Markets are on a knife’s edge this Friday, October 3, 2025. A mix of US government shutdown chaos, anticipation for the Nonfarm Payrolls (NFP) release, and lingering central bank shocks have left traders whipsawed by violent swings in major pairs. The dollar is fragile, confidence is thin, and every tick now feels like a potential reversal trigger. Here’s how AUD/USD, EUR/USD, and GBP/USD are setting up as the week closes.

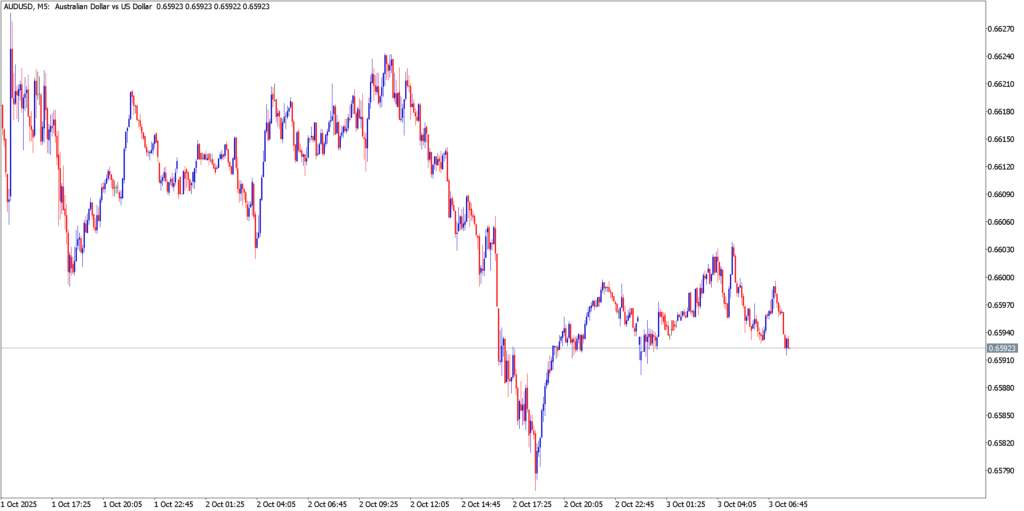

AUD/USD

Fundamental Analysis

The Aussie dollar remains pressured after mixed signals from the RBA and weak Chinese demand outlooks. China’s Golden Week slowdown has left commodity currencies vulnerable, with iron ore and coal exports projected to dip. Meanwhile, the RBA’s decision to pause hikes continues to weigh, though its hawkish tone tempers the downside. On the U.S. side, traders are bracing for NFP carnage with whispers of a softer print, USD bulls are jittery. Until clarity emerges, AUD/USD is being tugged between risk sentiment swings and NFP speculation.

Technical Analysis

The chart shows AUD/USD struggling to hold 0.6600 and now slipping toward 0.6590. Recent candles form a bearish continuation pattern, suggesting momentum favors the downside. A break under 0.6575 could open a test of 0.6540. On the upside, resistance sits at 0.6625–0.6640. RSI is tilting lower, adding bearish weight, though the pair remains range-bound. Today’s session hinges on U.S. data, volatility spikes are likely.

