Tuesday’s trading picked up right where the new year rally left off – with investors piling into risk assets and the U.S. dollar extending its pullback. Confidence swept through global markets, boosting stocks to record highs and sending safe-haven currencies retreating. Early in the day, upbeat sentiment was bolstered by signs of cooling inflation in Europe and expectations that the Federal Reserve will ease policy later in 2026. The dollar index wavered near recent lows as traders showed little appetite for safety, favoring growth-sensitive currencies instead. The British pound and Australian dollar both surged to levels not seen in over a year, capitalizing on the greenback’s weakness and their own supportive storylines. Even the euro regained ground before steadying, as attention turned to upcoming data after a soft German CPI reading. In all, the forex market displayed a classic “risk-on” tableau: commodity-linked and high-yielding currencies rallied, the dollar and yen stayed on the back foot, and participants looked ahead to major U.S. economic reports later in the week to guide the next leg of the move.

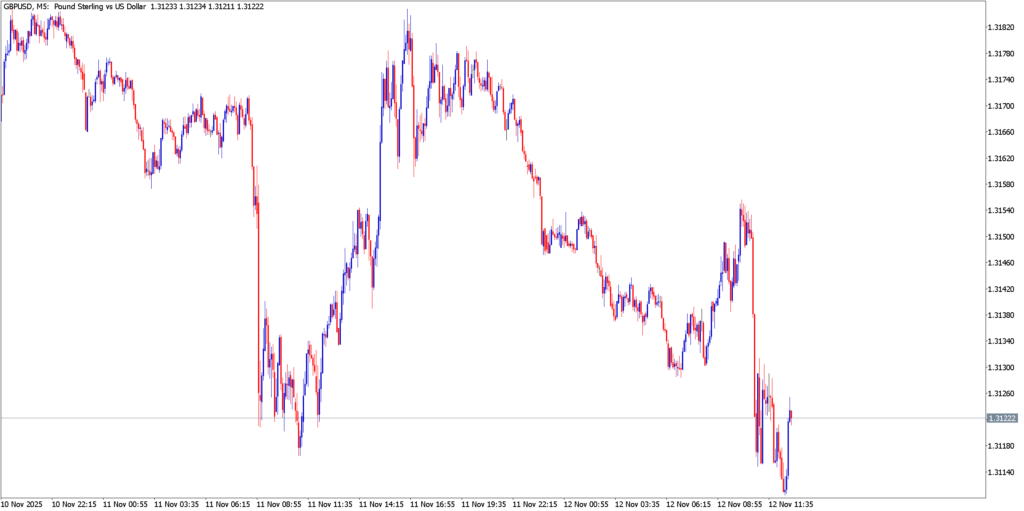

GBP/USD

Technical Analysis

GBP/USD extended its powerful uptrend, breaking above $1.3550 and tagging its highest level since mid-September. The pair’s advance built on Monday’s gains, forming a series of higher highs and higher lows on the chart – a clear bullish structure. On Tuesday, sterling bulls pushed the price up to roughly $1.3570 before the rally paused, establishing that area as immediate resistance. If upside momentum persists, the next psychological hurdle looms at $1.3600, and a break beyond could open the door toward the mid-$1.36s (where a key peak from last summer resides). Technical indicators show strong bullish momentum: short-term oscillators are nearing overbought territory but have yet to flash a reversal signal, and moving averages are trending upward with widening gaps. On the downside, former resistance around $1.3500–1.3520 now serves as initial support after being decisively cleared. Below that, additional support lies at $1.3400, the prior day’s low and an area of consolidation. The pound’s chart picture remains decidedly bullish, though traders will watch for any loss of momentum as the pair approaches major long-term resistance levels.

