A limit order is an instruction to buy or sell an asset at a specific price (or better). It executes only if the market reaches that price, giving traders precise control over entry and exit and reducing slippage, ideal for planned entries in forex, CFDs, and stocks.

Key takeaways

- Definition: A limit order executes only at your set price or better, not instantly like a market order.

- Use cases: Best for planned entries (buy-the-dip) and precise exits (take-profit).

- Execution: May not fill if the market never reaches your price; partial fills are possible.

- Platform note: Popular on MT5 and other trading platforms as a “pending order.”

- Strategy fit: Useful for swing traders, range traders, and disciplined entry strategies.

- Broker factors to consider: Choosing brokers with tight spreads (from 0.3 pips), no commissions or swap fees, and fast execution plus high leverage (up to 1:2000) and quick withdrawals can improve practical use of limit orders.

- Risk reminder: Always combine limit orders with risk management (stop-loss, position sizing) to avoid missed opportunities or overexposure.

Understanding Limit Orders

A limit order allows traders to control the exact price they buy or sell at. Unlike a market order, which executes immediately at current prices. When you place a limit order, your trade activates only when the market reaches your desired level, giving you better control over entry and exit points.

For instance, if EUR/USD is trading at 1.0900, you might place a buy limit order at 1.0850, meaning your trade will only execute if the price drops to that level or lower. This approach is ideal for traders who prefer strategic entries rather than reacting to market fluctuations.

Limit orders are a crucial tool for disciplined traders because they:

- Allow planned entries and exits.

- Help avoid emotional or impulsive decisions.

- Enable better price efficiency during volatile market moves.

- Can be left pending until price conditions are met.

How Limit Orders Work

A limit order works as a conditional instruction. It tells your trading platform to execute a buy or sell only when the price reaches your preset level. This type of order ensures you get the desired price (or better), but it also means there’s no guarantee your order will be filled.

When you submit a limit order:

- The platform marks your request as pending until the target price appears in the market.

- Once the market hits that price, your order is triggered and filled. Either fully or partially, depending on liquidity.

- If the market reverses before reaching your limit, your order remains inactive or expires (if you set a time limit).

This makes limit orders a powerful choice for precision trading, perfect for entering at pullbacks or setting planned take-profit levels.

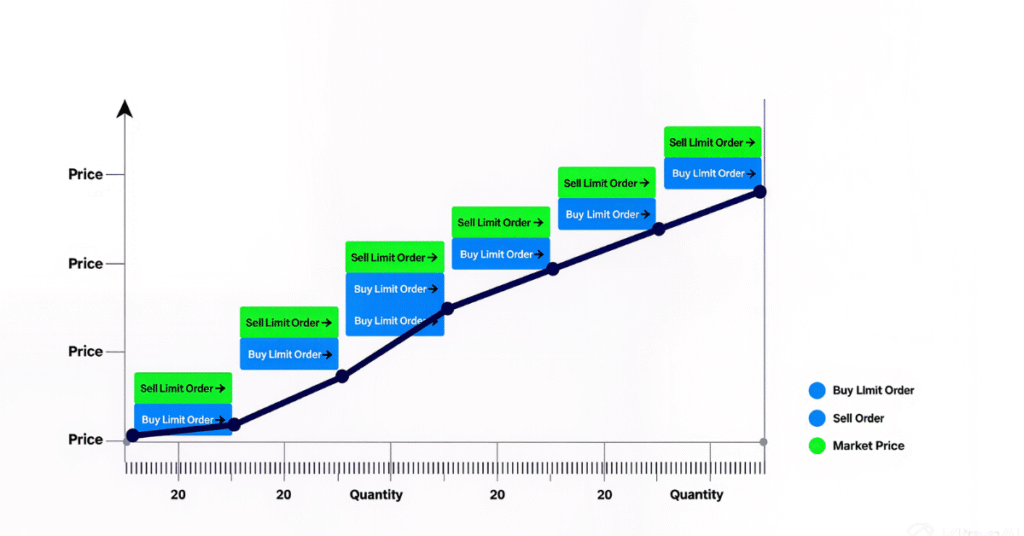

Types of Limit Orders in Forex Trading

In forex and CFD trading, limit orders come in two main types. Buy limit orders and sell limit orders. Both serve different strategic purposes depending on whether you expect the market to rise or fall after reaching a certain level.

1. Buy Limit Order

A buy limit order is placed below the current market price. It instructs your platform to buy an asset when its price drops to your specified level or lower. This helps traders enter the market at a discounted price during pullbacks.

Example: If EUR/USD is trading at 1.0900, and you believe it will rebound after touching 1.0850, you can place a buy limit order at 1.0850. When the market price drops to that level, your trade automatically executes, capturing a more favorable entry.