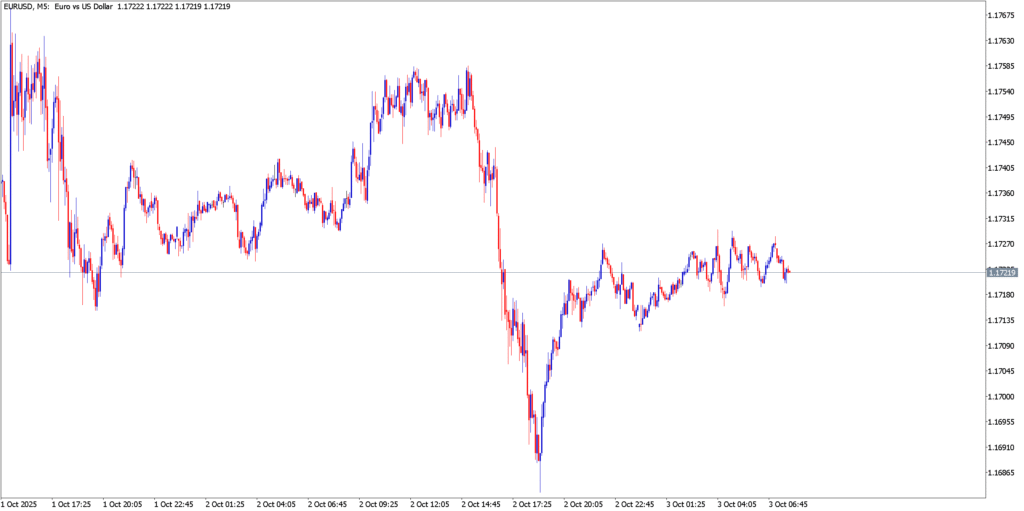

EUR/USD

Fundamental Analysis

The euro has steadied after Thursday’s sharp swings, buoyed by firmer Eurozone inflation signals and ECB caution. Traders now price out deeper cuts, contrasting sharply with the Fed’s dovish lean. Political stability in Europe adds relative calm compared to the U.S. chaos, where shutdown fears and NFP uncertainty keep USD in check. Markets whisper about a “dollar credibility crisis,” giving EUR a defensive bid heading into the weekend.

Technical Analysis

EUR/USD is consolidating near 1.1720, caught between Thursday’s high rejection at 1.1765 and support at 1.1700. Momentum is flat, but the structure hints at a bullish base. A push above 1.1760 could ignite a run to 1.1800–1.1820. Conversely, losing 1.1700 risks a slide toward 1.1660. Neutral RSI supports a coiling market, ready to spring when NFP delivers the spark.

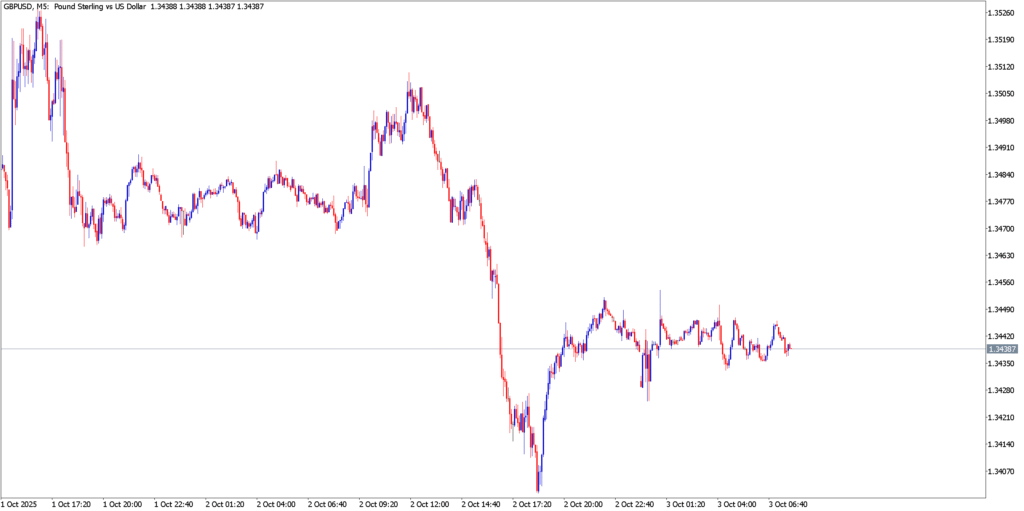

GBP/USD

Fundamental Analysis

The pound has been volatile, driven by the BoE’s stubborn inflation fight and the U.S. dollar’s weakness. UK GDP resilience keeps hawkish pressure alive, even as growth fears build. Across the Atlantic, U.S. political turmoil and looming jobs data dominate. Traders expect NFP to dictate whether GBP/USD extends its rebound or snaps lower. The narrative is clear: BoE hawkishness vs Fed uncertainty keeps cable trading like a rollercoaster.

Technical Analysis

GBP/USD is holding around 1.3440 after rebounding from Thursday’s plunge. Immediate support lies at 1.3420, with deeper support near 1.3380. Resistance stands at 1.3480–1.3500, a key breakout zone. The RSI has flattened after oversold conditions, hinting at consolidation before the next move. If NFP underwhelms, cable could surge back toward 1.3520. If it beats, a crash to the low 1.33s is not off the table.

Market Outlook

Friday, October 3, 2025, may be the most explosive day of the week. With NFP set to drop under the cloud of a U.S. shutdown, traders are braced for whiplash moves across all majors. AUD/USD looks fragile, EUR/USD is coiled for breakout, and GBP/USD trades on a razor’s edge. The balance of risk lies in whether U.S. jobs data confirms weakness or surprises with strength. In either case, expect heightened volatility, sudden reversals, and dramatic closes as the market wraps up a week of global currency shockwaves.