Fundamental Analysis

The pound’s stellar run continued unabated, as favorable fundamentals and risk appetite combined to lift GBP/USD. With no fresh UK economic releases on Tuesday, sterling drew strength from the positive mood in global markets and lingering tailwinds from earlier data. Traders remained encouraged by Monday’s strong UK credit and lending figures, which suggested the British economy started the year on solid footing. Additionally, the absence of any dovish surprises from Bank of England officials kept the policy outlook relatively supportive for the pound. On the U.S. side, the dollar struggled amid a backdrop of easing inflation expectations and Fed succession uncertainty. A top Fed official’s comments the day before – noting the risk of higher unemployment and a neutral policy stance – reinforced the idea that the Fed is unlikely to turn more hawkish anytime soon. This undercut the dollar and benefited currencies like GBP. By Tuesday, sterling’s momentum also owed to technical and positional factors: having cleared key levels, the pound attracted trend-following buyers. Some investors noted that the UK’s improved inflation trajectory (inflation has been gradually slowing) might give the BoE room to hold rates steady, avoiding the aggressive cutting cycle that could weaken the currency. In sum, GBP/USD’s climb reflected a blend of USD weakness and the pound’s relative appeal, with traders now eyeing upcoming US data (and any Brexit or UK political news) to gauge if this rally has more room to run.

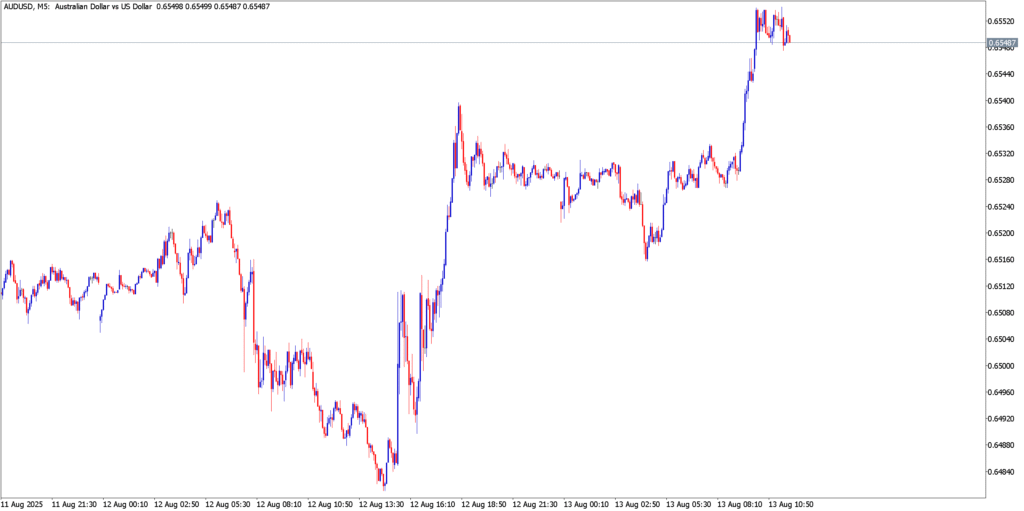

AUD/USD

Technical Analysis

The AUD/USD ripped higher in a bullish breakout, soaring above $0.6700 to reach territory not seen in over a year. The Australian dollar’s climb was steep and decisive – by Tuesday it traded around $0.6740–0.6750, marking its strongest level since October 2024. This move cleared a significant resistance band near $0.6720 (the previous multi-month high), confirming a breakout from the long consolidation that had capped the pair’s advances. With that hurdle overcome, technical focus turns to the upside: the next resistance may appear around $0.6800, a round number and minor pivot level from mid-2024. Beyond $0.68, the $0.6900–0.7000 zone comes into view as a longer-term target if bullish momentum persists. Indicators underscore the strength of the uptrend – the Aussie is riding above its short and medium-term moving averages, and trend indicators like the MACD point to growing positive momentum. One caution is that short-term RSI levels are entering overbought territory after the rapid ascent, so a pullback or some consolidation could occur. If so, the broken resistance at $0.6700–0.6720 should now act as support on dips. Further support is seen around $0.6600–0.6650, where the pair consolidated before this week’s breakout. Overall, technical signals affirm that AUD/USD has resumed an uptrend, with any corrective dips likely to be shallow as long as the risk-on environment holds.

