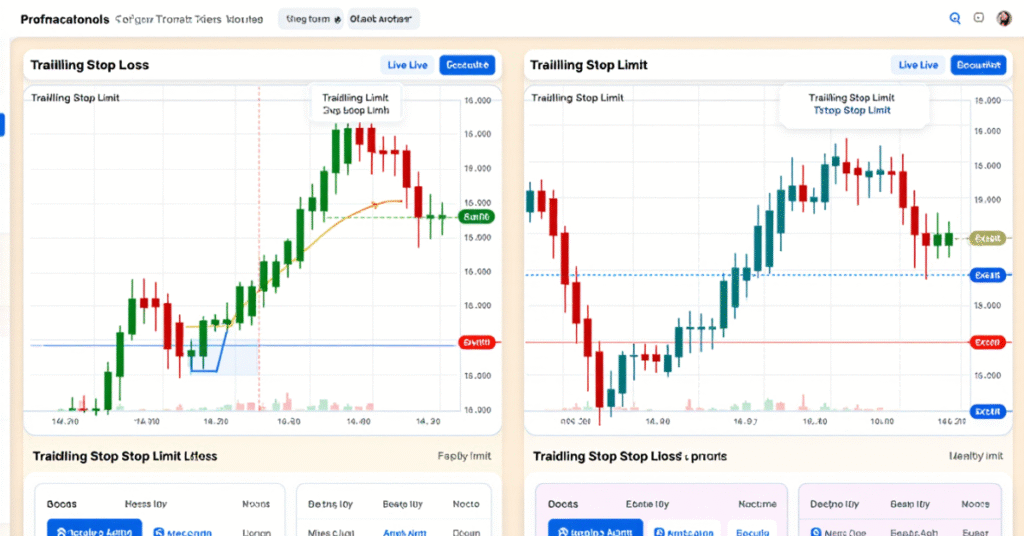

Trailing stop loss is a dynamic market order exit that follows price to lock in gains, guaranteeing execution but not exact price. Trailing stop limit sets a moving limit price to control exit price, preventing bad fills but risking non-execution if price gaps. Choose based on volatility and exit priority.

Key takeaways

- Trailing stop loss = market order exit → guaranteed execution, less price control.

- Trailing stop limit = moving limit order → better price control, no guarantee of execution.

- Use trailing stop loss in fast or highly volatile moves when exit certainty matters.

- Use trailing stop limits when avoiding bad fills and you can accept execution risk.

- Set trailing distance based on asset volatility too tight = premature exits; too wide = low protection.

What Is a Trailing Stop Loss?

A trailing stop loss is a type of stop order that automatically adjusts with the market price to protect profits while limiting losses. As the asset price moves in your favor, the stop level “trails” the price by a fixed distance (in pips, points, or percentage). When the price reverses by that distance, the order triggers a market sell (or buy) to close the trade immediately.

Example: You buy EUR/USD at 1.1000 and set a 50-pip trailing stop loss.

- If the price rises to 1.1050, your stop moves to 1.1000.

- If it reaches 1.1100, your stop moves to 1.1050.

- If price then falls to 1.1050, your trailing stop triggers and closes the position, locking in 50 pips of profit.

Key Points:

- It guarantees order execution because it becomes a market order when triggered.

- It helps maximize profits by letting winners run.

- Works well for volatile instruments (forex, commodities, indices).

What Is a Trailing Stop Limit?

A trailing stop limit is a more controlled version of a trailing stop order. Like a trailing stop loss, it automatically follows the market price by a set distance but when triggered, it places a limit order instead of a market order. This gives traders price control but introduces a risk: the trade may not execute if the market moves too quickly past the limit price.

Example: You buy EUR/USD at 1.1000 and set a 50-pip trailing stop limit with a 10-pip limit offset.

- If price rises to 1.1100, your stop price moves to 1.1050 and the limit order sits at 1.1040.

- If the price drops suddenly to 1.1030, your limit order won’t fill because the price skipped past your limit level leaving your position open.

Key Differences Between Trailing Stop Loss and Trailing Stop Limit

Although both tools help traders lock in profits and manage risk, their execution behavior and reliability differ.

Here’s a clear comparison of how each works and when to use them:

| Feature | Trailing Stop Loss | Trailing Stop Limit |

| Order Type | Market Order | Limit Order |

| Execution Guarantee | Yes, executes at next available price | No, may remain unfilled if price skips the limit |

| Price Control | No, accepts next available price | Yes, defines minimum (or maximum) execution price |

| Risk of Non-Execution | Low | Medium to High |

| Best Used In | Volatile or fast-moving markets | Stable or low-volatility conditions |

| Purpose | Ensure exit and protect profits | Control exit price and avoid slippage |

| Trader Type | Active or short-term traders | Strategic or price-sensitive traders |

Use Trailing Stop Limit when you prioritize price control and can tolerate potential non-execution.

Pros and Cons of Trailing Stop Loss vs. Trailing Stop Limit

Understanding the advantages and disadvantages of both trailing stop loss and trailing stop limit orders helps traders select the right tool for their trading goals and market conditions.

