Global markets were in a frenzy on Oct. 28, 2025 as a torrent of dovish central bank chatter and trade optimism sent shockwaves through FX. Investors piled into equities and commodity-linked currencies on the back of renewed US–China deal hopes and an expected Fed rate cut. The US dollar sank sharply across the board, touching multi-week lows as the euro and loonie rallied and even the battered yen briefly recovered some ground. Oil prices steadied after OPEC+ signalled another output increase. In sum, it was a high-drama, risk-on session: market attention zeroed in on looming policy meetings and trade summits, while safe-haven flows caused sudden yen strength amid intervention talk.

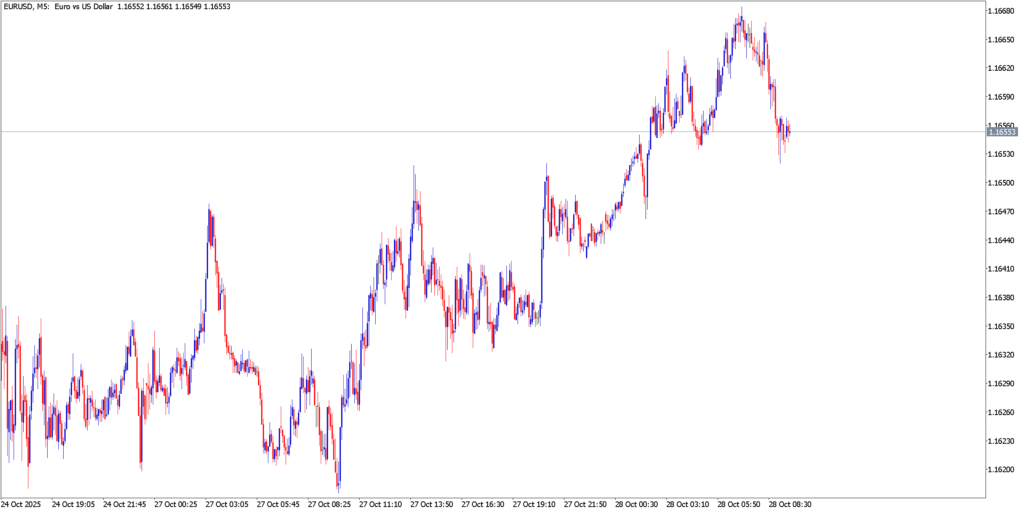

EUR/USD

EUR/USD extended its recent bounce, rallying near the mid-$1.16s. The pair has clawed back from last week’s dip to ~1.1580, rebounding off support as traders shrugged off Wednesday’s (Oct 29) Fed meeting. A broad dollar sell-off – driven by solid US inflation data that cleared the way for a Fed rate cut – kept EUR/USD bid. (September US CPI was just +3.0% y/y, easing Fed pressure.) Euro strength was also underpinned by surprisingly robust Eurozone data: Friday’s flash PMI survey showed composite activity at 52.2, a 17-month high, and Germany’s IFO business climate ticked up in October. Technically, EUR/USD faces resistance around last week’s high (~$1.1720) and support near the recent $1.1580 swing low. In short, the euro has “notched four straight days of modest gains”as the dollar retreats. Any further breakout through $1.17 could ignite fresh buying, while a slip below $1.16 would revive bearish momentum. Traders will watch for the US shutdown saga to end and upcoming U.S. data, but for now the Euro is riding the wave of dollar weakness and stronger EU sentiment.

