Thursday’s forex session saw the US dollar maintain a firm but controlled tone, as incoming economic data failed to materially alter expectations for Federal Reserve policy in early 2026. With inflation already digested earlier in the week, markets focused on whether follow-up data would challenge the prevailing narrative of a cautious, patient Fed. Instead, the data largely confirmed stability rather than urgency, keeping the dollar supported without triggering aggressive buying.

US Treasury yields held steady, reinforcing demand for the dollar against major counterparts. As a result, most USD pairs continued to favor consolidation or mild continuation moves rather than sharp reversals. The session reflected a market growing more confident in its baseline assumptions and less reactive to incremental data surprises.

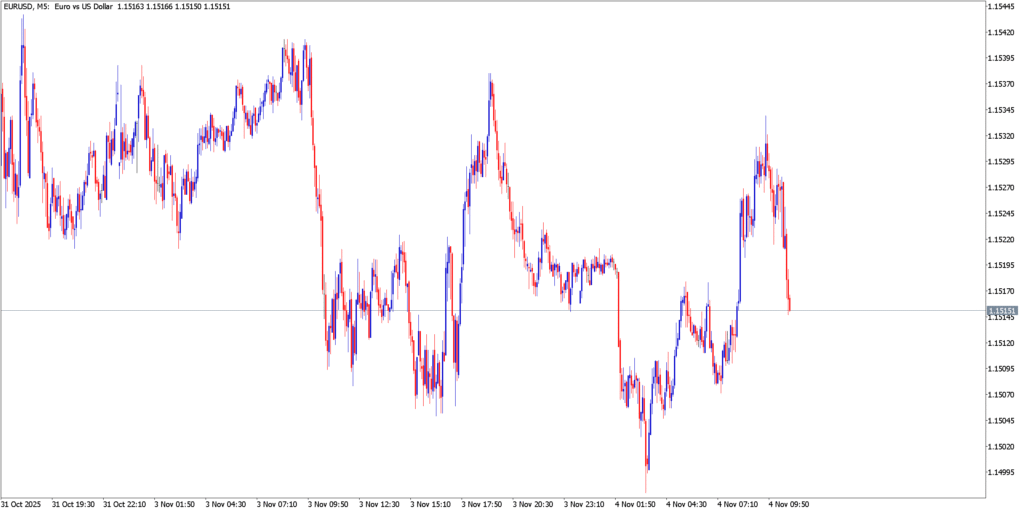

EUR/USD

Technical Analysis

EUR/USD extended its pullback on Thursday, slipping further from recent highs as downside momentum gradually built. The pair traded below short-term resistance and continued to pressure support levels in the lower-1.17 region. On intraday charts, the structure shifted from consolidation into a shallow corrective channel, suggesting sellers are gaining modest control. While the broader medium-term trend remains constructive, a sustained break below current support would expose the pair to a deeper retracement toward the mid-1.16s. For now, price action suggests controlled correction rather than trend reversal.

Fundamental Analysis

From a fundamental perspective, EUR/USD weakness was driven almost entirely by the dollar side. US data reinforced the view that the Federal Reserve is in no rush to ease policy further, keeping rate differentials supportive of the dollar. With no major Eurozone releases to counterbalance this dynamic, the euro lacked catalysts to resist the drift lower. Traders continued to favor trimming euro exposure rather than initiating fresh longs, particularly with the pair still elevated on a multi-week basis.

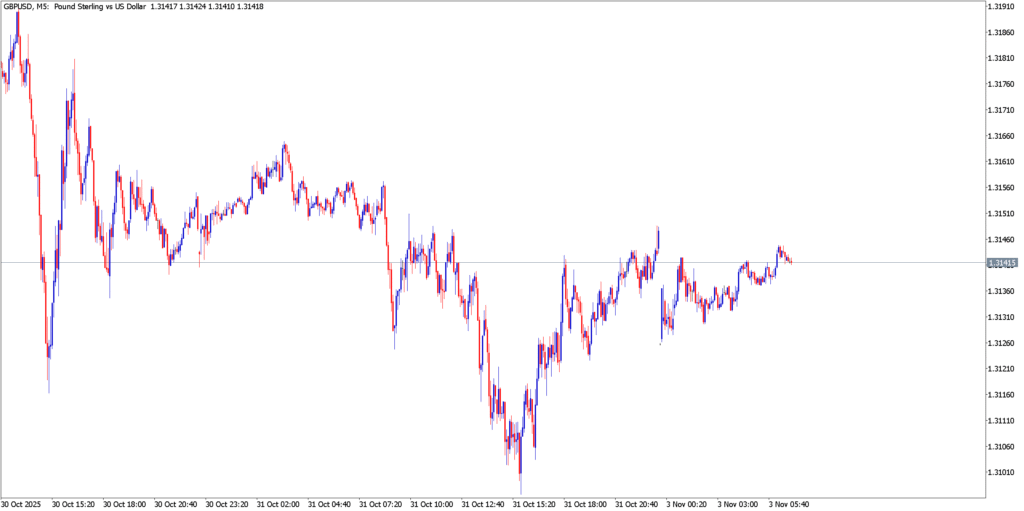

GBP/USD

Technical Analysis

GBP/USD also moved lower, tracking the same dollar-strength theme. The pair slipped toward near-term support, with price action remaining orderly and lacking panic selling. On the daily chart, the broader bullish structure remains intact, but momentum has clearly softened. Failure to hold current support levels would confirm a corrective phase, while any bounce would likely face resistance near prior breakdown zones. Overall, sterling appears vulnerable to further downside if the dollar remains bid.