2. Sell Limit Order

A sell limit order is the opposite; it’s placed above the current market price. It tells your platform to sell an asset when its price rises to your desired level or higher. This is useful for traders expecting a price reversal after a rally.

Example: If GBP/USD is trading at 1.2750, and you anticipate resistance around 1.2800, you could set a sell limit order at 1.2800. If the market climbs to that level, your trade will execute automatically, potentially allowing you to profit from the predicted downturn.

| Order Type | Placement Level | Action | Purpose |

| Buy Limit | Below current price | Buy | Enter at lower, favorable price |

| Sell Limit | Above current price | Sell | Enter at higher, favorable price |

Limit Order vs Market Order vs Stop Order

To trade effectively, it’s important to understand how limit orders differ from market and stop orders. The three core order types are used in forex and CFD trading. Each behaves differently, impacting both price control and execution speed.

1. Limit Order

A limit order executes only at your set price or better, ensuring control but not guaranteed execution. Ideal for traders who value precision and planned entries.

Example: Buy EUR/USD at 1.0850; the limit order triggers only if the price drops to 1.0850 or below.

2. Market Order

A market order executes instantly at the current best price. Execution is guaranteed, but price may differ slightly in volatile conditions. Best for traders who prefer immediate entry or exit.

Example: Buying EUR/USD now executes instantly at the market rate (e.g., 1.0902).

3. Stop Order

A stop order activates once the market hits a trigger level, then executes as a market order. Commonly used for breakout entries or stop-loss protection.

Example: A buy stop at 1.0950 activates once the price breaks above that level, confirming upward momentum.

| Order Type | Execution | Guarantee | Ideal For | Example |

| Limit Order | At chosen price or better | Price control, not guaranteed | Strategic entries/exits | Buy at 1.0850 limit |

| Market Order | Instant at best price | Guaranteed execution | Quick entries/exits | Buy now at 1.0902 |

| Stop Order | When price hits trigger | Execution, not price | Breakout/stop-loss setups | Buy stop at 1.0950 |

Limit = enter at a better price

Stop = enter when price confirms trend

Misunderstanding this difference can result in wrong entries or missed trad

5 Advantages of Using Limit Orders in Forex Trading

Limit orders are a favorite among professional traders because they allow precise entries, risk control, and automation, key components of a disciplined trading strategy. Unlike market orders, limit orders let you decide the price, giving you more power over timing and execution.

Here are the top 5 benefits:

1. Better Price Control

Limit orders let you decide exactly what price you want to buy or sell at avoiding unfavorable entries during volatility. You’ll never pay more or sell for less than your chosen level.

2. Emotion-Free Trading

Because limit orders execute automatically once conditions are met, they reduce emotional decision-making. You don’t have to watch the charts constantly or panic during price spikes.

3. Perfect for Volatile Markets

In fast-moving forex pairs or commodities, limit orders help you capture value during sudden dips or rallies without overpaying. This precision is particularly valuable in high-leverage environments.

4. Suitable for Automated Strategies

Limit orders can be integrated with trading bots, EAs (Expert Advisors), and algorithmic systems executing entries exactly as programmed.

5. Helps Manage Risk and Reward

You can set both buy/sell limit and take-profit levels in advance, ensuring every trade follows a planned risk-to-reward ratio.

5 Risks and Limitations of Limit Orders

While limit orders give traders control and precision, they also come with certain drawbacks that must be understood before relying on them entirely. Using them wisely is key to avoiding missed trades or unfilled positions.

1. No Guarantee of Execution

A limit order executes only when the market reaches your specified price. If the price never touches that level, your order remains pending, which can lead to missed trading opportunities.

Example: You place a buy limit order at 1.0850, but the market only drops to 1.0855 before rallying; your order won’t execute.

2. Possible Partial Fills

In markets with low liquidity, your limit order might be partially filled. This happens when there isn’t enough volume at your set price to execute the full order size.

3. Price Gaps and Volatility Risks

During major news events or weekend gaps, prices can skip over your limit price without triggering the order. This risk is common in high-volatility assets or when trading outside major market sessions.

4. Missed Profits During Strong Moves

Because limit orders wait for price retracements, traders may miss strong trending moves that never pull back to the desired level.

