Forex markets are on edge to start the week, buffeted by a perfect storm of fast-moving macroeconomic and geopolitical events. A U.S. government shutdown grinding into its third week has frozen key data releases – even the pivotal September jobs report – injecting uncertainty and thinning market liquidity. Meanwhile, central bankers on both sides of the Atlantic are striking a combative-yet-cautious tone: the Federal Reserve is mid-pivot toward rate cuts, the European Central Bank remains on hold after earlier easing, and the Bank of England is warning against dovish overreach. Add in inflation surprises and flickers of political turmoil – from Washington’s budget brinkmanship to Europe’s street protests – and you have a volatile mix sending traders scrambling. Against this backdrop, EUR/USD, GBP/USD, and USD/CAD are experiencing high drama, with each pair reacting to its own cocktail of policy signals, economic data, and risk sentiment swings.

EUR/USD

Fundamental Analysis

The euro-dollar exchange rate is caught in a tug-of-war between divergent policy paths and economic fortunes. On one side, the Fed has already begun easing – a quarter-point rate cut in September – and investors expect additional 0.25% cuts at the Fed’s remaining meetings this year. On the other, the ECB, having slashed rates by 200 bps through June, has signaled it will hold steady unless new shocks emerge, especially after Eurozone inflation showed a slight uptick to 2.2% in September (core steady at 2.3%). ECB officials appear largely untroubled by this blip, noting broader disinflation forces remain in play. In fact, some policymakers worry inflation could fall too low in 2024, given a slowing European economy “hamstrung by U.S. tariffs” and weak industrial activity. This contrast in outlooks – a dovish Fed vs. a paused ECB – would normally favor the euro, but surging U.S. economic momentum has kept the dollar buoyant. The U.S. is tracking near 4% GDP growth in Q3 (even as official data are delayed), and safe-haven dollar demand is percolating as the Washington budget standoff sows uncertainty. Euro bulls are also contending with political jitters in Europe: a flare-up of French fiscal unrest over budget cuts and tax hikes has clouded the Eurozone mood. In short, EUR/USD’s fundamental landscape is marked by cross-currents – a potentially softer USD on Fed policy, but offset by Europe’s own vulnerabilities and the dollar’s haven appeal amid global tension.

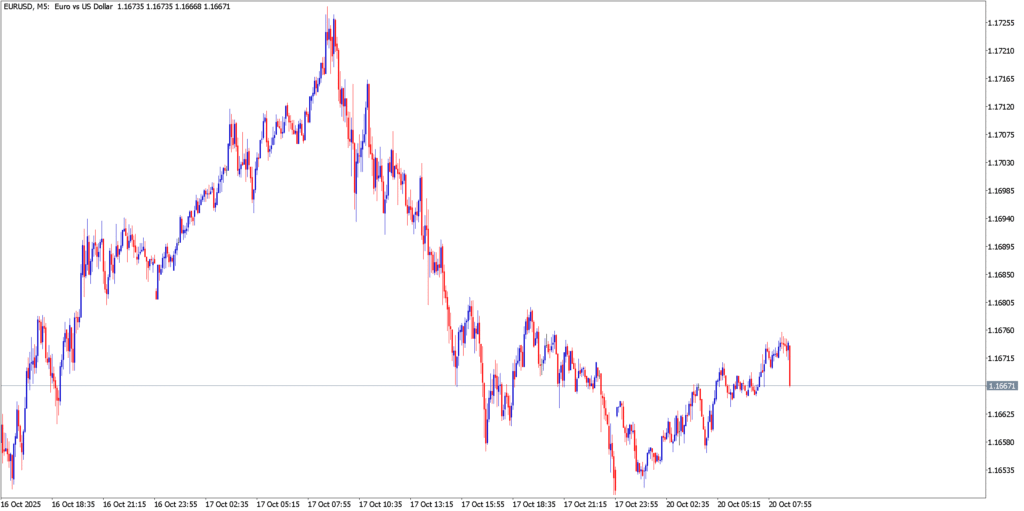

Technical Analysis

EUR/USD remains under pressure on the charts, but a potential double-bottom may be forming. Repeated attempts by euro bears to break below the $1.1540 support area have failed, establishing that level as a line in the sand on two separate occasions. This has kept the pair precariously above the psychological $1.1500 threshold. If EUR/USD can punch above its short-term neckline around the mid-$1.16s – roughly the 1.1630 mark – it would confirm the double-bottom breakout and open the door toward $1.17+ as a measured move target. Notably, a rally to the $1.1720 area would still lie below the last major lower-high (around $1.1750) in the broader downtrend, meaning the overall bearish structure remains intact unless bulls propel a significantly larger rebound. On the downside, a decisive drop through $1.1540 would invalidate the budding base and could accelerate losses, but for now momentum appears to be stalling rather than accelerating, giving euro bulls a fighting chance at a relief rally.

