm that bearish reversal pattern and could accelerate losses toward the next major support at 1.3140 (August’s low). On the upside, any rebounds are likely to meet selling interest around 1.3420 to 1.3450, and stronger resistance looms near 1.3500. The 200-day moving average (around 1.3260-1.3270) also sits just below current prices, representing a key inflection point. With momentum indicators nearing oversold territory (RSI in the high-30s), a short-term bounce is possible – but unless bulls can reclaim the 1.3350 to 1.3400 zone, the overall technical picture will remain decidedly bearish for the pound.

AUD/USD

Fundamental Analysis

The Australian dollar has been hammered by a confluence of negative news, making AUD/USD one of the day’s most volatile pairs. The Aussie’s troubles started with last week’s flare-up in U.S.-China trade tensions – given Australia’s heavy economic ties to China, the announcement of new Chinese port fees on shippers hit AUD especially hard. By this morning, the pair was down over 1%, plumbing fresh lows near 0.6440 as European trading got underway. Traders were already bracing for dovish signals from the Reserve Bank of Australia: the RBA’s latest meeting minutes, released today, struck a cautious tone. The bank kept rates unchanged at 3.60%, citing still-elevated inflation, but hinted that it may cut rates in upcoming meetings – possibly trimming the cash rate to 3.35% as early as next month. This prospect of easier Aussie policy has weighed on the currency. Layered on top is the broader risk-off mood fueled by the U.S. drama (trade wars, government shutdown), which tends to hit growth-sensitive currencies like AUD. There is a silver lining: those earlier U.S.-China trade “fears” have shown signs of fading slightly as backchannel talks are rumored, and China’s economy hasn’t shown any immediate calamity. This helped the Aussie stabilize off its lows midday. Additionally, traders are looking ahead to Australia’s employment report (due later this week), hoping strong jobs data might stem the bleeding. For now, however, the fundamental bias remains bearish – it’s hard to fight the dollar’s ascent when global sentiment is this shaky and the RBA is inching toward rate cuts.

Technical Analysis

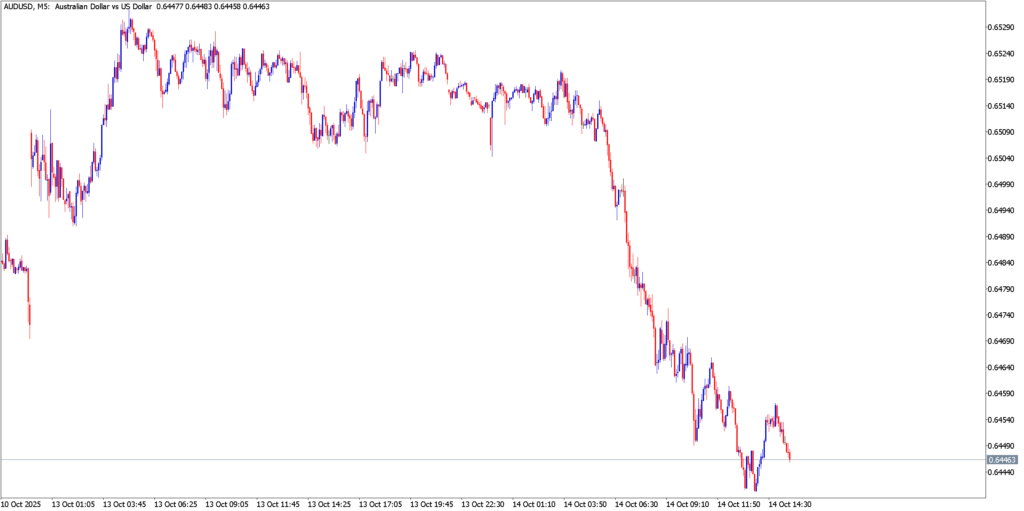

AUD/USD’s M5 chart reflects the pair’s recent plunge and tentative attempt at bottoming out. The short-term trend turned decisively bearish last week, with the pair falling from the 0.66 handle and slicing through support levels to hit 0.6467 on Friday – the lowest since late August. Early today, that support gave way as well, extending the slide to roughly 0.6440 before buyers cautiously stepped in. The intraday volatility is evident: sharp sell-offs followed by brief consolidation and minor rebounds. Immediate resistance now lies around 0.6520-0.6530, which was the breakdown zone from earlier in the week (and roughly the 50-day moving average). On the downside, minor support at 0.6465 has been tested; a clean break below opens up a path toward a potential double-bottom target near 0.6420 (the late-August low). Notably, a bullish harami candlestick pattern emerged on the daily chart – a small up-day following a large down-day – hinting at a possible relief rally. If momentum flips upward, AUD/USD could bounce toward the 0.6600 resistance level in the coming sessions. Still, any recovery may prove short-lived unless the pair can reclaim 0.6600+ and negate the series of lower highs. In summary, the Aussie is trying to carve out a base after a steep drop, but the burden of proof is on the bulls to show that this isn’t just a pause before the next leg down.

Conclusion

In this fast-paced, risk-sensitive environment, traders should buckle up for more turbulence. The U.S. dollar’s bullish grip is being tested by looming central bank pivots and political brinkmanship, setting the stage for abrupt reversals if narratives shift. EUR/USD remains vulnerable so long as Europe’s data disappoints and U.S. policy uncertainty prevails – a dovish surprise from Powell or a de-escalation in the trade war could spark a short-term euro rebound, but absent that, the downtrend looks intact. GBP/USD faces an uphill battle amid the UK’s stagflation story; only markedly positive UK news or a softening dollar can flip the script for sterling. AUD/USD, battered by trade headlines and RBA jitters, could see a relief bounce on any good news (be it Chinese stimulus or upbeat Aussie jobs numbers), yet the broader pressure from global risk aversion is likely to cap any rallies. Heading into the next sessions, the overarching narrative is one of caution: FX markets are trading headline to headline. Any clarity from policymakers – or surprise resolution of today’s economic dramas – will dictate whether these major pairs extend their dramatic moves or finally find some footing. For now, the sentiment pendulum is swinging fast, and traders are keenly focused on the upcoming catalysts that could redefine the forex landscape in the days ahead.