Most stock markets operate for around 252 trading days per year. The exact number changes slightly each year because exchanges close on weekends and observe public holidays. Depending on how these dates fall, a given year may have 250 to 253 total trading days.

Key Takeaways

- ✔ Most stock markets are open for about 252 trading days per year.

- ✔ Trading days vary slightly between 250–253 each year.

- ✔ Weekends and major holidays are excluded from trading days.

- ✔ Holiday weekdays mean fewer trading days; weekend holidays mean more.

- ✔ Knowing trading days helps in strategy, risk management, and yearly planning.

How Many Trading Days Are in a Year?

The number of trading days in a year depends on the stock exchange schedule, weekends, and official market holidays. In major markets such as the NYSE and NASDAQ, there are typically about 252 trading days per year. This figure represents the total weekdays in a year minus weekends and holidays, and it is widely used across the financial industry for calculations and performance analysis.

Average Trading Days Per Year (U.S. Markets)

Most U.S. financial sources confirm that the stock market usually has:

- There are around 252 trading days in a typical year.

- A range of 250–253 days, depending on how holidays align with weekdays.

- Small variations in years where major holidays fall on weekends or during leap years.

These averages match the commonly cited trading-day count used by analysts, brokers, and financial educators.

Why the Number of Trading Days Changes Each Year

The total number of trading days is not fixed. Although most years average around 252 trading days, the actual number can shift by 1–3 days depending on how the calendar is structured. Several factors influence whether a given year ends up with 250, 251, 252, or 253 trading days.

1. Weekend Distribution

Stock markets are closed every Saturday and Sunday, so the yearly count is heavily affected by how many weekends occur within a calendar year.

- Some years contain more weekdays, resulting in more trading days.

- Other years contain more weekends starting early or ending late, reducing the total.

Even one additional weekend alignment can alter the final count.

2. Public Market Holidays

U.S. markets observe holidays such as:

- New Year’s Day

- Independence Day

- Thanksgiving

- Christmas Day

- Labor Day

- Martin Luther King Jr. Day

When these holidays fall on a weekday, the market closes, reducing the total trading days that year. If a holiday falls on a weekend, the market may observe a substitute weekday closure, but not always, further affecting the count.

3. Leap Years

A leap year adds one extra day (February 29), but this does not guarantee an extra trading day.

It depends entirely on whether the extra day lands on:

- a weekday → potentially adds one trading day

- a weekend → no change

Leap years therefore influence the trading-year total only in certain calendar configurations.

4. Exchange-Specific Rules and Special Closures

Markets may occasionally close unexpectedly due to:

- national days of mourning

- severe weather or natural disasters

- technical outages

- government-mandated shutdowns

While rare, these special events can reduce the number of trading days in a given year.

5. Cultural and Regional Holiday Differences

In global markets (Europe, Asia, and the Middle East), trading-day counts differ due to:

- additional cultural holidays

- different working-week structures (e.g., Middle Eastern markets close Friday–Saturday)

- unique market calendars for each exchange

This is why international markets rarely share the same number of annual trading days as the U.S.

Trading Days by Market Region

Different financial markets around the world do not share the same number of trading days. While U.S. markets average around 250–252 trading days, other regions have different holiday schedules, cultural observances, and even different weekend structures.

Below is an overview of trading-day expectations across major global regions.

United States (NYSE & NASDAQ)

- Average: 250–252 trading days per year

- Weekend: Saturday–Sunday

- Holidays: ~10 official market holidays

The U.S. markets are among the most standardized and predictable, typically landing near the global average.

United Kingdom (London Stock Exchange – LSE)

- Average: 250–253 trading days

- Weekend: Saturday–Sunday

- Holidays: UK Bank Holidays (e.g., Boxing Day, Easter Monday)

The LSE often has slightly fewer trading days than the U.S. due to additional bank holidays.

Europe (Euronext, Deutsche Börse / DAX, CAC 40)

- Average: 248–252 trading days

- Weekend: Saturday–Sunday

- Holidays: Varies across countries, includes more religious holidays (e.g., Pentecost Monday, Ascension Day)

European markets often close for multiple Catholic and regional holidays, reducing their total trading days.

