Wednesday’s forex session was marked by a stabilization in the US dollar, as markets fully absorbed the implications of December’s inflation data and shifted focus toward forward-looking policy expectations. After the sharp reactions earlier in the week, price action across major USD pairs slowed, signaling a transition from reactive trading into consolidation.

US Treasury yields held relatively steady, reinforcing the idea that the Federal Reserve is under no immediate pressure to accelerate rate cuts. This supported the dollar broadly, though without triggering aggressive upside momentum. As a result, most USD pairs traded in controlled ranges rather than trending decisively. The session reflected a market recalibrating rather than reversing, with traders increasingly selective ahead of upcoming macro releases.

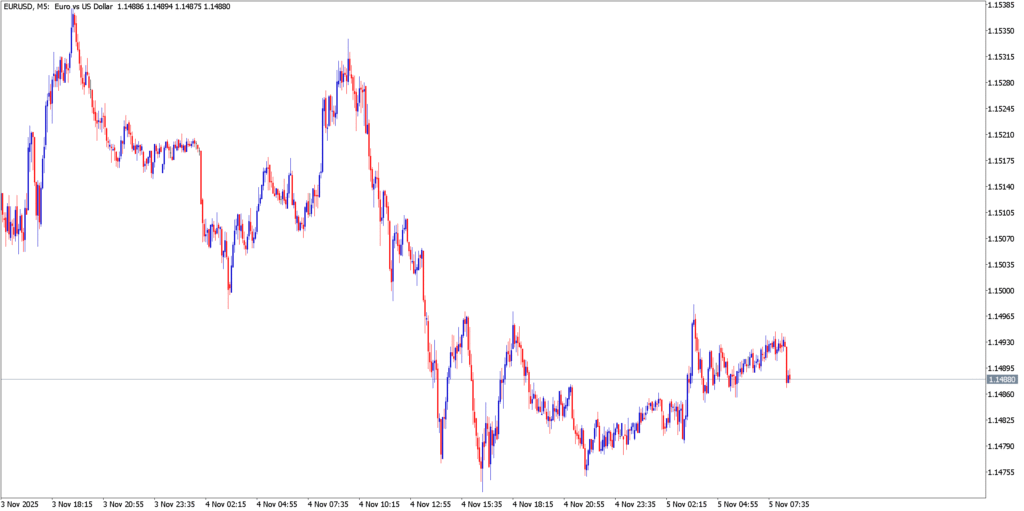

EUR/USD

Technical Analysis

EUR/USD drifted lower during Wednesday’s session, extending its short-term consolidation phase. The pair remained capped below recent highs, with sellers defending resistance in the upper-1.17 region. On intraday charts, price action continued to respect a narrowing range, suggesting declining momentum. Despite the mild downside pressure, the pair held above key support near the lower-1.17 area, keeping the broader structure intact. A decisive break below this support would open the door to a deeper pullback, while a recovery above resistance would signal renewed bullish intent.

Fundamental Analysis

Fundamentally, the euro’s softness reflected a slightly firmer US dollar rather than euro-specific weakness. With US CPI no longer reinforcing expectations for rapid Fed easing, the relative policy gap between the Fed and ECB appeared more balanced in the near term. In the absence of fresh Eurozone data, EUR/USD was largely driven by dollar-side dynamics, with traders trimming long positions and waiting for clearer directional cues.

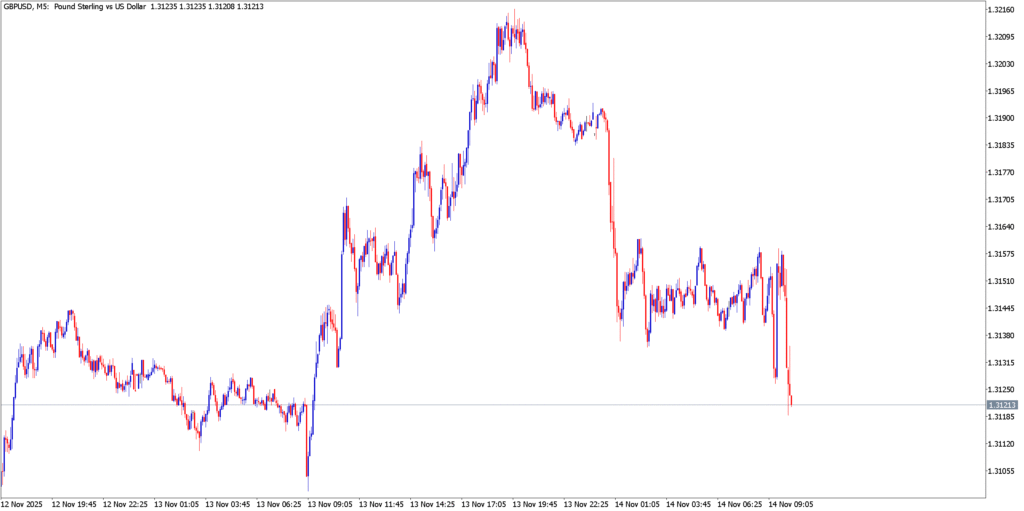

GBP/USD

Technical Analysis

GBP/USD also edged lower, tracking the broader dollar stabilization theme. The pair failed to build on prior gains and slipped toward short-term support, though selling pressure remained orderly rather than aggressive. On the daily chart, GBP/USD stayed within its established uptrend, with higher lows still intact. However, momentum indicators cooled, highlighting reduced buying interest. A sustained move below near-term support would signal a corrective phase, while a bounce from current levels could keep the broader bullish bias alive.

