The forex market opened the second full trading week of 2026 in a more measured and selective tone, as the initial volatility from year-end repositioning faded and traders began reassessing directional bias. After the US dollar’s modest recovery late last week, momentum slowed on Monday, with the greenback trading mixed across the board rather than extending gains. The shift reflected a market increasingly focused on upcoming US inflation data and central bank guidance, rather than chasing post-holiday trends.

Risk sentiment was cautious but stable. Global equity markets traded sideways, while bond yields eased slightly, removing some of the yield support that had recently underpinned the dollar. The Japanese yen found renewed demand after weeks of weakness, pressuring USD/JPY lower from elevated levels. Meanwhile, the euro consolidated after its strong December rally, and commodity currencies struggled to gain traction as investors adopted a wait-and-see approach ahead of key macro releases later in the week.

Overall, Monday’s session was characterized by consolidation rather than conviction, with price action suggesting markets are pausing to recalibrate before committing to the next directional move.

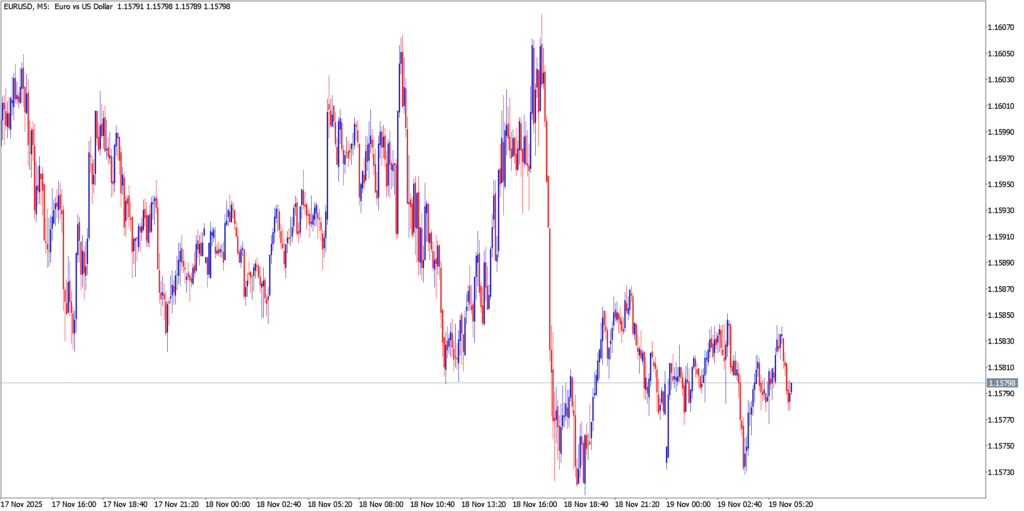

EUR/USD

Technical Analysis

EUR/USD traded in a narrow range on Monday, consolidating below recent highs after failing to extend its December rally. The pair hovered above the 1.1700 region, which continues to act as near-term support, while upside attempts stalled ahead of resistance in the upper-1.17s. On the four-hour chart, price action formed a mild consolidation structure rather than a reversal, indicating that bullish momentum has cooled but not broken. Momentum indicators such as RSI stabilized near neutral levels, suggesting the market is digesting prior gains rather than preparing for an aggressive sell-off. As long as EUR/USD holds above the 1.1680–1.1700 zone, the broader bullish structure remains intact. A clean break above resistance could reopen the path toward the 1.1800 handle later in the week, while a sustained move below support would signal a deeper corrective phase.

Fundamental Analysis

Fundamentally, the euro’s stability reflects a balance between supportive medium-term expectations and short-term caution. Markets continue to price a relatively steady ECB outlook compared to the Federal Reserve, where policy uncertainty remains higher. With US CPI data approaching, traders were reluctant to push EUR/USD aggressively in either direction. The lack of major Eurozone data releases on Monday also kept volatility muted. From a broader perspective, the euro remains underpinned by expectations that the Fed’s easing cycle will gradually narrow the rate differential in 2026, but near-term flows suggest profit-taking and consolidation are dominating. As a result, EUR/USD appears to be in a holding pattern, waiting for a catalyst to determine whether the next leg is continuation or correction.

