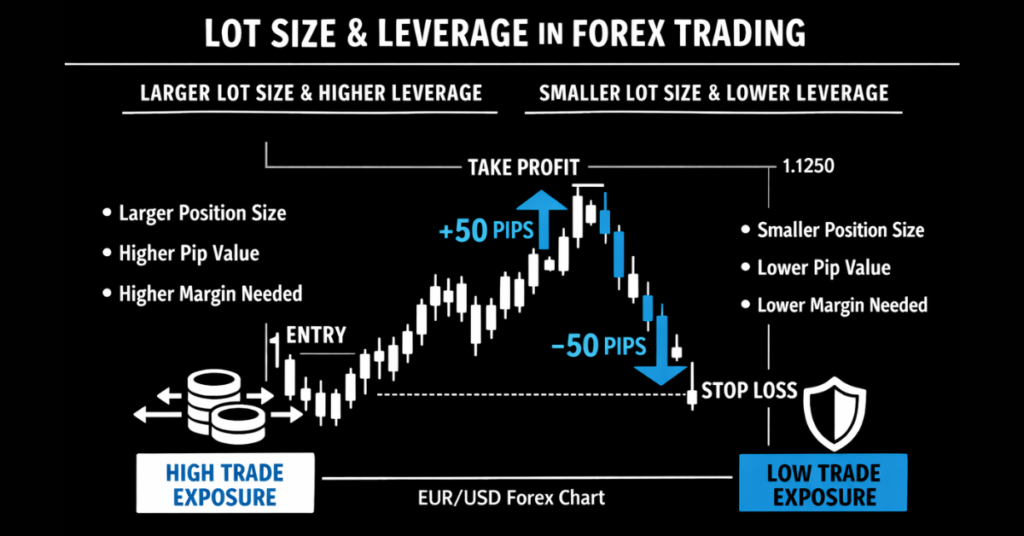

Lot size vs leverage explains how trade volume differs from borrowed exposure. Lot size defines how many units you trade and determines pip value and risk. Leverage lets you control that position with less capital. Confusing them leads to oversized risk and margin problems.

Key Takeaways

- Lot size defines the actual trade volume and directly determines pip value, profit, and loss.

- Leverage allows traders to control larger positions with less capital but does not change trade risk by itself.

- Risk in forex trading is driven mainly by lot size, not by leverage.

- Higher leverage reduces margin requirements but can increase the chance of overexposure if misused.

- Properly combining lot size and leverage helps maintain consistent risk management and account stability.

What Is Lot Size in Forex Trading?

Lot size in forex trading refers to the number of currency units you buy or sell in a single trade. It defines the actual size of your position and is one of the most important factors affecting profit, loss, and risk. Unlike leverage, lot size directly controls how much money you gain or lose for every pip the market moves.

In forex, lot sizes are standardized to help traders measure position size consistently. A standard lot represents 100,000 units of the base currency. Smaller traders often use mini lots (10,000 units) or micro lots (1,000 units) to reduce risk and gain more precise control over their trades. Some brokers also allow nano lots, which are even smaller.

The most critical impact of lot size is on pip value. As lot size increases, the value of each pip increases, meaning both profits and losses grow faster. This is why lot size is the primary risk control tool in forex trading. Two traders using the same leverage can experience very different results simply because they chose different lot sizes.

Understanding lot size helps traders align their position size with account balance, stop-loss distance, and overall risk strategy. Without proper lot size control, even a small market move can result in disproportionately large losses.

What Is Leverage in Forex Trading?

Leverage in forex is the ability to control a larger position than your actual capital by borrowing funds from the broker. It is expressed as a ratio, such as 1:50, 1:100, or 1:2000, which shows how many times your account balance can be multiplied to open a trade.

With 1:100 leverage, a trader with $1,000 can control a position worth $100,000.

Leverage allows traders to access larger market exposure with a smaller initial investment, making it a powerful tool for increasing potential profits.

However, leverage also magnifies losses. If the market moves against your position, losses are calculated based on the full size of the trade, not just the capital you invested. This is why proper risk management is essential.

Leverage doesn’t change the pip value or profit/loss per lot that is determined by the lot size. Instead, it affects how much margin you need to open and maintain a trade. Understanding leverage helps traders plan positions responsibly without overcommitting their account balance.

