Can I Trade With $1 on MetaTrader 5?

Yes, you can trade with $1 on MetaTrader 5 using micro accounts offered by brokers that support low deposits. With spreads starting from 0.3 pips,

Yes, you can trade with $1 on MetaTrader 5 using micro accounts offered by brokers that support low deposits. With spreads starting from 0.3 pips,

To short the market means to sell an asset you don’t own in order to buy it back later at a lower price. Short selling

The USD to MXN exchange rate shows how many Mexican pesos equal one US dollar. This currency pair reflects economic strength, interest rate differences, inflation

An expert advisor (EA) is an automated trading robot that executes trades automatically based on pre-programmed rules. It is a type of trading automation software

A pairs trading strategy is a market-neutral trading approach where a trader buys one asset and sells another correlated asset at the same time. The

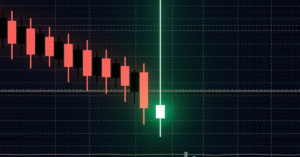

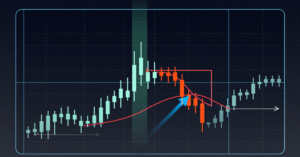

Reading candlestick charts means understanding how price moved during a specific time period by analyzing the candle’s body and wicks. Stock candlestick patterns help traders

The inverted hammer candlestick, also known as the upside-down hammer pattern, is a bullish reversal candlestick that appears after a downtrend. It signals potential buying

Good stocks to invest in for beginners are usually well-established, financially stable companies with predictable performance. These stocks are easier to understand, less volatile, and

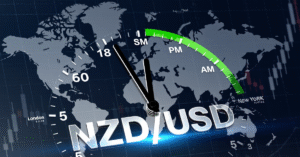

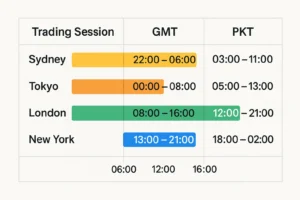

The best currency pairs to trade during the Sydney session are AUD/USD, NZD/USD, and minor crosses like AUD/JPY because they offer moderate price movement and

The 10 largest economies in the world are ranked by Gross Domestic Product (GDP), which measures the total value of goods and services produced within

Momentum stock trading means buying stocks that are already moving strongly upward and selling them when the momentum slows down. Traders use price trends, volume,

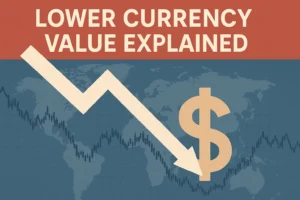

Exchange rates impact international trade by affecting the prices of goods and services between countries. When a country’s currency strengthens, its exports become more expensive

The best currency pairs to trade during the Tokyo session are JPY-based pairs like USD/JPY, AUD/JPY, NZD/JPY, and EUR/JPY. These pairs show the most consistent

Day trading can be profitable, but success depends on skill, strategy, and risk management. Traders who use disciplined strategies, control leverage, and monitor market conditions

Yes, gold is considered a commodity. It falls under the category of precious metals, alongside silver, platinum, and palladium, and is one of the most

SMT in trading stands for Smart Money Technique. It refers to a concept where traders compare price movements between correlated markets to identify divergence, signaling

The golden rules of trading are: plan your trades with clear goals, manage risk carefully, control emotions, focus on low-cost trading, continuously learn and adapt,

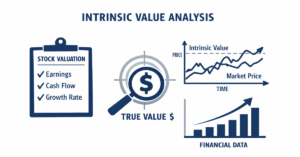

The intrinsic value of a stock is the true, underlying worth of a company’s shares based on fundamentals like earnings, cash flow, and growth potential,

The Big 5 currencies refer to the five most traded and widely recognized currencies in the world: USD (US Dollar), EUR (Euro), GBP (British Pound),

The top 10 best currencies in the world are ranked based on strength, stability, and global demand. While many people assume the US dollar or

The 3 strongest currencies in the world are the United States Dollar (USD), the Euro (EUR), and the Japanese Yen (JPY). These 3 currencies are

To start investing in the stock market, learn the basics of how stocks work, choose a reliable online investing platform, open and fund an account,

If the dollar collapses, the price of gold tends to rise significantly this is because gold is widely viewed as a reliable store of value

To take partial profit in forex, you close a portion of your trade while letting the rest continue running. This locks in some gains while

Exchange rates have an impact on imports, exports, inflation, interest rates, investment flows, tourism, and the cost of living. A small change in a currency’s

To calculate spread in trading, subtract the bid price from the ask price. The spread represents the broker’s profit and the cost of entering a

What Is Backtesting in Trading? Backtesting in trading is the process of testing a trading strategy using historical market data to see how it would

The US dollar goes the furthest in countries where the local currency is weak against the USD and living costs are low. Popular destinations include

The top 10 currencies are the most widely traded and valuable currencies in the world, known for high liquidity, global acceptance, and stability. These include

There are 4 main types of forex traders: scalpers, day traders, swing traders, and position traders. Each type uses a different trading style, time frame,

