Tuesday’s forex session was shaped by a renewed bout of yen weakness and a steady, data-supported US dollar, as markets digested December US inflation figures and refocused on policy divergence themes. While US CPI did not dramatically alter the Federal Reserve’s outlook, it reinforced the view that policymakers can afford to remain patient, limiting expectations for aggressive near-term rate cuts. This helped stabilize the dollar after recent volatility, particularly against low-yielding currencies.

The Japanese yen was the clear underperformer of the day. Growing concerns around Japan’s fiscal outlook, combined with speculation over political maneuvering and continued ultra-accommodative monetary conditions, weighed heavily on the currency. As a result, USD/JPY pushed higher and yen crosses remained firmly bid. Elsewhere, the euro and pound traded with a consolidative tone, reflecting a market that is increasingly selective rather than broadly risk-seeking.

Overall, the session marked a transition from early-year repositioning toward more theme-driven trading, with policy credibility and relative yields returning to the forefront.

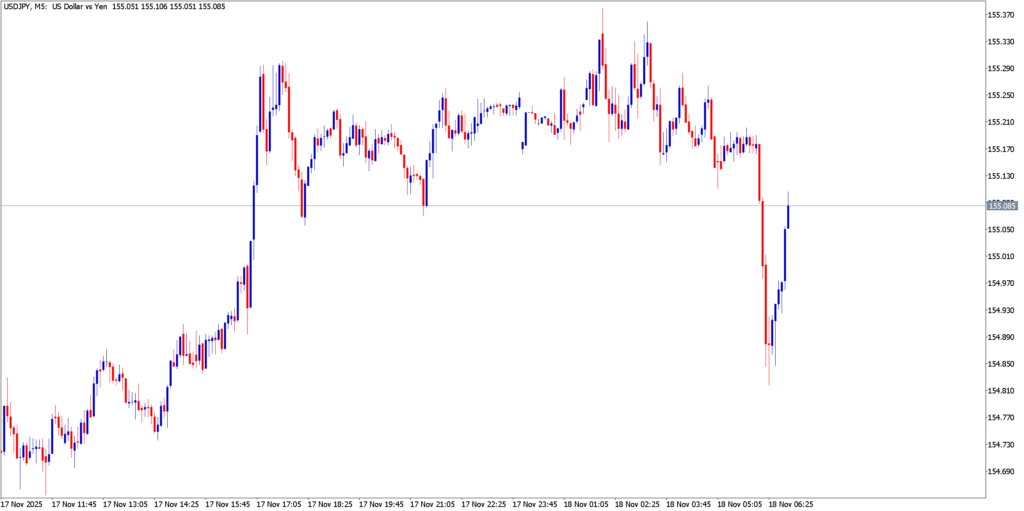

USD/JPY

Technical Analysis

USD/JPY extended its advance on Tuesday, maintaining a strong bullish structure after holding above recent breakout levels. The pair traded comfortably above the mid-156 area, with buyers repeatedly stepping in on shallow pullbacks. On the daily chart, price action remained firmly above key moving averages, reinforcing the underlying uptrend. Momentum indicators stayed elevated but not yet extreme, suggesting room for continuation. The psychological 160.00 level increasingly stands out as the next major reference point, while initial support is seen near 156.50. Only a sustained break below that zone would signal a deeper corrective move.

Fundamental Analysis

Fundamentally, the yen’s weakness was driven by domestic factors rather than US dollar strength alone. Markets continued to price in Japan’s loose policy stance against a backdrop of heavy government spending and limited progress toward meaningful monetary tightening. With Japanese real yields deeply negative and no immediate shift expected from the Bank of Japan, the currency remained vulnerable. At the same time, US CPI reinforced a “higher for longer” narrative at the margin, supporting US yields and widening the rate differential further. This combination kept pressure on the yen and allowed USD/JPY to extend higher with limited resistance.