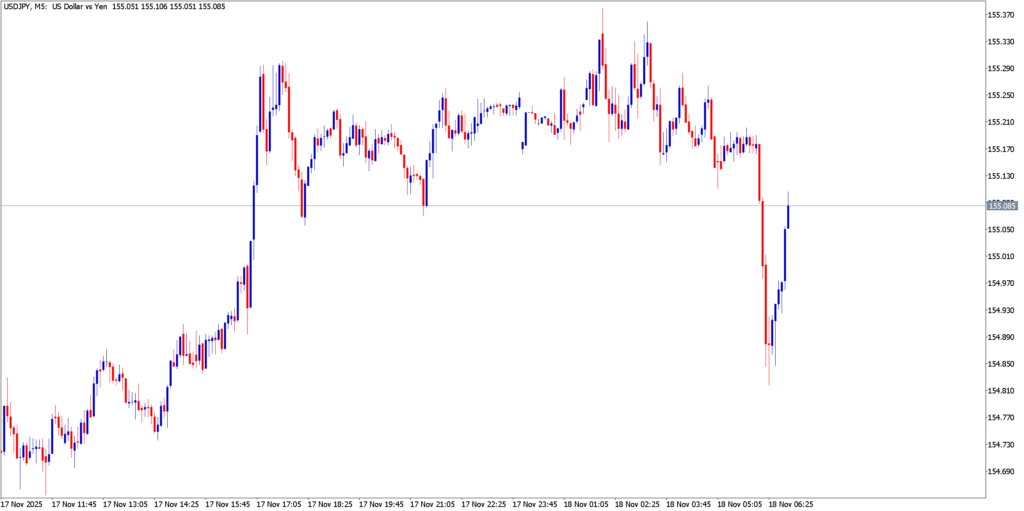

USD/JPY

Technical Analysis

USD/JPY softened on Monday, retreating from elevated levels after failing to sustain last week’s upside momentum. The pair slipped back toward the mid-156 area after repeated rejections near the upper-157s. This price behavior suggests buyer exhaustion rather than a full trend reversal, but it does mark a shift from the one-way move that dominated late December. On the daily chart, USD/JPY remains above key moving averages, keeping the broader uptrend intact. However, short-term indicators rolled over from overbought territory, opening room for further pullback toward initial support around 155.50. A deeper move below 155.00 would challenge bullish structure, while a renewed push above 157.80 would signal trend continuation toward psychological resistance near 160.00.

Fundamental Analysis

The yen’s modest recovery was driven primarily by positioning and declining US yields rather than any shift in Japanese policy. With US Treasury yields easing slightly, the yield differential that fueled USD/JPY’s rally narrowed just enough to trigger profit-taking. Additionally, renewed discussion around potential Japanese official discomfort with excessive yen weakness likely added a layer of caution for long positions, even in the absence of direct intervention signals. From the US side, traders reduced dollar exposure ahead of inflation data, contributing to the pair’s pullback. Fundamentally, USD/JPY remains sensitive to yield dynamics and risk sentiment, and Monday’s move reflects a market testing whether recent highs can be sustained without fresh catalysts.

