In general, the euro (EUR) holds a higher value than the U.S. dollar (USD). Typically, one euro equals slightly more than one dollar, meaning the euro can purchase more goods or services internationally compared to the dollar, reflecting its stronger relative exchange rate in global markets.

Key takeaways

- General position: EUR > USD euro around $1.17.

- Why it matters: Dollar softness is linked to Fed cut expectations and short-term risk sentiment, which boosts the euro and other currencies.

- Drivers to watch: interest-rate differentials (Fed vs. ECB), inflation data, geopolitical/news shocks, and energy prices.

- Trading implication: Traders should watch real-time rate moves and macro releases, strength can reverse quickly on policy surprises.

- Practical note for traders: If you trade EUR/USD, prefer platforms with tight spreads, fast execution, and fast withdrawals to act on volatility (we’ll mention Defcofx’s relevant features later in the article).

What Determines a Currency’s Strength?

A currency’s strength is shaped by how investors perceive its economy’s health and stability. The U.S. dollar and euro both reflect their regions’ economic power, but several measurable factors decide which performs better in global markets.

5 Key Factors That Drive Currency Value

- Interest Rates: Higher central bank rates attract foreign investment, boosting demand for that currency.

- Inflation Rates: Lower inflation preserves purchasing power, keeping a currency stronger.

- Economic Growth: Strong GDP growth signals a stable economy, increasing currency demand.

- Trade Balance: Countries exporting more than they import tend to have stronger currencies.

- Investor Confidence: Safe-haven demand during global uncertainty often favors stable economies like the U.S.

When the Federal Reserve (Fed) raises interest rates faster than the European Central Bank (ECB), the dollar typically strengthens. Conversely, when the ECB tightens policy or Europe’s trade balance improves, the euro gains value.

Historically, the USD and EUR move inversely; when one rises, the other tends to fall because they’re among the most traded currencies worldwide.

This foundational understanding helps traders assess why the market fluctuates between dollar strength and euro dominance and how macroeconomic indicators directly influence the EUR/USD pair.

Why the Dollar Is Currently Stronger Than the Euro

Although the euro briefly gained strength, the U.S. dollar has generally maintained a stronger position over the past few years due to a combination of economic resilience, monetary policy, and global investor behavior.

Let’s break down the main reasons:

1. Higher U.S. Interest Rates

The Federal Reserve kept policy rates relatively higher than the European Central Bank (ECB) to control inflation.

- Higher rates attract global investors seeking better returns on U.S. assets.

- As demand for dollars rises, its value strengthens against the euro.

2. Stronger U.S. Economic Data

The U.S. economy continues to outperform the Eurozone in GDP growth, job creation, and consumer spending.

- Investors perceive the U.S. as economically safer.

- This steady data flow pushes traders to buy the dollar during uncertain periods.

3. Global Uncertainty and Safe-Haven Demand

The dollar remains the world’s reserve currency and a preferred safe-haven asset.

- During geopolitical tensions or market volatility, investors move capital into USD-denominated assets like Treasury bonds.

- This consistent inflow reinforces dollar demand.

4. Eurozone Challenges

The Eurozone faces structural issues:

- Energy price fluctuations since the Russia-Ukraine crisis.

- Uneven growth among member nations.

- Dependence on exports and fragile fiscal balance.

These weaken investor confidence in the euro.

The Euro’s Weakness Explained

While the euro remains one of the world’s most important currencies, its performance has been undermined by several persistent structural and economic challenges. These issues make it less appealing to global investors compared to the U.S. dollar.

1. Slow Policy Response from the European Central Bank (ECB)

The ECB was slower than the Federal Reserve to raise interest rates after inflation surged.

- This lag allowed the U.S. dollar to strengthen first.

- Even as the ECB caught up, markets still viewed the euro as trailing in policy aggressiveness.

2. Energy Price Vulnerability

Europe’s heavy reliance on imported energy, especially gas, leaves the euro exposed to global price spikes.

