The best currency pairs to trade during the London session are EUR/USD, GBP/USD, USD/JPY, and GBP/JPY favored for high liquidity, tight spreads, and strong moves during the London–New York overlap. Trade with tight risk controls and focus on breakout, scalping, and news-driven strategies.

Key Takeaways

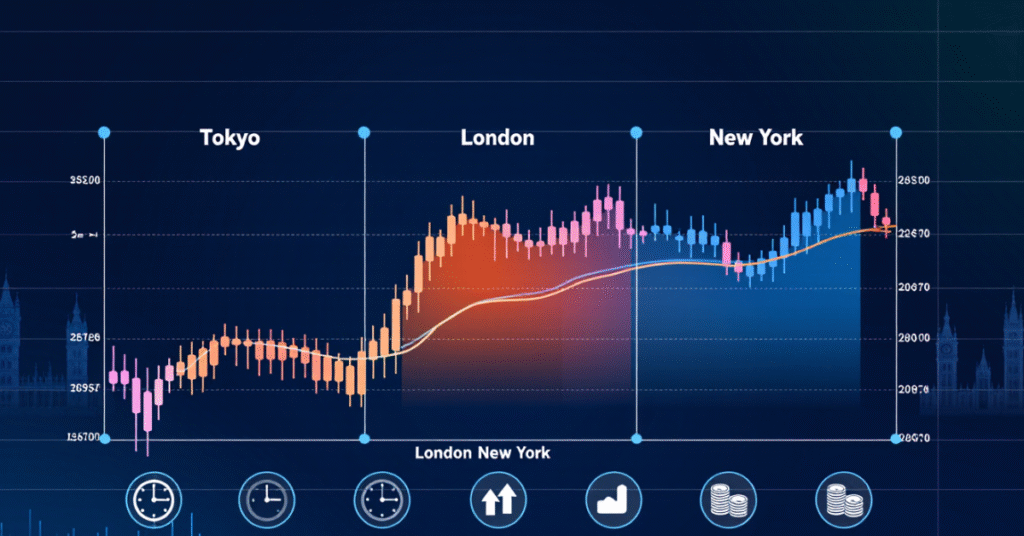

- Most Active Session: The London session sees the highest trading volume, often overlapping with New York for peak volatility.

- Top Pairs: EUR/USD, GBP/USD, USD/JPY, and GBP/JPY are most liquid and volatile.

- Best Time to Trade: Between 8:00 AM – 12:00 PM GMT, when both London and New York markets are active.

- Ideal for: Scalpers and day traders who capitalize on short-term price movements.

- Tip: Use a trusted broker like Defcofx offering up to 1:2000 leverage, low spreads (from 0.3 pips), and fast withdrawals for optimal performance.

Understanding the London Trading Session

The London session is one of the most important periods in the forex market, accounting for nearly 35% of global daily trading volume. It starts around 8:00 AM GMT and ends by 4:00 PM GMT. This session is known for tight spreads, high liquidity, and strong volatility, especially when it overlaps with the New York session (12:00 PM–4:00 PM GMT).

During these hours, major financial hubs like London, Frankfurt, and Zurich are active, meaning European and U.S. traders are both influencing price movements. This results in:

- Sharp price fluctuations: ideal for breakout traders.

- Higher trading volumes: making it easier to execute large trades.

- More predictable trends: as institutional traders dominate this period.

Why the London Session Is the Most Profitable

The London session is often considered the most profitable trading window because it combines high market participation and strong price action. Let’s explore why traders prefer this session:

1. High Liquidity and Tight Spreads

The London market is where the major banks and institutions trade large volumes. This results in tighter spreads sometimes as low as 0.3 pips and better order execution.

2. Volatility That Favors Traders

Price movements during this session are more consistent and powerful, especially when the London and New York sessions overlap. These trends are ideal for:

- Scalping small price movements.

- Day trading short-lived market swings.

- Breakout strategies around news releases.

3. Clear Market Direction

Economic data from Europe and the U.K. (like inflation, GDP, or interest rate decisions) often drive strong trends. Traders can anticipate moves based on scheduled reports.

4. Favorable Overlap Window

The London–New York overlap (12:00–4:00 PM GMT) brings the highest volatility of the day, allowing traders to capture large price moves with precise timing.

Best Currency Pairs to Trade During the London Session

The London session is known for its strong movements, especially in major and cross-currency pairs linked to the Euro (EUR) and British Pound (GBP). Below are the top pairs that provide the best balance of liquidity, volatility, and trading opportunity.

1. EUR/USD (Euro / U.S. Dollar)

- Why it’s ideal: Highest traded pair worldwide with extremely tight spreads (often 0.3–0.5 pips).

- London edge: Driven by major European economic news such as ECB announcements or Eurozone inflation data.

- Trading style fit: Perfect for scalpers and news traders during early London hours.

2. GBP/USD (British Pound / U.S. Dollar)

- Why it’s ideal: Nicknamed “Cable,” it reacts quickly to both U.K. and U.S. data.

- London edge: Most active around 9:00 AM–12:00 PM GMT, when U.K. economic data is released.

- Trading style fit: Best for swing traders and day traders due to strong directional moves.

