Understanding forex trading sessions in EST ICT trading is a game-changer for anyone following Inner Circle Trader (ICT) principles. This guide walks you through how forex market hours, especially when viewed in Eastern Standard Time (EST), interact with ICT kill zones and institutional order flow. By syncing your strategy to the timing of market manipulation and liquidity grabs, you’ll trade more deliberately, avoid fakeouts, and align with the smart money.

Key Takeaways

- The forex market runs 24 hours, but meaningful moves often occur during the London and New York sessions.

- ICT traders focus on specific high-probability trading windows, most effectively monitored in EST.

- Proper timing is as crucial as analysis; identifying when institutions are active sets ICT apart.

- Precision trading during overlapping sessions requires discipline, timing, and clean chart setups.

What Are the Major Forex Trading Sessions in EST?

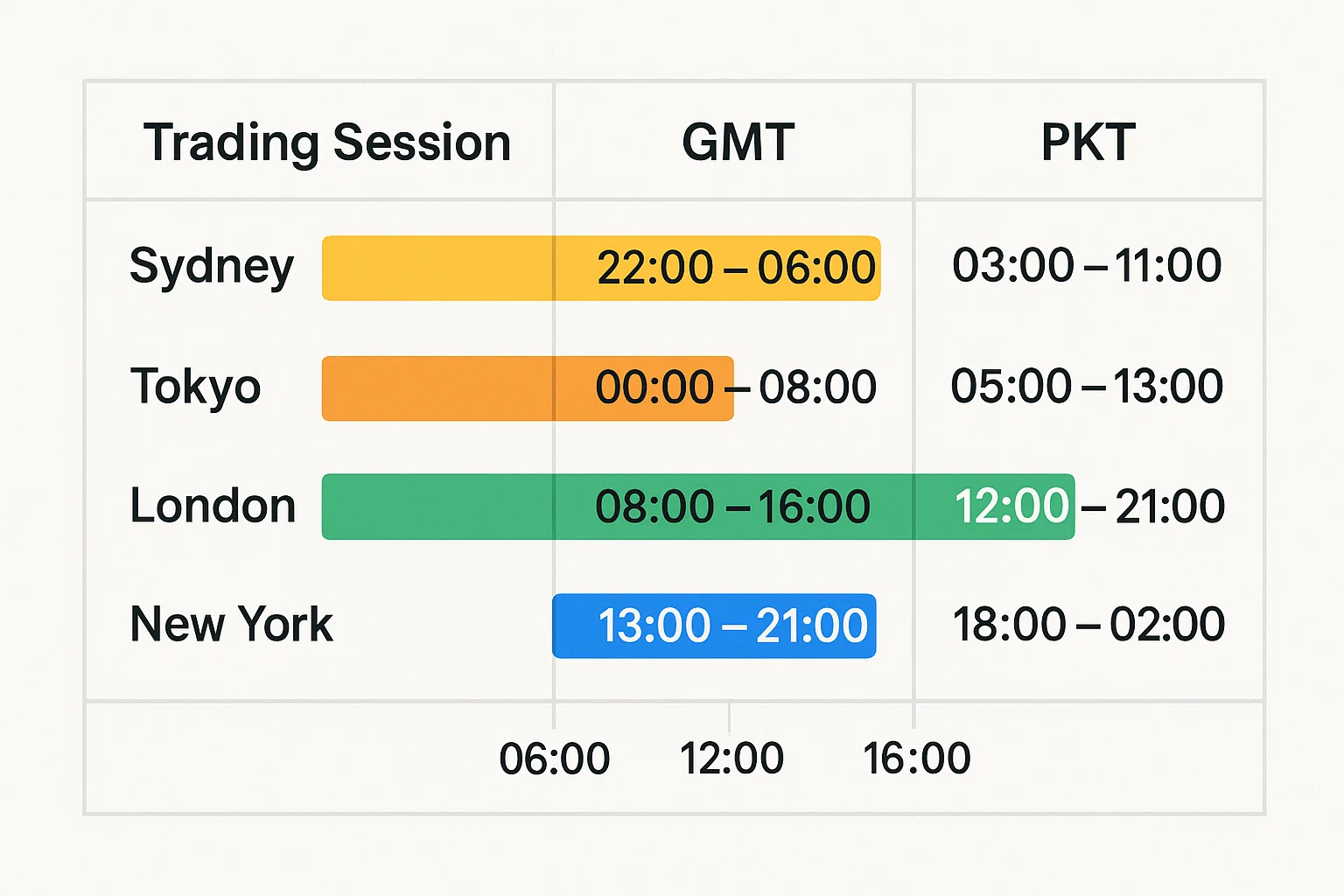

Forex is traded globally across four major time zones. While the market is technically open 24/5, each session offers different characteristics.

