Currently, no. The U.S. dollar is significantly stronger than the Japanese yen. One USD typically buys well over 140 JPY, which shows monetary policy differences, global demand, and economic fundamentals. But strength here is nuanced and depends on context.

Key Takeaways

- The dollar has maintained a stronger position versus the yen due to higher U.S. interest rates and its global reserve role.

- The yen’s value is affected by Japan’s low interest rate environment, large public debt, and export orientation.

- Stronger does not always mean a numerically larger unit value; it means purchasing power, global demand, and economic stability.

- Periods of market stress can flip the script: the yen often acts as a safe haven, gaining when global risk rises.

- Traders of USD/JPY must monitor central bank policy, inflation, risk sentiment, and Japan’s trade balance for shifts in strength.

What Does Stronger Mean in Currency Terms?

When people ask whether one currency is stronger than another, they may mean several things: higher exchange rate value, greater purchasing power, global demand, stability, or reserve currency status.

For example, if 1 USD = 150 JPY, it might seem the yen is weaker. But that doesn’t automatically mean Japan’s economy is weaker. It simply means each yen unit buys less USD. What matters more is how much one currency can buy in real terms and how it’s used globally.

Why the U.S. Dollar Is Stronger Than the Yen

Interest Rate and Yield Differentials

A major driver is the gap in interest rates. The Federal Reserve (Fed) has kept rates elevated in recent years, while the Bank of Japan (BoJ) held them near zero or even negative for an extended period. This makes USD‑denominated assets more attractive and yen less so.

Global Reserve & Safe‑Haven Status

The U.S. dollar remains the world’s primary reserve currency and is deeply embedded in international trade, debt issuance, and commodity pricing. This creates constant demand. By contrast, while the yen is also a major currency, it doesn’t command the same global reserve role.

Export-Driven Strategy & Weak Yen Bias

Japan benefits when the yen is weaker because it boosts export competitiveness. A weaker yen makes Japanese goods cheaper abroad. Some policymakers effectively tolerate or encourage yen strength to remain low to support export industries.

