Three White Soldiers is a bullish candlestick pattern of three consecutive long green (or white) candles that signal a potential trend reversal from bearish to bullish; traders use it across Forex, CFDs and crypto to time entries, often confirming with volume and momentum indicators before trading.

Key Takeaways

- Definition: Three long bullish candles in a row that suggest a strong shift to buying pressure.

- Signal type: Bullish reversal best after a clear downtrend.

- Confirmation: Look for rising volume, RSI/MACD momentum confirmation, or a bullish MA crossover.

- Timeframes: Works on multiple timeframes (H1, H4, D1); higher timeframes give stronger signals.

- Risk management: Use stops below the first candle’s low and sensible position sizing.

- Practical use: Common across Forex, CFDs, stocks, and crypto; ideal for swing entries.

What Is the Three White Soldiers Pattern?

The Three White Soldiers candlestick pattern is a powerful bullish reversal signal that forms after a sustained downtrend. It consists of three consecutive long bullish candles, each opening within or near the previous candle’s body and closing progressively higher. This consistent upward movement shows growing buyer confidence and a potential end to bearish momentum.

Each candle in this pattern typically has a small or no lower wick, indicating that buyers maintained control throughout the session. The steady progression reflects not just price recovery but the start of a possible trend reversal.

This pattern appears across multiple markets Forex, CFDs, equities, and even crypto and is highly valued for its clarity and reliability when confirmed by technical indicators like RSI or MACD.

Example scenario: Imagine the EUR/USD pair has been falling for several sessions. Suddenly, three long bullish candles appear, each closing higher than the last. This pattern hints that selling exhaustion is complete and a potential uptrend may soon begin a textbook Three White Soldiers setup.

How to Identify the Three White Soldiers Pattern

Identifying the Three White Soldiers pattern requires close observation of candle structure, body size, and positioning within a trend. It typically appears after a clear downtrend or a short-term pullback, signaling the start of renewed buying momentum.

Here’s how to spot it accurately:

- Three Consecutive Bullish Candles: Each candle should close higher than the previous one, forming a steady staircase-like pattern upward.

- Open Within Previous Candle’s Body: Each new candle opens inside or slightly above the body of the previous candle, confirming continuation rather than sudden spikes.

- Small or No Wicks: Long real bodies with minimal shadows indicate consistent buying pressure and limited selling during the sessions.

- Progressive Increase in Closing Prices: Every candle closes higher, showcasing sustained buyer control.

- Appears After a Downtrend: The most reliable signals occur when the market has been bearish, and this pattern emerges at the bottom.

- Volume Confirmation: Ideally, volume should increase across the three candles showing genuine market participation.

What the Three White Soldiers Pattern Indicates in Market Psychology

The Three White Soldiers pattern reflects a powerful psychological shift in the market—from selling pressure to consistent, confident buying. Each of the three bullish candles tells part of the story of how sentiment transforms after a downtrend.

- First Candle – Reversal Initiation: The first large bullish candle often appears after a long period of selling. It signals that buyers are stepping in, halting bearish control.

- Second Candle – Confirmation of Strength: The second candle opens near the first candle’s close and pushes higher, confirming that buyers are maintaining dominance. It attracts more traders who begin to believe a reversal is taking shape.

- Third Candle – Full Sentiment Shift: The third bullish candle solidifies the transition. It proves that buying momentum is not temporary; the market has shifted from bearish to bullish territory.

When this pattern forms at the bottom of a trend, it’s not just a visual cue; it represents renewed optimism and a surge in market confidence. Institutional traders often view it as an early signal to start accumulating long positions.

How to Trade Using the Three White Soldiers Pattern

Trading the Three White Soldiers pattern involves recognizing its setup, confirming its strength, and executing trades with disciplined risk management. Here’s a structured, practical approach:

Step 1: Identify the Pattern

Confirm the appearance of three long bullish candles after a downtrend. Make sure each candle opens within the body of the previous one and closes higher, showing consistent buying strength.