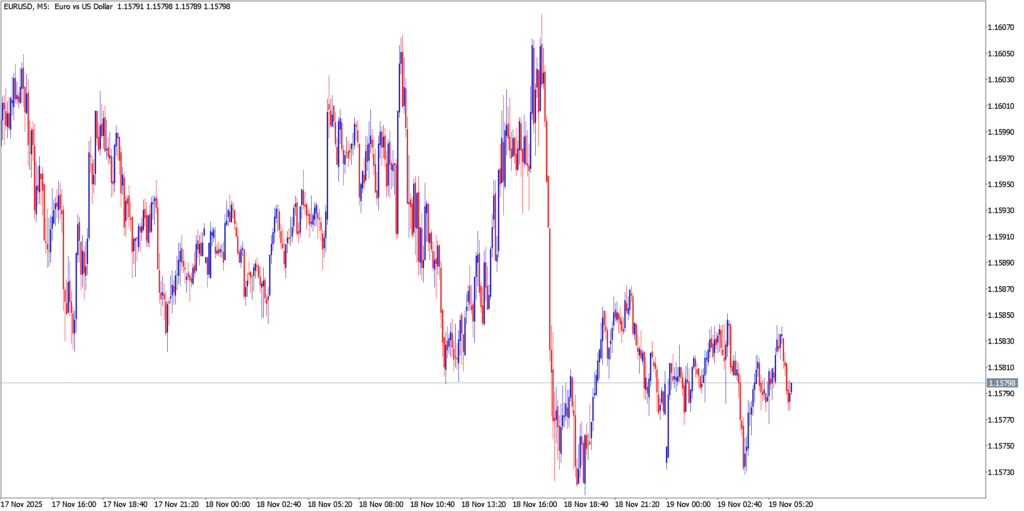

EUR/USD

Technical Analysis

EUR/USD spent the session consolidating, trading in a narrow range just below recent highs. The pair held above key short-term support around the lower 1.17 area, signaling that buyers are still defending the broader uptrend. However, repeated failures to push decisively higher suggest fading momentum rather than renewed bullish acceleration. On intraday charts, price action formed a tightening range, often a precursor to a volatility expansion. A clean break above resistance would reopen upside potential, while a move below support would confirm a corrective phase.

Fundamental Analysis

The euro’s sideways behavior reflected a lack of fresh catalysts rather than a change in outlook. With US inflation data now absorbed and no major Eurozone releases on the calendar, traders showed little urgency to add new positions. The broader fundamental backdrop still favors the euro on a relative basis, as expectations persist that the Fed’s easing cycle will eventually narrow the policy gap with the ECB. However, Tuesday’s price action highlighted that near-term gains may require confirmation from either weaker US data or stronger European signals.

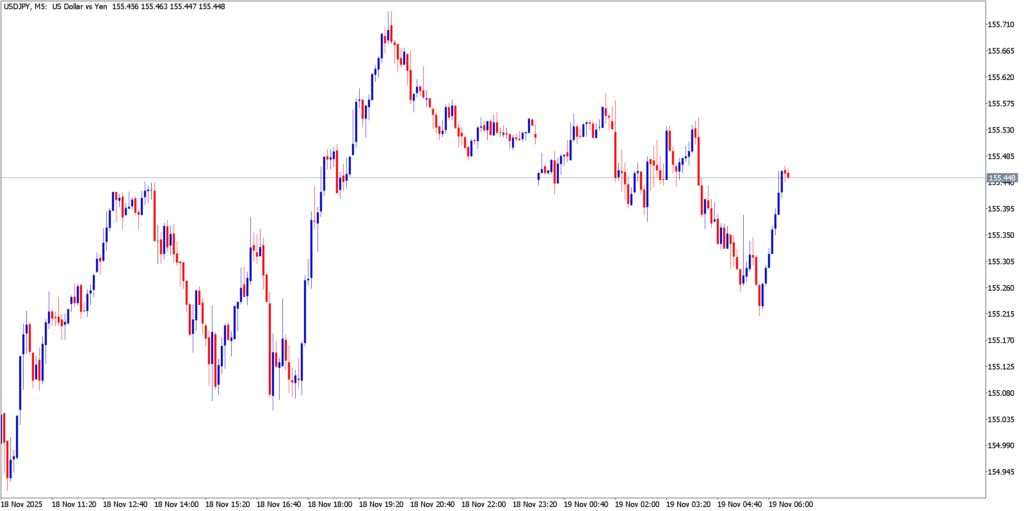

EUR/JPY

Technical Analysis

EUR/JPY remained firmly supported, extending its upward bias as yen weakness dominated cross flows. The pair continued to trade near multi-month highs, with dips remaining shallow and quickly bought. Trend structure stayed intact across multiple time frames, supported by rising moving averages and strong momentum readings. As long as price holds above recent breakout levels, the technical bias favors continuation rather than reversal.

Fundamental Analysis

This move was primarily a yen story. The euro itself was not particularly strong on the day, but relative stability versus pronounced yen weakness created a favorable environment for the cross. With Japanese policy remaining highly accommodative and fiscal concerns lingering, the yen continued to underperform across the board. In contrast, the euro benefited from its status as a comparatively stable alternative, allowing EUR/JPY to outperform even in a subdued risk environment.

Market Outlook

Heading into midweek, the market focus remains on policy divergence and yield dynamics, particularly for yen-related pairs. USD/JPY is increasingly sensitive to both momentum and headline risk as it approaches levels that historically attract official scrutiny. Meanwhile, EUR/USD and other major dollar pairs appear to be coiling, with traders waiting for the next macro catalyst to determine direction.

If US yields remain supported and Japanese policy expectations unchanged, yen weakness could persist, favoring USD/JPY and yen crosses. However, with positioning becoming more extended, the risk of sharp, headline-driven pullbacks is rising. As liquidity builds further into January, the coming sessions are likely to test whether current trends can sustain or whether consolidation gives way to a broader reset.

Discover More Forex Reports with Defcofx

Dig into our recent market analysis for deeper insights on currency movements, USD trends, and macro drivers shaping forex sentiment:

- Dollar Stabilizes After CPI as USD Pairs Consolidate

- Dollar Trades Firm as Data Fails to Shift Fed Outlook

- Dollar Softens as New Year Flows Settle – 15 January 2026

- Markets Shrug Off Venezuela Shock as Dollar Retreats

- Dollar on the Ropes as Risk Rally Roars

These reports cover key themes like dollar consolidation after inflation prints, Fed-related data impacts, and risk sentiment in global markets, helping you stay informed on what’s moving the forex landscape.