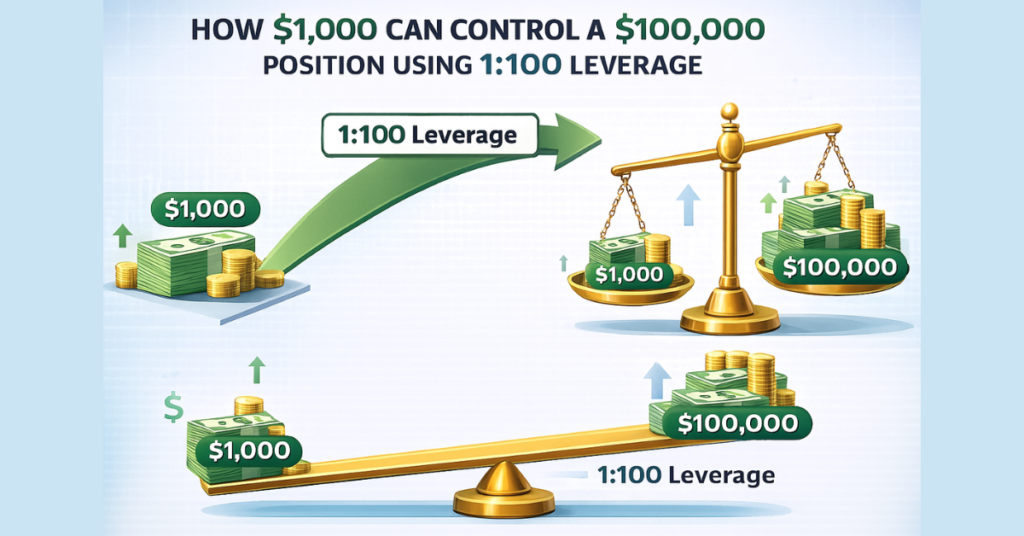

1:100 leverage means a trader can control a position 100 times larger than their actual capital. For example, with $1,000 in margin, you can open trades worth up to $100,000. While leverage increases market exposure, it also magnifies both potential profits and losses.

Key Takeaways

- 1:100 leverage allows traders to control larger positions with a relatively small amount of capital by using margin.

- Both profits and losses are magnified, making risk management essential when using leverage.

- Margin requirements decrease as leverage increases, but this also raises the chance of margin calls.

- 1:100 leverage is commonly used in forex trading, balancing flexibility and risk for many traders.

- Leverage is a tool, not free money; its effectiveness depends on strategy, discipline, and market understanding.

Understanding Leverage in Trading

Leverage in trading refers to using borrowed funds from a broker to increase your market exposure beyond your actual account balance. Instead of paying the full value of a trade, you only commit a small portion of it as margin, while the broker effectively finances the rest.

This mechanism allows traders to participate in larger market movements with limited capital, which is why leverage is especially popular in forex and CFD markets. However, leverage does not change the market itself; it only changes how strongly price movements affect your account. A small price fluctuation can lead to significant gains or losses, depending on how much leverage is applied.

It is important to understand that leverage and margin are closely connected but not the same. Leverage defines how much exposure you can control, while margin is the actual amount of money required to open and maintain a leveraged position. Used correctly, leverage can improve capital efficiency; used carelessly, it can quickly deplete an account.

How 1:100 Leverage Works in Practice

When you use 1:100 leverage, every $1 of your trading capital allows you to control $100 in the market. This doesn’t mean you receive extra money in your account; instead, the broker temporarily increases your buying power so you can open larger positions.

For example, if a trader has $1,000 in their account, 1:100 leverage allows them to open positions worth up to $100,000. The trader only needs to set aside a small portion of that amount as margin, while the rest is covered by the broker. As market prices move, profits and losses are calculated on the full position size, not just the margin used.

This is why 1:100 leverage can feel powerful. A small favorable price movement can produce noticeable gains, but the same logic applies in reverse. Even minor adverse movements can quickly reduce available margin if proper risk controls are not in place.

1:100 Leverage Example (Simple Calculation)

Let’s break down 1:100 leverage with a clear example:

Suppose you have $1,000 in your trading account and open a $100,000 position in EUR/USD using 1:100 leverage.

- Margin required: $1,000 (your actual capital)

- Position controlled: $100,000

- Profit/loss impact: If the currency pair moves 1% in your favor, your gain is $1,000 (100% of your margin). If it moves 1% against you, you lose $1,000, your entire margin.

Margin Requirement With 1:100 Leverage

With 1:100 leverage, the margin required to open a trade is 1% of the total position size. Margin is essentially a security deposit that allows the broker to cover potential losses on your trade.

For example, if you want to trade $50,000 worth of a currency pair:

- Margin needed = $50,000 ÷ 100 = $500

- Your trading capital remains available for other positions or as a buffer against losses.