5. Broker Execution Quality Matters

Even with perfect analysis, poor order execution can ruin results. Choose brokers that offer:

- Tight spreads (from 0.3 pips)

- No commissions or swap fees

- High leverage up to 1:2000

- Fast withdrawal times (within 4 business hours)

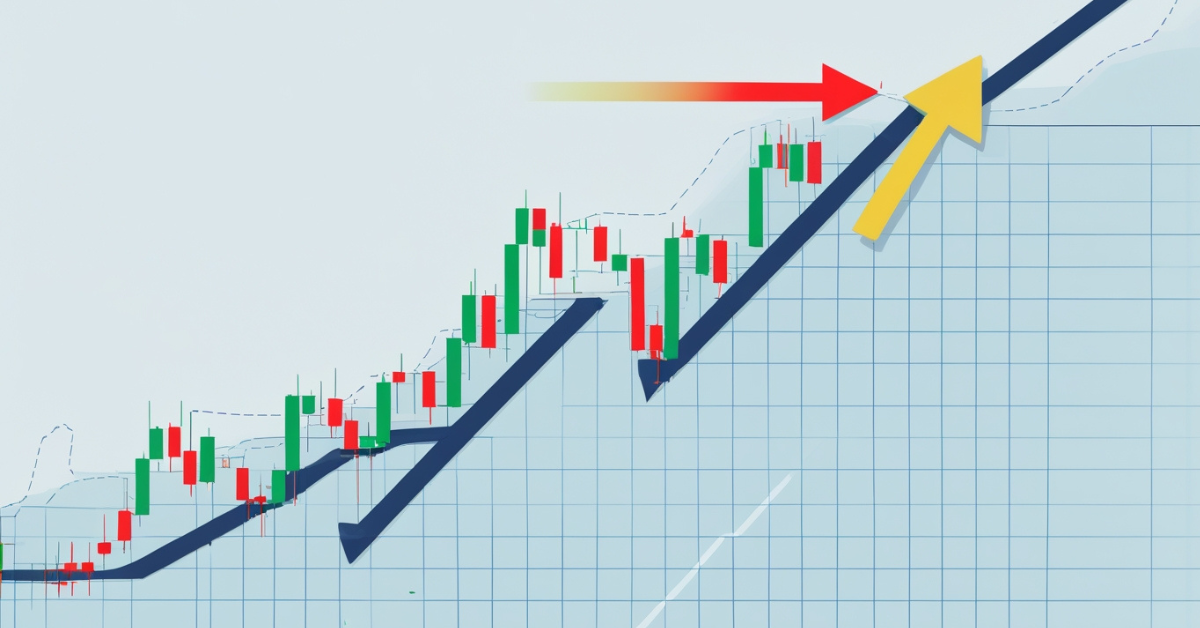

When to Use Limit Orders (Best Scenarios)

Knowing when to use limit orders can significantly improve your trading performance. Limit orders work best in markets where prices fluctuate within predictable ranges or where traders want to catch pullbacks at favorable levels.

Here are the most effective scenarios:

- Entering on Pullbacks: Limit orders are perfect for entering trades during temporary retracements in trending markets. For example, in an uptrend, placing a buy limit at a key support level allows you to enter when the price dips, capturing the next upward wave.

- Setting Take-Profit Targets: You can use sell limit orders to automatically close positions when the price reaches a specific profit target. This ensures you secure gains even when you’re not actively monitoring the market.

- Range-Bound or Sideways Markets: When the market moves between support and resistance, limit orders help capitalize on those ranges.

→ Buy Limit near support

→ Sell Limit near resistance. This approach works well for swing and range traders. - Avoiding Emotional Entries: By planning limit orders in advance, traders can avoid entering trades impulsively due to market noise or fear of missing out (FOMO).

- Capturing Value in High Volatility: During news announcements or sharp moves, prices often overextend before correcting. Limit orders let traders enter at more reasonable levels after volatility settles.

Step-by-step: How to place a pending/limit order on MT5

1. Open MT5 and log in

Launch MT5 and connect to your trading account.

(Note: It’s assumed you already have login credentials from your broker.)

2. Open the “New Order”/“Order” window

You can do this in several ways:

- In the Market Watch window, right-click the symbol (instrument) you wish to trade → choose New Order.

- Or click the “New Order” icon/button on the toolbar.

- Ensure the correct symbol is selected (e.g., EUR/USD, etc.).

3. Select “Pending Order” as the order type

- In the “Type” or “Order Type” dropdown, switch from “Market Execution” (or equivalent) to “Pending Order.”

- Then choose the subtype of pending order: e.g., Buy Limit, Sell Limit, Buy Stop, Sell Stop, etc.

4. Enter the trigger price for the limit order

- For a buy limit, you enter a price level below the current market price (you expect the price to drop to your level and then rebound).

- For a sell limit, you set a price above the current market price (you expect the price to rise to your level and then reverse).

- Make sure you input the exact price you want the pending order to trigger at.

5. Define volume, stop-loss, and take-profit (optional but recommended)

- Set the trade volume (lot size) you wish to place.

