The first trading day of 2026 brought high drama and unexpected market moves. A daring U.S. raid captured Venezuela’s president over the weekend, but instead of sparking a sustained flight to safety, global markets opened risk-on. Stocks jumped and oil briefly spiked, while the U.S. dollar initially firmed then quickly reversed lower. Traders looked past geopolitical tensions and refocused on looming economic catalysts – most notably this week’s U.S. jobs report – leading to a broad retreat in the dollar by Monday’s close. Against this backdrop, major currency pairs experienced sharp reversals: the British pound surged on upbeat UK data, the yen strengthened on hawkish signals from Tokyo, and even commodity-linked currencies outperformed as optimism trumped fear.

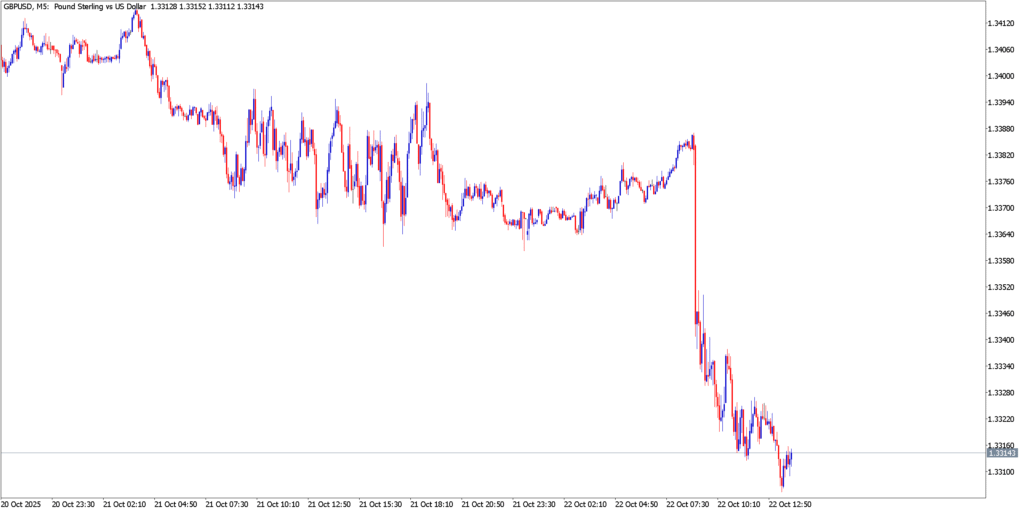

GBP/USD

Technical Analysis

Cable (GBP/USD) exploded upward, rising from an early low near the $1.3400 area to pierce the $1.3500 threshold by the New York session. The bullish reversal broke above a key resistance zone around $1.3500, turning it into immediate support. Short-term momentum indicators point upward as the pair trades well above its 50-day moving average, reflecting a fresh uptrend. With bulls in control, GBP/USD is eyeing the next resistance around $1.3580 (a level not seen since mid-September). Any pullback may find support at $1.3400, the launch-point of today’s rally, with deeper support around $1.3350 if a correction unfolds.

Fundamental Analysis

The British pound was Monday’s standout performer, bolstered by both domestic data and broad dollar softness. Early in the London session, stronger-than-expected UK financial data (including a jump in consumer credit and lending figures) signaled resilience in household spending. This gave sterling a boost, reinforcing speculation that the Bank of England might stay cautious on any further rate cuts. Meanwhile, the U.S. dollar’s safe-haven bid faded rapidly as markets shrugged off the Venezuela saga. With traders anticipating a stable Federal Reserve outlook – and even entertaining rate-cut bets for later in the year – the dollar lost steam, allowing GBP/USD to climb aggressively. By day’s end, the pound’s rally reflected a confident risk appetite and positioning ahead of key U.S. data, with sterling sentiment turning optimistic as long as UK fundamentals remain steady.