A good profit factor in trading typically ranges from 1.5 to 2.0 or higher, indicating a profitable strategy where gross profits significantly exceed losses. Traders

MetaTrader and TradingView are two of the most widely used platforms for forex and market analysis. MetaTrader offers full trading execution, custom indicators, and expert

A trade assist is a trading support tool or system that helps traders analyze markets, identify opportunities, manage risk, and execute trades more efficiently. It

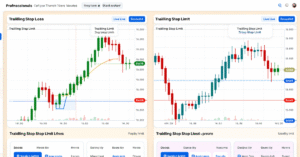

The best forex exit strategies include trailing stop-loss, take-profit targets, price action-based exits, and time-based closures. A good exit plan is just as important as

The best times to trade gold are during the London and New York sessions, especially their overlap between 8:00 AM and 12:00 PM EST. This

Lot size vs leverage explains how trade volume differs from borrowed exposure. Lot size defines how many units you trade and determines pip value and

Yes, forex trading can be lucrative, but only with proper education, strategy, and discipline. While some traders earn steady income or even full-time profits, most

Only about 10% to 15% of forex traders succeed consistently in the long run. Most new traders lose money due to lack of education, poor

The top 20 trading indicators are essential tools for traders to analyze market trends, momentum, volatility, and volume. These indicators, including Moving Averages, RSI, MACD,

The forex market opens on Sunday at 10:00 PM GMT, when the Sydney trading session begins. This marks the start of the global trading week.

Forex traders can make anywhere from $100 to over $10,000 a month, depending on their capital, strategy, risk level, and experience. Beginners often earn less

An MT5 indicator for volatility index measures market volatility on MetaTrader 5, highlighting price expansion and contraction to signal breakouts, reversals, and trend strength. Traders

An MT4 entry indicator is a tool used on MetaTrader 4 that automatically signals optimal buy or sell points by analyzing price, trend, or momentum

A MetaTrader 4 support and resistance indicator automatically detects and plots key price zones where an asset tends to stall or reverse, saving traders time

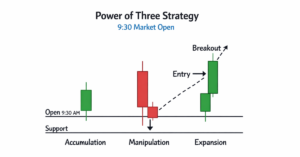

The Power of Three trading strategy at the 9:30 market open is a method that identifies three consecutive price bars to predict market direction. It

With $1,000, most day traders realistically make 1%–3% per day, or about $10–$30, depending on strategy, risk control, and market conditions. Beginners often earn less

Yes, banks actively invest in forex to manage currency reserves, hedge risks, and profit from market fluctuations. Central banks stabilize national currencies, investment banks trade

The 7-3-2 rule is a money and risk management guideline used in trading that limits overall exposure. It typically means allocating no more than 7%

A swap in forex is the overnight interest charged or credited when a trade remains open past the daily market close. It is based on

If you want to use moving averages for swing trading, identify market trends by applying common averages like the 50 EMA or 200 SMA on

A buy limit in forex is a pending order placed below the current market price to buy a currency pair at a lower, pre-set level.

The best moving average for a 4-hour chart is the 50-period Exponential Moving Average (50 EMA). It reacts quickly to price changes, helps identify trend

A spread-only account in forex is a trading account where all trading costs are built into the bid-ask spread, with no separate commissions charged per

You can earn anywhere from a few dollars a day to thousands per month from forex trading, depending on your capital, skill level, risk management,

Yes, the British Pound (GBP) is generally stronger than the US Dollar (USD) in terms of face value. One pound is usually worth more than

Indices in forex are market-wide measures that track the aggregated price performance of a basket of equities or assets; traders access them via index CFDs

G10 currency pairs involve the ten most heavily traded and liquid currencies in the world. These pairs are preferred by forex traders due to their

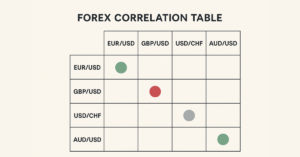

Currency Pair 1 Currency Pair 2 Correlation Coefficient Relationship Type Trading Insight EUR/USD GBP/USD +0.85 Strong Positive Often move together; avoid duplicate exposure EUR/USD USD/CHF

The 10 most traded currencies are the US dollar (USD), euro (EUR), Japanese yen (JPY), British pound (GBP), Australian dollar (AUD), Canadian dollar (CAD), Swiss

The best currencies to trade depend on the forex session. EUR/USD and GBP/USD are ideal during the London/New York overlap. USD/JPY is most active during

You can’t reliably state how many lucky trades you can get in a day because outcomes depend on probability and market conditions. Some traders may

1:100 leverage means a trader can control a position 100 times larger than their actual capital. For example, with $1,000 in margin, you can open

Scalp trading involves making many small trades in minutes, while swing trading focuses on holding trades for days or weeks. Scalp traders profit from quick

You can day trade without $25,000 by using a forex or CFD broker that isn’t restricted by U.S. Pattern Day Trader (PDT) rules. Brokers like

A cease trade order is an official regulatory directive that prohibits trading in a company’s securities until compliance or disclosure issues are resolved. Issued by

Swap on MetaTrader 4 (MT4) is the overnight interest charged (or credited) for holding a position past the platform’s daily rollover. It reflects interest-rate differentials

You can start trading on MetaTrader 5 (MT5) with as little as $10, but the ideal amount depends on your trading goals and risk tolerance.