- When energy prices rise, production costs increase, weakening exports.

- That leads to a wider trade deficit and lower euro demand.

3. Economic Fragmentation Among Member States

Unlike the United States, the Eurozone is a collection of 20 different economies.

- Divergent growth rates and fiscal policies create uneven economic performance.

- Investors worry about political and financial instability within the union.

4. Weak Trade Balance and Reduced Exports

The euro benefits from strong exports, but recent years have seen a slowdown in industrial output.

- High costs and slowing demand from Asia and the U.S. have reduced export revenues.

- As a result, fewer foreign buyers need euros for trade.

5. Investor Sentiment and Confidence

Currency strength is not purely data-driven; confidence matters.

- The euro lost some of its appeal as a global reserve currency when the dollar remained dominant during crises.

- Major institutions continued to hold U.S. assets for security and liquidity.

Dollar vs. Euro Exchange Rate Trends (2020–2025)

The USD/EUR exchange rate has undergone significant fluctuations from 2020 to 2025, shaped by global events, monetary policies, and shifting investor sentiment.

Let’s review how these trends evolved and what they indicate for traders.

1. 2020–2021: Euro’s Short-Term Strength During Pandemic Recovery

- At the height of the pandemic, massive U.S. stimulus packages led to a weaker dollar.

- The euro gained temporarily, reaching 1.22 in early 2021 as Europe’s reopening gained momentum.

- However, this rise was short-lived as inflation began to climb globally.

2. 2022: Fed Tightening Reverses the Trend

- The Federal Reserve began an aggressive rate-hike cycle to combat inflation, while the ECB maintained a slower pace.

- The U.S. dollar surged to parity (1.00) against the euro for the first time in 20 years.

- Safe-haven demand during the energy crisis and global uncertainty further supported USD strength.

3. 2023: Modest Euro Recovery

- The euro regained some ground as the ECB increased interest rates more decisively.

- By mid-2023, the euro hovered around 1.08–1.10, reflecting a more balanced market.

- However, underlying investor preference for the dollar persisted.

4. 2024–2025: Sideways Market with USD Advantage

- Both economies stabilized, but U.S. growth remained more resilient, and rate differentials continued to favor the dollar.

- The euro averaged between 1.15 and 1.18 in 2025, with only short-lived rallies.

- As inflation pressures eased, traders focused on growth divergence, again leaning toward USD assets.

Historical Snapshot (2020–2025 Average Rates)

| Year | Average EUR/USD Rate | Trend |

| 2020 | 1.14 | Euro up (Stimulus-driven) |

| 2021 | 1.18 | Euro strong (Recovery peak) |

| 2022 | 1.03 | Dollar up (Rate hikes) |

| 2023 | 1.09 | Euro stabilizing |

| 2024 | 1.16 | Dollar holds firm |

| 2025 | 1.17 | Mild USD advantage |

The trend shows that while short-term euro gains occur during easing phases, the dollar consistently dominates during tightening or uncertain cycles due to its role as the world’s reserve and safe-haven currency.

How Traders Can Profit from Dollar–Euro Fluctuations

The EUR/USD pair is one of the most traded currency pairs globally, offering ample opportunities for traders to profit from both short- and long-term movements. Understanding what drives its volatility allows traders to strategize effectively in any market condition.

1. Trade Based on Interest Rate Differentials

One of the most reliable strategies in forex trading is to monitor central bank policy changes.

- When the Federal Reserve signals rate hikes, the dollar usually strengthens.

- When the European Central Bank (ECB) becomes more aggressive, the euro may recover.

2. Use Economic Reports as Entry Signals

Major reports such as Non-Farm Payrolls (NFP), Eurozone GDP, and CPI inflation often trigger high volatility.