Fundamental Analysis

The Australian dollar has been a prime beneficiary of the global risk rally, and Tuesday showcased that dynamic clearly. Investor optimism and stronger commodity outlooks translated into aggressive AUD buying. There were several fundamental undercurrents lifting the Aussie. First, China – Australia’s biggest trading partner – has shown signs of stabilization in its services sector (recent Chinese PMI readings have been solid), which bodes well for Australian exports and sentiment. Secondly, commodity prices, from industrial metals to energy, saw modest gains as traders grew more confident in global growth; Australia’s resource-heavy economy stands to gain from such trends. On the domestic front, traders were positioning ahead of Australia’s latest inflation data (monthly CPI due overnight). Hopes that inflation might remain contained, combined with the Reserve Bank of Australia’s current neutral stance, create a scenario where Australia’s interest rates are relatively attractive without the risk of imminent cuts – a recipe that supports the currency. Meanwhile, the U.S. dollar’s weakness provided the other half of the equation. With Wall Street rallying and volatility measures low, capital flowed out of safe havens and into higher-yielding plays like AUD. The Fed’s cautious tone and softer U.S. data (e.g. Monday’s weak manufacturing PMI) have diminished the USD’s appeal, allowing AUD/USD to climb unfettered. In short, the Aussie’s breakout reflects both a local story of economic resilience and a global story of risk appetite. Going forward, traders will watch Australia’s CPI and any hints of RBA policy shifts, but as long as the world market mood remains positive, the path for AUD/USD may continue to tilt upward.

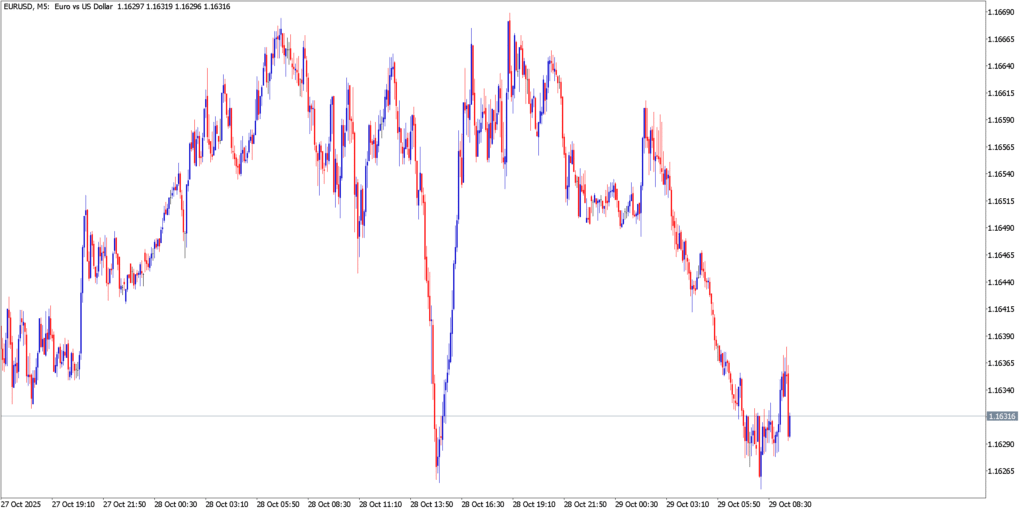

EUR/USD

Technical Analysis

EUR/USD traded in a choppy yet upward-biased range on Tuesday, ultimately managing a modest rise as it navigated competing forces. In the European morning, the pair pulled back from near $1.1750 highs down toward the lower-$1.17s after encountering resistance. That $1.1750–1.1770 zone has emerged as a short-term ceiling — it represents last week’s high as well as the neckline of a possible double-top pattern formed by repeated failures to break above $1.1800 in recent weeks. After the mid-day dip, euro bulls stepped in to defend support around $1.1700, a round figure and close to the 20-day moving average. The euro’s rebound from those levels kept it within its recent range. For now, $1.1800 remains the key upside hurdle: a clear breakout above that would signal a more significant bullish continuation, potentially targeting the $1.1900–1.1950 region (the highs from last year). On the downside, $1.1650 serves as immediate support (the area of last week’s lows), with stronger support near $1.1600 in case of a deeper pullback. The pair’s technical posture is slightly bullish on the higher timeframes – it is holding above its 50-day EMA and still respecting an uptrend line from late last year – but momentum has slowed. Indicators like RSI are mid-range, reflecting the euro’s hesitation as it straddles between its well-defined support and resistance levels. In summary, EUR/USD is range-bound with an upward tilt, awaiting a fresh catalyst to break out of the congestion between $1.16 and $1.18.

