If you want to understand how to see limit orders being placed on the exchange, you have to know how to gain visibility into the pending buy and sell orders that traders submit to an exchange and which sit in the order book waiting for execution. These orders reveal much more than price charts alone, as they also show where liquidity resides, how participants are positioned, and where potential support or resistance levels may form.

Key Takeaways

- Limit orders show trader intentions, where buyers and sellers are willing to act, giving insight beyond standard price charts.

- The limit order book (LOB) displays all active buy and sell limit orders, revealing liquidity levels, potential support, and resistance zones.

- Watching the order flow helps refine trade entries, exits, and stop-loss placement while managing slippage and execution risk.

- You can view limit orders using Level 2 or market depth data on modern trading platforms, which update in real time.

- Be aware of hidden or spoof orders; not all visible volume is genuine; some traders disguise size or cancel quickly.

- Liquidity changes across timeframes and news cycles; a thin order book can cause wider spreads and unpredictable fills.

- The order book is highly dynamic; interpreting a single snapshot without watching changes can lead to errors.

- Combine order-book analysis with price action and risk management; never rely on visible orders alone.

- Successful traders use limit order insights to understand market behavior, anticipate moves, and execute trades more precisely.

What Are Limit Orders and the Order Book?

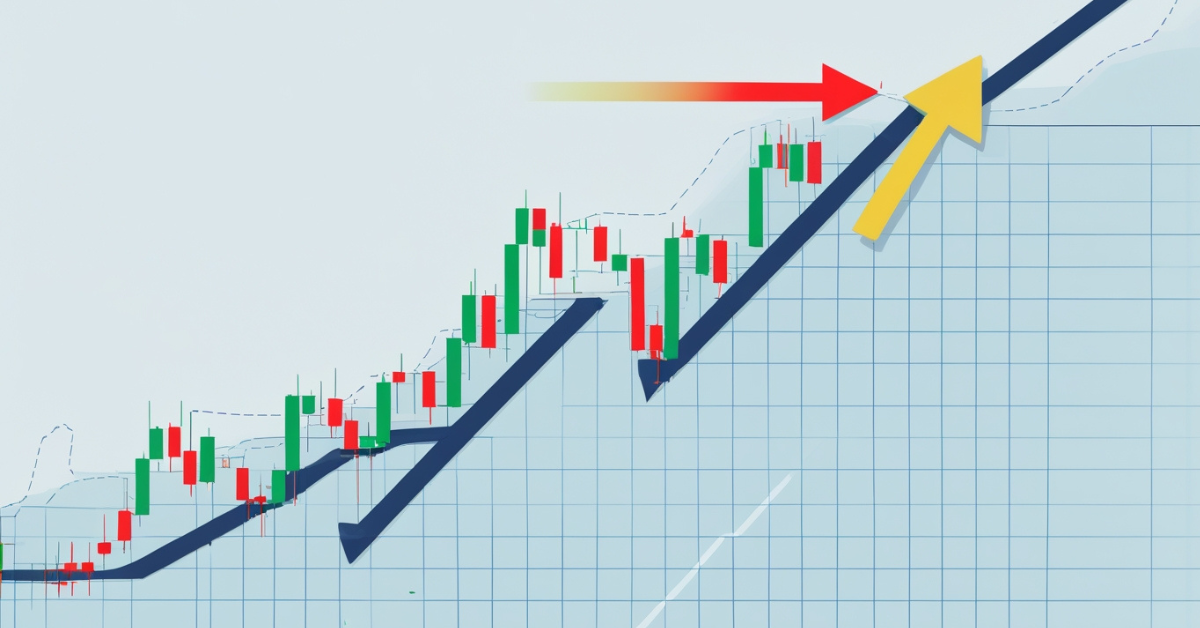

A limit order is an instruction to buy or sell a security at a specified price or better. For example, you might place a buy limit order at $50, meaning you are willing to purchase if the price drops to $50 or lower. Conversely, a sell limit order at $60 means you only want to sell if the price reaches $60 or higher.

When many of these limit orders are placed, they accumulate in what is known as the limit order book (LOB). The LOB is effectively a sorted list of outstanding orders: on one side the bids (buy orders) ranked from highest to lowest price, and on the other side the asks (sell orders) ranked from lowest to highest price. The highest bid and lowest ask together are known as the top of the book, and the difference between them is called the bid‑ask spread.

When you learn how to see those limit orders being placed, you’re moving beyond just seeing executed trades to seeing the intentions of market participants and where they are willing to enter or exit positions.

The Importance of Watching Limit Orders

When you look at the limit order book (LOB), you’re tapping into real‑time supply and demand.

For example, if you see a large volume of buy limit orders at a particular price level, that price level may act as support, as the market may struggle to go below it because many orders are sitting there ready to absorb selling pressure. On the flip side, a large cluster of sell limit orders may act as resistance.

By seeing these orders placed, you gain insight into where participants are positioning themselves, and that insight allows you to refine entries, exits, stop‑losses, and trade size. It can also alert you to execution risk: if you place a market order without awareness of a thin order book, you could suffer slippage or find your trade fills at multiple price levels.

How to Access and Interpret Order Book Data

Modern trading platforms and many brokers provide access to the order book through Level 2 or market depth data. The steps to access and interpret these are as follows.

First, open a chart or order book view for the instrument you’re be it a stock, futures contract, or other asset. You will see a list of price levels with volumes on both the bid and ask sides. This data typically updates in real time. According to Coinbase, an order book is “a list of current buy orders (bids) and sell orders (asks) for a specific asset.”