Asia – Japan (Tokyo Stock Exchange – TSE)

- Average: 240–245 trading days

- Weekend: Saturday–Sunday

- Holidays: Golden Week, Coming of Age Day, National Foundation Day, Showa Day

Japan has one of the highest holiday counts globally, resulting in fewer trading days compared with U.S. and European markets.

Asia – Hong Kong Stock Exchange (HKEX)

- Average: 245–248 trading days

- Weekend: Saturday–Sunday

- Holidays: Lunar New Year, National Day, Mid-Autumn Festival

Hong Kong observes major Chinese holidays, leading to more market closures than Western exchanges.

Singapore Exchange (SGX)

- Average: 245–250 trading days

- Weekend: Saturday–Sunday

- Holidays: Chinese New Year, Hari Raya, Deepavali

Singapore’s multicultural holiday calendar produces moderate variations in yearly trading days.

Middle East (Saudi Stock Exchange – Tadawul)

- Average: 250–255 trading days

- Weekend: Friday–Saturday (not Saturday–Sunday)

- Holidays: Eid al-Fitr, Eid al-Adha, National Day

Because the Middle Eastern weekend differs, the trading-day structure does not match Western markets.

Key Insight

Global markets operate on different schedules; traders focusing internationally must account for holiday calendars, weekend differences, and region-specific closures to accurately measure performance and plan trading strategies.

Comparison Table: Average Trading Days by Global Markets

| Region | Market / Exchange | Typical Trading Days Per Year | Notes |

| United States | NYSE / NASDAQ | ≈ 252 | Most consistent globally; ~10 holidays. |

| United Kingdom / Western Europe | LSE, Euronext, DAX | ≈ 248–253 | Additional religious/national holidays. |

| Japan | Tokyo Stock Exchange | ≈ 244–245 | One of the highest holiday counts worldwide. |

| Hong Kong | HKEX | ≈ 248–252 | Lunar New Year causes multi-day closures. |

| Singapore | SGX | ≈ 245–250 | Multi-cultural holiday mix. |

| Middle East | Tadawul (Saudi Arabia) | ≈ 250–255 | Friday–Saturday weekend; unique holiday calendar. |

How Trading Days Affect Traders

The number of trading days in a year directly influences market behavior, liquidity, volatility, and the performance expectations traders set for themselves. Fewer or more trading days can shift the rhythm of the markets, affecting both short-term strategies and long-term investment analysis.

1. Liquidity and Market Volume

Trading days determine how often market participants can buy or sell, which affects overall liquidity.

- More trading days → More opportunities for consistent volume and orderly price movement

- Fewer trading days (holiday weeks) → Thinner liquidity, which can lead to sharper price gaps or unpredictable moves

Institutional traders often adjust positions before holidays, creating noticeable volume drops.

