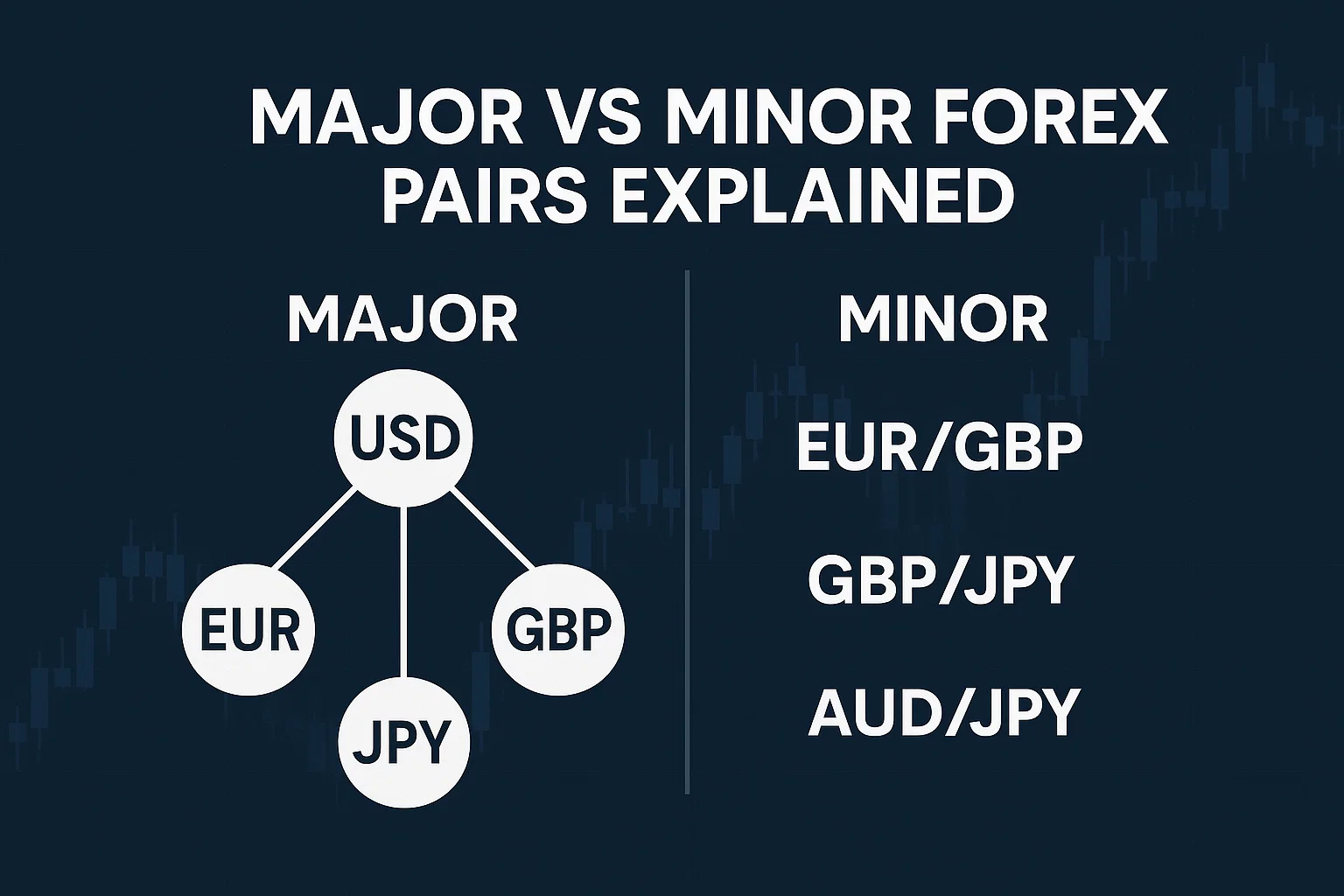

Major forex pairs are the seven most traded currency pairs in the world, and they all include the U.S. dollar. Minor forex pairs (also called cross-currency pairs) exclude the USD and are formed between other major global currencies.