Trailing Stop Loss — Pros & Cons

| Advantages | Disadvantages |

|---|---|

| Guaranteed execution — once triggered, it becomes a market order so the trade always closes. | No control over exit price — executes at the next available price, which may be worse due to slippage or gaps. |

| Automatically protects profits as price moves in your favor. | Can trigger too early if the trailing distance is too tight. |

| Simple to set and easy to understand on most platforms. | — |

| Works well in volatile markets by following trends and protecting against reversals. | — |

Trailing Stop Limit — Pros & Cons

| Advantages | Disadvantages |

|---|---|

| Full control over exit price — you specify the minimum/maximum acceptable price. | No execution guarantee — if price gaps beyond the limit, the trade won’t close. |

| Reduces slippage risk compared to market exits. | More complex setup requiring both trailing distance and limit offset. |

| Effective in stable, steady-moving markets. | Not suitable for volatile markets due to possible missed exits. |

Real-World Examples: How Trailing Stops Work in Forex and Stocks

Let’s see how Trailing Stop Loss and Trailing Stop Limit orders behave in real trading conditions, both in Forex and Stock markets.

Forex Example: EUR/USD Trade

A trader opens a buy position on EUR/USD at 1.1000, expecting it to rise.

- Trailing Stop Loss (30 pips)

- The stop price automatically moves up as EUR/USD climbs.

- When the price reaches 1.1100, the stop level trails to 1.1070.

- If the market suddenly reverses, the order executes at the next available price ensuring exit, even if slippage occurs.

- The stop price automatically moves up as EUR/USD climbs.

- Trailing Stop Limit (30 pips with 10-pip limit offset)

- The stop activates at 1.1070, but a limit order is placed at 1.1060.

- If the price falls rapidly to 1.1050, the order remains unfilled because the limit was missed potentially leading to more loss.

- The stop activates at 1.1070, but a limit order is placed at 1.1060.

Stock Example: Tesla (TSLA)

A trader buys TSLA at $200 aiming for a short-term breakout.

- Trailing Stop Loss (5%)

- The stop automatically trails 5% below the current market price.

- If TSLA climbs to $220, the stop moves to $209.

- A drop below $209 triggers an immediate market exit.

- The stop automatically trails 5% below the current market price.

- Trailing Stop Limit (5% with 1% offset)

- Stop triggers at $209, but a limit order at $207.8 is placed.

- If the stock falls sharply to $205, the order is skipped meaning no execution and potential deeper loss.

- Stop triggers at $209, but a limit order at $207.8 is placed.

Best Practices for Using Trailing Stops Effectively

To maximize profits and protect capital, traders must configure Trailing Stop Loss and Trailing Stop Limit orders strategically.

Below are the best practices for setting them up effectively across different market conditions.

1. Choose the Right Trailing Distance

- If your trailing distance is too tight, the order may trigger prematurely on small pullbacks.

- If it’s too wide, you might give back too much profit before the order activates.

2. Adjust Your Trailing Stop with Market Volatility

Market volatility changes constantly so your trailing setup should adapt too.

- Use indicators like ATR (Average True Range) to calculate ideal trailing distances.

- A dynamic stop ensures protection during high volatility and flexibility in calm markets.

3. Combine with Technical Levels

- Place trailing stops beyond key support/resistance zones to prevent false triggers.

- For example, if support is at 1.1050, setting a trailing stop at 1.1040 reduces premature exits.

4. Backtest Your Strategy First

Before applying trailing stops to live trades, test on demo accounts to analyze how your strategy performs under different market conditions. This ensures your trailing mechanism aligns with your trading plan and risk appetite.

5. Don’t Rely Solely on Automation

While trailing orders are helpful, traders should still monitor open positions especially during news releases or major market events. Sudden volatility can cause gaps that affect both stop types differently.

Final Thoughts on Trailing Stop Loss vs Trailing Stop Limit

Choosing between a trailing stop loss and a trailing stop limit ultimately comes down to your trading priorities, certainty of exit vs. control over price. A trailing stop loss is ideal for fast, volatile markets where securing profits and ensuring execution is critical, even if it means accepting slippage. On the other hand, a trailing stop limit gives you more control over the exit price, but with the trade-off that your order might not fill if the market gaps or moves too quickly.

Both tools are invaluable for locking in gains and managing risk automatically, but the key is setting the right trailing distance and limit offset based on volatility and strategy. When supported by platforms that offer smooth order execution and low trading costs, like Defcofx, trailing tools can help traders stay dynamic and react strategically to market moves without needing to monitor every tick.

Open a Trading Live AccountFrequently Asked Questions (FAQs)

A trailing stop loss becomes a market order when triggered, guaranteeing execution but not the exact price. A trailing stop limit becomes a limit order, allowing you to control the minimum (or maximum) price, but execution is not guaranteed if the market skips that price.

For Forex, a Trailing Stop Loss is generally better because the market moves fast, and guaranteed execution protects profits during volatility. A Trailing Stop Limit is better suited for calm or predictable market conditions.

It depends on volatility and strategy.

For major Forex pairs: 30–50 pips.

For stocks: 3–5% below the current price.

Use volatility indicators like ATR (Average True Range) for accuracy.

Trailing Stop Loss: Executes at the next available price (even with slippage).

Trailing Stop Limit: Might not execute if the gap skips your limit price, leaving your position open.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.

- New York Session Forex Pairs List

- Best Currency Pairs to Trade During London Session

- How Much is 0.5 Lot Size in Dollars

- Best Time To Trade NZD/USD

- Why is Yen so Weak?

- Is NZD/USD a Major or Minor Pair?

- Trailing Stop Limit: Definition, Uses & Trading Guide

- When Does a Bearish Market Become Bullish in Forex?

- Lower Currency Value: Causes, Effects & Trading Insights