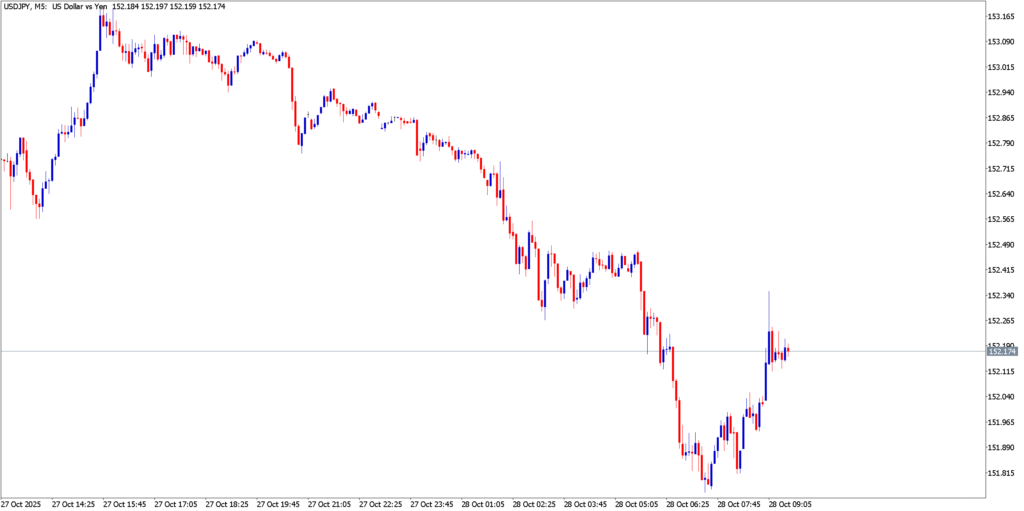

USD/JPY

The USD/JPY cross wobbled violently Tuesday. Technically, the 5-minute chart shows a double top near ¥148.0 followed by a slide toward ¥147.4 support, a pattern that underpinned bearish bias. News-wise, the yen suddenly strengthened over 0.6% to about ¥151.85 per dollar. This snap-back was fueled by intense intervention speculation: U.S. Treasury Sec. Scott Bessent publicly urged Japan’s BOJ to pursue “sound monetary policy,” a clear hint that Washington wants faster yen tightening. The remark and a meeting between Trump and Japan’s new PM Takaichi sent traders scrambling into yen. The BOJ is widely expected to hold rates, but these developments have reignited talk of a currency intervention. Meanwhile, a retreat in U.S. yields (after a recent sell-off) trimmed the dollar’s appeal. In sum, safe-haven demand and political pressure helped USD/JPY rebound off recent lows. Watch for ¥151 as near-term resistance and ¥150 (the prior trough) as support; any break below could signal a deeper yen recovery. With the BOJ meeting and Trump-Xi summit looming, yen volatility is likely to stay high.

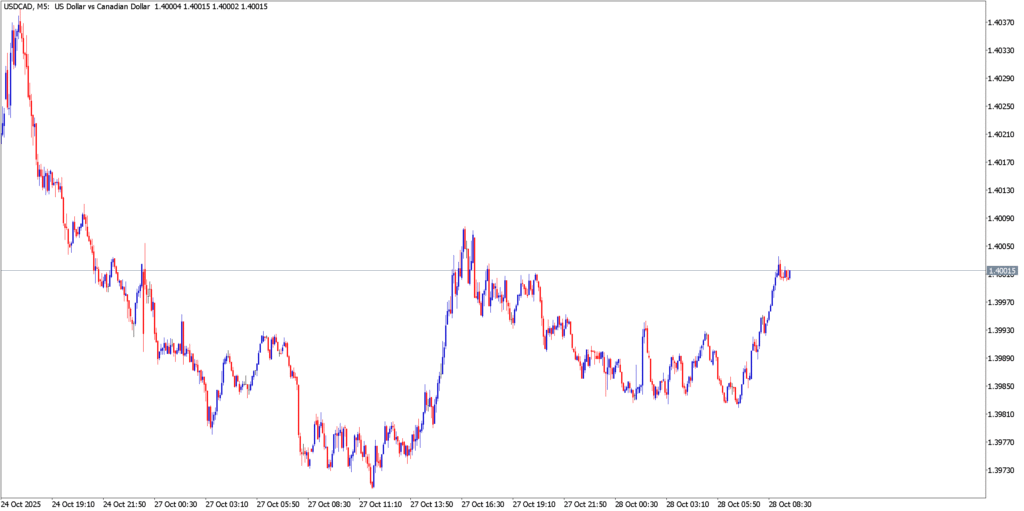

USD/CAD

USD/CAD churned in a tight 1.398–1.404 range as traders grappled with mixed signals. The loonie got a lift on Tuesday from CAD-friendly headlines, but Canada’s outlook remains shaky. A Reuters poll had already priced in a 25-bp BoC cut to 2.25% on Oct.29, and Washington’s sudden halt to trade talks over a tariff dispute undermined confidence in Canada’s exports. “The trade headline reinforces pessimism around CAD,” said a Wells Fargo strategist, noting that traders would “buy USD/CAD on dips until the growth side in Canada looks better”. On the charts, last week’s high around C$1.4035 still caps USD/CAD gains, while the mid-$1.39s mark near-term support. Oil prices were mildly softer on OPEC’s planned output rise, offering little comfort to the commodity-linked loonie. In short, fundamentals favor USD strength here: a wary CAD economy (high unemployment, rising inflation) plus looming rate cuts keep USD/CAD afloat. Traders will keep an eye on crude and any fresh trade news, but for now the greenback hovers near 1.40, with the loonie’s next moves hinging on BoC policy clues and U.S.-Canada negotiations.

Market Outlook

Investors close out Oct. 28 with major policy fireworks ahead. The Federal Reserve’s Oct.29–30 meeting is front and center – markets have fully priced a quarter-point cut, so traders will scrutinize the FOMC statement and any clues on when QT might end. The Bank of Japan’s decisions (Oct.29–30) and comments from BOJ Governor Ueda could jolt USD/JPY further. In Canada, the BoC’s Oct.29 rate call will test if easing is indeed finished or just paused. On the data front, U.S. Q3 GDP and any late-breaking job figures will be eyed, but the shutdown may keep data scarce. Finally, President Trump’s planned meeting with China’s Xi Jinping (Oct.30 in Seoul) looms large: even hints of a trade truce could send every USD-cross surging or plunging anew. In this climate, watch those technical levels (EUR/USD ~$1.1720 resistance, USD/JPY ~¥152 resistance, USD/CAD ~1.404 resistance) and brace for more drama – the FX market is wired for volatility.