Why the Yen Isn’t Stronger Right Now

Ultra-Loose Monetary Policy

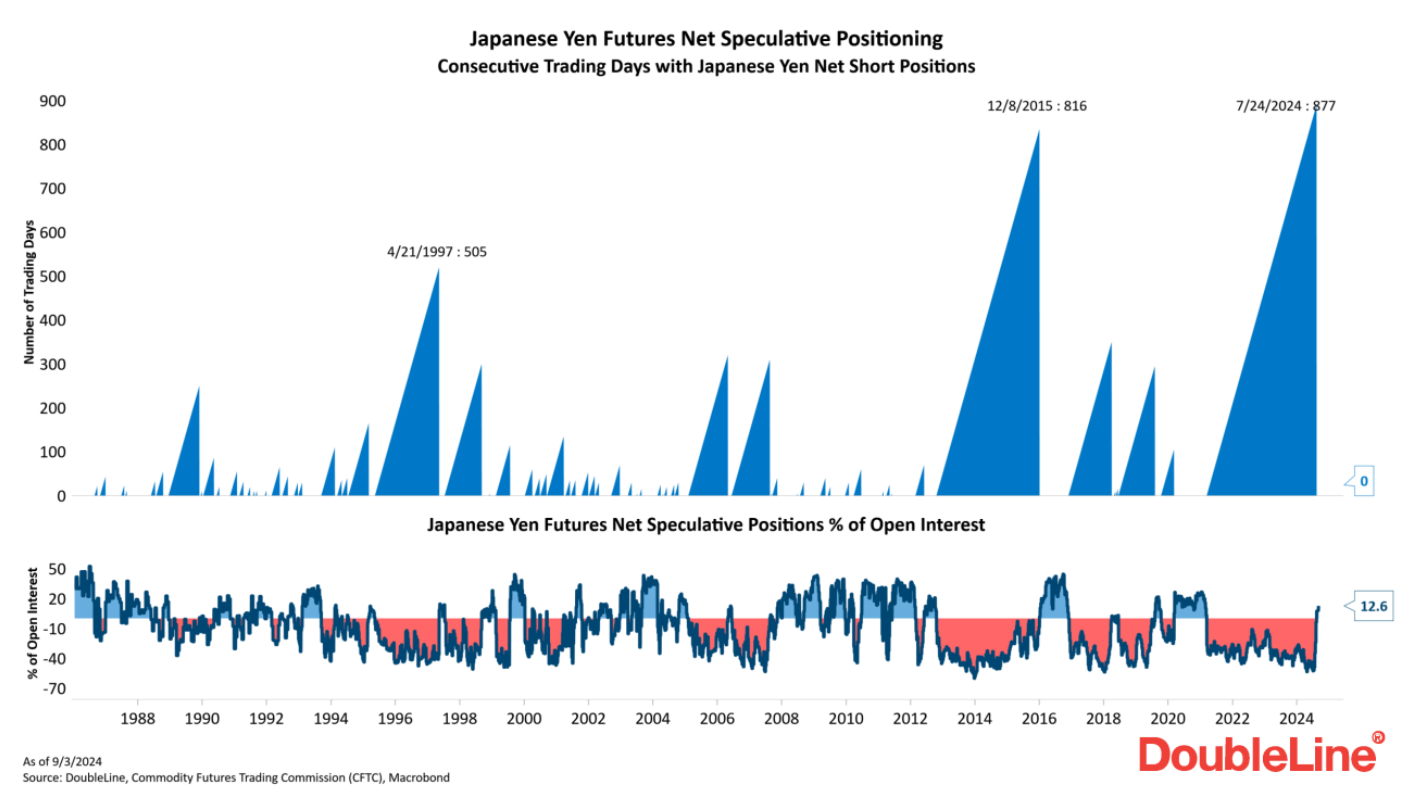

The BoJ’s very low interest rates for many years disrupted capital flows. Investors could borrow yen cheaply and invest in higher‑yielding currencies, which is a carry trade that weakened the yen.

Japan’s Large Public Debt

Japan’s public debt is among the highest of advanced economies, limiting monetary policy freedom. The BoJ’s policies to cap yields to manage the debt burden indirectly suppress currency strength.

Imports & Inflation

While a weaker yen helps exports, it raises import costs (Japan imports most energy and raw materials). That feeds inflation and household strain. A too‑weak yen can be economically problematic.

USD vs JPY

| Metric | U.S. Dollar (USD) | Japanese Yen (JPY) |

| Exchange Rate (example) | 1 USD ≈ 140–155 JPY (2025) | 1 JPY ≈ 0.0065–0.0071 USD |

| Interest Rate (policy) | Higher (Fed) | Ultra‑low/near zero (BoJ) |

| Reserve Currency Role | Primary global reserve | Secondary |

| Export vs Import Bias | Balanced economy | Export‑heavy, import‑reliant |

| Typical Strength Drivers | High yields, safe‑haven demand | Safe‑haven status only, weak domestic yields |

When Can the Yen Be Stronger?

Though the yen is weaker now, it still can regain strength under certain conditions:

Safe‑Haven Flows

During global risk and crisis events, the yen often appreciates because investors seek safe assets. For example, USD/JPY may drop when the dollar weakens or risk appetite falls.

Monetary Policy Reversal

If the BoJ moves to normalize rates and the Fed signals cuts, the yield gap narrows, which could strengthen the yen. Analysts note this as a key watch factor.

Trade & Structural Shifts

A resilient Japanese economy, strong wage growth, or a shift away from heavy reliance on exports could improve yen fundamentals and reverse weakness.

Why Traders Monitor USD/JPY Closely

This pair is used widely because:

- It’s highly liquid and has tight spreads

- It responds strongly to policy decisions, inflation, yield moves

- It often leads other yen crosses (EUR/JPY, GBP/JPY)

- It can signal broader global sentiment (risk‑on vs risk‑off)

Traders use USD/JPY to capture moves both in the strength of the dollar and changes in yen dynamics.

Final Thoughts: Is the Yen Stronger Than the Dollar

So, is the yen stronger than the dollar? Right now, the answer is no. The dollar holds the upper hand in value, interest rates, and global demand. But strength is relative and can change. For traders and investors, recognizing why the dollar is stronger helps you anticipate when that may shift.

Platforms like Defcofx allow you to trade USD/JPY and other major pairs with low spreads and fast execution so you can take advantage of both trends and reversals.

Open a Live Trading AccountFAQs

Though Japan has a large, industrial economy, its monetary policy has been very loose, interest rates extremely low, and public debt very high. These conditions reduce the yen’s appeal relative to the dollar.

Yes. If it takes more Japanese yen to buy one U.S. dollar, that means the yen has less value relative to the dollar. For example, 150 JPY per USD means the yen is weaker than if it were 110 JPY per USD.

Yes. If Japan raises rates, improves its economic fundamentals, or global risk causes safe‑haven flows into the yen. Many analysts expect potential reversals when policy divergence narrows.

Higher interest rates attract capital, increasing demand for that currency and strengthening it. With the Fed’s higher rates and the BoJ’s near‑zero rates, capital flows favor the dollar over the yen.

Yes. During global uncertainty or risk‑off periods, the yen often strengthens as investors shift assets into safe currencies. This means the yen can act strong even when fundamentals are weak.

A weaker yen makes exports more competitive, which can boost trade surplus over time. But it also raises import costs, which can dent growth and cause inflation. This trade‑off influences long‑term strength.

Yes. USD/JPY is heavily influenced by yield differentials, BOJ/Fed policy, global risk sentiment, and carry‑trade flows. Traders must monitor central bank commitments, Japan’s structural economy, and global interest trends to trade this pair effectively.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.