Monday’s session kicked off with global markets ablaze: trade-truce optimism among Trump and Xi lifted stocks to fresh highs while the U.S. dollar softened. Safe-havens crashed — gold plunged toward the $4,000 level — as traders bet on a breakthrough in U.S.–China talks. This risk-on backdrop catapulted currencies into a frenzy. EUR/USD, USD/JPY and USD/CAD all swung dramatically as we saw sharp moves driven by economic surprises and policy whispers. Below we break down each pair’s performance, key inflection points and the catalysts that moved them.

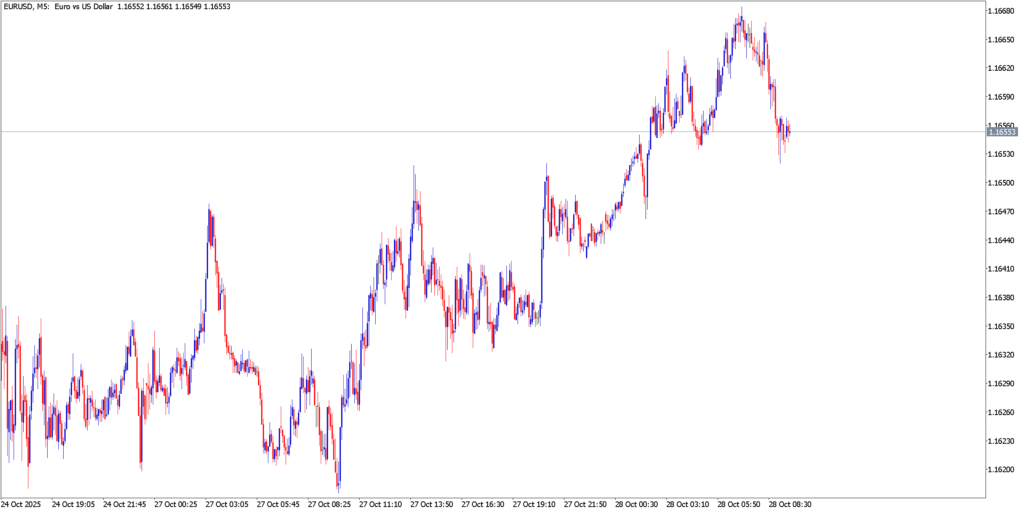

EUR/USD

The euro punched higher early Monday, climbing out of the 1.15s after Germany’s business climate index beat forecasts. The Ifo index jumped to 88.4 in October (from 87.7 prior, above the 88.0 consensus), surprising traders and boosting EUR/USD. As news hit, EUR/USD surged toward 1.1650 and tested resistance in the 1.1685–1.1700 area. Technically, the 20-day simple moving average (around 1.1655) was a barrier, and analysts warned that a clear drop below 1.1550–1.1570 could trigger a renewed selloff toward the 1.1400 zone. On balance, Monday’s dollar weakness and upbeat euro data drove EUR/USD sharply higher, though gains stalled near the upper resistance cluster.