Below is the verified and corrected list:

List of Major Forex Pairs (The 7 Majors)

These are universally accepted across all brokers and trading institutions:

| Pair | Currencies | Explanation |

| EUR/USD | Euro – US Dollar | The most traded pair globally, known for high liquidity and low spreads. |

| USD/JPY | US Dollar – Japanese Yen | Extremely liquid and influenced by global risk sentiment. |

| GBP/USD | British Pound – US Dollar | Known for strong trends and higher volatility. |

| USD/CHF | US Dollar – Swiss Franc | Considered a safe-haven pair due to Switzerland’s stability. |

| AUD/USD | Australian Dollar – US Dollar | Correlated with commodities, especially gold. |

| USD/CAD | US Dollar – Canadian Dollar | Closely tied to oil prices and North American economic data. |

| NZD/USD | New Zealand Dollar – US Dollar | Moves with agricultural exports and global risk trends. |

List of Minor Forex Pairs (Categorized by Region)

These are the most traded, most liquid, and most widely cited minor pairs across forex education sources.

EUR Crosses (Most Traded Minors)

| Pair | Currencies |

| EUR/GBP | Euro – British Pound |

| EUR/JPY | Euro – Japanese Yen |

| EUR/CHF | Euro – Swiss Franc |

| EUR/AUD | Euro – Australian Dollar |

| EUR/CAD | Euro – Canadian Dollar |

| EUR/NZD | Euro – New Zealand Dollar |

GBP Crosses

| Pair | Currencies |

| GBP/JPY | British Pound – Japanese Yen |

| GBP/CHF | British Pound – Swiss Franc |

| GBP/AUD | British Pound – Australian Dollar |

| GBP/CAD | British Pound – Canadian Dollar |

(GBP crosses are popular due to higher volatility.)

JPY Crosses

| Pair | Currencies |

| AUD/JPY | Australian Dollar – Japanese Yen |

| NZD/JPY | New Zealand Dollar – Japanese Yen |

| CAD/JPY | Canadian Dollar – Japanese Yen |

| CHF/JPY | Swiss Franc – Japanese Yen |

(JPY crosses are among the most actively traded minors.)

AUD & NZD Crosses

| Pair | Currencies |

| AUD/NZD | Australian Dollar – New Zealand Dollar |

| AUD/CHF | Australian Dollar – Swiss Franc |

| AUD/CAD | Australian Dollar – Canadian Dollar |

(Smaller liquidity but still standard minor pairs.)

CAD & CHF Crosses

| Pair | Currencies |

| CAD/CHF | Canadian Dollar – Swiss Franc |

| NZD/CHF | New Zealand Dollar – Swiss Franc |

| NZD/CAD | New Zealand Dollar – Canadian Dollar |

Key Takeaways

- Major forex pairs always include the US dollar and represent the highest liquidity in the market, including EUR/USD, USD/JPY, and GBP/USD.

- Minor forex pairs, also called cross-currency pairs, exclude the USD and combine two other leading currencies, such as EUR/GBP or GBP/JPY.

- Major pairs offer lower spreads and smoother price movements, making them ideal for beginners and high-volume traders.

- Minor pairs generally experience higher volatility and wider spreads but can provide more trading opportunities for experienced traders.

- Knowing the difference between major and minor pairs helps traders choose instruments based on liquidity, volatility, and trading costs.

What Are Major Forex Pairs?

Major forex pairs are the seven most heavily traded currency pairs in the global forex market. They always include the U.S. dollar (USD) and represent the highest liquidity, the lowest spreads, and the most stable price movements. Because these pairs dominate global currency transactions, they tend to behave more predictably, making them popular among both beginner and experienced traders.

Major forex pairs are also the most cost-efficient to trade. Brokers typically offer their tightest spreads and fastest execution speeds on majors because of their massive trading volume. If a trader wants consistency, smoother trends, and reliable volatility, major pairs are usually the best place to start.

What Are Major Forex Pairs?

Major forex pairs are the seven most heavily traded currency pairs in the global forex market. They always include the U.S. dollar (USD) and represent the highest liquidity, the lowest spreads, and the most stable price movements. Because these pairs dominate global currency transactions, they tend to behave more predictably, making them popular among both beginner and experienced traders.

Major forex pairs are also the most cost-efficient to trade. Brokers typically offer their tightest spreads and fastest execution speeds on majors because of their massive trading volume. If a trader wants consistency, smoother trends, and reliable volatility, major pairs are usually the best place to start.

Difference Between Major and Minor Forex Pairs

Below is a clear side-by-side comparison of major vs. minor forex pairs, showing their differences in liquidity, spreads, volatility, and suitability for traders.