GBP/USD

Fundamental Analysis

The British pound finds itself whipsawed by high inflation and a hesitant central bank. UK inflation is still running hot – near 4% year-over-year, roughly double the BoE’s 2% target. This persistent price pressure, fueled in part by one-off cost surges (energy and even a jump in regulated water bills), has made the Bank of England wary of easing aggressively. The BoE has trimmed rates five times since last year, bringing Bank Rate down to 4.0%, but officials now hint at moving “more slowly” on cuts. MPC member Megan Greene – who opposed the last cut in August – remarked that there’s “no case” for continuing to cut every quarter as previously expected. Likewise, Chief Economist Huw Pill warned against lowering rates “too far or too fast,” urging caution to prevent sticky inflation from re-entrenching. On the positive side, the UK labor market is finally showing a bit of slack: unemployment ticked up and wage growth has cooled slightly, reducing the risk of a wage-price spiral. This suggests inflation may gradually come to heel, which could give the BoE cover to cut rates at a gentler pace. However, the UK economy remains fragile – recent surveys point to a losing momentum in the housing market and consumer spending – so the BoE faces a delicate balancing act. For now, the pound draws some support from the BoE’s prudent stance (higher UK yields relative to a cutting Fed can underpin GBP), but any upside is tempered by Britain’s lingering growth risks and still-high inflation.

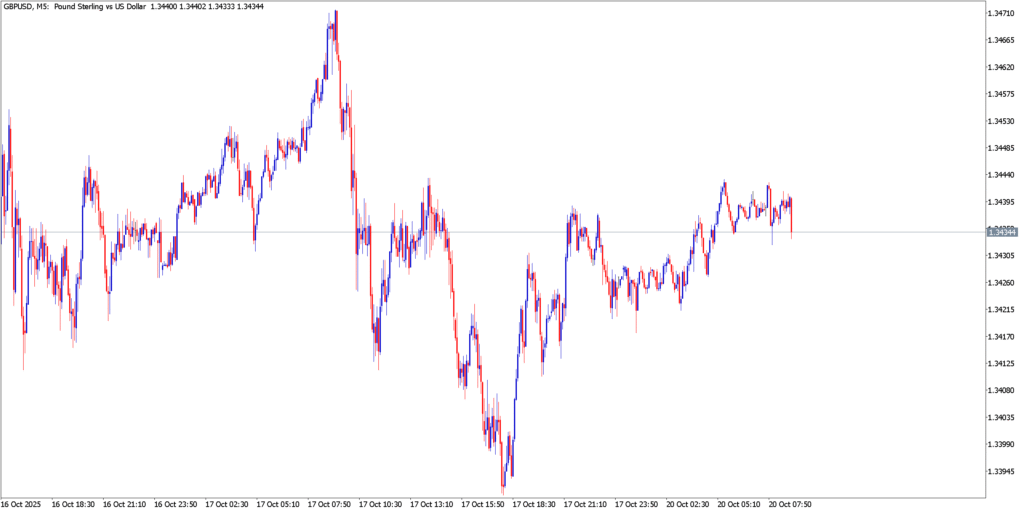

Technical Analysis

The pair’s downtrend has evolved into a falling wedge pattern on the charts – lower lows and lower highs, but with contracting amplitude. Such a formation often precedes a bullish reversal, as it reflects waning downside momentum. Pound-dollar is already bumping up against a key resistance zone: the upper bound of the wedge coincides with a significant Fibonacci retracement level, and $1.3414 has been identified as a major hurdle overhead. A break and close above the $1.34 handle – effectively busting out of the wedge – would be an early confirmation that bulls are seizing control. That could spark a sharper rebound toward the mid-$1.35s. Until then, however, the burden of proof is on buyers. Initial support lies in the low-$1.33s (recent swing lows); if that floor gives way, the wedge pattern could unravel into another leg lower. But as long as those lows hold, the stage is set for a potential pound comeback, with the tight wedge coils hinting that any upside catalyst (e.g. a soft U.S. CPI or upbeat UK data) might unleash a swift breakout rally.