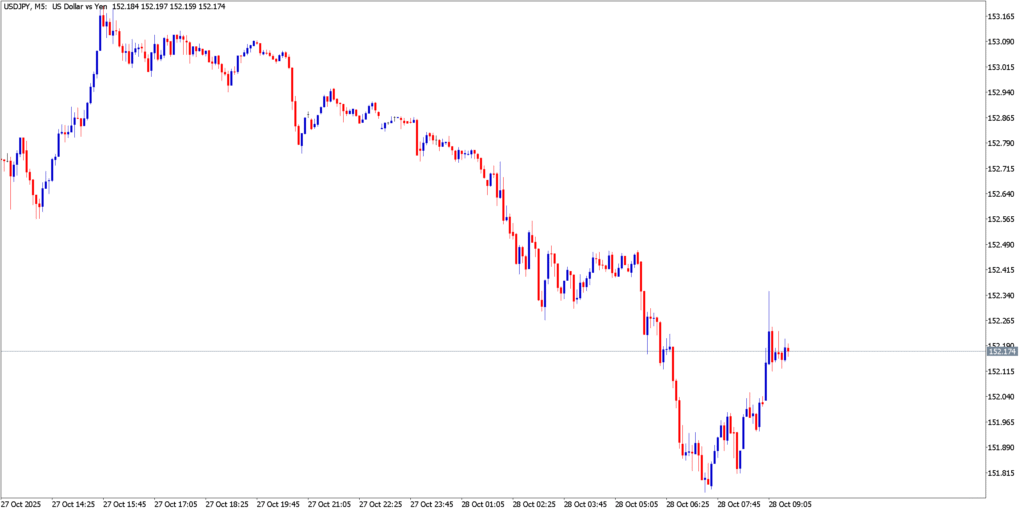

USD/JPY

The dollar surged against the yen, with USD/JPY briefly breaking 153.00 on Monday. Rising U.S. Treasury yields (the 2-year topped ~3.50%) lent support to USD/JPY, as did the widespread risk-on mood that sent traditional safe-haven yen lower. Traders noted that Japan’s market-shaking news was thin, but the Bank of Japan’s dovish stance (no change expected) meant any weakness in the yen would lift USD/JPY. From a technical standpoint, the pair was eyeing resistance near 154.50–155.00 if 153.00 holds, while immediate support was the 20-day moving average around 151.15. In short, Monday’s action saw USD/JPY run into short-term overbought conditions, but with yields up and BoJ ultra-easy, the uptrend had room above recent highs.

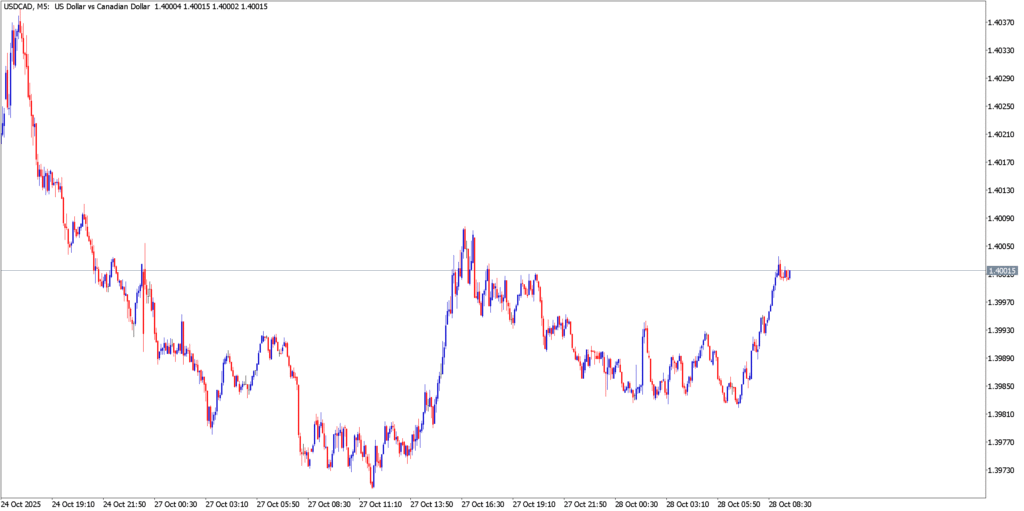

USD/CAD

USD/CAD largely treaded water, hovering just under the 1.4000 mark on Monday. The loonie’s advance was capped by plunging oil prices and looming policy shifts. West Texas crude slid to about $61/barrel as OPEC+ hints at higher output pressured oil-linked currencies. At the same time, markets were pricing in more U.S. rate cuts, keeping the dollar buoyant. A surprise geopolitical twist added flavor: over the weekend Trump announced a 10% tariff hike on Canadian imports, which risked dragging the CAD lower (despite most Canadian trade being tariff-exempt). The result was a stalemate: USD/CAD extended losses into mid-1.39s briefly but quickly bounced, settling near 1.3990. Analysts noted that a clear break above 1.4015–1.4020 would point toward 1.4080, but for now the pair stayed range-bound near key resistance.

Market Outlook

Looking ahead, volatility is likely to stay elevated. Key events to watch this week include:

- US Fed Meeting (Oct 29): Markets fully expect a 25 bp rate cut. If Powell signals further easing (or a cautious data outlook), the USD could come under renewed pressure.

- BoJ & BoC (Oct 30): Japan’s central bank is expected to hold policy but guide on inflation – any hint of easing would weaken the yen further. In Canada, the BoC is widely expected to cut rates, which would cap CAD strength.

- U.S.–China Summit (Oct 30): The Trump–Xi meeting at the APEC summit remains the wildcard. A firm trade deal or tariff rollback could extend the risk rally (and pressure the dollar), while any disappointment may send safe-havens like the yen and dollar bouncing back.

Against this backdrop, forex traders should brace for sharp swings. EUR/USD will hover around its 20-day moving average and the 1.1700 zone as ECB data looms; USD/JPY remains sensitive to U.S. yields versus Japan’s steady policy; USD/CAD may be volatile on every oil move and policy hint. Stay tuned to economic calendars and central-bank signals as Monday’s drama flows into the rest of the week.