A trailing stop limit is a dynamic order that moves your stop and limit prices as the market advances in your favor, helping lock in gains while controlling the exit price. Traders use it in Forex and CFD markets to automate risk management and reduce emotional decisions.

Key Takeaways

- Trailing Stop Limit Definition: A smart order that automatically adjusts stop and limit prices as the market moves in your favor.

- Purpose: Protects profits and limits losses without manual intervention.

- Difference: Unlike a simple trailing stop, it includes a price limit for controlled exits.

- Usage: Ideal for Forex, commodities, and CFD traders managing volatile markets.

- Platform Integration: Can be easily set and adjusted on MetaTrader 5 (MT5).

- Risk Management: Prevents emotional decision-making while securing profits automatically.

- Advanced Application: Supports both manual and automated trading systems for better precision.

What Is a Trailing Stop Limit Order?

A trailing stop limit is an advanced trading order that automatically adjusts your stop and limit levels as the market price moves in your favor. Its purpose is to lock in profits and minimize losses by allowing your trade to follow the market trend without constant manual monitoring.

When the market moves positively, the stop price trails behind the current market price by a fixed distance (for example, 20 pips). If the market reverses by that distance, the order becomes a limit order at the predefined limit price, allowing you to exit at your chosen level instead of the next available price.

Example: Let’s say you buy EUR/USD at 1.1000 with a trailing stop limit set 20 pips below the market price. As the price rises to 1.1020, your stop and limit move up accordingly. If the price drops to 1.1000, the limit order triggers, aiming to sell at that level and protect your gains.

This makes the trailing stop limit especially effective in volatile or trending markets, where traders want both automation and control over exit prices.

Trailing Stop vs. Trailing Stop Limit, What’s the Difference?

Many traders confuse trailing stop with trailing stop limit, but they work differently in terms of execution and risk management. Both help you lock profits as the market moves, but their behaviors when prices reverse are distinct.

| Feature | Trailing Stop | Trailing Stop Limit |

| Order Type | Becomes a market order when triggered | Becomes a limit order when triggered |

| Execution Guarantee | Ensures execution but not price | Ensures price but not execution |

| Control Over Exit Price | None, executes at best available price | Full control over limit price |

| Best For | Fast-moving, high-volatility markets | Traders prioritizing price certainty |

| Risk Level | Slightly higher slippage risk | Slightly higher non-execution risk |

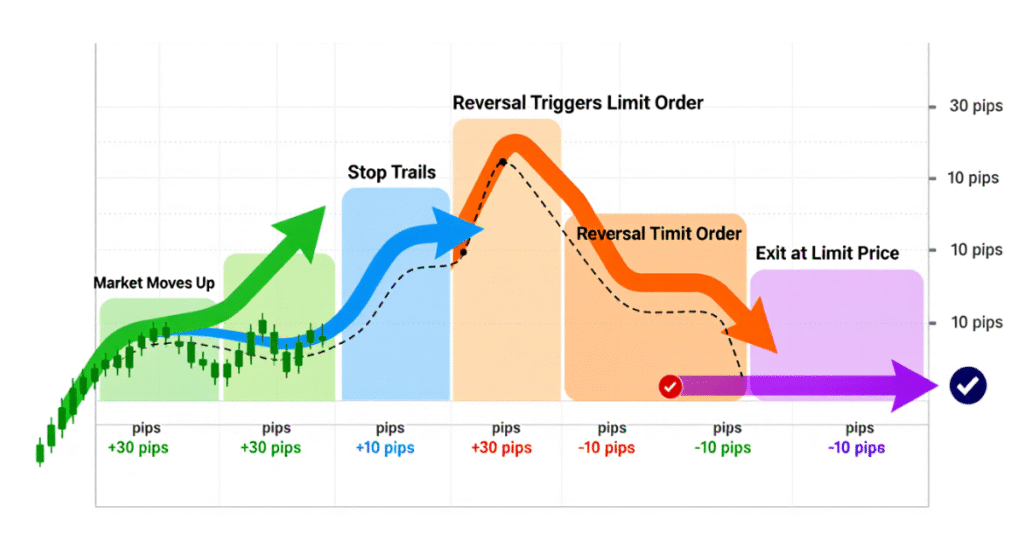

How a Trailing Stop Limit Works Step-by-Step

Understanding the mechanics of a trailing stop limit helps traders use it effectively in different market conditions. Here’s a clear, step-by-step breakdown of how it operates:

- Set the trailing distance: You choose how far below (for a buy) or above (for a sell) the market price the stop should trail. For example, 20 pips.

- Price moves in your favor: As the market price rises, your stop price automatically moves up by the same distance, maintaining the 20-pip gap.

- Price reaches new highs: The stop continues trailing upward as long as the market moves in your favor — protecting growing profits.

- Price reverses: Once the price falls by the trailing distance (20 pips in this case), the stop triggers and places a limit order at the preset limit price.

- Order executes at the limit price or better: If the market trades at or above your limit price, the order fills ensuring you exit profitably and on your terms.

When to Use a Trailing Stop Limit in Trading

A trailing stop limit isn’t suited for every situation, it performs best under specific market conditions where traders seek to balance automation with control. Understanding when to use it can significantly improve your trading results.

4 Best Situations to Use a Trailing Stop Limit

- Trending Markets: When prices move consistently in one direction, a trailing stop limit helps you ride the trend while securing incremental profits.

