The trading week kicks off with major currency pairs showing mixed early signals on the heels of last week’s central bank headlines. Ahead of key economic data and Fed/RBA meeting minutes, the charts for USD/CAD, GBP/USD, and AUD/USD offer clues on short-term direction. We look at Monday’s 5-minute charts (provided) for technical patterns, then consider the macro drivers from rate bets to commodity swings that could sway each pair.

USD/CAD

Technical Analysis

USD/CAD 5-minute chart (Nov 24, 2025). The pair has traced a gentle upchannel with higher lows. The latest candles show support around the 1.4080 area and resistance near 1.4150. A recent pullback found buyers (notice the bullish engulfing bar at support), signaling continuation of the minor uptrend. Overall, the pattern is mildly bullish as each dip is bought, but traders will watch for a clear break above 1.4150 to sustain upside momentum.

Fundamental Analysis

On the fundamentals side, USD/CAD is straddling two forces. Oil prices are a key factor – a rally in crude would strengthen the loonie and cap USD/CAD, whereas any oil pullback would favor the dollar. As of late 2025, oil has been relatively firm, so that could lend some CAD support. Interest rate outlooks also matter: the U.S. Fed has signaled a “higher-for-longer” stance, keeping the USD supported, while the Bank of Canada may be closer to the end of its hiking cycle. This policy divergence tends to keep USD/CAD elevated unless Canadian data or commodity prices shift. In sum, look for moves in U.S. yields and oil/commodity prices to dictate the pair’s short-term trend.

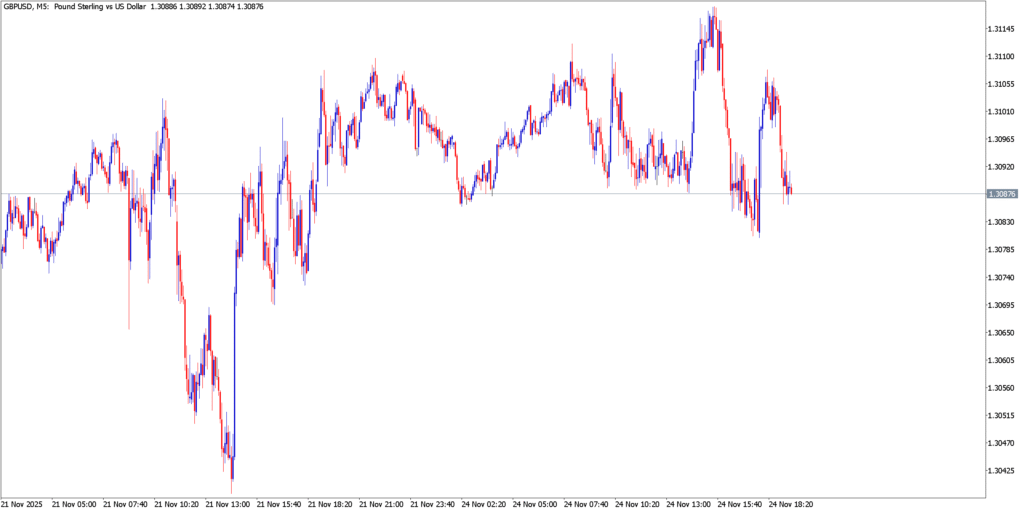

GBP/USD

Technical Analysis

GBP/USD 5-minute chart (Nov 24, 2025). The pair is trading in a tight range near the 1.2300 mark. Price has dipped to around 1.2250 support multiple times and capped out near 1.2350. Recent candles show lower highs and a few indecisive dojis, suggesting bearish pressure but without a decisive breakdown yet. A break below 1.2250 could open the path to the next support, while moving above 1.2350 may shift the bias back toward the upside. For now, traders note the sideways chop and watch for a breakout from this narrow band.