Yes, MT5 is good for beginners because it offers a user-friendly interface, strong charting tools, and access to many indicators. While it has advanced features,

The Opening Range Breakout (ORB) strategy is a popular technique used by day traders to capitalize on early market momentum. While it is widely used

No, the Iraqi Dinar (IQD) isn’t commonly traded on the global forex market. Most major forex brokers don’t list it due to low demand, high

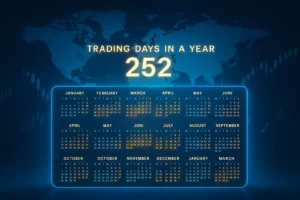

Most stock markets operate for around 252 trading days per year. The exact number changes slightly each year because exchanges close on weekends and observe

One of the first questions new traders ask is how many hours a day do day traders work. The short answer is that most successful

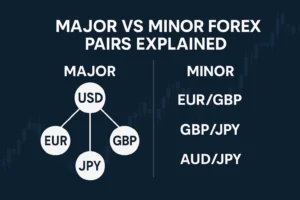

Major forex pairs are the seven most traded currency pairs in the world, and they all include the U.S. dollar. Minor forex pairs (also called

XAUUSD pips and lot size are important to understand if you want to trade gold like a pro. Whether you’re using a mini account or

Currency controls are government-imposed restrictions that regulate how a country’s currency can be bought, sold, or moved across borders. They help manage exchange rates, protect

In general, the Kuwaiti Dinar (KWD) is the most valuable currency in the world, trading at about 1 KWD ≈ 3.26 USD, driven by Kuwait’s

Momentum trading is a short- to medium-term strategy that buys assets showing strong price momentum and sells those losing it, using indicators like RSI, MACD,

The 7 major currency pairs are the most traded pairs in the forex market. These pairs always include the U.S. dollar (USD) on one side

The greatest risk associated with forex settlement is principal risk, also known as Herstatt risk. This occurs when one party in a currency exchange sends

Turning $1000 into $10000 in a single month is technically possible, but it is extremely rare and requires taking very high financial risks. Most traders

The best moving average crossover for 15 min chart combines short and long averages to help traders spot quick entries and exits. On a 15-minute

Yes, the pound is stronger. In General, 1 GBP ≈ 1.33 USD. Currency strength shifts with interest-rate differentials, inflation, central-bank policy (BoE vs Fed) and

The wick fill trading strategy is a powerful method that focuses on how price reacts to long wicks (shadows) on candles. Traders use this technique

DXY, also called the U.S. Dollar Index, measures the value of the U.S. dollar against a basket of major currencies, including the euro, yen, and

Most volatile forex pairs are currency pairs that show the largest average price swings; commonly GBP/JPY, GBP/NZD, XAU/USD (gold), AUD/JPY and USD/TRY lead volatility. Traders

The forex market is officially closed on weekends, meaning you can’t trade major currency pairs through most brokers from Friday 5 PM EST to Sunday

The exponential moving average (EMA) is a technical indicator that smooths out price data while giving more weight to recent prices. It’s used by traders

Understanding forex trading sessions in EST ICT trading is a game-changer for anyone following Inner Circle Trader (ICT) principles. This guide walks you through how

When discussing USD/CAD forex trump tariffs, it refers to how trade policy under Donald Trump, especially tariffs on Canadian goods, has influenced the U.S. dollar/Canadian

Yes, you can trade on MetaTrader 5 (MT5). It’s a powerful, all-in-one trading platform used by forex traders worldwide. MT5 offers access to forex, stocks,

The best technical indicators for day trading blend trend, momentum, volatility and volume tools notably EMA/SMA, RSI, MACD, Bollinger Bands, VWAP and ATR. Use two

The best time to trade forex is when the market has the highest liquidity and volatility, usually during overlapping trading sessions like London–New York or

A correlated forex pairs list helps you trade smarter by knowing which currency pairs tend to move together or in opposite directions. Using this knowledge,

London market open time is 08:00 GMT (09:00 BST during daylight saving), running roughly 08:00–16:00 GMT. In Pakistan, it’s 13:00 PKT (14:00 PKT during summer).

Trailing stop loss is a dynamic market order exit that follows price to lock in gains, guaranteeing execution but not exact price. Trailing stop limit

When you search for a list of all currency pairs, you’re looking at the combinations of currencies available for trading in the foreign exchange market.

Lower currency value means a currency loses purchasing power against other currencies due to inflation, weak growth, capital outflows or policy moves. It raises import

A bearish market becomes bullish in forex when prices stop making lower lows and start forming higher highs, signaling a shift in market structure. This

A trailing stop limit is a dynamic order that moves your stop and limit prices as the market advances in your favor, helping lock in

NZD/USD is a major forex pair, representing the New Zealand Dollar and US Dollar. It is widely traded due to high liquidity and significant global market