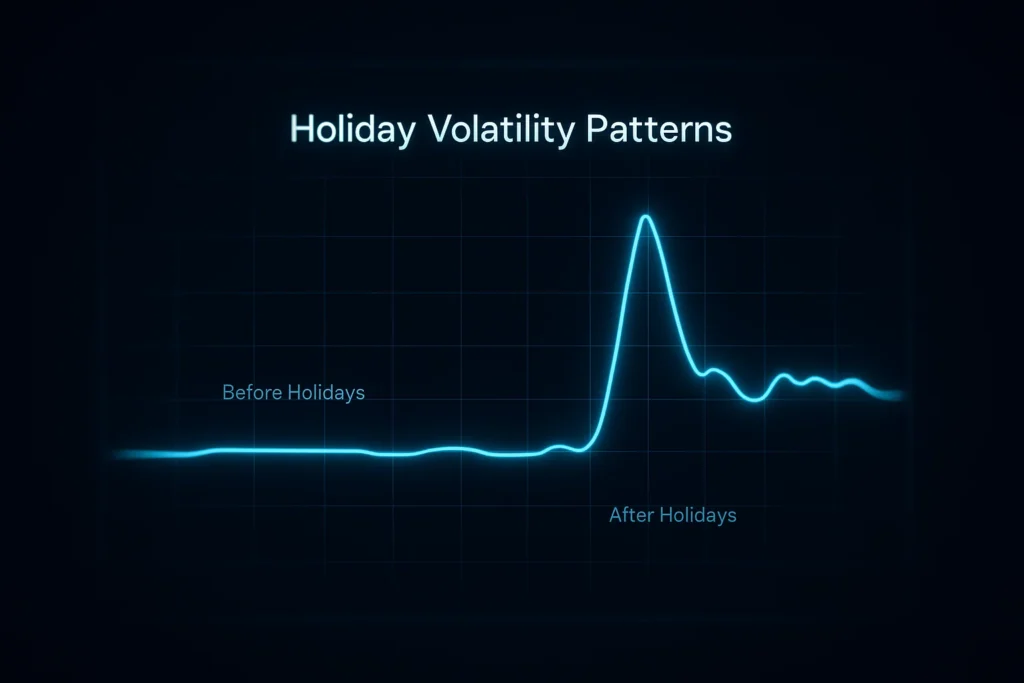

2. Volatility Patterns Around Holidays

Market volatility often changes depending on how trading days cluster around holidays:

- Before holidays: Lower participation, quieter markets

- After holidays: Sudden volatility as traders return and reposition portfolios

- Extended closures: Increase uncertainty, which can trigger stronger post-holiday moves

This is why traders pay close attention to short trading weeks.

3. Impact on Trading Strategies and Performance

Trading strategies, especially those based on daily signals, rely heavily on the number of trading days:

- Scalpers & day traders: Fewer trading days = fewer setups

- Swing traders: More gaps and price dislocations during holiday periods

- Algorithmic traders: Must adjust calendars for accurate backtesting

Even annual performance metrics (e.g., “yearly return”) depend on understanding how many trading days were actually available to trade.

4. Market Psychology and Seasonal Trends

Seasonal tendencies such as

- the January Effect

- summer slowdown

- holiday rallies

are all shaped by the number and spacing of trading days throughout the year.

For example, August and December often show lower liquidity because of vacations and holidays.

5. Risk Management Considerations

Fewer trading days can amplify risk:

- Wider spreads during low-liquidity periods

- Larger overnight or multi-day gaps

- Difficulty exiting positions quickly in quiet markets

Traders typically reduce position sizes before holidays to manage these risks.

Key Insight: Trading days influence market behavior, trader performance, risk management, and strategic planning. Understanding annual trading-day patterns helps traders prepare for low-volume periods, anticipate volatility spikes, and set realistic expectations for their strategies.

How to Calculate Trading Days Yourself

Calculating the number of trading days in a year is simple once you understand how markets define open and closed sessions. The total is based on weekdays minus market holidays, with optional adjustments for special closures. Traders often calculate trading days to estimate strategy performance, plan yearly goals, or backtest systems accurately.

1. Start With All Weekdays in a Year

A calendar year contains:

- 365 days (or 366 in a leap year)

- Minus 104 weekend days (52 Saturdays + 52 Sundays)

This leaves:

- 261 weekdays in a standard year

- 262 weekdays in a leap year

2. Subtract Official Market Holidays

Each stock exchange publishes an annual holiday schedule.

For example, U.S. markets typically close for:

- New Year’s Day

- Martin Luther King Jr. Day

- Presidents’ Day

- Good Friday

- Memorial Day

- Independence Day

- Labor Day

- Thanksgiving Day

- Christmas Day

Most years include 9–10 holidays, bringing the trading-day total near 252.

Different regions have different numbers of national or cultural holidays, which changes the final count.

3. Adjust for Holidays That Fall on Weekends

If a holiday falls on a:

- Saturday → markets often observe the holiday on Friday

- Sunday → markets may close on Monday

This shift affects the yearly total.

Some exchanges do not observe substitute holidays, so the effect varies by region.

4. Include Any Special Market Closures

Rare events can reduce the number of trading days:

- National days of mourning

- Major weather events

- Technical outages

- Government-mandated shutdowns

While uncommon, these create small deviations from the typical annual range.

