The mood Wednesday was nothing if not frenetic. Asian markets opened cautiously after U.S.–China trade optimism bolstered risk appetite, while Europe awaited the Fed’s decision. Stocks and commodities quietly ticked up as the dollar found bids ahead of a widely-expected Fed rate cut. (U.S. officials even played up a pending deal – President Trump publicly mocked Fed Chair Powell as “Jerome ‘Too Late’ Powell” in Seoul as he hyped an incoming trade truce.) In currency markets, the euro slipped under pressure from the deal news, trading near $1.1630, while the yen bounced as traders parsed safe-haven flows against hawkish BoJ talk. The loonie wavered on fresh U.S.–Canada tariff headlines. All in all, markets brace for fireworks at the Fed (and later the BoC/BoJ) as dramatic headlines sent traders scrambling for cover.

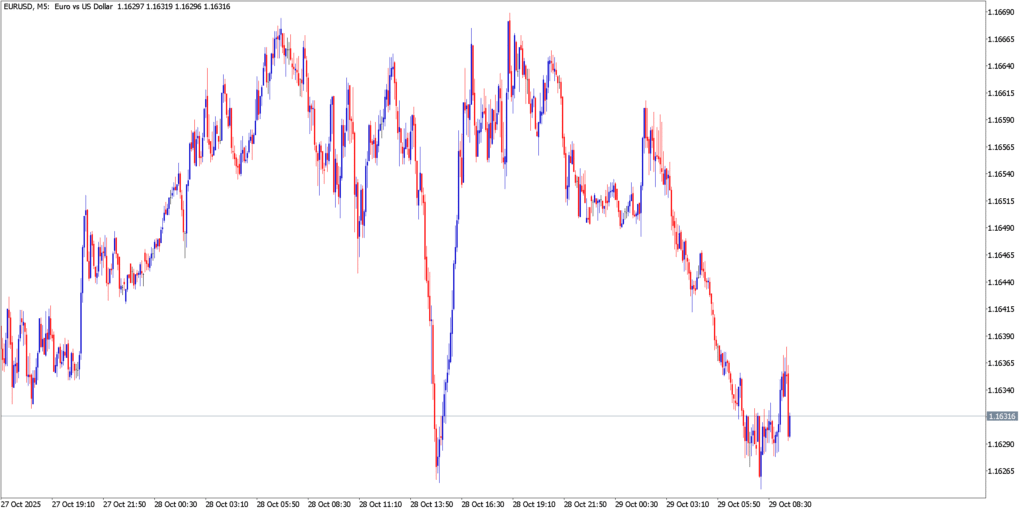

EUR/USD

Technical Analysis

The euro struggled to break above the 1.1660 ceiling on the charts, capping its five-day rally. EUR/USD drifted around 1.1630 as momentum waned and the relative strength index faded below neutral. 100- and 200-day moving averages (near 1.1660 and 1.1690) now cap upside. Key supports sit at about 1.1580 and 1.1550, levels to watch if the dollar strengthens again. In short, buyers must clear 1.1660 (the 100-day SMA) and a chart resistance line to keep any bullish run alive. If Powell’s press conference spooks traders, EUR/USD could slip towards those 1.1580–1.1550 floors.

Fundamental Analysis

Trade headlines and Fed policy dominated EUR/USD. Early Asia trade saw Trump promise huge tariff rollbacks for Beijing in return for a fentanyl control deal – a risk-on shock that dented the euro. Yet the Fed’s looming 25-bp cut kept any greenback fatigue in check. Markets fully priced Wednesday’s easing and focused on Powell’s tone for clues on further cuts. With the ECB widely expected to sit tight on Thursday, the euro had little fundamental boost besides market sentiment swings. In summary, a buoyant dollar on easing odds and dovish Fed expectations tempered EUR/USD upside. Any surprise dovishness from Powell could drag the euro back, especially ahead of Thursday’s Eurozone GDP/flash CPI releases.

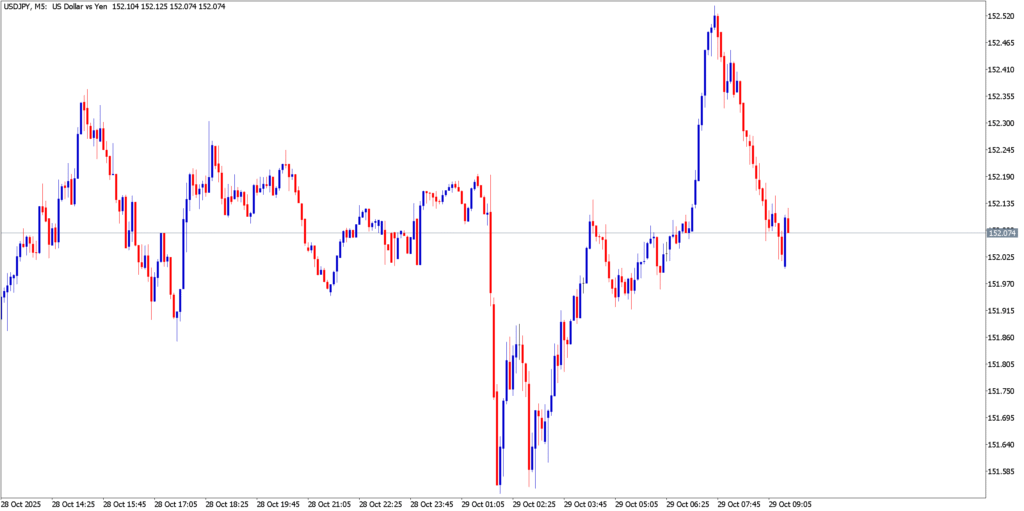

USD/JPY

Technical Analysis

USD/JPY has flipped from hot to iced after hitting ~¥153.00 resistance on Tuesday, setting up what looks like a double-top on the daily chart. The pair then collapsed sharply, trading near ¥150 – a key support zone reinforced by the 50-day moving average. If that ¥150 line and the 50-day EMA (~¥149.50) break, traders eye the next floor around ¥147–148. Conversely, a quick rebound above ¥153.00 (the double-top threshold) would put the 154.50 area on the radar again. In short, volatility is extreme and USD/JPY is pinballed between resistance near ¥153 and a critical ¥150 support. Chart watchers note any hammer bounces or sell signals at these lines – the pair is packed with technical tension.