- Strong U.S. data → Buy USD / Sell EUR

- Weak U.S. data or strong Eurozone results → Buy EUR / Sell USD

Info Box: 5 Key Reports to Watch

- U.S. Non-Farm Payrolls (Monthly)

- Federal Reserve Rate Decision (FOMC)

- Eurozone CPI & GDP Releases

- ECB Press Conferences

- Global Energy Market Data

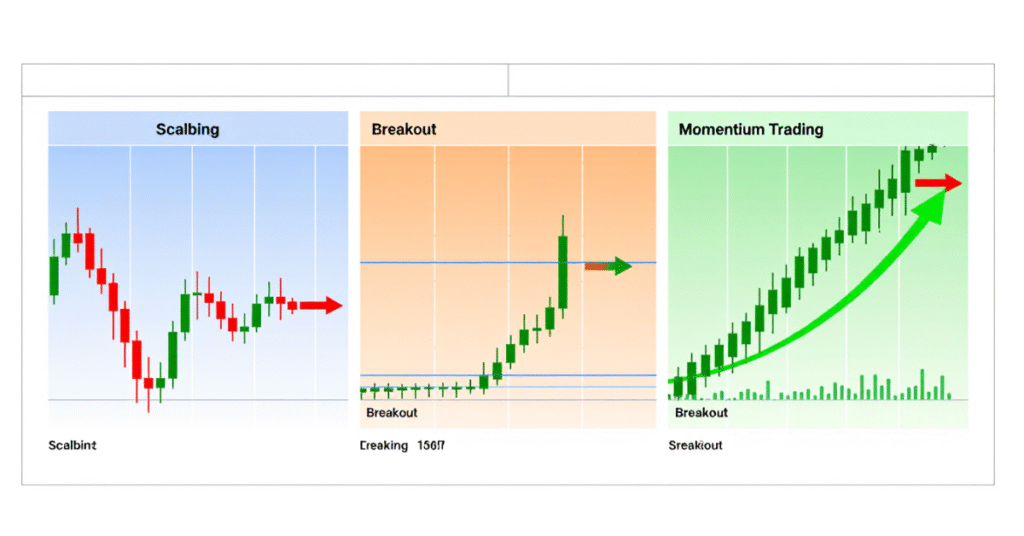

3. Apply Technical Analysis for Short-Term Moves

Use chart tools like support and resistance, moving averages, and RSI indicators to spot trends.

- For example, if EUR/USD breaks above 1.20 with strong volume, it could signal a bullish continuation.

- In contrast, a drop below 1.10 may confirm renewed dollar strength.

4. Use High Leverage Wisely

Platforms like Defcofx offer up to 1:2000 leverage, which allows traders to open larger positions with smaller capital.

- Ideal for experienced traders who understand risk management.

- Even small EUR/USD movements can lead to significant profits when used responsibly.

Alert Box: High leverage magnifies both profits and losses. Always use stop-loss orders and never trade more than you can afford to lose.

FAQs Dollar vs. Euro Strength

Yes, as of late 2025, the U.S. dollar remains stronger than the euro. This strength is mainly due to higher U.S. interest rates, better GDP growth, and continued global demand for the dollar as a safe-haven currency.

The dollar’s strength comes from a mix of:

1. Higher Federal Reserve interest rates.

2. Robust U.S. job and consumer data.

3. Safe-haven demand during uncertainty.

4. Energy independence, compared to Europe’s reliance on imports.

Yes, if the European Central Bank keeps rates elevated while the Federal Reserve cuts earlier, or if Europe achieves faster growth and energy independence, the euro could regain some strength. However, this may take time and consistent policy improvements.

EUR/USD movements impact global trade, investment flows, and forex profitability. For traders, it’s one of the most liquid and predictable pairs, ideal for technical and macro-based trading strategies.

Successful traders use a combination of

Economic calendar analysis (watching rate decisions and inflation reports).

Technical indicators (moving averages, RSI, support/resistance).

Risk management tools (stop-loss and leverage control).

Platforms like Defcofx provide up to 1:2000 leverage, no commissions or swap fees, and spreads from 0.3 pips, allowing traders to capitalize on even small EUR/USD shifts.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.