The 4-week rule in forex is a breakout strategy where traders buy when the price surpasses the highest high of the last four weeks and sell when it breaks below the lowest low of the same period. It helps capture early trends using price action alone; no indicators are needed.

Key Takeaways

- Buy Signal: When price breaks above the highest high of the past 4 weeks

- Sell Signal: When price falls below the lowest low of the past 4 weeks

- Entry Logic: Based on breakout momentum, not indicators

- Exit Strategy: Can use opposite breakout, fixed target, or trailing stop

- Ideal For: Trend-following traders in strong directional markets

Understanding the 4-Week Rule in Forex Trading

The 4-week rule is a classic trend-following method first popularized by Richard Dennis and the Turtle Traders. The logic is simple: if price can break above or below a 20-day range, it may be the start of a trend. This makes the rule especially helpful for traders who prefer price action over indicators.

This breakout technique uses raw market structure, no fancy algorithms, and no oscillators, just highs and lows. It’s based on the idea that markets that break out of tight ranges often continue in that direction.

How Traders Apply the 4-Week Breakout Strategy

To apply the 4-week rule in forex:

- Step 1: Look back over the last 20 trading days (about 4 weeks)

- Step 2: Identify the highest high and lowest low during that time

- Step 3: Buy if price closes above the 4-week high and sell if price closes below the 4-week low

- Step 4: Use proper risk management and set stop losses, often 1 ATR below/above the breakout point

Strengths and Limitations of the 4-Week Rule

The 4-week rule remains popular because of its simplicity, trend-following nature, and historical performance in breakout strategies. However, like any trading method, it has both advantages and drawbacks that traders need to weigh before relying on it in live markets.

Strengths of the 4-Week Rule Strategy

Trend-Catching Power

The biggest advantage of the 4-week rule is its ability to identify strong price trends early. When price breaks out of a 4-week range, it often signals a shift in market momentum. This allows traders to ride the wave of a new trend before it becomes crowded. In many trending markets, especially after news events or during strong dollar cycles, this rule can capture significant pips.

No Indicators or Laggy Filters

Unlike strategies that rely on MACD, RSI, or moving averages, the 4-week rule is based purely on price action. This makes it clean and easy to implement, especially for beginners who want to avoid indicator overload. You simply need to track highs and lows over a rolling 20-day window.

Time-Tested and Institutional Backing

This method gained fame through Richard Donchian and later the Turtle Traders experiment by Richard Dennis. It has since been adopted by many trend-following systems, hedge funds, and algorithmic trading models. The logic is grounded in market behavior: when price escapes a long range, it often keeps moving.

4 Key Strengths of the 4-Week Rule Strategy

False Breakouts in Sideways Markets

A major weakness of the 4-week rule is that it performs poorly during consolidation phases. In choppy markets, breakouts above or below the 4-week range often reverse quickly, triggering stop losses and producing whipsaws. This is especially risky on low-volatility pairs or when major news is lacking.

No Built-In Exit Strategy:

The rule tells you when to enter, but not when to exit. Traders must create their own exit logic. Some use the opposite 4-week breakout as a reversal signal, while others rely on fixed risk-reward ratios (e.g., 2:1) or trailing stops. This lack of a standardized exit method makes performance dependent on the trader’s skill and discipline.

Lagging Entry During Sharp Moves

Since the breakout only triggers after the 4-week high or low is breached, traders may miss a portion of the move, especially on fast rallies or crashes. This lag can reduce reward-to-risk ratios and make entries less attractive when breakouts are sudden or news-driven.

Not Ideal for All Market Conditions

This strategy works best in strongly directional environments. Applying it in quiet or mean-reverting pairs (e.g., AUD/NZD) can result in low success rates. Traders need to evaluate market context, including overall trend, volatility, and news cycles, before using the rule.

Examples of the 4-Week Rule in Major Currency Pairs

Let’s apply the strategy to some real-world examples:

EUR/USD Example

- Last 20 days high: 1.0950

- Current price: 1.0962 → Breakout triggers a buy trade

- Entry: 1.0962

- Stop loss: 1.0900

- Target: 1.1100 (based on risk-reward ratio)

GBP/USD Example

- Last 20 days low: 1.2600

- Price falls to 1.2580 → Breakout triggers a sell trade

- Entry: 1.2580

- Stop loss: 1.2660

- Target: 1.2400

How the 4-Week Rule Differs from Other Strategies

While most traders use indicators like RSI or MACD, the 4-week rule ignores indicators entirely. It gives priority to pure price structure, which makes it easier to implement and harder to over-optimize.

