The best currencies to trade depend on the forex session. EUR/USD and GBP/USD are ideal during the London/New York overlap. USD/JPY is most active during the Tokyo session. Timing your trades with session volatility gives you tighter spreads, more liquidity, and better setups, especially when trading with a broker like Defcofx.

Key Takeaways

- Forex trading runs 24 hours, split into four main global sessions.

- Major currency pairs move most when their home markets are open.

- The London and New York overlap (8 AM to 12 PM EST) is the most volatile window.

- Trading session timing boosts trade accuracy and lowers slippage.

- Defcofx offers low-latency trading across all major pairs with tight spreads during peak hours.

Overview of Forex Trading Sessions

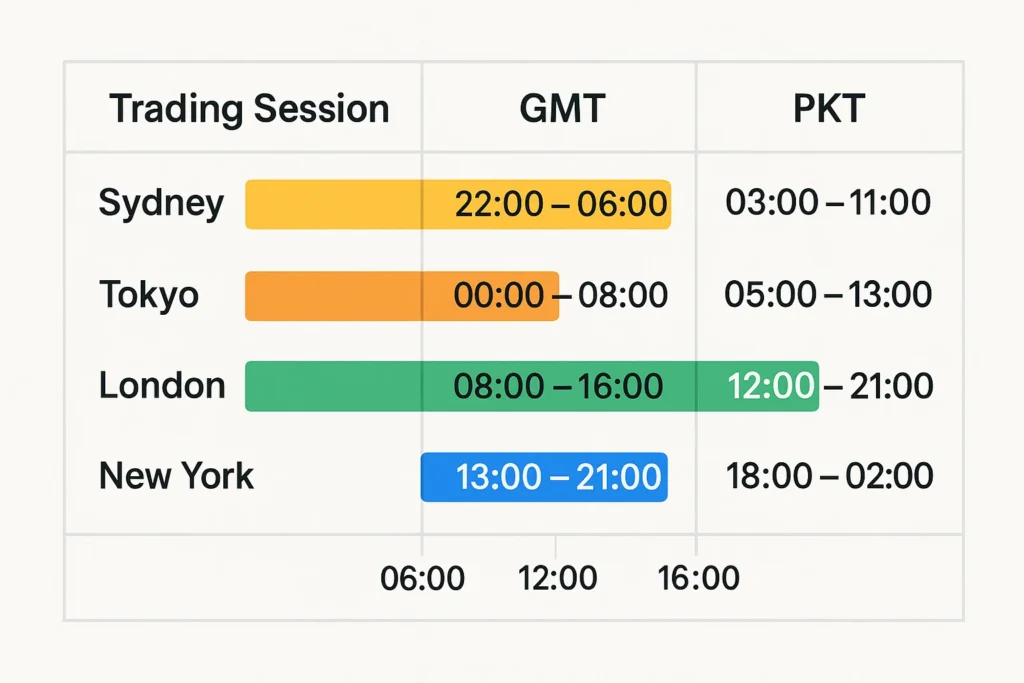

The global forex market operates across different time zones.

Here are the 4 major sessions in Eastern Standard Time (EST):

| Session | Time (EST) | Characteristics |

| Sydney | 5:00 PM – 2:00 AM | Quiet, sets early tone for the week |

| Tokyo (Asia) | 7:00 PM – 4:00 AM | Active for JPY pairs, modest volatility |

| London (Europe) | 3:00 AM – 12:00 PM | High liquidity, EUR & GBP movements |

| New York (US) | 8:00 AM – 5:00 PM | USD volatility peaks, overlaps with London |

The best currencies to trade change depending on which session is active. Understanding this timing can help you catch bigger moves with smaller spreads.

Best Currencies by Trading Session

1. Asian Session (Tokyo)

Time: 7:00 PM – 4:00 AM EST

Top Currencies:

- USD/JPY

- EUR/JPY

- AUD/JPY

- NZD/JPY

The Tokyo session is dominated by the Japanese Yen and its cross pairs. Traders can expect slower movement compared to London or New York, but still enough volatility for scalping and short-term trades. Defcofx offers ultra-low spreads on JPY pairs, making it a great choice for this session.