Lot Size vs Leverage: The Real Difference

While lot size and leverage are closely related, they serve very different purposes in forex trading.

- Lot size determines the actual volume of your trade, directly affecting how much you gain or lose per pip movement. It is the main factor controlling trade risk.

- Leverage determines how much margin you need to open that position. It allows you to control a larger trade with less capital but does not change the risk inherent in the lot size itself.

Many beginners confuse the two, thinking higher leverage automatically increases potential profit. In reality, risk is driven by lot size, and leverage simply allows you to open larger positions with less upfront capital. Two traders using the same leverage can experience very different outcomes depending on the lot sizes they choose.

How Lot Size and Leverage Work Together

Lot size and leverage are interconnected, but understanding their relationship is key to managing risk effectively.

Leverage allows traders to open larger positions than their account balance would normally permit.

For example, with 1:100 leverage, a $1,000 account can control a $100,000 trade. However, the lot size still determines the pip value and actual profit/loss. A larger lot size increases both potential gains and potential losses, regardless of leverage.

Traders often calculate margin requirements using the formula:

Margin = (Lot Size × Contract Size) ÷ Leverage

This shows how leverage reduces the amount of capital needed to hold a position. While leverage affects the margin, it does not reduce risk; lot size does. Using high leverage with a large lot size without proper risk control can quickly lead to account losses.

Lot Size vs Leverage vs Margin (Full Clarity)

Many beginners in forex trading confuse lot size, leverage, and margin. While they are closely related, each plays a different role, and misunderstanding them can lead to excessive risk or margin calls.

| Concept | What It Means | Example | Impact on Risk |

|---|---|---|---|

| Lot Size | Trade volume — how many units of the base currency you buy or sell. |

Standard: 100,000 units Mini: 10,000 units Micro: 1,000 units |

Determines pip value and how much you gain or lose per price move. |

| Leverage | Allows you to control a large position with a smaller amount of capital. | 1:100 leverage lets a $1,000 account control $100,000 | Reduces required margin but does not reduce risk. |

| Margin | Funds held by the broker to open and maintain a trade. | 1 standard lot with 1:100 leverage = $1,000 margin | Losses are based on the full lot size, not just the margin. |

How they work together

Lot size controls how much you gain or lose per pip, leverage determines how much capital is needed, and margin is the actual amount locked by your broker. Two traders using the same leverage can face very different risks depending on their lot size.

Practical Tip

When opening a trade, always calculate:

- Maximum risk per trade (usually 1–2% of account balance)

- Lot size that aligns with that risk

- Required margin based on leverage

How to Calculate Lot Size With Leverage (Practical Example)

Calculating lot size with leverage is essential for proper risk management in forex trading. Many beginners focus only on leverage, assuming higher leverage means bigger profits, but the actual trade risk is determined by lot size, not leverage. Understanding this calculation ensures you never risk more than your account can handle.

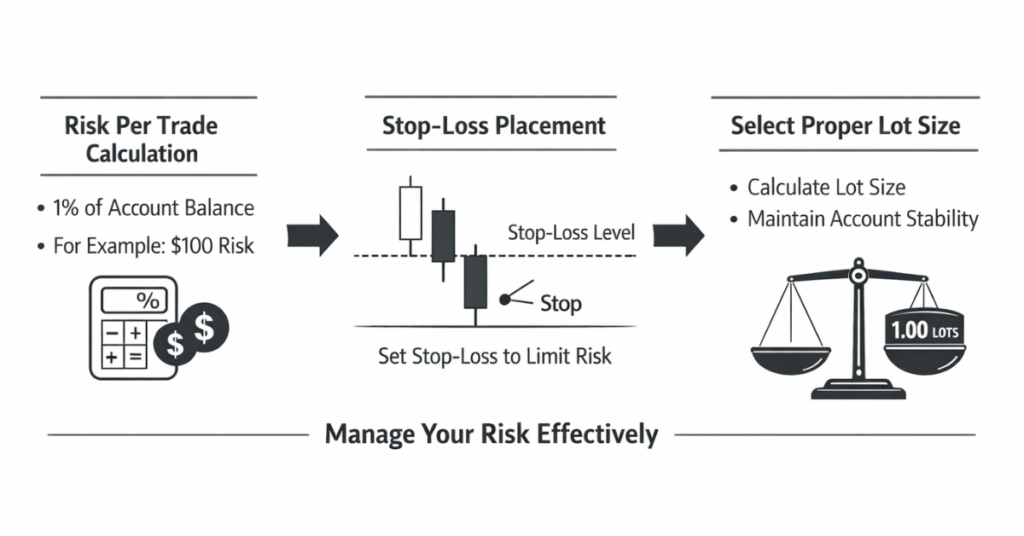

Step 1: Determine Your Risk Per Trade

First, decide how much of your account you are willing to risk on a single trade. A common rule is 1–2% of your account balance.

