World markets were electrified on Oct 30 as a dovish Fed and an unexpected trade thaw sent major currencies on a rollercoaster. The Fed slashed rates 25 bps on Wednesday, but Powell’s “strongly differing views” warning (and a stalled government shutdown) kept traders cautious. At the same time, President Trump’s summit with Xi Jinping produced a tariff cut (China tariffs trimmed to 47% from 57%) and rare-earth deal, easing a major risk overhang. Oil prices ticked up on Thursday (Brent ~$64.6) as US crude stocks fell hard. In short, risk-on sentiment mixed with policy twists: USD slid broadly, while carry‐sensitive FX and oil-linked currencies saw relief. Against this backdrop, EUR/USD, USD/JPY and USD/CAD each made sharp moves.

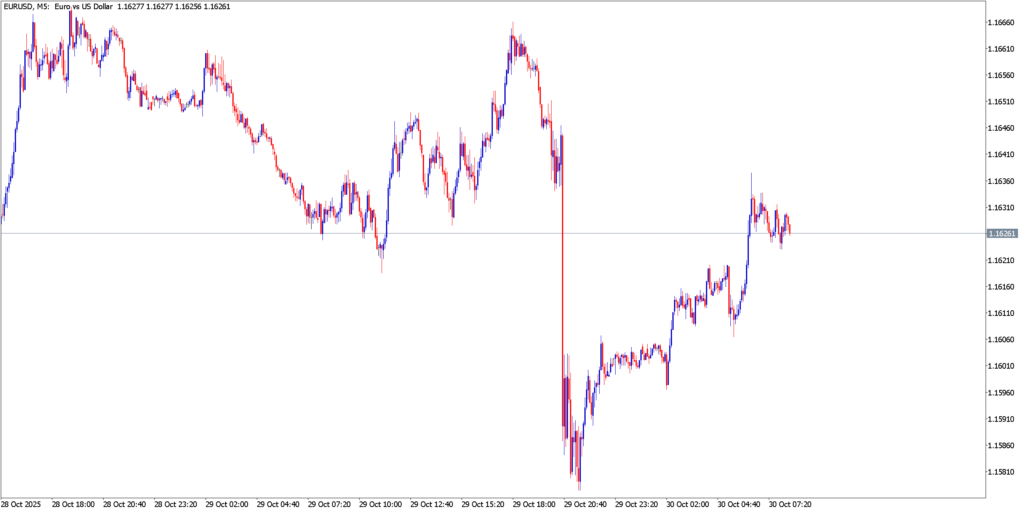

EUR/USD

Technical Analysis

The euro enjoyed a burst of upside. On the intraday chart it pierced a short-term downtrend line, with the RSI climbing past 60 (bullish momentum is building). Price action shows a break above last week’s highs near 1.1580, with key resistance now around ~1.1660 (the 100-day MA) and 1.1700 (the 200-SMA/Fibonacci). Support holds near 1.1550–1.1580. Momentum indicators are turning positive after earlier consolidation.

Fundamental Analysis

EUR/USD found tailwinds from Fed dovishness and thawing trade tensions. The Fed’s 25bp cut was broadly priced in, but Powell’s downbeat outlook and data blackout (shutdown) capped USD strength. Overnight, Trump and Xi clinched a trade framework (soothing demand fears). Europe’s side was stable: the ECB held rates steady (as expected) on Oct. 30, stressing that inflation is “on target”. Market commentary sees ECB policy “in a good place” and even a chance of a cut by mid-2026. On fundamentals, euro-zone growth and politics remain modest – French political turmoil and weak PMI data have kept buyers cautious – but for now EUR enjoys USD softness. In fact, after Fed news the euro nudged higher (to ~$1.1625 on Thurs), reflecting broad USD weakness and mild risk appetite.

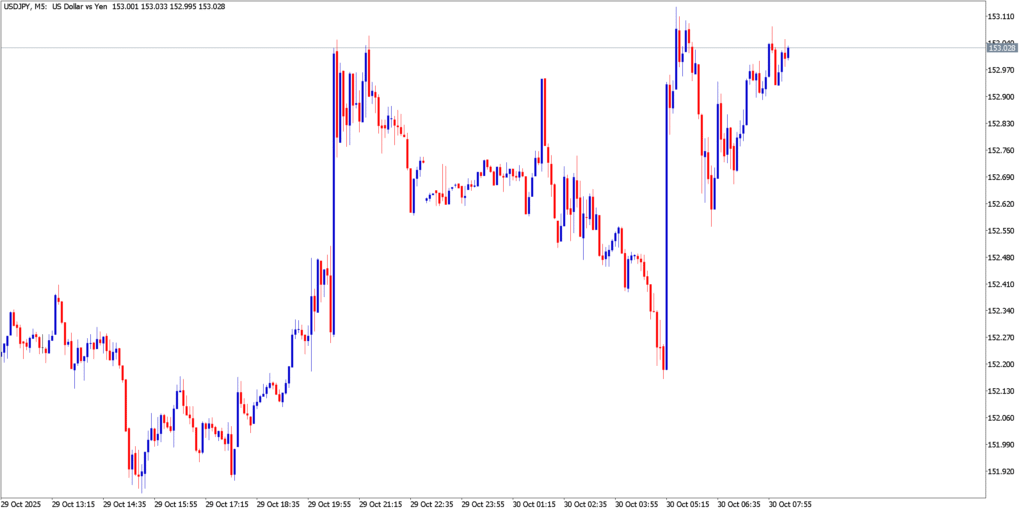

USD/JPY

Technical Analysis

USD/JPY has jumped to near 153.0 after early-Friday moves. The pair broke above resistance around 152.50, reflecting the yen’s weakness, and now trades near the high-$152 area. On the chart, this surge has steered price well above its 50- and 100-day averages, with RSI in overbought territory (not shown). Key support stands near 152.00 and 151.50; resistance is at the recent peaks (~153.00), a level it struggled to clear earlier. In sum, the technical tone is bullish for USD/JPY on short time frames, though the break above 153 could stall absent fresh catalysts.