Fundamental Analysis

Sterling’s performance was shaped almost entirely by external forces on Wednesday. With no major UK data releases, GBP/USD reacted to shifting US rate expectations and modest dollar demand. Traders continued to price the possibility that the Bank of England may follow the Fed with rate cuts later in 2026, limiting upside enthusiasm for the pound. As long as the dollar remains supported by stable yields, GBP/USD may struggle to regain momentum without a clear domestic catalyst.

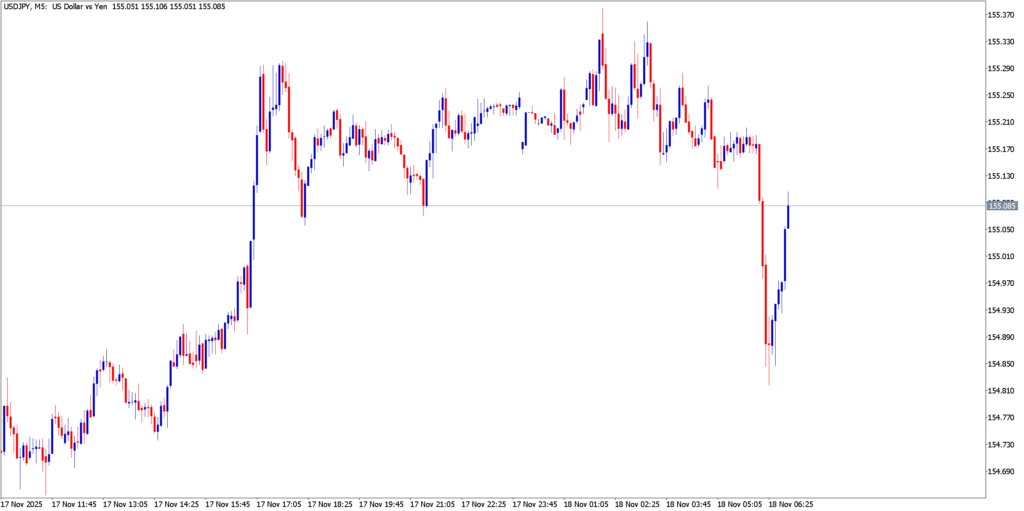

USD/JPY

Technical Analysis

USD/JPY pulled back modestly after failing to sustain gains near recent highs. The pair retreated from elevated levels, signaling short-term exhaustion rather than a structural reversal. Despite the pullback, price action remained above key support zones, preserving the broader uptrend. On lower time frames, momentum indicators rolled over from overbought conditions, suggesting further consolidation may be needed before the next directional move. The area just below recent highs remains a key pivot, with price sensitivity increasing around psychological resistance levels.

Fundamental Analysis

The yen’s modest recovery was driven by a combination of profit-taking and heightened awareness of potential policy sensitivity around excessive currency weakness. While there was no concrete shift in Japanese monetary policy, market participants grew cautious about pushing USD/JPY aggressively higher after recent gains. On the US side, stable yields and a patient Fed outlook limited downside pressure on the dollar, resulting in a balanced, two-way market rather than a sharp reversal.

Market Outlook

As markets move toward the latter half of the week, USD pair direction will remain tightly linked to rate expectations and yield behavior. With inflation data now priced in, traders will look ahead to upcoming US economic indicators for confirmation or contradiction of the current “Fed on hold” narrative.

EUR/USD and GBP/USD remain in consolidation phases, vulnerable to further pullbacks if the dollar continues to find support. USD/JPY, meanwhile, sits at a technically sensitive zone where momentum and policy awareness intersect, increasing the likelihood of volatility spikes on headlines.

Overall, Wednesday’s session suggests the market is transitioning from reaction to evaluation. The next decisive moves across USD pairs are likely to emerge only once fresh data or policy signals provide a clearer directional catalyst.

Discover More Forex Reports with Defcofx

Stay updated with key insights and in-depth forex market analysis from Defcofx:

- Dollar Trades Firm as Data Fails to Shift Fed Outlook

- Markets Shrug Off Venezuela Shock as Dollar Retreats

- Dollar on the Ropes as Risk Rally Roars

- Dollar Softens as New Year Flows Settle – 15 January 2026

- Yen Weakness Dominates as CPI Keeps Caution

Explore these reports for timely perspectives on how macroeconomic data, Fed outlooks, and global sentiment are shaping currency trends in early 2026.