The 7 major currency pairs are the most traded pairs in the forex market. These pairs always include the U.S. dollar (USD) on one side and are known for their high liquidity, tight spreads, and constant market activity. If you’re new to trading, these pairs are a great place to start.

Key Takeaways

- Major currency pairs include USD and another top global currency.

- The 7 majors are EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, AUD/USD, and NZD/USD.

- They offer low spreads and high liquidity, ideal for new and experienced traders.

- Brokers like Defcofx provide raw spreads and instant execution on these pairs.

- Major pairs react strongly to global economic events and news.

7 Major Currency Pairs

The 7 major currency pairs are the most widely traded forex pairs across the world. These pairs involve the U.S. dollar and a strong, stable economy like the Eurozone, Japan, or the UK. Because they are traded so often, the prices move quickly and smoothly. Traders love these pairs because they offer great trading opportunities almost any time of day.

Let’s look at each pair more closely:

| Pair | Nickname | Description |

| EUR/USD | Fiber | The Euro vs. the U.S. Dollar. Most traded pair in the world. |

| USD/JPY | Ninja | U.S. Dollar vs. Japanese Yen. Known for tight spreads. |

| GBP/USD | Cable | British Pound vs. U.S. Dollar. Volatile and great for news trades. |

| USD/CHF | Swissy | U.S. Dollar vs. Swiss Franc. Safe-haven favorite. |

| USD/CAD | Loonie | U.S. Dollar vs. Canadian Dollar. Tied closely to oil prices. |

| AUD/USD | Aussie | Australian Dollar vs. U.S. Dollar. Influenced by commodities. |

| NZD/USD | Kiwi | New Zealand Dollar vs. U.S. Dollar. Smaller but still liquid. |

Why Are Major Currency Pairs Important?

Major currency pairs are important because they are reliable, easy to analyze, and have strong reactions to global news. Since they’re so widely traded, you can count on them to behave more predictably during active trading hours. New traders often start with majors because they offer better spreads and faster trade execution.

Trading EUR/USD, for example, usually means lower costs because the spread is tiny, sometimes less than 1 pip on platforms like Defcofx. Plus, there are tons of educational tools and indicators made just for these pairs, so it’s easier to learn.

Start trading major currency pairs with precision. Sign up with Defcofx for raw spreads, lightning-fast execution, and free access to MetaTrader 5 with all 7 majors ready to go.

Open a Live Account TodayHow to Trade the 7 Major Currency Pairs

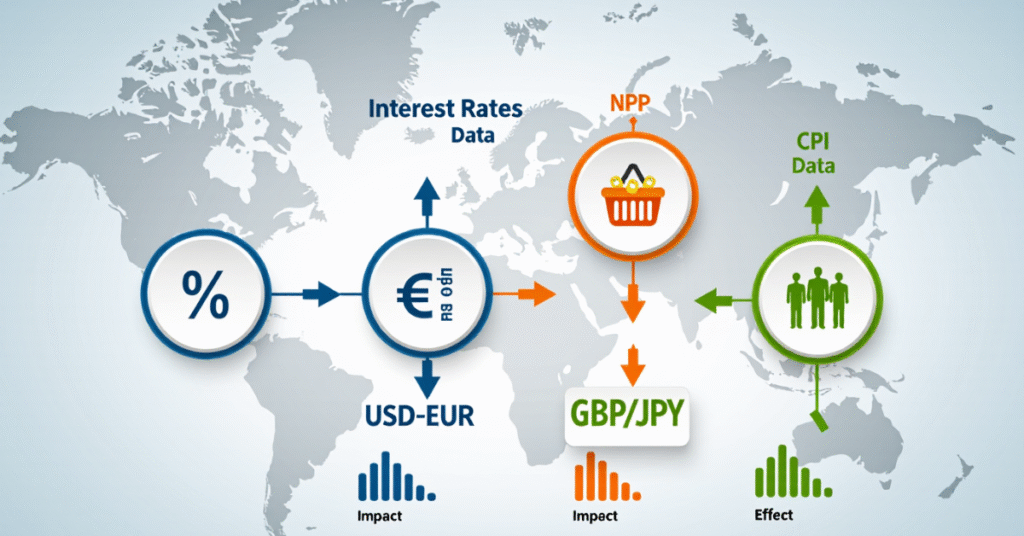

Trading the 7 major currency pairs starts with understanding their behaviors. Each one reacts differently to news and economic data. For instance:

- EUR/USD responds to ECB or Federal Reserve interest rate decisions.