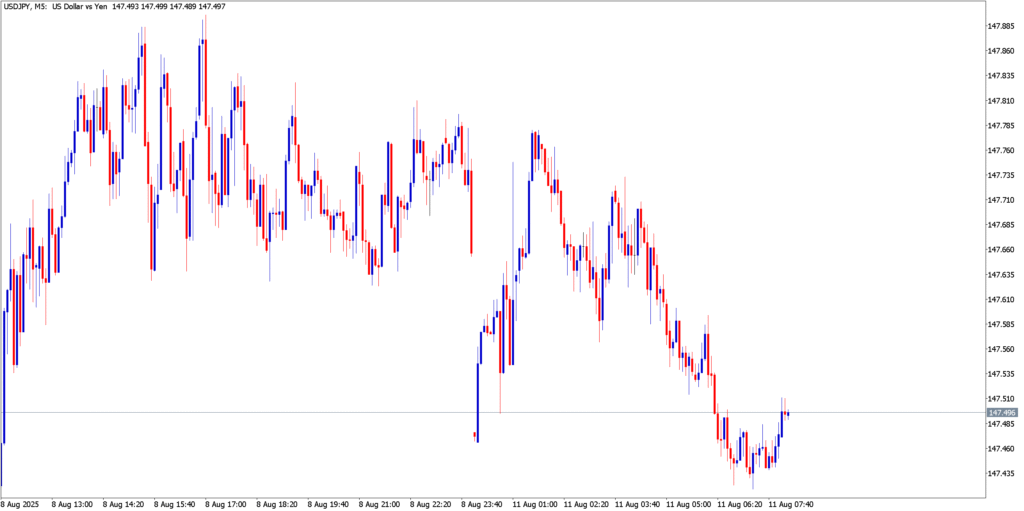

USD/JPY

Technical Analysis

The USD/JPY pair flipped from bullish to bearish intraday, dropping from highs near ¥157.0 down into the mid-¥156s. Early in the session, dollar-yen attempted to extend last week’s uptrend, but it stalled just below recent peak levels. A swift reversal sent the pair below its short-term moving averages on intraday charts, indicating a loss of upside momentum. The retreat found tentative support around ¥156.0, which roughly aligns with a minor swing low and psychological level. If that floor gives way, USD/JPY could test the next support near ¥155.5. On the upside, any rebound will face resistance at ¥157.0, the session high and a barrier reinforced by last week’s highs. The pair’s failure to break higher suggests momentum has shifted, with technical signals hinting at a potential near-term topping pattern as the yen strengthens.

Fundamental Analysis

The Japanese yen caught a broad bid on Monday, aided by both global and local factors. As the market’s risk aversion faded, traditional safe-haven demand for the U.S. dollar ebbed, removing a pillar of support for USD/JPY. Traders who had initially bought dollars on the Venezuela news unwound those positions once it became clear that the geopolitical risk was contained. Simultaneously, hawkish undertones from the Bank of Japan added fuel to yen strength. BOJ Governor Kazuo Ueda reiterated that the Bank will continue raising interest rates if economic conditions align with forecasts – a striking stance as Japan shifts away from decades of ultra-easy policy. This signaled to markets that Japanese yields may rise further, boosting the yen’s appeal. In contrast, U.S. data on Monday showed manufacturing still in contraction (the ISM PMI hit a 14-month low), reinforcing the view that the Fed will hold rates steady or even ease later in the year. The result was a double tailwind for the yen, sending USD/JPY lower despite an early dollar uptick. Going forward, traders will watch if the yen’s strength persists, especially with U.S. bond yields softening and the BOJ sounding more confident about tightening – factors that could keep USD/JPY under downward pressure.