Here’s how the sessions translate into Eastern Standard Time:

| Forex Session | EST Time | Characteristics |

| Sydney | 5:00 PM – 2:00 AM | Kicks off the weekly market. Thin liquidity. Low volatility. |

| Tokyo (Asia) | 7:00 PM – 4:00 AM | Focus on JPY pairs. Minor setups form before London opens. |

| London (EU) | 3:00 AM – 12:00 PM | High volume. Institutions become active. ICT’s London kill zone. |

| New York (US) | 8:00 AM – 5:00 PM | USD-dominated action. News releases. Major volatility. |

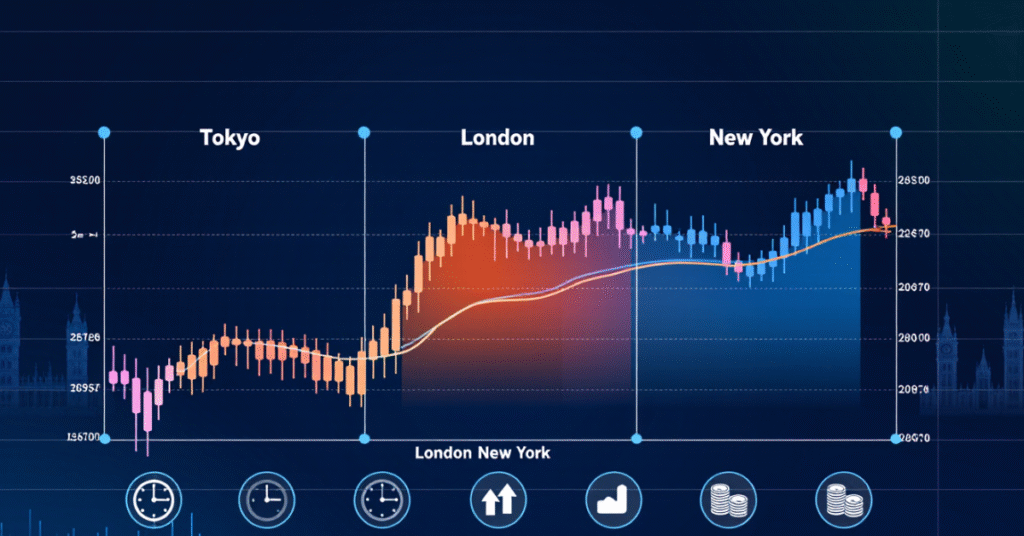

The most critical period for ICT traders is the London/New York session overlap, from 8:00 AM to 12:00 PM EST. This window is where stop hunts, liquidity sweeps, and institutional manipulation often occur.

Understanding ICT Kill Zones in EST

ICT, or the Inner Circle Trader method (developed by Michael J. Huddleston), is centered around identifying institutional intent and timing. ICT strategies are deeply rooted in time and price theory.

Rather than trade at random points in the day, ICT traders wait for price action to unfold during specific kill zones:

- London Kill Zone: 2:00 AM – 5:00 AM EST

- New York Kill Zone: 8:30 AM – 11:00 AM EST

These zones are where smart money makes their moves, by accumulating orders, manipulating price to trigger stop-losses, and then distributing in the intended direction. This is referred to as the Power of Three:

- Accumulation: Price ranges sideways to collect orders

- Manipulation: Price fakes out or sweeps liquidity

- Distribution: The true move occurs

By tracking these events during the right times, traders gain better odds of catching precise entries and exits.

When Does Volatility Spike?

