The top 10 currencies are the most widely traded and valuable currencies in the world, known for high liquidity, global acceptance, and stability. These include the US Dollar (USD), Euro (EUR), Japanese Yen (JPY), British Pound (GBP), and other major currencies, which dominate global forex and financial markets.

Detailed List of the Top 10 Currencies

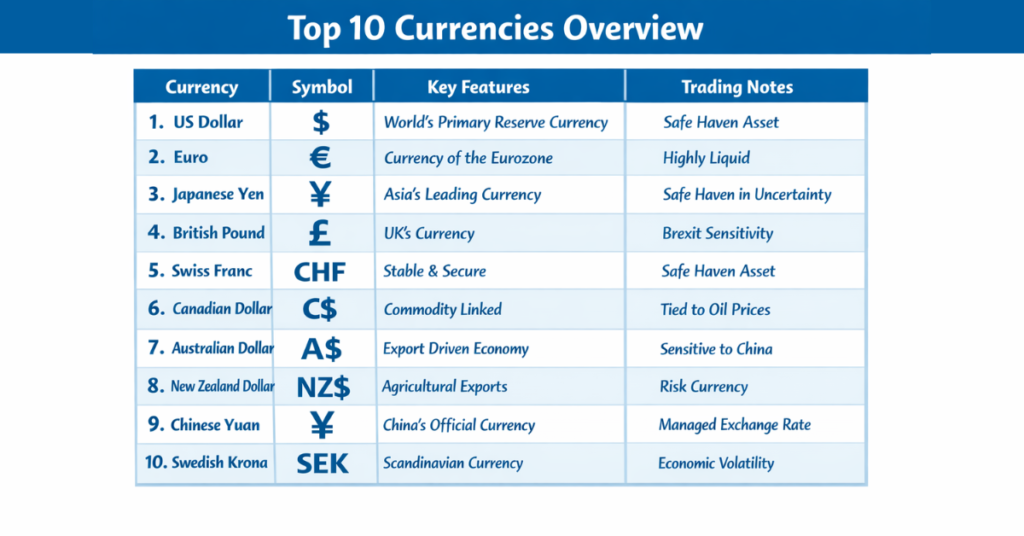

Here’s a comprehensive look at the top 10 currencies, their symbols, and key details:

| Currency | Symbol | Key Features / Trading Notes |

| US Dollar | USD | Most widely traded currency, backbone of global markets. Highly liquid and stable. |

| Euro | EUR | Official currency of the Eurozone. Second most traded currency with strong liquidity. |

| Japanese Yen | JPY | Popular for carry trades due to low-interest rates; highly liquid in forex. |

| British Pound | GBP | Stable currency with historical significance, active in major forex pairs. |

| Australian Dollar | AUD | Commodity-linked currency; influenced by metals and global trade. |

| Canadian Dollar | CAD | Tied to oil prices; widely used in forex and global trade. |

| Swiss Franc | CHF | Considered a safe-haven currency, highly stable in volatile markets. |

| Chinese Yuan | CNY | Growing global influence; used in international trade and investment. |

| New Zealand Dollar | NZD | Commodity-driven; popular for forex trading and diversification. |

| Swedish Krona | SEK | Smaller but stable currency; used in regional and forex markets. |

Each of these currencies is widely traded due to liquidity, global acceptance, and stability, making them key choices for forex traders and investors alike.

Important Key Points

- The top 10 currencies dominate global trade due to liquidity, stability, and widespread use.

- Traders prefer these currencies for consistent market activity and reliable exchange rates.

- Key trading advantages include high leverage options, low spreads, and access to global markets.

- Choosing the right currency requires understanding volatility, economic strength, and global trends.

- Platforms that offer fast support and withdrawals can enhance trading efficiency and experience.

Understanding the Top 10 Currencies

The top 10 currencies are determined by trading volume, stability, and global economic influence. These currencies are widely used in international trade, central bank reserves, and forex markets. They represent the backbone of global finance and include currencies like:

- US Dollar (USD)

- Euro (EUR)

- Japanese Yen (JPY)

- British Pound (GBP)

- Australian Dollar (AUD)

- Canadian Dollar (CAD)

- Swiss Franc (CHF)

- Chinese Yuan (CNY)

- New Zealand Dollar (NZD)

- Swedish Krona (SEK)

These 10 currencies are preferred by traders because they offer high liquidity, meaning they can be bought or sold quickly without significant price changes. Their stability and predictable behavior make them ideal for both short-term trading and long-term investment.

Why These 10 Currencies Are Important Globally

The top 10 currencies play an important role in international trade, finance, and investment. They are widely accepted for global transactions, serve as reserve currencies for central banks, and influence international markets. Their stability reduces risks for businesses, investors, and traders operating across borders.

For traders, these currencies are highly attractive because they provide predictable price movements and deep liquidity, which means entering and exiting trades is easier and more efficient. High liquidity also allows for tight spreads and lower trading costs, making them ideal for both beginners and professional traders.

How to Choose Which Currency to Trade

Selecting the right currency to trade involves analyzing liquidity, volatility, and market trends. Traders often prefer highly liquid currencies like the USD, EUR, and JPY because they allow quick entries and exits with minimal price impact.

Other 4 factors to consider include:

- Economic Strength: Currencies from stable economies tend to be less volatile.

- Interest Rates: Higher interest rates can attract traders seeking carry trade opportunities.

- Global Events: Political stability, trade agreements, and economic news can impact currency movements.

- Correlation: Some currencies move in relation to others, which can affect risk and strategy.

Platforms offering features like high leverage, fast support, and low spreads can enhance trading efficiency, making it easier to take advantage of market movements without unnecessary costs.

Trading Tips With Defcofx for Top 10 Currencies

When trading the top 10 currencies, using a reliable platform can make a significant difference. Defcofx offers traders features that enhance trading efficiency and reduce costs, such as:

- High Leverage Options: Up to 1:2000 leverage allows flexible trading strategies.

- No Commissions or Swap Fees: Spreads start from just 0.3 pips, reducing trading costs.

- Global Reach: Traders from all countries can access the platform with multiple language options.

- Fast Support and Withdrawals: Funds can be withdrawn within 4 business hours, even on weekends.

Practical Trading Tips:

- Focus on Major Pairs: Start with pairs like EUR/USD, GBP/USD, and USD/JPY to ensure liquidity.

- Monitor Economic News: Global events can create short-term volatility, offering opportunities.

- Use Risk Management: Always set stop-loss and take-profit levels to protect capital.

Final Thoughts on Top 10 Currencies

The top 10 currencies are essential for traders and investors due to their high liquidity, stability, and global influence. Focusing on these currencies allows you to make informed trading decisions, reduce risks, and take advantage of consistent market opportunities.

When trading, consider market trends, economic events, and volatility, and use reliable platforms to enhance efficiency. Platforms that offer high leverage options, low spreads, fast support, and withdrawals can make trading smoother and more cost-effective.

Open a Live Trading AccountFAQs

The US Dollar (USD) is the most traded currency globally, accounting for the majority of daily forex transactions. It is widely used in international trade, reserves, and major currency pairs like EUR/USD and USD/JPY.

Beginners often start with USD, EUR, or JPY due to their high liquidity and predictable price movements. Major pairs with these currencies typically have tighter spreads, making trading more cost-effective.

You can invest in top currencies through forex trading platforms, currency ETFs, or currency futures. Using platforms like Defcofx allows access to multiple currency pairs with high leverage, low spreads, and fast withdrawals, making trading smoother and more efficient.

Currency value is affected by interest rates, economic performance, political stability, and global trade trends. Monitoring these factors helps traders make informed decisions.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.