A margin call is a broker’s request that a trader add funds or close positions when account equity falls below the required margin; it happens when losses push the margin level under the broker’s threshold, prompting immediate action to avoid automatic liquidation of open trades.

Key Takeaways

- A margin call occurs when your trading account no longer has enough equity to support open positions.

- It serves as a warning signal to deposit more funds or reduce exposure before forced liquidation.

- Margin calls are triggered when the margin level drops below the broker’s set percentage (often 100%).

- Proper risk management, such as using stop-losses and maintaining extra margin, helps prevent margin calls.

- Reputable brokers like Defcofx provide real-time margin monitoring and flexible leverage to help traders manage margin risk efficiently.

Understanding Margin in Forex Trading

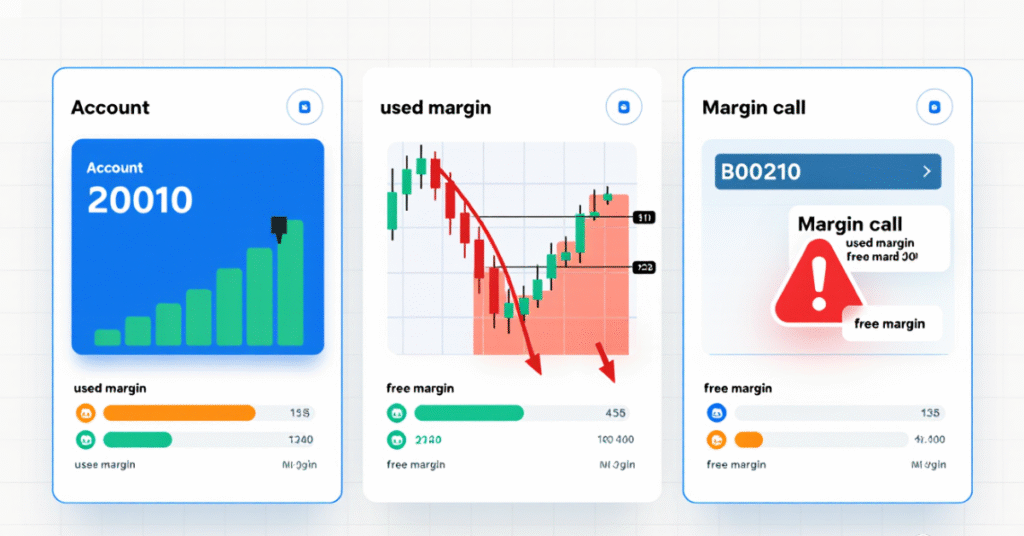

In Forex trading, margin acts as a security deposit that allows traders to open positions larger than their account balance. It’s not a fee; it’s collateral that ensures your broker can cover potential losses. Understanding how margin interacts with equity, used margin, and free margin is essential for avoiding margin calls.

4 Key Margin Terms Explained

- Equity: The total value of your trading account, including unrealized profits or losses.

- Used Margin: The portion of funds currently tied up in open positions.

- Free Margin: The amount left available to open new trades or absorb losses.

- Margin Level: A critical ratio that determines the health of your account and whether a margin call may occur.

Margin Level Formula

Margin Level = EquityUsed MarginX 100%

A margin level below 100% often triggers a margin call, while higher levels indicate better risk control.

How a Margin Call Works (Step-by-Step)

Let’s walk through a simple example to understand how a margin call occurs in real trading conditions.

Example Scenario

- You deposit $1,000 into your Forex trading account.

- You open a position worth $50,000 using 1:50 leverage.

- Your broker requires a 2% margin, meaning $1,000 is used as margin to maintain this trade.

- If your trade moves against you and your unrealized losses reach $800, your equity drops to $200.

- The margin level = (Equity / Used Margin) × 100 = (200 / 1000) × 100 = 20%.

Since the margin level has fallen below 100%, your broker issues a margin call. If the losses continue and reach the stop-out level (e.g., 20%), your broker will begin closing open positions automatically to protect the account from going negative.

Even small price changes can rapidly reduce your margin level.

Always choose leverage that matches your experience and risk tolerance.

5 Causes of a Margin Call

A margin call doesn’t happen by chance; it’s the result of specific trading conditions that reduce your available equity. Understanding these 5 causes helps traders anticipate and prevent them before they occur.

1. Excessive Leverage Usage

Leverage magnifies both potential gains and losses. When traders overuse leverage, even small market movements can quickly wipe out available margin.

Example: Using 1:1000 leverage means a 0.1% price move against you can cause major losses.

2. High Market Volatility

Sudden market movements, such as during major news events, can cause prices to spike or drop rapidly. This can drain your equity faster than you can react, triggering a margin call.

3. Lack of Stop-Loss Orders

Failing to set stop-loss levels leaves trades vulnerable to large, unexpected losses. A few unfavorable movements can quickly deplete available margin.