Step 2: Wait for Confirmation

Before entering a position, verify momentum and volume:

- RSI above 50 signals bullish momentum.

- MACD crossover or rising histogram supports continuation.

- Volume should increase steadily during formation.

Entering too early (before confirmation) can expose you to false reversals.

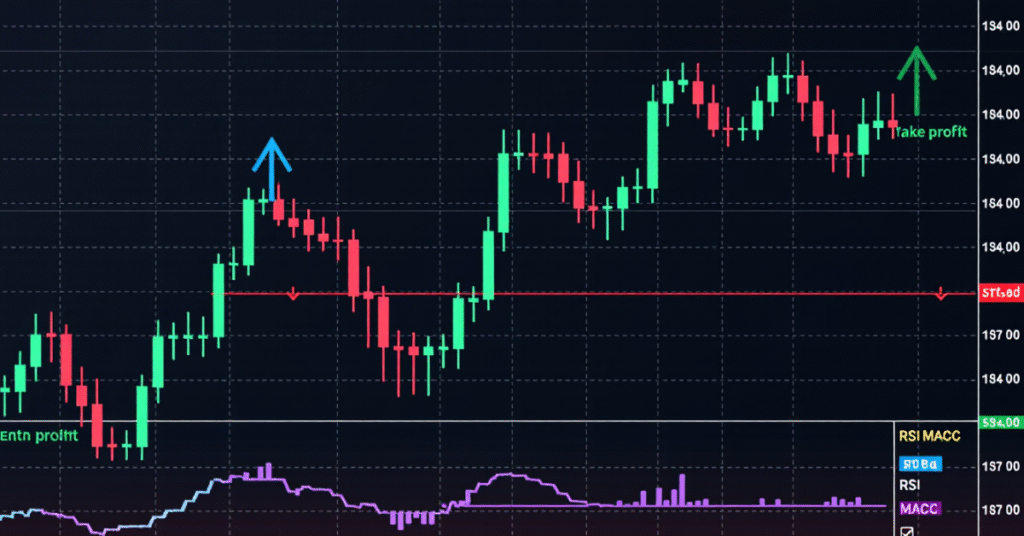

Step 3: Entry Strategy

- Conservative Entry: Enter at the open of the fourth candle after confirmation, or on a minor pullback toward the third candle’s body.

- Aggressive Entry: Enter right after the third candle’s close, but only if supporting indicators agree.

Step 4: Stop-Loss Placement

- Set your stop-loss just below the low of the first candle in the pattern.

- This protects your capital if the market fails to sustain the breakout.

Step 5: Take-Profit Targets

- Use nearby resistance levels, Fibonacci extensions, or risk-reward ratios (1:2 or 1:3) to determine profit goals.

- Scale out of positions as price reaches major resistance zones.

Example: If EUR/USD forms Three White Soldiers on the 4-hour chart after a prolonged decline, a trader might enter a buy trade after the third candle closes, placing a stop-loss below the first candle’s low and targeting the next resistance level.

Step 6: Apply Risk Management

Even reliable patterns can fail. Trade with proper position sizing and never risk more than 1–2% of your account balance per trade.

Start TradingConfirmations and Indicators to Strengthen the Signal

While the Three White Soldiers is a powerful reversal formation, confirming its validity with technical indicators and contextual analysis greatly enhances accuracy. Here are the top confirmations used by professional traders:

1. RSI (Relative Strength Index)

When RSI crosses above 50, it confirms growing bullish momentum.

- Ideal Zone: Between 50 and 70 after pattern formation.

- Overbought Warning: Above 70 may indicate limited room for further upside, watch for minor corrections.

2. MACD (Moving Average Convergence Divergence)

A bullish crossover when the MACD line crosses above the signal line supports the reversal.

- Look for histogram bars turning positive, showing increasing bullish volume.

3. Volume Confirmation

The most reliable Three White Soldiers appear with rising volume across the three candles.

This ensures strong participation from institutional buyers, confirming genuine demand.