Fundamental Analysis

Fundamentally, the British pound remains weighed down by a slower UK economy compared to the U.S. Inflation in the UK has been cooling, and the Bank of England is seen as cautious (even hinting at future rate cuts if growth falters). In contrast, the Fed’s strong stance on inflation gives the USD an edge. This interest-rate gap tends to keep GBP/USD on the back foot. Geopolitical factors – such as trade ties, post-Brexit adjustments, or any UK political news – can add volatility, but absent big surprises, sterling’s outlook is mixed-to-weak. Any upbeat UK data or a dovish Fed surprise could lend GBP brief support, but the underlying pressure is toward USD strength here.

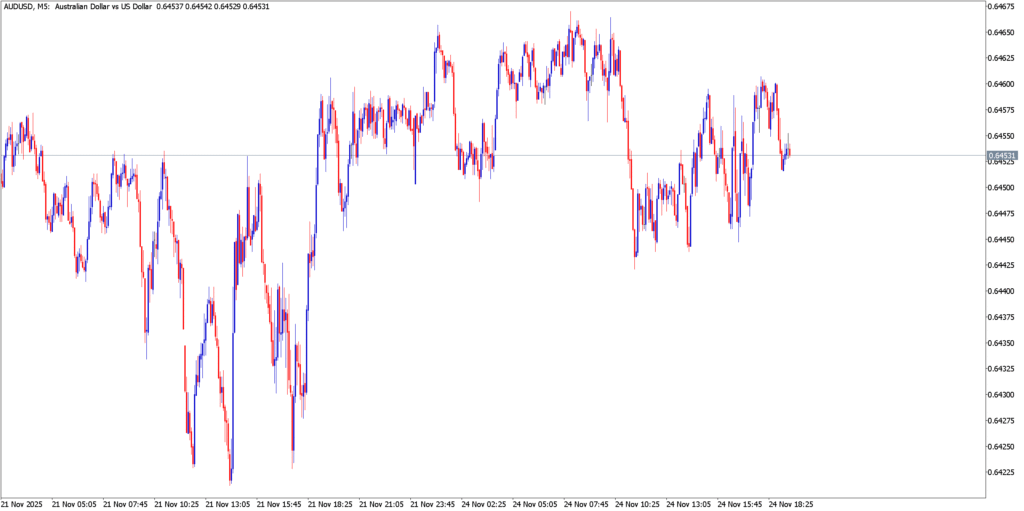

AUD/USD

Technical Analysis

AUD/USD 5-minute chart (Nov 24, 2025). The Australian dollar is showing a mild downtrend from around 0.6830 into the 0.6740 area. The short-term channel slopes lower, with resistance forming near 0.6800. A recent hammer-like candle at 0.6740 suggests buyers are stepping in at that support zone, hinting at a possible bounce. In general the technical picture is slightly bearish – lower lows prevail – but any recovery above 0.6800 would signal a shift. Traders will monitor these levels for a clearer directional bias.

Fundamental Analysis

The AUD/USD pair is largely driven by risk appetite and commodities. China’s economic growth (and its demand for iron ore, coal, etc.) is a key factor; any weakness there tends to hurt AUD. Meanwhile, global risk sentiment matters – if markets turn risk-off, AUD (a pro-cyclical currency) often underperforms. Looking at policy, the Reserve Bank of Australia has been more cautious after a cycle of rate hikes, and if RBA hints at easing sooner than the Fed, AUD may struggle against USD. On the other hand, any surprise in iron ore prices or Chinese stimulus could buoy AUD. As of Nov 24, watch U.S. Treasury yield moves (boosting USD) and any China-related news for cues on AUD/USD.

Market Outlook

In summary, each of these key pairs is balancing technical signals with macro drivers. USD/CAD shows mild bullish momentum but is likely capped by high oil prices; GBP/USD remains choppy as UK fundamentals trail U.S. conditions; AUD/USD tilts slightly bearish under a strong dollar and soft commodity backdrop. Across the board, the overarching theme is U.S. dollar strength into late November – driven by Fed policy and global uncertainty – so traders might stay positioned for USD support. Key levels to watch are 1.4150 on USD/CAD, 1.2250/1.2350 on GBP/USD, and 0.6740/0.6800 on AUD/USD. Upcoming data (U.S. ISM, China PMI, central bank minutes) and any geopolitical news could tip the scales, but for now the market outlook favors cautious, USD-biased trading into this week’s sessions.