Fundamental Analysis

The euro’s performance on Tuesday was a balancing act between encouraging and cautionary signals. On one hand, the Eurozone received news of easing inflationary pressure: Germany’s preliminary CPI for December came in cooler than expected, hinting that price growth is slowing in Europe’s largest economy. This development could relieve some pressure on the European Central Bank to keep policy tight, and initially it weighed on the euro, as traders speculated the ECB might turn more dovish if disinflation continues. However, any euro weakness was tempered by the broader context of a softening U.S. dollar and still-positive sentiment in markets. Additionally, Eurozone economic activity data (final PMI readings) indicated that while growth has cooled, the region still closed 2025 with its strongest quarter in years. This helped reassure investors that the Eurozone economy is handling higher rates and that the ECB won’t need to pivot dramatically just yet. Meanwhile in the U.S., all eyes were on the Fed’s next moves and the impending jobs report. The divergence in central bank tone – with the Fed sounding cautious and the ECB previously signaling it would monitor inflation carefully – kept EUR/USD in a tug-of-war. Traders ultimately leaned toward selling dollars, given expectations of Fed rate cuts later in the year, which provided support to the euro after its brief dip. In essence, EUR/USD is being pulled by cross-currents: improving inflation outlook in Europe (potentially euro-negative) versus a dollar hampered by lower U.S. yields and risk-on flows (euro-positive). As Tuesday showed, the net result was a relatively flat euro, but with enough underlying support to maintain its recent gains. Going forward, traders are watching for any clues from central bankers – a hint from the ECB about policy flexibility or a surprise in U.S. data could finally push this pair out of its range. For now, the euro appears to have found a fragile footing around the mid-1.17s as it awaits clearer direction.

Market Outlook

With two trading days of the new year now in the books, forex traders turn their gaze to mid-week catalysts that could disrupt the prevailing trends. The market mood remains tilted toward risk-taking: equity markets are at highs, commodities are perky, and the dollar is subdued. Wednesday will test this equilibrium with a few key events. Most prominently, the U.S. ISM Services PMI is due – given the outsized role of America’s service sector, a strong or weak reading could swiftly alter expectations for U.S. growth and Fed policy. Currency markets will react if the services data surprises: a sharper slowdown could add pressure on the Fed to cut rates sooner, likely sinking the dollar further, whereas an unexpectedly robust services sector might lend the greenback some relief by underscoring economic resilience. Additionally, any further signals on who President Trump will nominate as the next Fed Chair (expected this month) could sway market sentiment, especially if the pick is seen as exceptionally dovish or hawkish. Outside the U.S., traders will keep an eye on Asian market cues overnight – Australia’s inflation report and any new moves by China’s central bank (which recently hinted at policy easing) may influence the AUD, NZD, and overall risk tone. So far, 2026 has begun with the dollar on the defensive and high-beta currencies in favor. The question for the coming sessions is whether this narrative extends or snaps. For now, the path of least resistance appears to be a continuation of the “risk-on” trade, but savvy traders know that each new data point or headline could tilt the scales. Caution is warranted even in this buoyant atmosphere. Going into Wednesday, the bulls in sterling, euro, and commodity currencies have the upper hand, but they will be navigating event risk that could inject volatility. All told, the forex market’s bias remains against the dollar in the very near term – unless incoming data or unexpected news provides a plot twist that puts global risk appetite or interest rate expectations into question.

Discover More Forex Reports with Defcofx

Stay updated with the latest forex market movements and macro-driven price action through our in-depth reports:

- Markets Shrug Off Venezuela Shock as Dollar Retreats

- Dollar Softens as New Year Flows Settle – 15 January 2026

- Yen Weakness Dominates as CPI Keeps Caution

- Dollar Stabilizes After CPI as USD Pairs Consolidate

- Dollar Trades Firm as Data Fails to Shift Fed Outlook

Explore these insights to better understand how global events, inflation data, and central bank expectations.