4. Support and Resistance Zones

Check if the pattern forms near:

- Key support levels → stronger reversal signals.

- Major resistance levels → higher risk of temporary pullback.

5. Moving Averages (MA)

- If the pattern forms above the 20-period MA after breaking through it, it reinforces bullish continuation.

- Crossing both the 20 and 50 MAs often signals a strong trend shift.

6 Common Mistakes Traders Make with the Three White Soldiers

Even though the Three White Soldiers is one of the strongest bullish reversal patterns, many traders misuse it leading to false entries or losses. Understanding these mistakes can help you trade smarter and more confidently.

1. Ignoring Market Context

Many beginners spot the pattern and jump in blindly. Always ensure it forms after a clear downtrend if it appears in the middle of a sideways market, it’s likely a false signal.

2. Entering Too Early

Entering during the second or third candle formation is risky.

- Wait until the third candle closes and confirmations align (RSI, MACD, and volume).

- Early entries often lead to being trapped in temporary retracements.

3. Overlooking Volume Confirmation

Low or declining volume weakens the pattern’s credibility.

- A true reversal requires rising volume, proving active buyer participation.

4. Ignoring Overbought Conditions

If RSI is already above 70 when the pattern forms, the move might be overextended.

- Wait for a pullback or consolidation before entering a trade.

5. Poor Stop-Loss Placement

Setting stop-loss too close to the third candle can cause premature exits.

- Always place stops below the first candle’s low the pattern loses validity if price breaks below it.

6. Using It on Small Timeframes

The pattern becomes unreliable below 1-hour (H1) charts.

- Market noise and volatility often produce deceptive signals that lack follow-through.

Combining the Three White Soldiers with Other Strategies

To maximize accuracy and profitability, professional traders rarely use the Three White Soldiers pattern in isolation. When paired with other strategies and tools, it becomes a powerful confirmation mechanism for trend reversals and entries.

1. Moving Average Crossovers

Combine the pattern with short-term and medium-term moving averages (e.g., 20 EMA and 50 EMA):

- If the pattern forms just as the 20 EMA crosses above the 50 EMA, it confirms a strong bullish reversal.

- It also helps identify trend continuation zones for scaling in additional positions.

2. Support and Resistance Breakouts

- If the Three White Soldiers appear near a major support zone, it strengthens reversal confidence.

- If they appear after breaking resistance, they indicate a confirmed breakout and the start of a new uptrend.

3. Fibonacci Retracement Levels

Traders often align entries with Fibonacci levels:

- Look for the pattern forming near 38.2% or 50% retracement levels of a previous decline, strong confirmation of a reversal from those zones.

4. Volume Profile and Market Structure

High trading volume along with the pattern signifies institutional buying interest.

- If the volume profile shows accumulation near the lows, it validates the bullish breakout potential.

5. Candlestick Combination Strategies

- Three White Soldiers + Bullish Engulfing: Enhances early reversal confirmation.

- Three White Soldiers + Morning Star: Provides double confirmation of market strength.

(FAQs) About the Three White Soldiers Pattern

The Three White Soldiers is a bullish candlestick pattern that signals a strong trend reversal from bearish to bullish. It consists of three consecutive long green (or white) candles, each closing higher than the previous one, showing sustained buying pressure and market confidence.

It’s one of the most reliable bullish reversal patterns, especially when it forms after a prolonged downtrend and is confirmed by rising volume, RSI above 50, and a bullish MACD crossover. However, traders should still confirm it using other indicators to avoid false signals.

The pattern works best on higher timeframes, such as H4, Daily, or Weekly charts, where price noise is minimal. On smaller timeframes (M5–M15), it may produce false or short-lived reversals.

Yes, the pattern can form in forex, stocks, indices, and commodities. However, its reliability depends on market liquidity and volume. Major forex pairs (like EUR/USD or GBP/USD) often produce clearer signals.

The opposite pattern is the Three Black Crows, which signals a bearish reversal consisting of three consecutive long bearish candles forming after an uptrend, showing that sellers are taking control.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.