Is forex a skill or luck? The short answer: Success in forex trading leans heavily toward skill, but luck can influence individual trades. Building strategy, managing risk, and executing consistently are all skills. Luck may give you a favourable move, but it won’t sustain your success in the long run.

Key Takeaways

- Consistent forex profits generally stem from skills like strategy, discipline, risk control.

- Luck can affect one trade, one win, or one stroke of good fortune, but cannot replace skill for the long haul.

- A skilled trader focuses on edge, risk‑reward, and execution; a trader relying on luck treats the market like gambling.

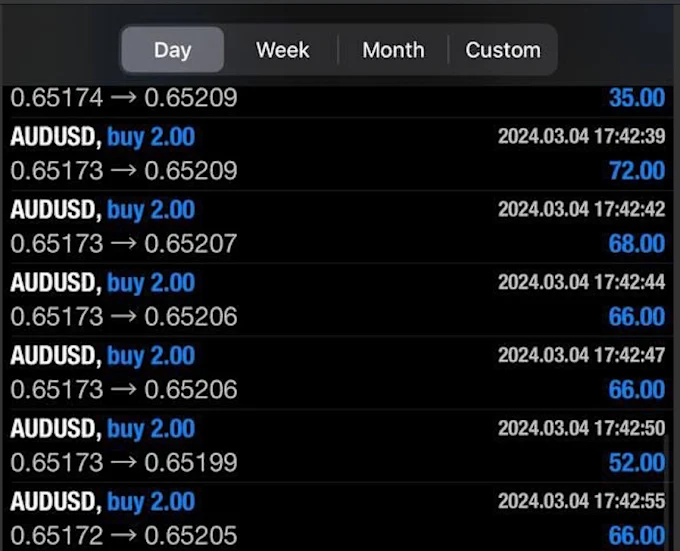

- Over short time frames, results often look random; over many trades, skill distinguishes winners from the pack.

- Understanding the difference helps you adopt the correct mindset: improve skills, don’t chase luck.

What Role Does Skill Play in Forex?

Skill in forex means developing a structured approach: you create a trading plan, choose your timeframes and pairs, calculate risk, place trades, monitor performance, and refine your strategy. Resources emphasize this every day.

Skill involves:

- Technical and fundamental analysis.

- Managing risk (stop‑losses, lot sizes).

- Emotional control (avoiding revenge trades, over‑leveraging).

- Journaling results and learning from mistakes.

Skilled trading leads to consistent returns, even when markets disagree with you.

What Role Does Luck Have in Forex?

Luck in forex often appears when market conditions favor your trade unexpectedly, maybe an economic surprise, news event, or sudden trend spurt.

For example, you might get a winning trade without real reason or buy just before a huge move. But because you cannot rely on such timing, luck should be seen as a by‑product, not a strategy.

Skill vs. Luck: What Really Drives Trading Success

Many experts describe trading results as lying on a spectrum between skill and luck. For short sample sizes, luck can dominate. But over months or years, skill matters much more strongly.

| Factor | Skill-led Trading | Luck-led Trading |

| Strategy | Clear method, rules, repeatability | No plan or random entries |

| Risk management | Tight stop‑losses, sensible lot sizes | Big exposure, hoping for payoff |

| Time horizon | Months to years, track record | One trade, a few wins, no consistency |

| Control over outcome | High (you control entries, exits) | Low (reliant on randomness) |

| Sustainability | Possible if skills maintained | Typically unsustainable over time |

5 Signs You Are Trading with Skill (Not Luck)

Here are five clear indicators that your trading is guided by skill rather than chance:

1. You can explain every trade decision. You know exactly why you entered and exited a trade, based on technical or fundamental reasons, not a gut feeling. Skilled traders can justify their moves because they follow a defined process.

2. You risk a consistent percentage per trade. Instead of betting random amounts, you risk a fixed percentage of your account (commonly 1–2%). This helps you control losses and ensures that no single trade can wipe out your capital.

3. You follow a trading plan, not emotions. Your trades align with a written plan that defines your strategy, entry and exit criteria, and risk rules. You don’t let fear or greed push you to act impulsively.

4. You analyze and learn from losing trades. Losing trades is inevitable, but skilled traders treat them as lessons. They review what went wrong, whether it was poor timing, setup, or discipline, and use that insight to improve.

5. You accept losses as part of the game. You don’t expect to win every trade. Instead, you focus on long-term consistency and the quality of your decisions. Skill-based traders think in probabilities, not perfection.

When these habits become part of your routine, you’re developing genuine trading skill. If they’re missing, your results may rely more on luck than mastery.

Why Beginners Often Mistake Forex for Luck

New traders frequently attribute wins to luck and losses to bad luck, because they don’t yet have the frameworks to evaluate skill. On short timeframes or with small sample sizes, randomness dominates. Without sufficient trades and a disciplined process, you can’t separate luck from skill. Beginners need time, practice, and reliable data.

How to Shift from Luck to Skill

- Create a written trading plan: Define your market, risk, trade rules, and review process.

- Use demo or small‐size live accounts: Build your skills with limited risk.

- Track everything: Entry, exit, reasoning, risk, and outcome. Constant review grows skill.

- Apply proper risk management: Only risk a small % of your capital per trade.

- Keep training: Learn new strategies, refine, and adapt to changing markets.

- Mindset matters: Accept losses, avoid impulsive trading, and stay consistent.

Ready to trade with skill and not luck?

Open your trading account with Defcofx today.Final Thoughts

So, is forex a skill or luck? While luck may have a place in one trade or a short winning streak, long‑term success in forex is overwhelmingly a matter of skill: disciplined execution, risk control, strategy, and learning. If you’re depending on luck alone, you’re gambling. If you’re building skill, you’re investing in your trading future.

Platforms like Defcofx give you the tools to apply your skills, like raw spreads, transparent execution, and access to global markets, so you can focus on building your process, not chasing random outcomes.

Open a Forex Trading Account

FAQs

Yes, a beginner might catch a lucky trade or two. But relying on luck alone rarely leads to sustained profitability. To succeed long‑term, skill and process matter far more.

Look at your performance over many trades, not just one or two. If you have a clear strategy, consistent positive expectancy, and well‑managed risk, it’s more likely skill. If you’re winning randomly, it’s likely luck.

If you trade without a plan, risk control, or strategy, it looks like gambling. With a plan, strategy, and discipline, it aligns more with investing and skill‑based trading.

Yes, especially in the short term. Unexpected market events or timing can produce lucky trades. But this luck is fleeting,, so you must rely on skill and process.

Start with education, demo trading, risk management rules, journaling, and disciplined execution. Focus on strategy first, then gradually build experience and confidence over time.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.