- You may also set Stop Loss (SL) and Take Profit (TP) levels to manage risk. While not always mandatory, many brokers allow you to set these alongside the pending order.

6. Choose the expiration of the pending order (if applicable)

- Some brokers allow you to select when the order should expire: e.g., “Good Till Canceled (GTC),” “Today,” or a specific date/time.

- If you don’t select an expiration, the order may remain in the queue until manually cancelled (depending on the broker).

7. Confirm and place the order

- After reviewing all the parameters (symbol, order type, price, volume, SL/TP, expiration), click Place or OK to submit the order.

- The pending order will now sit in the system and will be triggered when the market reaches the specified price.

A Few Additional Notes

- A “limit” order is a type of pending order, not executed immediately at market price, but at a specific price you define.

- On MT5, pending orders include types like Buy Limit, Sell Limit, Buy Stop, Sell Stop, and more complex variants (e.g., Stop Limit).

- Execution depends on your broker’s server, market conditions (e.g., price gaps, slippage), and your account having sufficient margin.

- If the specified price level is never reached, the pending order will not execute.

- If you set a pending price that is illogical (for example, a buy limit above the current price in some broker setups), it may execute immediately or be rejected. Always verify your broker’s rules.

- After placing the pending order, you can modify or cancel it through the “Trade” tab or directly on the chart.

5 Common Mistakes to Avoid with Limit Orders

Even though limit orders give traders more control, small mistakes can lead to missed trades, unexpected entries, or reduced profits. Understanding these errors helps you trade smarter and avoid preventable losses.

1. Setting Unrealistic Price Levels

Many traders place limit orders too far from the current price. If your price target is unrealistic, the order may never execute, causing you to miss potential moves.

2. Ignoring Market Volatility

Market conditions change quickly. A limit order that makes sense during calm markets might fail during high volatility. Always consider news events, market sessions, and spreads before setting your limit levels.

3. Forgetting to Set Stop-Loss Orders

Limit orders control entry price, not risk. Without a stop-loss, a trade can move sharply against you after execution. Pair every limit order with a properly placed stop-loss for capital protection.

4. Overusing Leverage

High leverage can amplify profits but also magnify losses if your order fills in the wrong direction. Use leverage wisely.

5. Leaving Old Orders Active

Traders sometimes forget to cancel old pending limit orders. If the market later reaches those prices unexpectedly, it can trigger unintended trades. Always review and manage your pending orders regularly.

Final Thoughts: Why Limit Orders Belong in Every Trader’s Toolkit

Limit orders are one of the most effective tools for maintaining control, discipline, and precision in trading. Whether you’re entering on a pullback or securing profits at a target level, they allow you to trade strategically instead of emotionally. By setting predefined prices, you protect yourself from impulsive decisions and ensure your trades align with your plan, not market noise.

However, their effectiveness depends heavily on broker execution quality. Fast trade execution, tight spreads, and reliable platform performance can determine whether your limit order fills smoothly or slips away due to latency or wide spreads.

That’s where Defcofx stands out. With spreads from 0.3 pips, no hidden commissions, fast withdrawals, and leverage up to 1:2000, Defcofx provides the infrastructure that makes limit orders work exactly as intended: precise, timely, and efficient.

Ready to trade with confidence and control?

Open a Live Trading Account with DefcofxFAQs About Limit Orders

Below are the most frequently asked questions traders have about limit orders, answered clearly to help you understand how to use them effectively in real-world trading.

A limit order is an instruction to buy or sell an asset at a specific price or better. It executes only when the market reaches your target price, giving you full control over your entry and exit points.

A limit order executes at your chosen price, while a market order executes instantly at the current market price. Limit orders offer price precision, whereas market orders guarantee immediate execution.

Yes. If the market never reaches your specified price, the limit order will remain pending and may expire unfilled if not triggered.

Absolutely. Limit orders are excellent for beginners who want price control and reduced slippage. They also help prevent emotional decision-making since trades execute automatically at preset prices.

Yes. Limit orders can be edited or canceled anytime before they execute. You can adjust the price, volume, or expiry time directly within your trading platform.

If a price gap occurs, such as after major news or a weekend, your limit order might skip execution because it only fills at your chosen level or better, not beyond it.

Yes. Platforms like MT5 Mobile fully support limit orders. You can set, modify, or cancel them easily on your phone, perfect for traders on the go.

Yes. Limit orders are used across forex, stocks, indices, commodities, and crypto markets anywhere traders want to control entry and exit prices.

Yes. Defcofx’s MT5 platform fully supports buy and sell limit orders, along with advanced tools for risk management, high leverage, and ultra-fast execution, ensuring maximum efficiency and control.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.