- Medium Volatility Conditions: Works well when price swings are moderate avoiding false triggers common in highly volatile markets.

- Swing and Position Trading: Ideal for traders holding positions for several hours or days, allowing orders to trail automatically without constant monitoring.

- Long-Term Profit Protection: When you’ve accumulated strong profits, a trailing stop limit can lock them in before trend reversal.

When to Avoid a Trailing Stop Limit

- High-Volatility Events: During major news releases or low-liquidity sessions, limit orders may not execute if prices jump suddenly.

- Sideways or Ranging Markets: Frequent price reversals can cause premature triggers and missed opportunities.

- Tight Trailing Distances: Setting the trail too close to the market price may stop you out too early.

Advantages and Disadvantages of Trailing Stop Limits

Trailing stop-limit orders offer strong profit protection with price control — but they also carry execution risks. Understanding both sides helps traders use them wisely.

Comparison Table

| Aspect | Advantages | Disadvantages |

|---|---|---|

| Profit Protection | Automatically trails the market, locking in profits as price moves upward. | If the market gaps below your limit price, the order may never execute. |

| Emotional Discipline | Eliminates the need for manual adjustments, reducing fear- or greed-based decisions. | Traders may rely too heavily on automation without monitoring market conditions. |

| Price Control | Lets you set a minimum acceptable exit price, avoiding poor fills seen with market orders. | Price certainty comes at the cost of execution uncertainty, especially in fast markets. |

| Trend Trading Suitability | Works well for medium- and long-term trend followers who want profits to compound. | Performs poorly in sideways or choppy markets where frequent reversals can trigger unnecessary stops. |

| Market Compatibility | Can be used across Forex, commodities, indices, stocks, and CFDs. | Requires careful setup — wrong trailing distance can cause premature triggers or missed exits. |

| Volatility Handling | Helps capture extended moves during stable trends. | In highly volatile markets, price may jump through your limit, preventing the order from filling. |

Summary

A trailing stop limit is best for traders who prioritize price control and are comfortable accepting the risk of non-execution. It shines in trending markets but requires caution during high volatility or range-bound conditions.

5 Common Mistakes to Avoid When Using a Trailing Stop Limit

Even experienced traders can misuse the trailing stop limit, often turning a good strategy into a missed opportunity or an unnecessary loss. Avoiding the following mistakes will help you use it effectively and confidently.

1. Setting the Trailing Distance Too Tight

If your trailing stop is too close to the current market price, normal fluctuations might trigger it prematurely closing your trade before it has a chance to grow.

2. Ignoring Market Volatility

Volatile markets can cause erratic movements that hit your trailing stop too soon. Failing to adjust your trailing settings during high-impact news or sessions like the London–New York overlap can lead to unwanted exits.

3. Not Defining a Proper Limit Offset

A limit offset that’s too small may prevent execution when the market moves rapidly. Always set a buffer between the stop and the limit price (e.g., 3–5 pips for Forex) to ensure execution while maintaining price control.

4. Forgetting to Monitor Orders

Trailing stop limits need active platform connectivity. If your terminal is closed, MT5 can’t adjust your stop dynamically.

5. Overusing Trailing Stop Limits on Every Trade

Not all strategies require trailing stops. For example, scalpers or range traders may prefer fixed stop-loss levels instead of trailing orders.

Final Thoughts on Trailing Stop Limit

The trailing stop limit is a sophisticated order type that empowers traders to strike a strategic balance between automation and control. By dynamically adjusting to market movements, it allows you to lock in profits as prices trend in your favor while retaining control over the minimum acceptable exit price through the limit component. This makes it particularly valuable in trending, moderately volatile markets where traders want to let profits run without the emotional pressure of manual management.

That said, its success hinges on smart configuration and appropriate timing. A poorly set trailing distance or limit offset can lead to premature exits or unfilled orders, especially during fast-moving or news-driven markets. When used wisely ideally on reliable platforms like MT5 trailing stop limits can enhance discipline, reduce emotional decision-making, and turn solid trades into consistently profitable positions.

Open a Trading Live Account(FAQs) About Trailing Stop Limit

A trailing stop limit order automatically adjusts your stop price as the market moves in your favor. When triggered, it converts into a limit order at your predefined price level giving you more control over your exit price compared to a regular trailing stop.

A trailing stop becomes a market order when triggered it guarantees execution but not price.

A trailing stop limit, however, becomes a limit order that guarantees price but not execution.

In short: one prioritizes execution, the other prioritizes control.

Yes. You can set a custom trailing stop limit on MT5 by right-clicking an open trade → Trailing Stop → Custom. Defcofx’s MT5 platform supports advanced order types like this, allowing traders to automate exits efficiently.

There’s no one-size-fits-all number; it depends on market volatility and your trading strategy.

For Forex pairs: 15–30 pips

For Gold (XAU/USD): 50–100 points

For Indices: 100–200 points

Yes. Since it becomes a limit order, it may not execute if the market gaps past your limit price. That’s why traders balance between a reasonable offset and acceptable risk to ensure timely exits.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.

- New York Session Forex Pairs List

- Best Currency Pairs to Trade During London Session

- How Much is 0.5 Lot Size in Dollars

- Best Time To Trade NZD/USD

- Why is Yen so Weak?

- Is NZD/USD a Major or Minor Pair?

- Which Currency Pair is Best for Beginners

- What Is the Opening Bell for the Asian Session in EST?

- Countries That Use The US Dollar