USD/CAD

Fundamental Analysis

The U.S. dollar vs. Canadian dollar pair has been driven to extremes by policy divergence and global market swings. The Bank of Canada, which had been on hold for much of 2024, resumed easing as growth cooled – cutting its overnight rate to 2.50% in September. Policymakers hinted that one 25 bps cut won’t suffice; markets and analysts widely anticipate another BoC rate reduction by late October so long as inflation behaves. So far, Canada’s price dynamics look manageable: headline CPI is hovering in the low-2% range (Sept inflation is forecast ~2.3% YoY) and core measures are roughly 2.5–3%, just a tad above target. This benign inflation backdrop gives the BoC room to breathe. Recent data out of Canada has been mixed but not alarming – retail sales rebounded modestly in August, and business sentiment appears to be stabilizing after a slump earlier in the year. (Notably, an earlier bout of intense U.S. trade tension had dented Canadian business confidence, but those fears have eased somewhat.) Furthermore, Canada’s job market sprung a positive surprise in September with unexpected strength, though the central bank is “humble” about its forecasts and more focused on downside risks ahead. Externally, the landscape tilts USD/CAD bullish: the U.S. economy’s outperformance (and higher short-term yields) has attracted capital to the dollar, and recent softness in commodity prices – oil remains far below last year’s highs – has undercut support for the oil-linked Canadian dollar. The result is an American dollar trading near multi-month highs against the loonie, even as both the Fed and BoC move in dovish directions. Traders are now watching upcoming events like the BoC’s Oct. 29 meeting and any resolution to the U.S. shutdown saga, which could either reinforce USD/CAD’s uptrend or trigger a sharp reversal if the fundamental picture shifts.

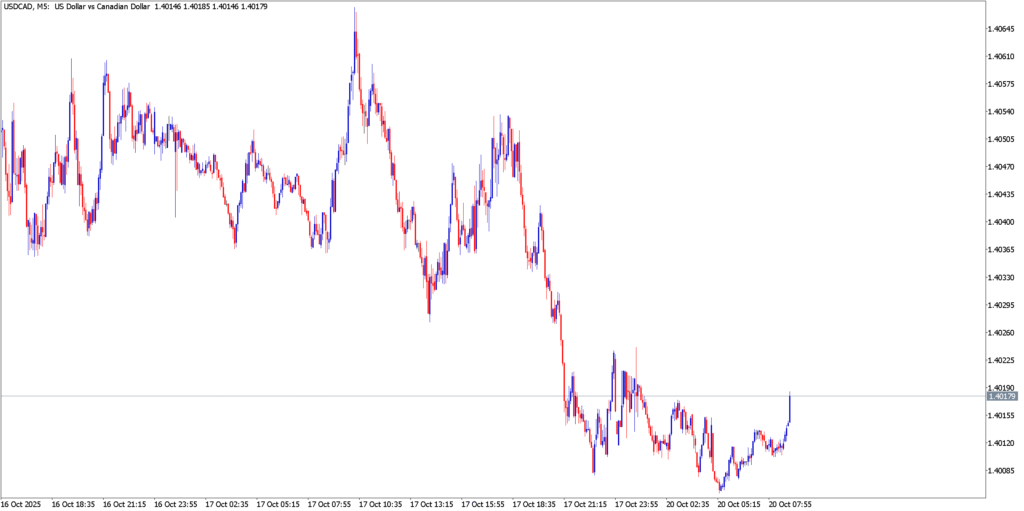

Technical Analysis

In recent sessions USD/CAD punched through the C$1.4000 mark, notching its highest level in six months amid a streak of higher highs. This breakout above the psychological 1.40 line puts the pair in rarified air; however, technical indicators suggest the move is overextended in the near term. Uptrend support is now eyed around C$1.3980–1.4000, the area of the recent breakout. Bulls will want to see that zone hold as a floor on any dips – successfully retesting 1.4000 from above would confirm it as new support and could invite another leg up. On the flip side, a firm break back below 1.3980 could signal a bullish fatigue and encourage a deeper pullback toward the mid-1.38s. Momentum still favors the USD/CAD on a broader basis, but as one senior strategist noted, the “challenge is [for bulls] to chase after the 1.4000 break”. Without fresh catalysts (like a spike in U.S. yields or oil plunging anew), the pair may struggle to accelerate much further. In summary, the trend is USD-friendly but stretched – cautious traders might wait for either a healthy correction or a clear new breakout signal before jumping into the next move.

Conclusion

Markets enter the week ahead in a state of high alert. Major triggers are looming in the very near term: the U.S. Bureau of Labor Statistics has confirmed it will release the delayed CPI report on Oct. 24, just days before the Fed’s policy meeting. That inflation data – along with any breakthrough (or breakdown) in U.S. budget negotiations – could set the tone for USD across the board. Across the pond, Eurozone and UK economic reports will feed into the Oct. 30 ECB decision and the BoE’s next steps, testing policymakers’ resolve in the face of persistent inflation and slowing growth. In Canada, all eyes are on the BoC’s Oct. 29 rate announcement, with another cut on the table and investors parsing every clue in advance. The market outlook for the coming weeks remains volatile: currency traders should be prepared for further twists as central bank messaging evolves and geopolitical flashpoints flare up. Sentiment can turn on a dime – a surprise headline or data point can tip EUR/USD, GBP/USD, or USD/CAD out of recent ranges in a burst of momentum. In this charged atmosphere, the only certainty is uncertainty itself, as the FX market braces for more fireworks to finish out October.