- Example: If your account has $5,000 and you choose to risk 2% per trade, your maximum risk is:

5000 × 0.02 = $100

Step 2: Identify Stop-Loss Distance

Next, set a stop-loss based on market conditions, which defines how many pips you are willing to let the trade move against you.

- Example: Stop-loss = 50 pips

Step 3: Calculate Pip Value per Trade

The pip value depends on the lot size:

- Standard Lot (1.0 lot): $10 per pip

- Mini Lot (0.1 lot): $1 per pip

- Micro Lot (0.01 lot): $0.10 per pip

Step 4: Calculate Appropriate Lot Size

Now, use the formula to match your risk tolerance:

Lot Size = Risk per Trade ÷ (Stop-Loss × Pip Value per Lot)

- Example: Risk = $100, Stop-Loss = 50 pips, Mini Lot pip value = $1

Lot Size = 100 ÷ (50 × 1) = 2 mini lots (0.2 standard lot)

Step 5: Consider Leverage

Leverage affects the margin required but does not change your risk per trade.

- Example: Using 1:100 leverage, controlling 0.2 standard lot (20,000 units) requires:

Margin = (Lot Size × Contract Size) ÷ Leverage

Margin = (20,000 ÷ 100) = $200

Even though you control $20,000 worth of currency, your risk is still capped at $100, which aligns with your account strategy.

Risk Management: Choosing the Right Lot Size and Leverage

Effective risk management is the cornerstone of successful forex trading. While leverage allows traders to control larger positions, and lot size determines trade exposure, the combination of both must be carefully managed to protect your account from significant losses.

1. Focus on Lot Size, Not Just Leverage

Many beginners mistakenly believe that higher leverage equals higher profits. In reality, lot size dictates the actual risk per trade, and leverage only reduces the margin required to open a position. A small lot with high leverage can be safer than a large lot with low leverage.

- Example: Trading 0.1 lot with 1:500 leverage exposes much less risk than 1 lot with 1:50 leverage, even though the first position controls a larger notional value.

2. Set Risk Per Trade Limits

Traders should never risk more than 1–2% of their account balance per trade. This simple rule ensures that even a string of losing trades will not wipe out the account.

- Example: $5,000 account → max risk per trade = $50–$100

- Using calculated lot size and stop-loss ensures this limit is respected.

3. Adjust Stop-Loss According to Market Volatility

Lot size should also consider the distance of your stop-loss. A wide stop-loss with a large lot increases risk exponentially. Always calculate the dollar risk based on pip movement, not leverage.

4. Avoid Overleveraging

High leverage is tempting because it allows larger positions with small capital. However, overleveraging combined with large lot sizes is the fastest way to blow an account.

5. Use a Consistent Risk Management Strategy

Successful traders often use a formula:

Lot Size = (Account Balance × % Risk) ÷ (Stop-Loss in Pips × Pip Value)

- This ensures every trade has a predefined risk, regardless of leverage.

- Adjust leverage to reduce margin requirements, not to increase trade risk.

6. Practical Example

- Account Balance: $5,000

- Risk per trade: 2% → $100

- Stop-loss: 50 pips

- Pip value for 0.2 lots: $1/pip

Lot Size = 100 ÷ (50 × 1) = 2 mini lots (0.2 standard lot)

- Leverage 1:100 → Margin Required = $200

- Even with leverage, risk stays capped at $100

5 Common Mistakes Traders Make With Lot Size and Leverage

Even experienced traders can make errors when managing lot size and leverage. Understanding these common mistakes helps avoid unnecessary losses and improves long-term trading consistency.

1. Confusing Leverage With Trade Size

Many beginners believe that higher leverage automatically increases profits. In reality:

- Leverage only reduces the margin required to open a position.

- Risk is determined by lot size and stop-loss distance, not leverage.