Let’s look at a general volatility timing table to help you visually prepare:

| Time (EST) | What’s Happening | ICT Relevance |

| 2:00 AM – 5:00 AM | London Kill Zone | Entry windows before EU open |

| 3:00 AM – 4:00 AM | London Open | Volatility rises |

| 7:00 AM – 8:00 AM | Pre-New York volatility/setup forming | Smart money may build positions |

| 8:30 AM – 9:00 AM | NY economic news / New York Kill Zone | Optimal entry zone for ICT traders |

| 10:00 AM – 11:00 AM | Continuation moves or reversal patterns | Often final move before midday fade |

Chart Setup Tips for ICT Traders (EST-Based)

ICT traders must align their chart time with EST (New York time). Platforms like MetaTrader 5, TradingView, or brokers like Defcofx can help you synchronize correctly.

Here’s how to set up:

- Enable Session Separators: Vertical lines to show session start/end.

- Add Time Zone Indicators: Some indicators convert broker time to EST.

- Use Color Zones: Blue for London, Red for NY, Gray for Asia, etc.

- Label Kill Zones: Draw rectangles to highlight kill zones directly.

Even a minor misalignment in time zone can lead to entering trades too early or too late.

Want better timing in your trades? Defcofx offers lightning-fast executions, raw spreads, and chart tools to help you trade during ICT kill zones with surgical precision. Time matters. So does execution.

Open a Live Forex Trading Account.How a Broker Like Defcofx Makes a Difference

In ICT trading, milliseconds count. During kill zones, spreads can widen, price can spike, and orders can slip. Defcofx stands out for its:

- Low-latency execution during volatile kill zones.

- Tight raw spreads are ideal for entry precision.

- Zero commissions and no swap fees.

- Support for MetaTrader 5, the preferred platform for time-based setups.

When precision matters, your broker matters. While ICT teaches you when to act, brokers like Defcofx ensure your execution doesn’t fail when it counts.

Final Thoughts

The heart of “forex trading sessions in EST ICT trading” is understanding when to trade, not just what to trade. ICT kill zones highlight moments of manipulation and momentum, critical for catching institutional moves.

By aligning your charts to EST, waiting for liquidity sweeps during kill zones, and using a platform like Defcofx to ensure smooth, reliable execution, you position yourself to trade smarter, not harder.

Open a Live Trading Account

FAQs

What makes the EST time zone important for ICT traders?

Most institutional events and U.S. economic releases are timestamped in EST. ICT traders rely on EST to align with liquidity windows and kill zones, especially during New York and London sessions.

What is the most active forex session in EST?

The London/New York overlap (8 AM – 12 PM EST) sees the highest volume and volatility, ideal for executing ICT strategies.

Can I trade ICT strategies during the Asian session?

It’s not recommended. The Asian session (Tokyo) is generally low-volatility. ICT traders often avoid it unless they’re monitoring for pre-London setups.

How do I adjust my charts to EST on MetaTrader 5?

MetaTrader 5 typically uses broker server time. You’ll need to calculate the time offset manually or use an indicator to convert chart time to EST.

Why are kill zones so important in ICT?

Kill zones align with the start of major trading sessions and institutional activity. They help traders enter after stop hunts and before real trends begin.

How long should I wait before entering a trade during a kill zone?

Wait for the manipulation move to finish, usually 15–45 minutes into the kill zone. Only enter once a confirmed structure or breaker has formed.

Do I need special indicators to trade ICT-style?

No, but clean charts and time-based tools like session overlays, time-based Fibonacci retracements, and kill zone boxes help.

What kind of broker supports ICT trading best?

A broker with fast execution, low spreads, and time-synced platforms like Defcofx is ideal. You want minimal slippage and maximum transparency during fast-moving kill zone setups.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.

- Trailing Stop Loss vs Trailing Stop Limit

- Best Currency Pairs to Trade During London Session

- How Much is 0.5 Lot Size in Dollars

- Best Time To Trade NZD/USD

- What Is Exponential Moving Average and How It Works

- Is NZD/USD a Major or Minor Pair?

- Trailing Stop Limit: Definition, Uses & Trading Guide

- Correlated Forex Pairs List for Smarter Trading

- Lower Currency Value: Causes, Effects & Trading Insights