It’s important to note that while higher leverage reduces the initial capital required, it also increases the likelihood of a margin call if the trade moves against you. A margin call occurs when your account equity falls below the required margin, and the broker may automatically close positions to prevent further losses.

Is 1:100 Leverage High or Low?

1:100 leverage is considered moderate in the world of trading. It is higher than low-leverage options like 1:10 or 1:30, yet lower than extremely high leverage options such as 1:500 or 1:2000, which some brokers offer, like Defcofx. This makes it a balanced choice for traders who want meaningful market exposure without taking on excessive risk.

Comparison with Lower Leverage (1:10, 1:30):

- Low leverage requires more capital to control the same position size, which reduces the risk of large losses but also limits profit potential.

- It is ideal for beginners or conservative traders who prefer slow and steady growth.

Comparison with Higher Leverage (1:500, 1:2000):

- Very high leverage can quickly amplify profits, but the downside risk is extreme. Even minor market movements can wipe out your margin.

- It is typically used by experienced traders who have precise strategies and can actively monitor positions.

Who Typically Uses 1:100 Leverage:

- Intermediate traders who want significant exposure without risking total capital in a single trade.

- Traders in forex and CFD markets where moderate leverage provides flexibility while still allowing reasonable risk management.

- It strikes a balance between capital efficiency and risk exposure, making it a popular default for many brokers.

Advantages of Using 1:100 Leverage

Using 1:100 leverage offers several advantages that make it attractive for traders seeking a balance between capital efficiency and market exposure:

1. Efficient Use of Capital: With 1:100 leverage, you only need 1% of the total trade value as margin. This allows you to control larger positions without tying up your entire account balance, freeing capital for other trades or risk management strategies.

2. Flexibility in Position Sizing: Moderate leverage enables traders to take positions that match their strategy, whether opening multiple smaller trades or a single larger position. It provides the flexibility to adjust trade sizes according to market conditions and personal risk tolerance.

3. Potential for Higher Returns: Profits are calculated on the full position size, not just your margin. Even small favorable market moves can generate meaningful returns compared to trading without leverage.

4. Commonly Available for Forex Trading: Many brokers offer 1:100 leverage as a standard option, making it accessible for most retail traders. It is widely regarded as beginner-friendly yet powerful enough for intermediate traders.

5. Balance Between Risk and Reward: Compared to extremely high leverage like 1:500 or 1:2000, 1:100 offers a reasonable chance of profit amplification while keeping the risk more controllable.

Risks of 1:100 Leverage You Must Understand

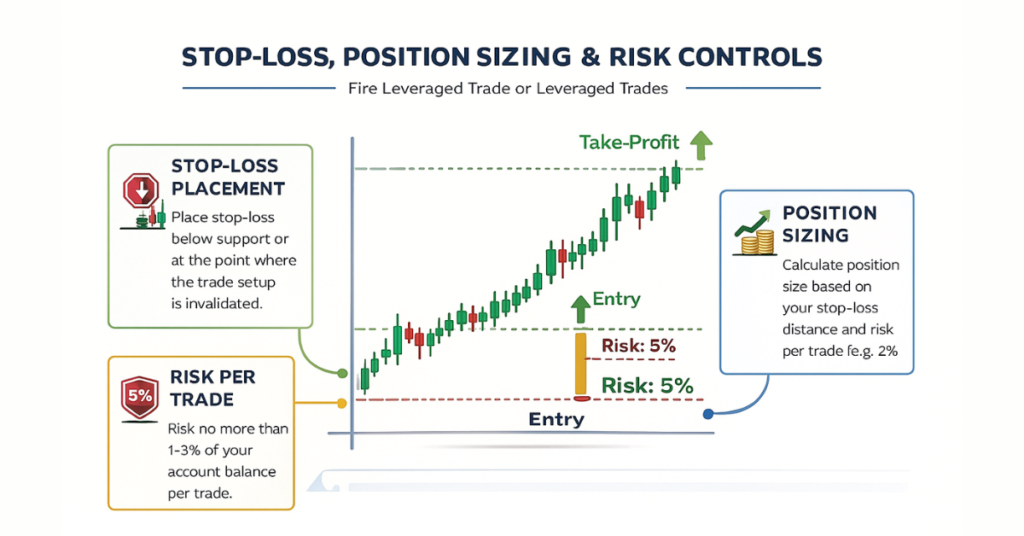

While 1:100 leverage can amplify profits, it also magnifies potential losses, making risk management essential. Traders must understand that even small market fluctuations can significantly impact account equity, especially if positions are not carefully sized.

Key Risks Include:

1. Loss Amplification: With 1:100 leverage, a 1% adverse move on a $100,000 position can wipe out your $1,000 margin. Without proper stop-losses or protective measures, losses can accumulate rapidly.

2. Margin Calls and Liquidation: If account equity drops below the required margin, brokers may issue a margin call or automatically close positions to prevent further losses. This can result in unexpected losses even for disciplined traders.