- USD/JPY is highly influenced by Japanese government policy and U.S. bond yields.

- GBP/USD moves fast during Bank of England updates or Brexit-related headlines.

Using tools like moving averages, MACD, and price action strategies, traders enter positions when trends form or when news breaks. Defcofx offers economic calendars and technical tools to help you spot trade setups on major pairs instantly.

Best Times to Trade 7 Major Currency Pairs

The best time to trade the 7 major currency pairs is when major markets overlap. This includes:

- London/New York session (12–16 GMT): Highest volume and volatility.

- Tokyo/London session (7–9 GMT): Decent moves, especially for USD/JPY.

- Sydney/Tokyo session (00–2 GMT): Good for AUD/USD and NZD/USD.

With a broker like Defcofx, you can trade around the clock using advanced charting and alerts, ensuring you never miss a key breakout.

Final Thoughts: What Are The 7 Major Currency Pairs

The 7 major currency pairs are the backbone of the forex market. They provide steady price action, tight spreads, and round-the-clock opportunities for traders at all levels. Whether you’re looking to trade during the London/New York overlap or ride short-term breakouts, starting with the majors is the smart move.

And with Defcofx as your broker, you’ll get the speed, pricing, and support needed to trade these pairs with confidence.

Open a Live Forex Account

FAQs

Why is EUR/USD the most traded currency pair?

EUR/USD is the most popular pair because it represents the two largest economies in the world, the U.S. and the Eurozone. It offers very tight spreads, high liquidity, and reacts strongly to news. This makes it ideal for technical and fundamental traders, especially on platforms like Defcofx that support fast execution.

Are major currency pairs good for beginners?

Yes, major pairs are excellent for beginners. They move steadily, have lower spreads, and are less prone to sudden spikes. With access to educational resources, demo accounts, and advanced platforms like Defcofx, new traders can build skills in a safer environment by starting with these pairs.

What affects the price of major currency pairs?

Prices move based on interest rates, inflation, political events, and economic data like employment or GDP. For example, if the U.S. releases strong jobs data, the USD might rise, affecting all USD-based pairs. Platforms like Defcofx offer economic calendars to help traders prepare for these events.

What’s the difference between major and minor currency pairs?

Major pairs always include the USD and one other top global currency like the euro or yen. Minor pairs (or crosses) don’t include the USD. They often have wider spreads and lower liquidity. That’s why many traders prefer majors for lower costs and better speed, especially with top-tier brokers.

Can I trade all 7 major pairs on any platform?

Most modern forex platforms support all 7 major pairs, especially brokers like Defcofx, which offers full access to majors on MetaTrader 5. You can chart, analyze, and trade them in real time with low commissions and fast order filling, even on mobile.

Which major pair is most volatile?

GBP/USD is known for big moves and high volatility. While it offers great trading opportunities, it also carries more risk. New traders should use tight risk management when trading GBP/USD. Combining it with tools like stop-loss and limit orders on Defcofx can reduce potential losses.

Do major currency pairs behave differently?

Yes, each pair has a unique personality. For example, EUR/USD trends smoothly, USD/JPY ranges more often, and AUD/USD reacts strongly to commodity news. Knowing how each pair moves helps in choosing the right strategy and timeframe for trading. Defcofx offers guides and analytics to assist.

Is trading major currency pairs profitable?

It can be profitable with the right strategy and risk management. Since majors have lower costs and better execution, traders get more value per trade. With real-time tools, news updates, and transparent spreads offered by Defcofx, your edge in the market increases significantly.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.

- Trailing Stop Loss vs Trailing Stop Limit

- Best Currency Pairs to Trade During London Session

- Forex Trading Sessions in EST ICT Trading Guide

- USD/CAD Forex Trump Tariffs and Market Reaction

- Wick Fill Trading Strategy Explained for Traders

- Is NZD/USD a Major or Minor Pair?

- Best Moving Average Crossover for 15 Min Chart

- When Does a Bearish Market Become Bullish in Forex?

- Lower Currency Value: Causes, Effects & Trading Insights