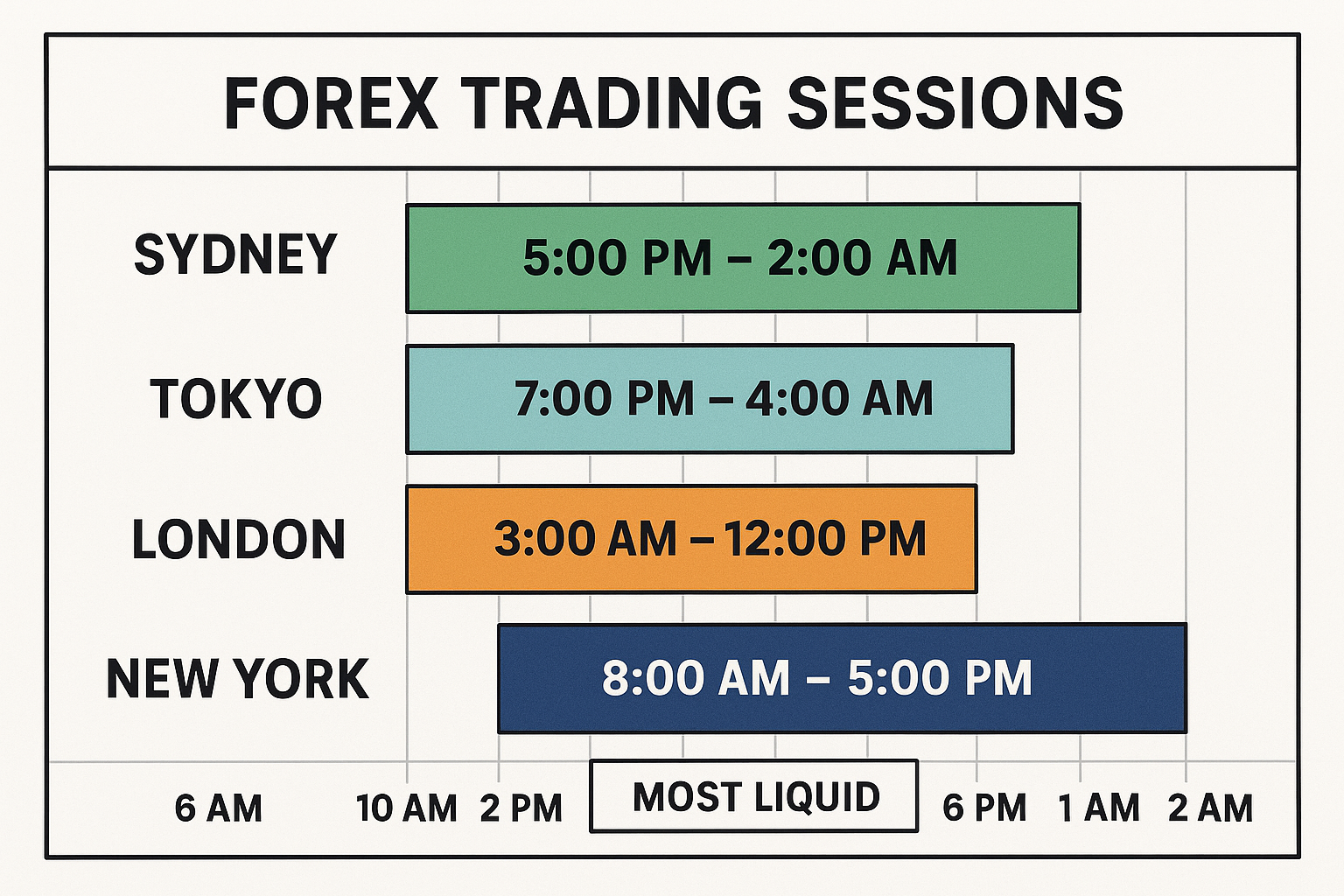

Forex trading sessions in EST run 24 hours across four main sessions: Sydney 5:00 PM–2:00 AM EST, Tokyo 7:00 PM–4:00 AM EST, London 3:00 AM–12:00 PM EST, and New York 8:00 AM–5:00 PM EST, the London–New York overlap (8:00–12:00 PM) is the most liquid.

Key Takeaways

- The forex market operates 24 hours, cycling through Sydney, Tokyo, London, and New York sessions in EST.