5. Final Formula for Estimating Trading Days

You can calculate an approximate number of trading days using:

Trading Days = Total Weekdays – Official Market Holidays – Special Closures

For most major markets, this results in:

- ≈ 250–253 trading days for U.S. and European exchanges

- ≈ 244–250 for many Asian exchanges

- ≈ 250–255 for Middle Eastern exchanges

Tools That Automatically Calculate Trading Days

Traders often use:

- Market calendars (NYSE, Nasdaq, LSE, HKEX)

- Economic-calendar websites

- Trading platforms (MetaTrader, TradingView)

- Excel formulas with holiday lists

These tools generate precise trading-day counts for any given year.

How Defcofx Supports Traders Throughout the Trading Year

The number of trading days may change from year to year, but traders still rely on a platform that offers stable conditions, low costs, and fast execution. Defcofx is designed to help traders make the most of every trading day, whether the calendar offers 250, 252, or 253 opportunities to participate in the market. With reliable pricing and simple account conditions, traders can focus on their strategies without worrying about unnecessary fees or delays.

6 key benefits traders receive with Defcofx include:

- Ultra-low spreads from 0.3 pips, giving traders tighter pricing on major pairs and more room to manage risk.

- High leverage up to 1:2000, allowing traders to participate in the market with flexible position sizing.

- No commissions and no swap fees, which is especially useful for traders who hold positions overnight or during short trading weeks.

- Fast withdrawals are processed within 4 hours, including weekends, ensuring quick access to funds when needed.

- A 40% welcome bonus on deposits of $1000+, offering traders additional capital to navigate active market periods.

- Global accessibility without regional restrictions, making it possible to trade both major and minor currency pairs regardless of geographic location.

Defcofx supports traders throughout the entire trading year by combining low costs, reliability, and ease of use. Whether markets are quiet around holidays or highly active during major economic releases, traders have the tools they need to operate confidently on every trading day the year provides.

Open a Live Trading AccountFAQs: How Many Trading Days in a Year?

Most stock markets have around 252 trading days per year. This number varies depending on weekends and market holidays. A typical range for major exchanges is 250–253 days, depending on how holidays fall within the calendar year.

A leap year may have one extra weekday, but trading days still depend on holidays. Most leap years have 251–253 trading days, depending on the specific calendar layout and how many market holidays fall on weekdays.

No. Trading-day counts differ worldwide due to cultural holidays, market-specific rules, and different weekend structures. For example, Japan typically has ≈244–245 days, while U.S. markets average ≈252, and Middle Eastern exchanges may exceed 250.

No. Cryptocurrency markets operate 24/7 without holidays or weekend closures. Unlike stock markets, crypto trading does not rely on a centralized exchange schedule, so there is no fixed number of “trading days” per year.

Trading days change based on weekends, public holidays, substitute holidays, and occasional special closures like extreme weather or national events. Even small calendar shifts can increase or reduce the year’s total trading days.

Trading days affect strategy planning, volatility expectations, annual performance targets, and backtesting accuracy. Understanding how many days the market is open helps traders measure returns realistically and prepare for low-liquidity or high-volatility periods.

Final Thoughts

The number of trading days in a year is a fundamental piece of information for traders, analysts, and investors. While most major stock markets operate for around 252 trading days annually, the exact count changes based on weekends, holidays, and exchange-specific closures.

Understanding how trading days vary across global regions and how they influence liquidity, volatility, and trading performance helps traders plan more effectively and set realistic expectations for their strategies. Whether you trade U.S. markets, follow Asian exchanges, or diversify globally, knowing the annual trading calendar is essential for accurate analysis and smart decision-making.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.

- What Currency is The Most Valuable

- Best Currency Pairs to Trade During London Session

- How Much is 0.5 Lot Size in Dollars

- List of Major and Minor Forex Pairs

- What Is Considered the Greatest Risk Associated With Forex Settlement?

- Is NZD/USD a Major or Minor Pair?

- Trailing Stop Limit: Definition, Uses & Trading Guide

- When Does a Bearish Market Become Bullish in Forex?

- Is Pound Stronger than Dollar?