Fundamental Analysis

The yen’s slide and dollar’s rally dominated USD/JPY. The BOJ kept its benchmark at 0.50% on Oct. 30, as widely anticipated. Even so, BOJ Governor Ueda emphasized that future hikes are still on the table if Japan’s strong recovery holds. Two BOJ board members dissented for a hike, signaling caution by the Bank. In the wake of the decision, the yen weakened – the USD/JPY rate hit around ¥152.83 (an 8–9-month low for the yen). Currency strategists note that the BOJ’s pause (with growing hawkish hints) contrasts with a Fed treading water, putting upward pressure on USD/JPY. Moreover, Trump-Xi trade optimism (and cooling tariff fears) boosted global risk appetite, nudging the carry-friendly yen lower. On Friday, Japan’s PM change (Sanae Takaichi’s looser policy stance) also weighed on JPY. In U.S. markets, Fed Chair Powell struck a surprisingly cautious tone about future cuts, which undercut USD gains somewhat, but the net impact on USD/JPY was still a modest rally.

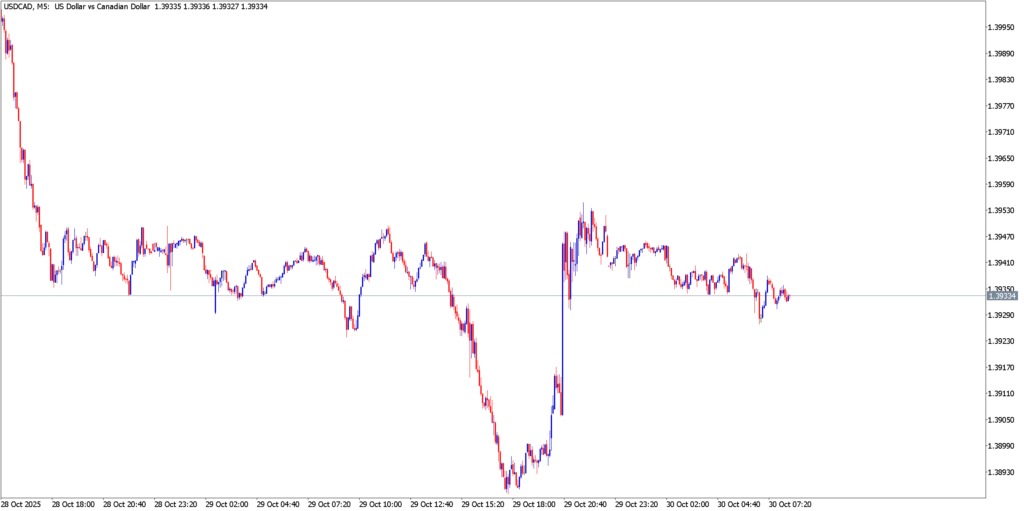

USD/CAD

Technical Analysis

USD/CAD hovered near 1.39–1.40 after earlier declines. The intraday chart shows USD/CAD carving out a falling wedge/triangle pattern: it briefly poked below 1.3900 (the mid-Oct low) on Wednesday but bounced back. Key support is at 1.3890–1.3900, while immediate resistance sits near 1.3950 and 1.4000 (psychological/round levels). Momentum on the 5-min chart has turned neutral after a bearish run; RSI is now around the mid-40s. A break below 1.3900 could target last week’s low (~1.3880), whereas a climb above 1.3960 would test the wicks of this week’s move.

Fundamental Analysis

The Loonie was driven by BoC policy and oil moves. On Oct. 29 the Bank of Canada cut rates to 2.25% (second cut) and signaled this might be the last in the cycle. Surprisingly, that announcement saw the Canadian dollar firm up (USD/CAD fell to ~1.3915 by day-end), as markets looked through the rate cut to brighter growth forecasts and ebbing tariff news. Oil prices provided mild support to CAD: U.S. crude spiked ~2% after big stock draws, though by Friday trade optimism outweighed that. Trump’s South Korea deals – cutting China tariffs and resuming soy purchases – eased global growth fears, buoying commodity demand. Conversely, Canada-US trade drama fizzled: U.S. tariff threats (10% on Canadian goods) were broadly shrugged off, undercutting any safe-haven flows into USD. The general USD softness (DXY off its highs) also helped CAD. In sum, USD/CAD dipped on Thursday as CAD strength and oil gains coincided; by Friday it was modestly lower on the session.

Market Outlook

Thursday’s session mixed dovish Fed vibes, an ECB hold, BOJ caution and surprising trade progress – a potent blend that kept FX markets on edge. EUR/USD rallied on USD selling and trade optimism, USD/JPY climbed as the yen languished, and USD/CAD eased as oil and BoC guidance supported the Loonie. Looking ahead, traders will eye the U.S. jobs report and inflation data (to gauge Fed’s next move), Eurozone PMI and CPI updates, and any follow-up on U.S.-China trade talks. Geopolitical flashpoints – including the U.S. government shutdown and European political risks – may re-inject volatility. With central banks united in patience for now (ECB and BoJ on hold) and markets priced for more Fed cuts next year, currency swings could stay sharp. Next week’s cues: U.S. nonfarm payrolls, Canada’s employment figures and further China news may provide the next catalysts in this drama.