- London–New York overlap (8 AM–12 PM EST) offers the highest volatility and best trading opportunities.

- Understanding session timings helps traders choose when to trade specific currency pairs.

- Daylight Savings Time (DST) can shift market hours slightly, so always double-check schedules.

- Traders in EST can benefit from Defcofx’s fast execution, 0.3-pip spreads, and 1:2000 leverage during peak hours.

Understanding the Global Forex Market

The forex market is a 24-hour global marketplace, operating five days a week and moving continuously through major financial centers Sydney, Tokyo, London, and New York. When one session closes, another opens, allowing traders to participate anytime, anywhere.

Each trading session reflects the economic activity and liquidity of its region. For instance, Asian pairs like USD/JPY and AUD/JPY are most active during the Tokyo session, while EUR/USD and GBP/USD dominate the London and New York sessions.

Being aware of session timings allows traders to identify periods of high liquidity and volatility, which are essential for effective strategies like scalping, day trading, or news trading.

Forex Trading Sessions Converted to EST

To trade effectively, it’s vital to understand when each major forex market opens and closes in Eastern Standard Time (EST). The forex market follows a 24-hour cycle divided into four main sessions Sydney, Tokyo, London, and New York each influencing volatility and liquidity differently.

Forex Market Hours in EST

| Session | Opening Time (EST) | Closing Time (EST) | Major Financial Centers | Key Characteristics |

| Sydney | 5:00 PM | 2:00 AM | Australia, New Zealand | Starts the trading week, lower liquidity, good for early trend setup |

| Tokyo | 7:00 PM | 4:00 AM | Japan, Singapore, Hong Kong | Active yen pairs, steady movement, ideal for Asian traders |

| London | 3:00 AM | 12:00 PM | UK, Europe | High volatility, major financial hub, strong moves in EUR and GBP pairs |

| New York | 8:00 AM | 5:00 PM | United States, Canada | USD-focused, overlaps London, high liquidity and volatility |

Understanding these sessions helps you align your trades with peak market activity, leading to better execution and higher potential profits.

Forex Session Overlaps (Best Times to Trade in EST)

The most active periods in the forex market occur when two major sessions overlap; this is when liquidity peaks and price movements are strongest, offering traders the best opportunities for profit.

The two key overlaps for EST traders are:

London–New York Overlap (8:00 AM – 12:00 PM EST)

This is the most liquid and volatile period of the forex trading day.

- Over 70% of all daily forex transactions occur during this overlap.

- Major pairs like EUR/USD, GBP/USD, and USD/JPY see significant movement.

- Ideal for day traders and scalpers seeking tight spreads and quick execution.

Tokyo–London Overlap (3:00 AM – 4:00 AM EST)

This overlap is short and less volatile, but can offer opportunities for traders who prefer Asian–European currency pairs such as EUR/JPY and GBP/JPY.

Understanding these overlaps helps traders maximize efficient trading when volatility, liquidity, and volume are at their highest, instead of during quiet, illiquid hours.

Best Time to Trade Forex in EST (By Currency Pair)

The best time to trade in the forex market depends on which currency pairs you’re focusing on. Each pair is most active when the countries it represents are in business hours. By aligning your trades with the right forex trading sessions in EST, you can capture stronger trends and tighter spreads.

Major Pairs (High Liquidity & Volatility)

EUR/USD, GBP/USD, USD/CHF, and USD/JPY

- Most active during the London–New York overlap (8:00 AM – 12:00 PM EST).

- These hours see major news releases from both the U.S. and Europe, creating sharp movements.

- Best suited for day traders, scalpers, and news traders.

Cross Pairs (Moderate Volatility)

EUR/JPY, GBP/JPY, AUD/JPY

- Most active during the Tokyo session (7:00 PM – 4:00 AM EST).

- These pairs are influenced by Asian and early European trading activity.

- Great for traders who prefer evening trading hours in the U.S.

Commodity & Exotic Pairs

USD/CAD, USD/ZAR, AUD/USD, NZD/USD

- USD/CAD: Peaks during the New York session due to U.S. and Canadian market overlap.

- AUD/USD & NZD/USD: More movement in the Sydney–Tokyo sessions (5:00 PM – 4:00 AM EST).

- USD/ZAR: Trades better during London hours.