Comparison Table: Major vs. Minor Forex Pairs

| Feature | Major Forex Pairs | Minor Forex Pairs |

| Includes USD | Yes — always | No — never |

| Liquidity | Very high (most traded globally) | Moderate to low, depending on pair |

| Spreads | Lowest spreads in the market | Wider spreads due to lower volume |

| Volatility | Stable, smoother price movements | Higher volatility, stronger swings |

| Trading Volume | Over 75% of global FX trading | Much lower volume than majors |

| Market Behavior | More predictable and consistent | Can be less stable, more reactive |

| Best For | Beginners, scalpers, institutional traders | Trend traders, swing traders, volatility seekers |

| Examples | EUR/USD, USD/JPY, GBP/USD | EUR/GBP, GBP/JPY, AUD/JPY |

Which Pairs Are Best for Traders? (Liquidity, Volatility, Cost)

The best forex pairs for trading depend on a trader’s experience level, strategy, and risk tolerance. Major pairs are typically the safest and most cost-efficient, while minor pairs offer more movement and higher opportunity—at higher risk.

Best Pairs for Beginners

- EUR/USD

- GBP/USD

- USD/JPY

These pairs offer tight spreads, smooth price action, and high liquidity.

Best Pairs for Low-Cost Trading

- EUR/USD

- USD/JPY

- AUD/USD

These pairs have extremely low spreads on most brokers, making them ideal for scalping and day trading.

Best Pairs for High Volatility Traders

- GBP/JPY

- EUR/JPY

- GBP/AUD

These pairs offer large intraday swings, making them attractive for momentum and trend-based strategies.

Best Pairs for Market Diversity

- EUR/GBP

- AUD/JPY

- CAD/CHF

These minor pairs help traders diversify beyond USD-dominated markets.

Best Overall for Most Forex Traders

- EUR/USD → Highest liquidity, lowest costs

- GBP/JPY → Strong trends and high volatility

- USD/JPY → Balanced liquidity and predictable movement

Each pair serves different strategies, and traders often choose based on volatility, spread costs, and market behavior.

How Defcofx Helps Traders Access Major and Minor Pairs

Defcofx provides traders with a highly flexible trading environment that makes it easy to trade both major and minor currency pairs. Whether you prefer low-cost major pairs or high-volatility minor pairs, Defcofx offers the tools, execution speed, and pricing structure needed to trade effectively.

6 Key Benefits for Major & Minor Pair Trading with Defcofx

- Ultra-low spreads from 0.3 pips: Perfect for majors like EUR/USD and USD/JPY, giving traders low-cost entry and exit points.

- High leverage up to 1:2000: Enables traders to open meaningful positions even on minor pairs that require larger margin movement.

- No commissions and no swap fees: Ideal for traders who hold major or minor positions longer without worrying about overnight charges.

- Fast withdrawals processed within 4 hours: Withdrawals are approved quickly, including weekends, giving traders reliable access to their funds.

- 40% welcome bonus for deposits of $1000+: Provides additional trading capital, especially useful when exploring minor pairs with higher volatility.

- Global accessibility: Defcofx welcomes clients from all countries and offers access to both major and minor forex pairs without regional trading restrictions.

With these features, Defcofx supports every trading style, from safe, low-spread major pairs to dynamic, fast-moving minor pairs.

Open a Trading Live AccountFAQ: Major and Minor Forex Pairs

Major forex pairs are the seven most traded currency pairs that always include the U.S. dollar: EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, USD/CAD, and NZD/USD. They offer the highest liquidity and lowest spreads.

Minor forex pairs, also called cross-currency pairs, do not include the U.S. dollar. They combine two other major currencies, such as EUR/GBP, GBP/JPY, AUD/JPY, and EUR/CHF. These pairs typically show higher volatility and wider spreads.

Beginners usually start with major pairs like EUR/USD, GBP/USD, and USD/JPY. These pairs offer smooth price action, tight spreads, and high liquidity, making them easier and more affordable to trade.

Minor pairs have lower trading volume compared to major pairs, which leads to wider spreads. Lower liquidity means brokers must price them higher to manage volatility and reduced market depth.

Yes. Major pairs are more stable because they involve highly traded global currencies and attract larger institutional participation. Minor pairs tend to move more sharply and react faster to economic news.

Yes. Defcofx offers full access to major and minor currency pairs with ultra-low spreads, high leverage up to 1:2000, and no commission or swap fees. Traders can choose pairs based on strategy and market conditions.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.

- What Currency is The Most Valuable

- Best Currency Pairs to Trade During London Session

- How Much is 0.5 Lot Size in Dollars

- Best Time To Trade NZD/USD

- What Is Considered the Greatest Risk Associated With Forex Settlement?

- Is NZD/USD a Major or Minor Pair?

- Trailing Stop Limit: Definition, Uses & Trading Guide

- When Does a Bearish Market Become Bullish in Forex?

- Is Pound Stronger than Dollar?