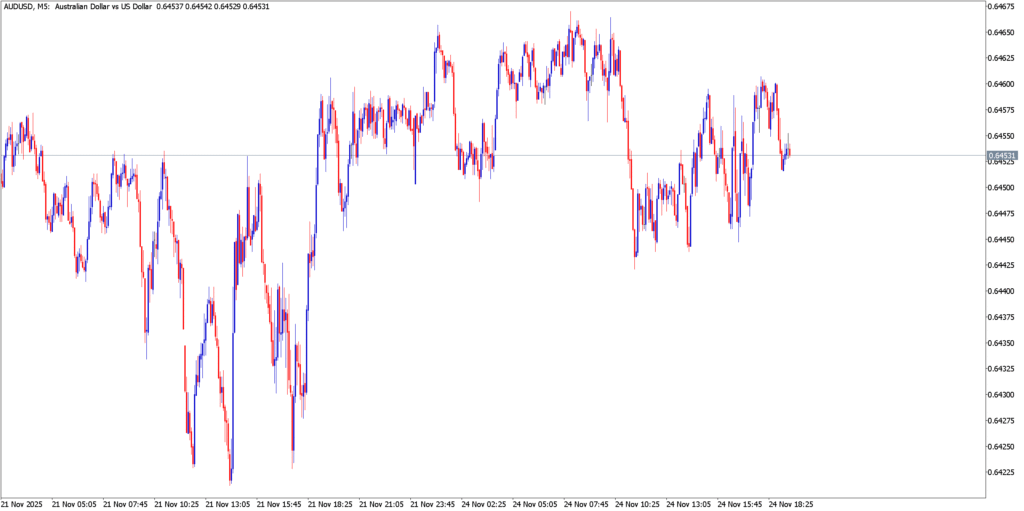

AUD/USD

Technical Analysis

AUD/USD struggled to build upside momentum and remained under pressure throughout Monday’s session. The pair traded below short-term resistance, failing to reclaim key levels that would signal renewed bullish intent. Price action remained capped beneath descending trend resistance on the four-hour chart, while support near recent lows was repeatedly tested. Momentum indicators stayed subdued, reflecting weak buying interest. Unless AUD/USD can regain traction above near-term resistance, the technical bias remains tilted toward consolidation or mild downside continuation. A clear break below support would expose the pair to further losses, while a recovery above resistance would be required to shift sentiment.

Fundamental Analysis

Fundamentally, the Australian dollar’s weakness reflected a cautious global risk environment and limited support from commodities. With equity markets trading defensively and investors awaiting clarity on global growth and inflation, risk-sensitive currencies struggled to attract inflows. The absence of major Australian data releases left AUD/USD at the mercy of broader sentiment and US dollar flows. While China-related optimism has provided intermittent support in recent weeks, Monday’s session showed that traders remain reluctant to commit aggressively to commodity currencies without stronger confirmation of risk appetite. As a result, AUD/USD continues to lag its major peers.

Market Outlook

As markets move deeper into January, attention shifts toward confirmation rather than speculation. The key driver in the days ahead will be US inflation data, which has the potential to reshape expectations around the Federal Reserve’s pace of easing in 2026. A softer-than-expected CPI print would likely reignite dollar selling and support EUR/USD and risk-oriented currencies, while a firmer reading could extend the dollar’s stabilization phase.

In Europe, traders will monitor ECB commentary for any hints of policy divergence with the Fed, while in Japan, USD/JPY remains vulnerable to shifts in yield differentials and intervention rhetoric. Risk sentiment will also play a crucial role, particularly for commodity currencies, as equity and bond markets seek direction.

Technically, many major pairs are sitting near important inflection zones rather than trending cleanly. This increases the probability of short-term range trading and false breaks before a clearer directional move emerges. Overall, Monday’s session suggests that the market is pausing, not reversing, and that the next decisive move will likely be driven by macro data rather than positioning alone.

As liquidity and participation normalize after the holiday period, the coming sessions should provide clearer signals on whether early-2026 consolidation evolves into trend continuation or a broader reset across major currency pairs.

Discover More Forex Reports with Defcofx

Stay updated with the latest currency market moves and deep-dive analysis from Defcofx:

- Markets Shrug Off Venezuela Shock as Dollar Retreats

- Dollar on the Ropes as Risk Rally Roars

- Yen Weakness Dominates as CPI Keeps Caution

- Dollar Stabilizes After CPI as USD Pairs Consolidate

- Dollar Trades Firm as Data Fails to Shift Fed Outlook

Explore these reports for up-to-date insights on forex trends, macroeconomic catalysts, and how major currencies are reacting to global events like geopolitical developments and central bank guidance.