3. USD/JPY (U.S. Dollar / Japanese Yen)

- Why it’s ideal: Offers clear trends during London–New York overlap.

- London edge: Volatility spikes as U.S. markets open; great for trend continuation setups.

- Trading style fit: Suitable for technical traders using momentum indicators.

4. GBP/JPY (British Pound / Japanese Yen)

- Why it’s ideal: Known for massive volatility can move 100+ pips in hours.

- London edge: Both currencies are influenced by major economic hubs (London and Tokyo).

- Trading style fit: Excellent for experienced traders looking for quick, high-return trades.

5. EUR/JPY (Euro / Japanese Yen)

- Why it’s ideal: Reacts to Eurozone and Asian market overlap, offering continuous movement.

- London edge: Great for identifying breakouts during early London hours.

- Trading style fit: Works well for momentum and trend-following strategies.

Best Time Frames and Strategies for the London Session

Trading during the London session requires precision and adaptability. The right time frames and strategies can make all the difference between capturing a strong breakout or missing a major move.

Best Time Frames to Trade

| Time Frame | Ideal For | Reason |

| 1-Minute to 15-Minute | Scalping | High volatility allows quick profit-taking. |

| 30-Minute to 1-Hour | Day Trading | Best for identifying intraday trends. |

| 4-Hour | Swing Trading | Smooths out smaller fluctuations for bigger moves. |

Top Strategies for the London Session

1. Breakout Strategy

- Look for breakouts from the Asian session range.

- Use pending orders above resistance or below support.

- Works best for EUR/USD and GBP/JPY.

2. Trend-Following Strategy

- Identify direction early (8–9 AM GMT).

- Trade pullbacks using moving averages (e.g., 20 EMA).

- Ideal for USD/JPY and GBP/USD.

3. News Trading Strategy

- Focus on key economic releases (e.g., U.K. CPI, ECB rate decisions).

- Expect fast moves and wider spreads.

- Use low-latency execution and tight stop-losses.

4. Scalping Strategy

- Trade quick 5–10 pip moves using short timeframes.

- Best with brokers offering low spreads (from 0.3 pips) and no commission fees.

- Effective during London–New York overlap.

Common Mistakes Traders Make During the London Session

Even experienced traders can struggle during the London session if they overlook crucial risk factors. Avoiding these mistakes can significantly improve consistency and protect your capital.

1. Overtrading During High Volatility

The London session is fast-paced, and price movements can be tempting. However, entering too many trades without confirmation often leads to losses from false breakouts.

Solution: Stick to a clear trading plan and limit trades to high-probability setups only.

2. Ignoring Economic News Releases

Events like BoE interest rate announcements or Eurozone GDP reports can cause massive swings.

Solution: Always check the economic calendar before trading avoid opening new positions 15–30 minutes before major news.

3. Trading Without Proper Stop-Losses

Because of sudden volatility spikes, unprotected positions can blow up quickly.

Solution: Use stop-loss orders and never risk more than 2% of your total balance per trade.

4. Using Inadequate Leverage

High leverage (like 1:2000) is powerful but misused, it’s dangerous.

Solution: Adjust leverage based on your strategy. Use lower leverage for long-term trades and higher leverage for short-term, well-defined setups.

5. Neglecting Market Overlaps

Some traders miss the London–New York overlap, where liquidity and opportunity are highest.

Solution: Focus your trades between 12:00–4:00 PM GMT, when price action is most dynamic.

Final Thoughts on Best Currency Pairs to Trade During London Session

The London trading session remains the powerhouse of the forex market, a window where liquidity, volatility, and opportunity align. For traders who prefer fast execution, tight spreads, and dynamic market conditions, it offers the most rewarding environment to grow capital efficiently.

To succeed, focus on major pairs like EUR/USD and GBP/USD, master breakout and trend-following strategies, and always maintain strict risk management. With the right broker offering up to 1:2000 leverage, zero commissions, and instant withdrawals you can fully capitalize on London’s market momentum and unlock your trading potential.

Open a Trading Live AccountFAQs About Best Currency Pairs to Trade During the London Session

The most popular pairs are EUR/USD, GBP/USD, USD/JPY, GBP/JPY, and EUR/JPY due to their high liquidity and volatility, especially during the London–New York overlap.

The London session runs from 8:00 AM to 4:00 PM GMT, with the peak activity occurring between 8:00 AM and 12:00 PM GMT.

The breakout strategy works best right after the Asian session closes, followed by trend-following and news trading strategies during key economic releases.

Yes, but beginners should start with major pairs like EUR/USD, use low leverage, and practice on a demo account before moving to live trading due to the high volatility.

It overlaps with the Asian and New York sessions, bringing together traders from Europe, Asia, and North America resulting in massive liquidity and sharp market moves.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.

- What Is a Limit Order?

- Inverted Hammer Candlestick

- What Is a Margin Call?

- Is Dollar Stronger Than The Euro

- Head and Shoulders Pattern Trading Guide

- Bullish Candlestick Patterns: Trader’s Guide

- Forex Trading Sessions in EST

- What Is the Opening Bell for the Asian Session in EST?

- Countries That Use The US Dollar