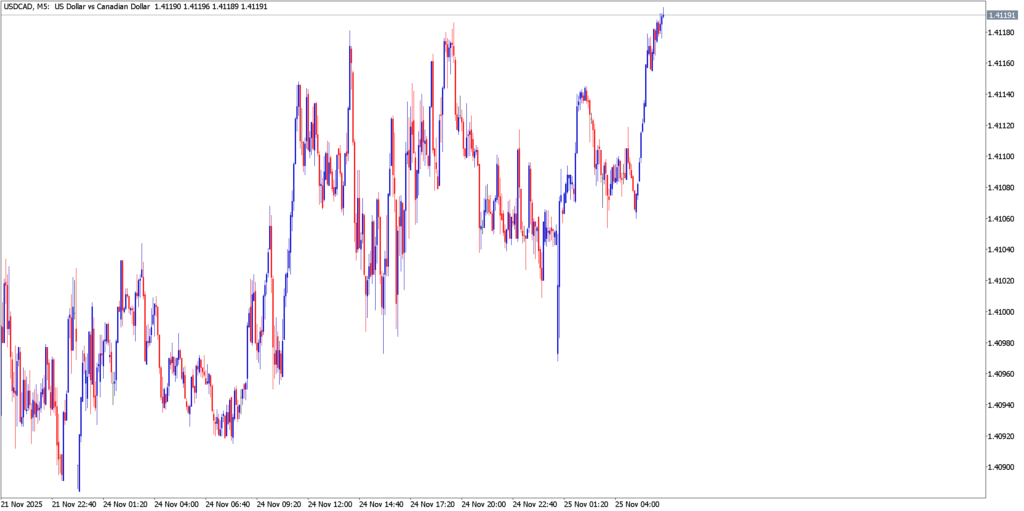

USD/CAD

Technical Analysis

USD/CAD edged higher on Monday, with the U.S. dollar gaining modest ground against the Canadian dollar. The pair bounced off support in the mid-C$1.26 range (formed after last week’s sharp dip) and climbed back above the C$1.2700 handle during the U.S. session. This recovery rally, while limited, suggests a short-term bottom may have formed around 1.2650–1.2700, a zone reinforced by previous lows. On the charts, USD/CAD’s move above 1.2700 brings the next resistance into focus near C$1.2770 (a level of recent consolidation and a possible 50-day average region). If bullish momentum continues, the pair could even retest the C$1.2850 area, which marks a larger inflection point from December. On the downside, initial support remains at C$1.2680 (Monday’s intraday floor), with stronger support at C$1.2600 should the pair reverse lower. The mild uptick in USD/CAD has so far lacked big momentum, but a break of these noted levels could ignite a more decisive trend.

Fundamental Analysis

The U.S. dollar’s retreat was not uniform on Monday – notably, it managed to rise slightly against the Canadian dollar, making USD/CAD an outlier among major pairs. The Canadian dollar underperformed even as overall market sentiment improved. Part of the hesitation on the loonie (CAD) came from the weekend’s Venezuela development, which introduced uncertainty about future oil supply. Canada’s economy is heavily tied to oil exports, and traders contemplated that a U.S.-led effort to boost Venezuelan oil production (following President Maduro’s capture) might add supply and dampen oil prices in the long run. In early trading, oil prices did jump on geopolitical shock, but they soon stabilized; however, the mere prospect of increased output down the road weighed on petro-currency sentiment. At the same time, Canada had little in the way of major data to shift the narrative on Monday, so USD/CAD followed the dollar’s intraday swings. Initially, the pair dipped when the greenback weakened globally, but it rebounded as some investors sought safety in USD relative to CAD given the oil news uncertainty. Essentially, while other currencies climbed on the dollar’s pullback, the loonie lagged, resulting in a gentle USD/CAD rise. Going forward, traders will monitor actual developments in oil markets and upcoming Canadian economic readings – any sign of firming oil demand or upbeat domestic data could rekindle CAD strength, whereas further U.S. dollar resilience or geopolitical supply moves might keep USD/CAD supported.

Market Outlook

As markets head into Tuesday’s session, the overall tone is cautiously optimistic. Monday’s impressive resilience – shrugging off a geopolitical shock – suggests traders are more fixated on economic cues than on one-off events. The U.S. dollar enters Tuesday on the back foot, and the question is whether it will extend its decline or find footing. A raft of service-sector PMI releases is slated for the next 24 hours globally, with particular focus on the U.S. ISM Services PMI mid-week. If the services side of the economy echoes the weakness seen in manufacturing, it could reinforce bets that the Fed will stay dovish, potentially keeping the dollar under pressure. On the flip side, any upside surprises in growth data may remind traders not to get too bearish on the greenback. Geopolitically, attention will linger on follow-ups to the Venezuela operation, but absent any escalation, its market impact appears to be fading fast. Overall, the bias favors a continued risk-on mood heading into Tuesday: equities are at highs, and high-beta currencies like the pound, Aussie, and kiwi have momentum on their side. However, volatility could tick higher as the week’s key events (like the U.S. jobs report on Friday) draw nearer. Traders will be positioning carefully, knowing that sentiment can shift quickly – but for now, the path of least resistance seems to be further dollar softness and strength in its major counterparts, barring any surprise news.

Discover More Other Forex Reports with Defcofx

Explore more of our latest forex market insights and stay ahead with timely analysis from Defcofx:

- Dollar on the Ropes as Risk Rally Roars

- Dollar Softens as New Year Flows Settle – 15 January 2026

- Yen Weakness Dominates as CPI Keeps Caution

- Dollar Stabilizes After CPI as USD Pairs Consolidate

- Dollar Trades Firm as Data Fails to Shift Fed Outlook

Dive deeper into these reports to understand key currency movements and what they mean for your trading decisions.