3. Emotional Pressure: High leverage can intensify emotional decision-making. Fear or greed may lead to overtrading or holding losing positions too long, further increasing risk exposure.

- Brokers like Defcofx offer high leverage options up to 1:2000, giving traders flexibility beyond 1:100 while maintaining margin efficiency.

- Traders also benefit from fast support and withdrawals within 4 business hours, which is crucial if quick adjustments or position closures are needed.

Who Should Use 1:100 Leverage?

1:100 leverage is suitable for traders who want meaningful market exposure while maintaining a manageable risk profile. It is not too aggressive like ultra-high leverage but provides more flexibility than very low leverage.

Ideal Users Include:

1. Intermediate Traders: Traders with some market experience can use 1:100 leverage to enhance profits while applying disciplined risk management strategies. They understand how margin works and can monitor positions effectively.

2. Traders in Forex and CFDs: Since forex markets often have smaller daily movements, 1:100 leverage allows traders to capitalize on minor fluctuations without committing excessive capital.

3. Risk-Conscious Traders: Those who want moderate exposure without over-leveraging can benefit from 1:100. It balances opportunity and safety compared to extreme leverage ratios.

4. Strategic Position Sizing: Traders who plan to diversify across multiple positions can use 1:100 leverage to maintain sufficient margin for each trade, reducing the risk of margin calls.

Open a Trading Live Account1:100 Leverage in Forex Trading

In forex trading, 1:100 leverage is one of the most commonly offered ratios because it provides a balanced mix of opportunity and risk. Forex markets are highly liquid and often have small daily price movements, making moderate leverage like 1:100 suitable for capturing meaningful gains without excessive exposure.

Why Traders Use 1:100 Leverage in Forex:

- Amplifies potential returns: Small currency price movements can yield significant profits when using leverage.

- Capital efficiency: Traders can open larger positions without tying up their entire account balance.

- Flexibility: It allows traders to diversify across multiple currency pairs without exhausting their margin.

How Brokers Like Defcofx Handle Leverage Options

Brokers like Defcofx offer a range of leverage options, including 1:100 leverage, to accommodate different trading strategies and risk profiles. This flexibility allows traders to choose the right leverage ratio based on their experience, capital, and market goals.

Key Features and Advantages:

1. Flexible Leverage Options

- Traders can start with moderate leverage like 1:100 and scale up to higher leverage options, up to 1:2000, if they understand the risks and have sufficient experience.

- This flexibility allows both beginners and advanced traders to tailor leverage to their strategy.

2. Low Trading Costs

- No commissions or swap fees and spreads starting from 0.3 pips make leveraged trading more cost-efficient.

- Lower trading costs mean traders can retain more profits while using leverage.

3. Global Access and Ease of Use

- Defcofx has a global reach, welcoming clients from all countries with multiple language options.

- This ensures traders worldwide can access leveraged trading and educational resources easily.

4. Fast Support and Withdrawals

- Withdrawals are processed within 4 business hours, including weekends, giving traders confidence to manage leveraged positions efficiently.

- Support teams assist with leverage setup, margin calculations, and risk management guidance.

Final Thoughts on What Does 1:100 Leverage Mean?

1:100 leverage is a versatile and widely used trading ratio that balances opportunity and risk. It allows traders to control larger positions with a relatively small amount of capital while still keeping risks manageable compared to ultra-high leverage options.

Proper understanding of margin, risk management, and trading discipline is essential. Traders should always use stop-loss orders, monitor their positions carefully, and adjust leverage according to experience and market conditions.

FAQs About 1:100 Leverage

1:100 leverage is moderate and generally considered safe for traders who apply proper risk management. While it amplifies profits, it can also increase losses, so stop-losses and disciplined position sizing are essential.

Beginners can use 1:100 leverage, but it is recommended to start with smaller positions and demo accounts to understand how leverage affects profits and losses before committing significant capital.

The margin required is 1% of the total position size. For example, to open a $50,000 trade, you only need $500 in your account as margin.

It depends on your risk tolerance. 1:100 provides a balanced approach with moderate risk, while 1:500 can yield higher profits but comes with significantly higher risk of losses.

Higher leverage reduces the margin required but increases the likelihood of margin calls if the market moves against your position. Proper monitoring and risk management help prevent forced liquidations.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.

- Cease Trade Order Definition

- What Is Swap on MT4?

- How Many Trading Days in a Year?

- What Are Currency Controls? Definition, Types & Examples

- Best Currency Pairs to Trade During London Session

- How Much is 0.5 Lot Size in Dollars

- List of Major and Minor Forex Pairs

- What Is Considered the Greatest Risk Associated With Forex Settlement?

- Is NZD/USD a Major or Minor Pair?

- Trailing Stop Limit: Definition, Uses & Trading Guide