Compared to:

- RSI strategy: Relies on overbought/oversold zones

- MACD crossover: Uses lagging signals

- Moving average systems: Smoother, but slower

The 4-week rule is crisper and ideal for traders who believe in market structure and trend strength.

Final Thoughts: What is the 4-Week Rule in Forex

So, what is the 4-week rule in forex? It’s a simple breakout method: buy when the price breaks the 4-week high, and sell when it breaks the 4-week low. While basic, it works well in trending markets and avoids indicator clutter.

However, success depends on discipline, market conditions, and proper exits. And with the right tools like low spreads, fast execution, and tight risk, you can explore strategies like these more effectively. Defcofx provides just that: global access, up to 1:2000 leverage, and no hidden fees.

Ready to test breakout strategies in a real trading environment? Trade smarter with Defcofx.

Open a Live Forex Trading AccountFAQs

Yes, it can be, especially in trending markets. It helps capture early breakouts with clear logic. But in sideways markets, it may produce false signals. Success depends on discipline, not just the rule itself.

The rule is often attributed to Richard Donchian and was used by the famous Turtle Traders led by Richard Dennis. It’s one of the oldest and most respected breakout methods in trading.

Absolutely. Its simplicity makes it a good choice for new traders. But beginners should still backtest the rule, use stop-losses, and avoid overleveraging.

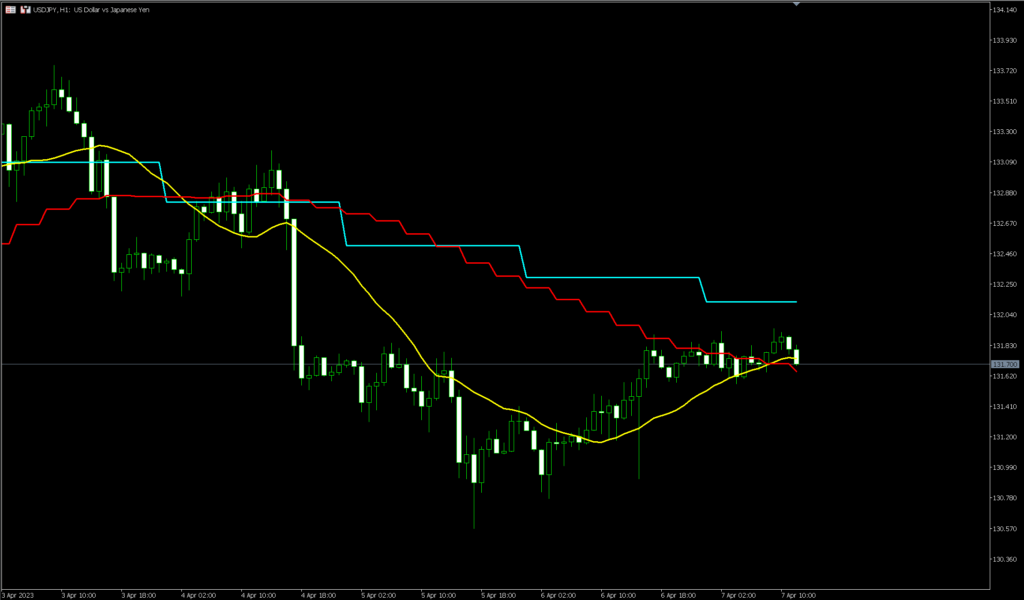

It works best on major pairs with strong volume and clearer trends like EUR/USD, GBP/USD, and USD/JPY. Fewer liquid pairs may produce inconsistent breakouts.

Traders exit using opposite breakouts, fixed reward targets, or trailing stops. For example, if you buy on a 4-week high, you may sell if the price hits the 4-week low again or reaches your risk-reward target.

Yes. Donchian Channels are based on the same idea: tracking the highest high and lowest low over a set number of days. The 4-week rule is essentially a simplified Donchian breakout.

Yes, especially those who trade mechanically or with systematic trend-following methods. Many hedge funds and prop firms have used this rule as part of larger systems due to its logical simplicity.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.