Fundamental Analysis

Sterling’s underperformance reflected external pressure rather than domestic weakness. While UK fundamentals have not deteriorated sharply, expectations that the Bank of England could follow the Fed with rate cuts later in 2026 continued to cap upside enthusiasm. In contrast, US data stability reinforced confidence in the dollar, widening the perception gap between the two currencies. As long as this relative policy outlook persists, GBP/USD may struggle to regain upside momentum.

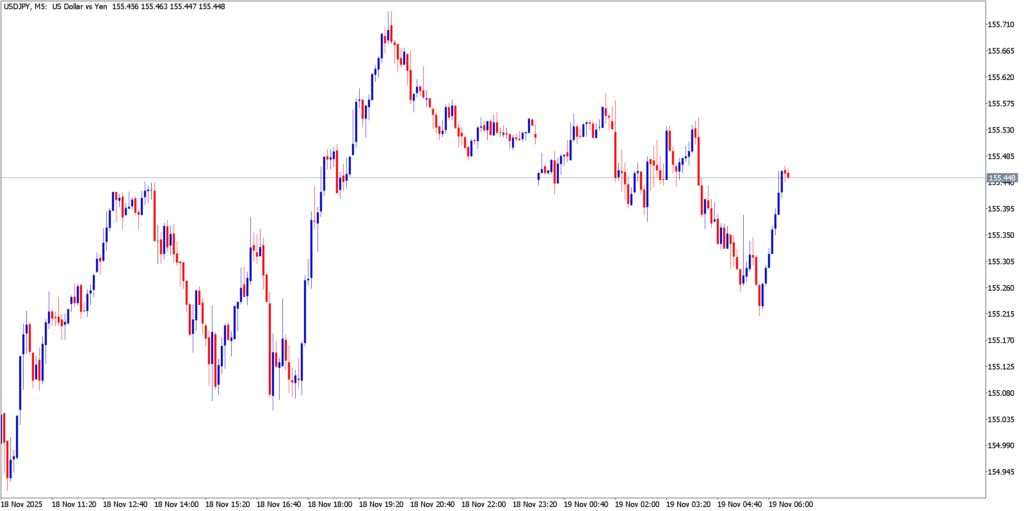

USD/JPY

Technical Analysis

USD/JPY stabilized on Thursday after earlier volatility, trading sideways near elevated levels. The pair respected key support zones following recent pullbacks, suggesting buyers remain active on dips. On shorter time frames, momentum flattened, indicating a pause rather than continuation or reversal. Price sensitivity remained high near psychological resistance levels, where even small shifts in sentiment can trigger sharp intraday moves. As long as USD/JPY holds above recent support, the broader bullish bias remains intact.

Fundamental Analysis

Fundamentally, USD/JPY remained anchored to yield dynamics. Stable US yields continued to support the dollar against the yen, while no meaningful shift emerged from Japanese policy circles. However, growing awareness of intervention risk at higher levels kept traders cautious about aggressively extending longs. This balance produced a tight, headline-sensitive trading environment, with neither side willing to force direction without a clearer catalyst.

Market Outlook

As the week draws toward a close, the forex market appears increasingly comfortable with a “Fed on hold” baseline, supporting the US dollar across major pairs. Unless upcoming data significantly challenge this view, USD strength is likely to persist in a measured rather than explosive fashion.

EUR/USD and GBP/USD remain in corrective modes, with downside risks increasing if support levels give way. USD/JPY continues to trade in a technically sensitive zone, where yield support favors the upside but policy awareness limits momentum.

Overall, Thursday’s session reinforced a key theme for mid-January: stability over surprise. With volatility compressing and positioning becoming more deliberate, traders will look ahead to next week’s data for confirmation of whether the dollar’s firmness evolves into a renewed trend or remains a controlled consolidation.

Discover More Forex Reports with Defcofx

Stay informed with our latest forex market analysis and insights:

- Markets Shrug Off Venezuela Shock as Dollar Retreats

- Dollar on the Ropes as Risk Rally Roars

- Dollar Softens as New Year Flows Settle – 15 January 2026

- Yen Weakness Dominates as CPI Keeps Caution

- Dollar Stabilizes After CPI as USD Pairs Consolidate

Explore these reports for timely perspectives on how geopolitical developments, macro data, and market sentiment are influencing major currency pairs.