Fundamental Analysis

USD/JPY’s swings reflected clashing policy winds. U.S. Treasury Secretary Bessent rattled markets by urging Japan to tighten policy, and yen bulls pounced – the dollar slid about 0.3% to ¥151.59 after those remarks. Bessent’s comments revived talk of another BoJ rate hike, as Japan’s inflation is now above target and policymakers have already lifted rates twice. The BOJ meets Thursday and is expected to hold for now, but three dissents for hikes could be on deck, which would keep yen fans vigilant. Meanwhile the Fed’s outlook pulls USD/JPY the other way: markets have priced a Fed cut today (with two more likely before next summer), which should weaken USD/JPY. In short, USD/JPY is caught between a stronger yen outlook (thanks to U.S. pressure and higher Japanese inflation) and potential safe-haven flows. Traders will also watch Japanese bond yields and global risk trends: equity gains may allow USD/JPY to bounce if investors chase higher yields, but any uptick in tensions or Fed dovishness could drive it lower.

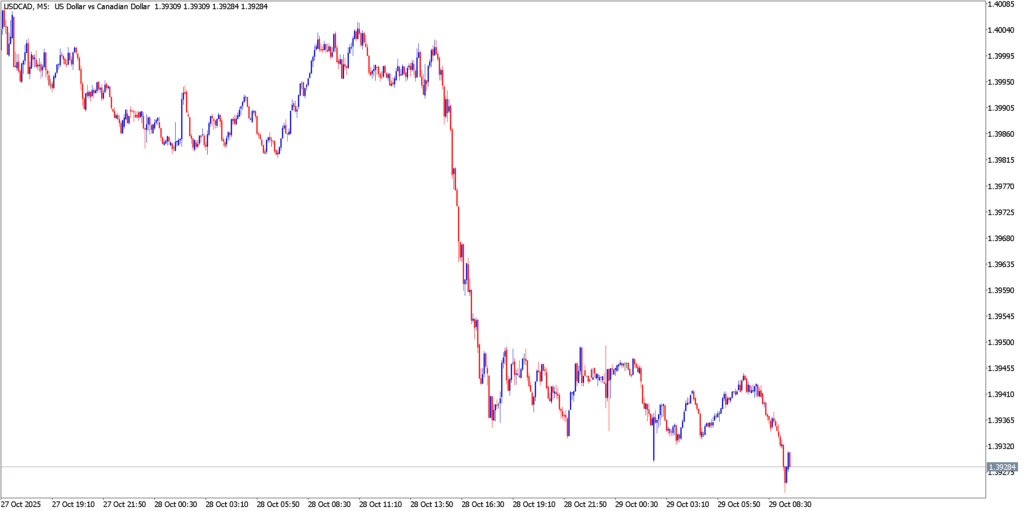

USD/CAD

Technical Analysis

The USD/CAD chart is flashing bearish. The pair extended losses for a third straight session and slipped to ~1.3930 in early European trade. It has broken below the nine-day EMA and its RSI is trading under 50, signaling rising downside momentum. Immediate support lies at the 50-day EMA (~1.3915) and the round 1.3900 mark. A clear break below this zone could target the 3-month trough around 1.3721 (set in early August). On the upside, resistance is stiff at 1.3979 (nine-day EMA) and the upper boundary of the recent range near 1.4060–1.4080. In other words, USD/CAD is rolling over in a downward flag; watch those 1.3915 and 1.3979 levels for how it plays out.

Fundamental Analysis

The loonie traded lower as data and policy outlooks skewed negative. Tariff tensions rose – Trump abruptly shelved trade talks with Canada – aggravating the export outlook. Against this backdrop, the Bank of Canada is widely expected to follow the Fed with its own 25-bp cut to 2.25% on Wednesday. Indeed, BoC business and consumer surveys were sharply downbeat. Canada’s inflation (about 2.4% in Sept) stayed relatively tame, giving the BoC room to ease despite higher prices. Weak crude prices (oil sat near multi-week lows) also removed a tailwind for CAD. The upshot: fundamental forces favored the dollar. USD/CAD was primed to climb on any pullback, especially after the Bank of Canada’s decision. Traders eyed BoC news and Canadian data, but Canada’s gloom and expected rate cut left the path open for USD/CAD gains heading into the end of the week.

Market Outlook

Wednesday’s action wove a dramatic narrative: Trump’s Asia theatrics and trade hints roiled sentiment even as the Fed readied another cut. The dollar ended stronger overall (Asian risk-on vs. Fed worry), the yen alternately rallied and retraced on policy chatter, and the loonie lagged under the weight of tariffs and central bank easing. Looking ahead, all eyes remain on Fed Chair Powell’s press conference for fresh guidance – any tilt in language will ricochet through currencies. Japan’s BoJ meeting and Canada’s policy announcement (and Ottawa’s reaction to U.S. tariffs) loom large for USD/JPY and USD/CAD. Meanwhile Thursday brings Euro-zone flash GDP and inflation figures and an ECB decision, which will test the euro’s next moves. In short: traders will stay on the edge of their seats. A single line from a central banker or a tweet from the world stage could send these pairs surging or plunging again, so buckle up for more volatility.