4. Holding Too Many Open Positions

Opening multiple large trades consumes more margin. If several trades move against you simultaneously, your equity can fall below required levels.

5. Ignoring Account Monitoring

Many margin calls occur simply because traders don’t check their margin level or free margin regularly. Most trading platforms display these values in real time and use them to track your risk.

How to Avoid Margin Calls

Avoiding a margin call is about practicing disciplined risk management and maintaining a healthy margin level.

Here’s how you can protect your account effectively:

1. Use Proper Leverage

Choose leverage according to your experience and trading strategy. High leverage can be powerful, but it should be used cautiously.

2. Always Set Stop-Loss Orders

Stop-losses automatically close losing trades before they become unmanageable. They’re your first line of defense against large drawdowns that can trigger margin calls.

3. Maintain a Margin Buffer

Keep extra funds in your account to act as a cushion. A buffer ensures that minor market fluctuations don’t push your margin level below the required threshold.

4. Diversify Your Trades

Avoid concentrating your capital in a single currency pair or asset. Spreading risk reduces the chance of multiple trades turning negative at once.

5. Monitor Your Margin Level Regularly

Check your margin level, used margin, and free margin on your trading platform frequently. Defcofx provides real-time margin tracking tools that help traders react quickly before a margin call occurs.

6. Stay Informed About Market Events

Economic announcements, interest rate decisions, and geopolitical news can trigger extreme volatility. Plan ahead by reducing position sizes or adding funds during high-risk periods.

What Happens If You Ignore a Margin Call?

Ignoring a margin call can have serious financial consequences. If you fail to act by either depositing more funds or closing positions, your broker will step in to protect your account and their capital.

1. Forced Liquidation (Stop-Out)

When your margin level continues to fall and reaches the broker’s stop-out level (often around 20%), open positions start getting automatically closed. The largest losing trades are usually closed first until your margin level rises above the threshold.

2. Account Balance Drops Sharply

After liquidation, your equity reflects only your remaining balance. In severe volatility, losses may exceed your margin, but most brokers, including Defcofx, offer negative balance protection to ensure you never owe more than you deposited.

3. Missed Trading Opportunities

If your positions are closed, you miss potential recovery moves or future opportunities. Maintaining healthy margin levels keeps you in control of your trades instead of reacting to forced closures.

4. Damaged Trading Psychology

Margin calls can be emotionally draining. The shock of sudden losses often leads to revenge trading, opening impulsive trades to recover quickly, which worsens losses.

Final Thoughts: What Is a Margin Call

Margin calls are a vital safeguard in Forex trading, ensuring traders maintain adequate equity to support open positions. Understanding how margin, leverage, and equity interact empowers traders to avoid sudden forced liquidations. Successful traders don’t fear margin calls; they prevent them through disciplined risk management, prudent leverage use, and consistent account monitoring.

Ultimately, maintaining a strong margin level isn’t just about keeping trades open, it’s about protecting your long-term trading capital and staying in control of your strategy.

Trade Smarter with Defcofx

Experience real-time margin tracking, flexible leverage, and advanced protection tools designed to keep your trades secure.

Start trading confidently with DefcofxFrequently Asked Questions (FAQs) About Margin Calls

A margin call happens when your trading account’s equity drops below the required margin to keep your open positions. It’s often triggered by excessive leverage, high market volatility, or multiple losing trades.

Keep your margin level above 100% by using smaller position sizes, applying stop-loss orders, and maintaining a balance buffer. Regularly check your margin ratio and avoid over-leveraging during volatile periods.

Act immediately. You can either deposit more funds to increase your equity or close losing trades to reduce margin usage. Ignoring it could lead to forced liquidation of your positions.

No. A margin call is a warning that your margin level is low. A stop-out occurs when your broker automatically closes trades once your margin level reaches a critical threshold, usually around 20%.

Leverage magnifies both gains and losses. The higher your leverage, the smaller your margin buffer becomes, meaning even small market moves can lead to a margin call. Use leverage wisely and align it with your risk tolerance.

Most regulated brokers offer negative balance protection, meaning your losses are capped at your deposited funds. Still, traders should manage risk carefully to avoid reaching that point.

Your margin level starts dropping, free margin decreases, and your equity shrinks compared to used margin. Monitoring these indicators helps you act early before receiving a margin call notification.

Yes, if multiple positions are open and unrealized losses temporarily outweigh profits, your equity may drop below the required margin, triggering a margin call even with an overall profitable strategy.

Absolutely. Volatile conditions can cause sudden price spikes that rapidly affect equity levels. Lower leverage and wider stop-losses can help reduce that risk.

Experienced traders recommend keeping your margin level above 200–300% for healthy risk management. This ensures enough buffer against market swings and reduces the likelihood of margin calls.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.