2. Ignoring Pip Value and Position Risk

Not calculating pip value per lot size is a common mistake:

- Example: Trading 1 standard lot EUR/USD, each pip = $10.

- If your stop-loss is 50 pips, risk = $500.

- Failing to consider this can result in unexpected losses.

3. Overleveraging With Large Lot Sizes

High leverage combined with a large lot size can dramatically increase risk:

- Example: Using 1:500 leverage with 2 standard lots on a $1,000 account is extremely risky.

- Even a small market move can cause significant losses.

4. Trading Without a Risk Management Plan

Some traders open positions based on market hype or tips without calculating:

- Appropriate lot size

- Stop-loss distance

- Account risk per trade

This approach often leads to overexposure and emotional trading decisions.

5. Failing to Adjust for Market Conditions

Market volatility affects how far stop-losses need to be placed. Not adjusting lot size to accommodate wider stops increases risk unnecessarily.

Trading Conditions That Help Manage Lot Size and Leverage

To trade effectively and manage risk, having the right trading conditions is as important as understanding lot size and leverage. Certain broker features and account types make it easier for traders to apply proper risk management and maintain consistent trading discipline.

1. High Leverage Options

Traders benefit from brokers offering flexible leverage, such as up to 1:2000, because it allows control of larger positions without tying up excessive capital. However, it’s important to use leverage responsibly and always calculate lot size first.

With 1:2000 leverage, a $1,000 account can control a $2,000,000 position. However, the risk per trade is still determined by the lot size and stop-loss settings, not by leverage alone.

2. Low Spreads and No Commission/Swap Fees

Brokers that offer spreads from 0.3 pips and no commissions or swap fees make trading more cost-efficient. Lower trading costs mean:

- You can use smaller lot sizes effectively without losing a significant portion of potential profits to fees.

- More flexibility when adjusting lot sizes according to account balance.

3. Global Reach and Accessibility

Trading platforms accessible to clients from all countries with multiple language options ensure that every trader can open accounts, monitor trades, and manage risk without barriers.

4. Fast Support and Withdrawals

Quick access to customer support and fast withdrawals (within 4 business hours, including weekends) is essential. If trades need adjustments or margin issues arise, fast broker support helps maintain control over positions.

5. Swap-Free or Islamic Accounts

For traders who cannot use traditional swap-based accounts, having swap-free options allows holding positions overnight without additional costs, which is useful when adjusting lot size and leverage for longer-term strategies.

Adjust lot sizes effectively

Control risk with precision

Maintain flexibility without sacrificing account protection

Final Thoughts: Lot Size vs Leverage Simplified

Understanding the difference between lot size and leverage is essential for every forex trader. Lot size determines your actual trade exposure and directly affects profit, loss, and risk, while leverage allows you to control larger positions with less capital but does not reduce the inherent risk of your trade.

By focusing on proper lot sizing, risk-per-trade limits, and calculated stop-losses, traders can use leverage responsibly and maintain account stability. High leverage is a powerful tool when paired with disciplined lot size management, but reckless use can quickly lead to significant losses.

Open a Live Trading AccountFAQs

No. Lot size determines the actual trade volume and profit/loss per pip, while leverage only determines how much margin you need to open that position. Confusing them can lead to excessive risk.

Not directly. Risk is determined by lot size and stop-loss distance, not leverage alone. High leverage can amplify losses if lot sizes are too large, but with proper risk management, it can be used safely.

Margin is calculated based on lot size and leverage. Larger lot sizes require more margin, but using higher leverage reduces the capital needed to hold that position.

Beginners should start with micro or mini lots (0.01–0.1 standard lot) to limit exposure while learning to manage trades, stop-losses, and leverage responsibly.

Yes, if lot size, risk per trade, and stop-loss levels are properly calculated. Leverage is a tool for flexibility, not a shortcut to higher profits.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.

- Top 20 Trading Indicators for Forex, Stocks & Crypto

- What Time Does the Forex Market Open on Sunday?

- MT5 Indicator For Volatility Index

- MT4 Entry Indicator

- Power of three for Trading at 930 Market Open

- How Much is 0.5 Lot Size in Dollars

- List of Major and Minor Forex Pairs

- What Is Considered the Greatest Risk Associated With Forex Settlement?

- Is NZD/USD a Major or Minor Pair?

- Trailing Stop Limit: Definition, Uses & Trading Guide