2. London Session

Time: 3:00 AM – 12:00 PM EST

Top Currencies:

- GBP/USD

- EUR/USD

- EUR/GBP

- GBP/JPY

The London session is the most liquid and volatile. Most economic data from Europe and the UK is released during this time. Major trends often form here. Swing traders and scalpers alike benefit from the movement of euro and pound pairs.

3. New York Session

Time: 8:00 AM – 5:00 PM EST

Top Currencies:

- EUR/USD

- GBP/USD

- USD/CHF

- USD/CAD

With Wall Street opening and US economic news flooding the market, volatility is high. USD-related pairs are most active. Trading the London/New York overlap (8 AM – 12 PM EST) offers prime setups with high liquidity and tight spreads, perfect for day trading with Defcofx.

4. Sydney Session

Time: 5:00 PM – 2:00 AM EST

Top Currencies:

- AUD/USD

- NZD/USD

- AUD/JPY

This session kicks off the trading week on Sunday evening in EST. While volume is low, it’s useful for traders watching for early-week gaps or positioning into the Tokyo session. Spreads may widen, so trading with a broker like Defcofx that provides stable pricing is crucial.

Session Overlap

The London/New York overlap (8:00 AM – 12:00 PM EST) is considered the most volatile period in forex. Here’s why:

- Two of the largest financial centers are active.

- High-impact economic releases (NFP, CPI, etc.).

- Massive institutional volume.

Top pairs to trade during this window:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CAD

Traders using Defcofx during this time benefit from razor-sharp spreads and fast execution—key factors when split-second decisions matter.

Matching Currency Volatility with Strategy

| Strategy Type | Best Session | Ideal Pairs |

| Scalping | London/New York Overlap | EUR/USD, GBP/USD |

| News Trading | New York Session | USD/CAD, USD/JPY |

| Swing Trading | London Session | EUR/GBP, GBP/JPY |

| Range Trading | Tokyo Session | AUD/JPY, NZD/USD |

Defcofx gives you the tools to succeed during any session. Real-time pricing, zero re-quotes, raw spreads, and platform stability. Trade the right currency at the right hour, confidently.

Open AccountFinal Thoughts

Knowing the best currencies to trade at what time gives you an edge in the forex market. By syncing your trades with regional sessions, you gain access to better liquidity, cleaner setups, and fewer trading mistakes.

Whether you’re scalping the overlap or swing trading trends, understanding timing is just as important as reading a chart. And with a trusted broker like Defcofx, you’re equipped to make the most of every hour the market gives you.

Open a Live Trading AccountFAQs

What is the best time to trade EUR/USD?

The best time to trade EUR/USD is during the London and New York sessions, especially between 8 AM and 12 PM EST. This is when both markets are open, and volume is at its highest, ideal for capturing volatility and liquidity.

Which currency pairs are most volatile during the Tokyo session?

During the Tokyo session, pairs like USD/JPY, AUD/JPY, and NZD/JPY are most volatile. These reflect regional economic activity and can show reliable movement during Asian hours, particularly for short-term strategies.

Is it good to trade during the Sydney session?

The Sydney session is generally the least volatile, especially on Sunday evenings when the market reopens. However, it’s useful for setting positions or catching early-week gaps. Avoid high-frequency trading unless your broker offers tight spreads like Defcofx does.

What is the best session for swing trading?

Swing trading works well during the London session when trends begin forming. EUR/USD, GBP/JPY, and USD/CHF offer good movement and follow-through for multi-day setups, especially if you’re managing trades part-time.

Can I trade any pair at any time?

Technically yes, but not all pairs are active in every session. Trading EUR/USD during the Tokyo session might result in slow movement. For better execution and tighter spreads, trade pairs that are regionally active. Defcofx helps optimize this with smart execution tools.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.

- Cease Trade Order Definition

- What Is Swap on MT4?

- How Many Trading Days in a Year?

- What Are Currency Controls? Definition, Types & Examples

- Best Currency Pairs to Trade During London Session

- How Much is 0.5 Lot Size in Dollars

- List of Major and Minor Forex Pairs

- What Is Considered the Greatest Risk Associated With Forex Settlement?

- Is NZD/USD a Major or Minor Pair?

- Trailing Stop Limit: Definition, Uses & Trading Guide