By choosing your trading time based on currency pair activity, you can increase your win rate and lower your trading costs. Defcofx’s real-time market analysis and global reach ensure traders can access opportunities across all sessions with precision.

4 Factors Influencing Forex Trading Session Volatility

While session timings determine when markets are open, volatility, the size and speed of price movements depends on various economic and geopolitical factors. Understanding these helps traders plan when to enter or exit positions with precision.

1. Economic Data Releases

Key data such as Non-Farm Payrolls (NFP), Consumer Price Index (CPI), and interest rate decisions significantly impact currency values.

- The New York session is particularly volatile when major U.S. data is released.

- London mornings (3–6 AM EST) also bring European economic reports.

2. Central Bank Announcements

Statements from central banks like the Federal Reserve (Fed), European Central Bank (ECB), and Bank of Japan (BoJ) can cause sharp market reactions.

- Central bank meetings often happen during local business hours, affecting the corresponding forex sessions.

- Traders should be cautious and manage leverage carefully during these times.

3. Geopolitical or Regional Events

Unexpected events such as elections, conflicts, or trade negotiations can instantly increase volatility.

- The impact often starts regionally (e.g., Asia, Europe, U.S.) and spreads globally.

- Traders who understand session overlaps can anticipate how these events ripple through time zones.

4. Seasonal and Weekly Patterns

- Mondays are often slower as markets digest weekend news.

- Mid-week (Tuesday–Thursday) brings the most consistent activity.

- Fridays can be volatile due to profit-taking and position closing before the weekend.

How to Use Session Timing to Improve Strategy

Mastering forex trading sessions in EST isn’t just about knowing the hours, it’s about aligning your strategy with the right levels of liquidity and volatility. When you trade at the optimal times, your strategies become more efficient, spreads are tighter, and execution quality improves.

1. Scalping and Intraday Trading

Scalpers thrive during periods of high volatility and liquidity.

- The London–New York overlap (8:00 AM – 12:00 PM EST) offers the best environment for quick in-and-out trades.

- Fast-moving pairs like EUR/USD and GBP/USD provide plenty of momentum.

2. Swing Trading

Swing traders hold positions for days or weeks, often entering when volatility begins to rise.

- Best times to analyze and open trades: early London session (3–5 AM EST) or start of New York session (8–10 AM EST).

- These windows often define daily trend direction.

3. News Trading

Economic releases and political statements cause rapid price movements.

- Focus on scheduled events like U.S. GDP, interest rate announcements, or European inflation reports.

- Use pending orders to catch breakouts without excessive slippage.

4. Long-Term / Position Trading

Position traders prefer lower volatility sessions to avoid unnecessary whipsaws.

- The Asian session (7 PM – 4 AM EST) often offers calmer price action for steady accumulation or exit points.

- This approach suits those who monitor macro trends rather than daily fluctuations.

5. Risk Management Across Sessions

- Avoid trading during session transitions (5–7 PM EST) when liquidity drops.

- Adjust leverage based on session volatility, use smaller positions during calm markets.

- Keep stop-loss and take-profit levels aligned with average volatility per session.

FAQs Forex Trading Sessions in EST

The four major forex sessions in Eastern Standard Time (EST) are:

1. Sydney: 5:00 PM – 2:00 AM EST

2. Tokyo: 7:00 PM – 4:00 AM EST

3. London: 3:00 AM – 12:00 PM EST

4. New York: 8:00 AM – 5:00 PM EST

Together, they ensure that the forex market operates 24 hours a day, five days a week.

The London–New York overlap (8:00 AM – 12:00 PM EST) is considered the best time to trade. This period offers maximum liquidity, tighter spreads, and stronger price movements, ideal for day traders and scalpers.

1. Asian Session: USD/JPY, AUD/USD, NZD/USD

2. London Session: EUR/USD, GBP/USD, USD/CHF

3. New York Session: EUR/USD, GBP/USD, USD/CAD, USD/JPY

4. Overlap Session: EUR/USD, GBP/USD, GBP/JPY

During Daylight Saving Time (DST), session timings shift by one hour in EST. Always double-check with your broker’s platform time to avoid confusion.

No. The forex market is open 24 hours a day from Monday to Friday, but closed on weekends. However, crypto CFDs on platforms like Defcofx may remain open during weekends.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.