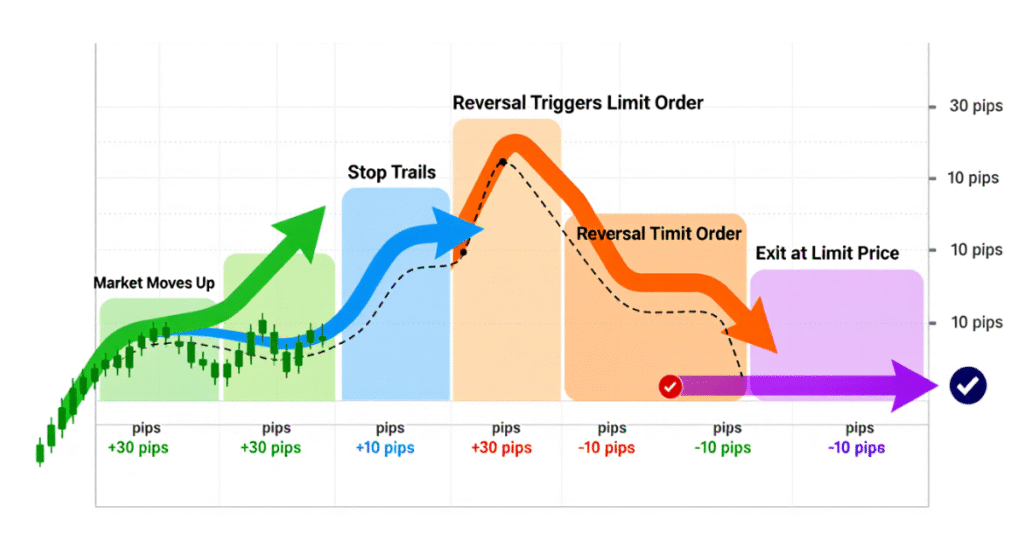

Next, identify the size of orders at each level: large visible orders can indicate genuine liquidity; smaller orders or continual order cancellations may signal opacity or manipulation (such as iceberg orders or hidden orders). Observe how the volumes evolve: Do you see orders being added, cancelled, or executed? For example, if you see a buildup of bids and no selling pressure consuming them, that may strengthen the case for support.

You should also monitor timing and the context: before major announcements, liquidity may dry up and the order book may thin out. The spread may widen, and visible orders may shift quickly. Recognizing these conditions helps you decide whether to trade or step aside.

What to Be Careful About When Reading the Order Book

Even though viewing limit orders provides an advantage, it comes with caveats.

Hidden orders are common. Some large traders or institutions place iceberg orders—only part of the order is visible in the book while a large hidden block remains. This means what you see may not reflect the full liquidity. Furthermore, some orders are placed only to be cancelled (spoofing), which can mislead traders who rely purely on visible volumes.

Liquidity varies across time frames. Outside of peak trading sessions, such as during pre‑market or after hours, the order book may be thin. You may see fewer resting orders and a larger spread; executing your trade may move the price more than expected.

The order book is dynamic and can change in milliseconds. Relying solely on one snapshot without monitoring evolution can lead to misinterpreting the data.

Practical Example of Using Order Book Data

Imagine you’re watching stock XYZ trading at $49.50. You open the order book and observe 30,000 shares bid at $49.40, while on the ask side only 5,000 shares are posted at $49.55.

That imbalance suggests that many traders are willing to buy at $49.40 and fewer sellers are willing to sell until $49.55, indicating a potential support area around $49.40. You might then place a limit buy order at $49.40 with a stop just below, or wait for price to test that level and bounce.

At the same time, you would monitor for cancellation of that bid volume or a sudden move lower, which would invalidate the support.

Such reading of limit order placement gives you more context than just a price chart, because you are interpreting where participants are parked. However, you should always apply a stop‑loss and maintain risk discipline because the visible wall may fail.

Final Thoughts: How to See Limit Orders Being Placed on the Exchange

Mastering how to see limit orders being placed on the exchange gives you a window into the mechanics of price formation. Instead of only seeing what the market did, you observe what it might do based on participant positioning. This move from passive chart reading to active order‑flow awareness can sharpen your trading execution, risk management, and timing.

The tool is especially potent when paired with a broker that offers robust market‑depth data and fast execution. Always remember: visible orders matter, but they are part of a bigger picture. Combine them with price action, volume, context, and risk controls for best results.

FAQs

A visible limit order shows up in the order book and displays both price and size. A hidden order (or iceberg) shows only part of its size to the market; the remainder is concealed, so what you see may understate true liquidity.

Yes and no. Many retail brokers provide Level 1 data (best bid/ask only). To see full depth (multiple levels), you need Level 2 or “market depth” data, which may require subscription or specific platform features.

Absolutely. Traders may place, adjust, or cancel limit orders based on changing conditions. A visible large order may vanish just before the price reaches it, which is why you should treat these signals cautiously.

No. While a large buy wall can act as support, if that wall is pulled or consumed by aggressive selling, the level can break quickly. Use stops and manage your risk accordingly.

Order‑book analysis is more relevant for active traders and intraday contexts. Long‑term investors are less concerned with short‑term liquidity shifts; they focus more on fundamentals and valuations.

No. In highly volatile or thin markets, e.g., during news announcements or outside major trading sessions, order‑book appearance can become unreliable. Orders may vanish, spreads widen, and execution becomes riskier.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.